More foreigners may rent instead of buy property in Singapore after doubling of additional buyer’s stamp duty

Some foreign high-net-worth individuals may rent first, apply for permanent residency, then buy a property to get lower additional buyer’s stamp duty rates, say observers.

Condominiums in Singapore at the Keppel Bay Yacht Marina area in the city centre. (Photo: iStock)

SINGAPORE: While the doubling of additional buyer’s stamp duty (ABSD) to 60 per cent for foreigners may deter some investors from purchasing Singapore properties, it may not turn away those who are serious about relocating here or who are setting up family offices, said experts.

Some may choose to rent instead of buy homes when they relocate.

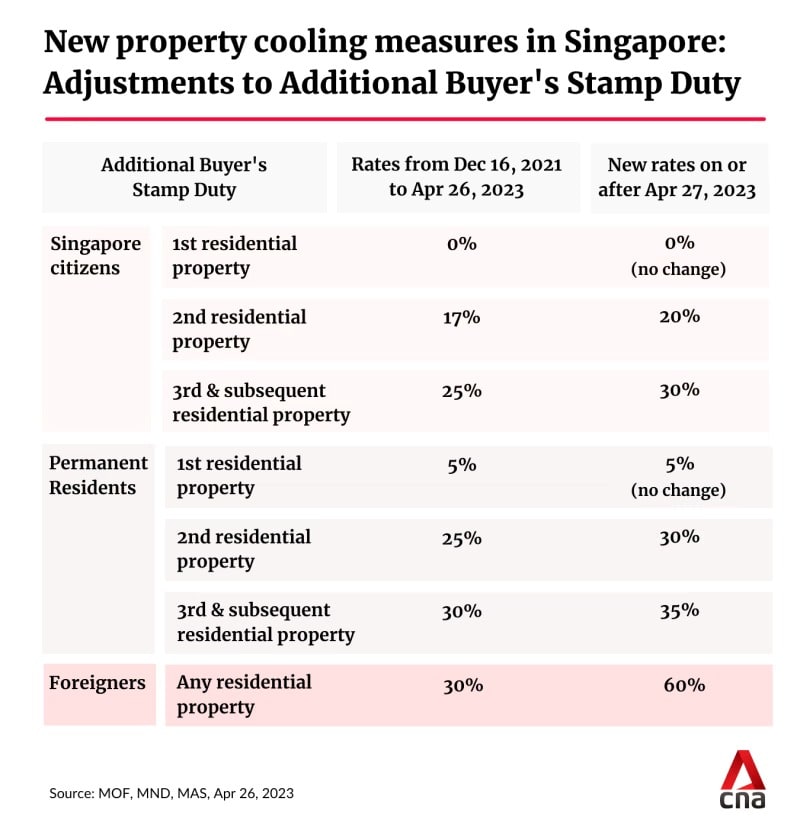

The cooling measures took effect on Thursday (Apr 27). It is the second time the ABSD has increased in the last two years – going from 20 per cent to 30 per cent in December 2021, before doubling to 60 per cent now.

The ABSD rate also went up to 65 per cent for entities or trusts purchasing any residential property, except for housing developers.

Meanwhile, Singaporeans pay no ABSD on their first property and 20 per cent on their second. Permanent residents pay 5 per cent on their first home and 30 per cent for the second.

The increase in ABSD for foreigners is “very significant”, said Mr Loh Kia Meng, co-head of private wealth and family office practices at Dentons Rodyk.

“I am sure that it will impact investor sentiment on the property market,” he added.

However, there are a variety of reasons why foreigners buy properties here, which affects how they view the ABSD rate, said Mr Alan Cheong, executive director of research & consultancy at Savills.

“When they park their money here, it is more like I want to diversify out of my country to a safe haven and some may say that I need to have a holiday home here, or I need to send my kids here to study,” he added.

Mr Loh said that foreign high-net-worth individuals may consider renting first, applying for permanent residency, and then buying a property after that to get much lower ABSD rates.

