How do electricity retailers charge lower prices than SP Group? 5 questions answered

(Photo: Ian Cheng)

SINGAPORE: With the roll-out of the Open Electricity Market in November, consumers now have more choice and many have been paying less for their electricity.

But people also wonder if this is tenable in the long run and why SP Group, formerly the sole retailer of electricity in Singapore, could not offer the same discounts as its emerging competitors.

Wouldn’t it make things a lot simpler if consumers could have smaller bills from SP Group instead?

We put these questions to the Energy Market Authority (EMA), SP Group, energy retailers and an expert.

Why doesn’t SP Group offer consumers electricity at lower rates?

In a nutshell: Because it doesn’t set the electricity tariff paid by consumers.

SP Group is required by the Government to supply electricity to all consumers in Singapore.

READ: Singapore consumers can choose electricity provider from November

Electricity tariffs are not set by the group, but are regulated by EMA to “recover the long-term costs of producing and delivering electricity to consumers”. This includes fuel prices, building and operating power plants as well as maintaining the power grid.

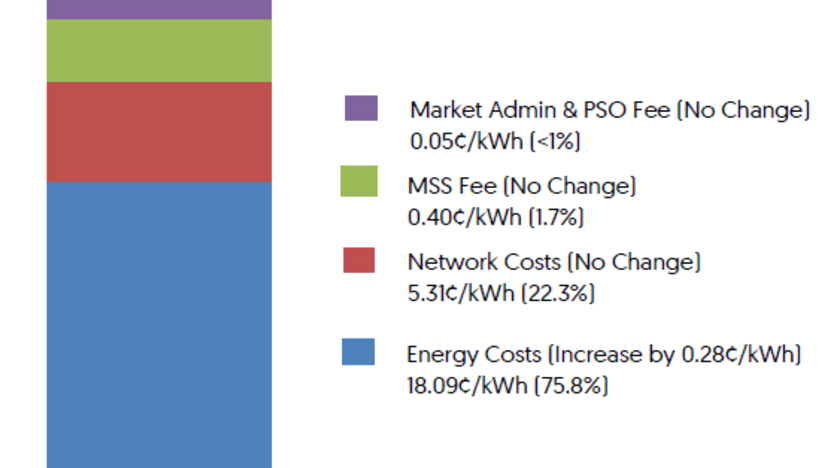

SP Group gets a fixed component out of the tariff for operating and maintaining the power grid, and providing services such as billing and meter reading. This regulated rate has been stable for the past decade, says EMA.

According to the rates in Q1 2019, SP Group is paid 5.71 cents per kWh, out of 23.85 cents per kWh paid by households. This comes to about 24 per cent of the tariff.

What else are we paying for in our power bills apart from the SP component?

Most of the tariff goes to power generation companies, while a small percentage goes to the Energy Market Company and EMA.

The energy cost, or cost of imported natural gas, is tied to oil prices by commercial contracts, which change depending on global market conditions. It is based on the average price of oil and the average SGD/USD exchange rate in the previous quarter. This component, paid to the power companies, is adjusted quarterly.

The market administration and power system operation fee is paid to the Energy Market Company, which operates Singapore’s wholesale electricity market, and EMA for operating the power system. This fee is reviewed annually.

How can electricity retailers offer cheaper electricity than SP Group?

Retailers in the Open Electricity Market are either the retail arm of power generators or independent retailers which buy electricity in bulk from power generation companies in a wholesale market where prices change every 30 minutes depending on demand and supply.

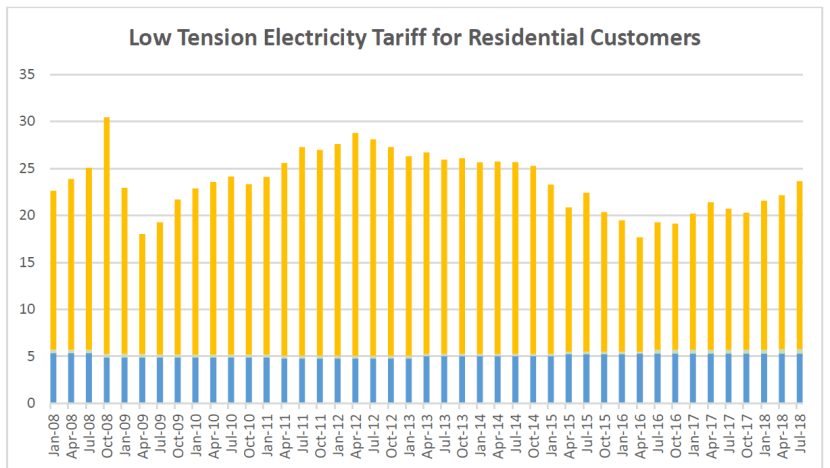

Between 2005 and 2012, the wholesale market price “trended upwards”. Until 2013, it tended to be higher than the regulated tariff.

READ: Singapore to open up retail electricity market from November: What it means for consumers

About five years ago, the electricity generation capacity began to exceed consumption. As a result of overproduction, wholesale prices dipped to below that of the regulated tariff.

The wholesale electricity price reached an all-time low in 2016 due to “excess generation capacity in the market and declining oil prices”, said EMA. In 2017, it increased as oil prices recovered.

Currently, the fuel cost in the regulated tariff is 18.1 cents/kWh, while the wholesale electricity price currently fluctuates in the range of 10 cents/kWh.

Consumers can now also purchase power from SP Group at the wholesale price, but they will be subject to the constant price fluctuations.

Why can retailers vary the rates offered to customers, especially when they are buying from the same pool of power generators?

Retailers can vary their prices and business strategies to adapt to current market conditions, and can also select their target consumer groups, like businesses or families.

Union Power, a subsidiary of home-grown bottled-gas supplier Union Energy, focuses on customers who are already using its liquefied petroleum gas.

ES Power, on the other hand, is hoping to differentiate itself with its carbon-neutral electricity, banking on the demand for green energy.

READ: More households switch electricity retailers, pay 20% to 30% less

READ: Sizzling competition, ‘encouraging’ sign-ups as electricity market opens up in Jurong

Retailers are also able to customise price plans, including the bundling of other services or products, and can impose contract lock-in periods or early termination charges.

For example, Geneco offers six plans, including a peak and off-peak option targeted at consumers who wish to monitor their own consumption.

“Generator-retailers like Geneco, and independent retailers ... are allowed to set their own rates, which takes into account current market conditions, shorter-term costs of producing electricity, and competition levels,” said Mr Low Boon Tong, Geneco’s executive vice-president of retail.

Retailers like Ohm Energy and Geneco also cut down on overhead costs by shifting their operations online, as well as automating their systems.

READ: Singapore to open up retail electricity market from November: What it means for consumers

How might prices and the market pan out in the long run?

As with energy markets overseas, several retailers are likely to be successful in the long run, said Professor Subodh Mhaisalkar, executive director of the Energy Research Institute at Singapore's Nanyang Technological University.

Companies have to innovate and offer differentiated services in order to adapt as the market evolves, he added.

“I see the market continuing to evolve and offer new ideas and new services; some energy related (for example: Internet of Things, apps, energy saving appliances) and others will offer bundled services,” he said.

READ: Will lower prices in open market make consumers use more electricity? Experts weigh in

READ: Red Dot Power exit: No electricity supply disruption, customers transferred to SP Group

However, demand for electricity is likely to increase, with changing lifestyles as well as the electrification push as seen in the rise of electric vehicles, port electrification and energy efficiency in industries.

The prices offered by retailers will change as the underlying cost of energy changes.

“While price may seem the most important factor for now, consumers must understand that lower prices today are not a given in the long term regardless of whether you stay on the current scheme or change to a new retailer,” said Geneco’s Mr Low.