Mr Leo Kwek, a real estate investment consultant at AnjiaSG, which specialises in helping Chinese clients buy property in Singapore, agreed that it will not affect potential immigrants’ decision to move to Singapore as they will look to obtain PR before purchasing a property.

He foresees that more foreigners will choose to rent instead of buying.

“Most of the clients setting up new family offices in recent years are from Asia and Asians typically like to own the properties they stay in. This may well change now with the large ABSD hike,” said Dentons Rodyk’s Mr Loh.

CALIBRATING ABSD

Minister for National Development Desmond Lee said on Thursday that the ABSD hike is a pre-emptive measure to dampen local and foreign investment demand in Singapore's property market.

When asked why the increase was much higher for foreigners than that for Singaporeans and PRs, he said that the ABSD adjustments for Singaporeans and PRs “should suffice” to dampen local investment.

“But when you talk about foreign investment demand, you’re talking about really … people who see Singapore residential property as an attractive investment class. Therefore, we've had to calibrate the ABSD rate in order to have an effective dampener on investments from abroad," said Mr Lee.

The Ministry of National Development has said that the ABSD rate increases will affect about 10 per cent of residential property transactions, based on 2022 data. Of these, about 5 percentage points are Singaporeans or PRs buying second or subsequent properties, foreigners make up about four in 10 and the remaining 1 percentage point are entities.

Foreigners appear willing to pay more for their properties and this price premium may be one reason driving up prices, said Professor Qian Wenlan of the Institute of Real Estate and Urban Studies.

She noted that foreign buyers paid more per unit price than Singaporeans and PRs in the first quarter of 2023.

In the same period, there were about 4,600 private residential property transactions, of which 74 per cent were Singaporean buyers, 18 per cent were PRs and about 6 per cent were foreign buyers.

For properties located in central districts, foreign buyers paid about 14 per cent more per square foot than Singaporean buyers and 16 per cent more than PR buyers. In the non-central regions, foreign buyers were willing to pay about 7 per cent more per square foot than Singaporean buyers and about 10 per cent more than PR buyers.

And despite the 30 per cent ABSD prior to Apr 27, there was an increase in the proportion of foreign buyers in the first quarter of 2023.

The percentage of foreign purchases hovered at 3 per cent to 4 per cent from 2021 to Q1 2022. This has been climbing steadily since the full reopening of Singapore’s borders in April last year to reach 6 to 7 per cent in the last six months, said Ms Tricia Song, CBRE's head of research, Southeast Asia.

These are concentrated in the Core Central Region (CCR), although the majority of buyers are still Singaporeans.

CBRE’s analysis of caveats found that 12.1 per cent of CCR private non-landed properties in 2022 were bought by foreigners compared with 4.4 per cent in the Rest of Central Region (RCR) and 1.7 per cent in the Outside Central Region (OCR).

Some analysts noted that foreigners have picked up more luxury properties in the first quarter of the year. There were 57 private homes sold at S$10 million or more in that quarter, compared with 45 units in the fourth quarter of 2022, said Mr Mohan Sandrasegeran, senior analyst at One Global Group.

Of the 57, Singaporean buyers made 37 of the transactions and foreigners accounted for 20.

For such purchases, the ABSD would have been upwards of S$3 million, and now, after the adjustment, S$6 million.

GREATER IMPACT ON CORE CENTRAL REGION, LUXURY PROPERTIES

Analysts concur that the effects of the new ABSD rates will be felt most keenly in the CCR.

PropNex CEO Ismail Gafoor said that foreigners may seriously reconsider buying residential property in Singapore because they do have options in many other cities around the world.

Singapore now has the highest property tax rate for foreign buyers among major global markets, Bloomberg reported.

“Foreigners buying a S$20 million home here now have to pay S$12 million ABSD. For this amount, they can easily buy a luxury home in many other liveable cities such as Melbourne, London and in other mature markets,” he said.

He added that under the respective free trade agreements, the citizens or permanent residents of certain countries will be accorded the same stamp duty treatment as Singaporeans. These are nationals and PRs of Iceland, Liechtenstein, Norway and Switzerland, as well as American citizens.

While the number of transactions by American buyers has picked up in recent years, the number is not large, at 305 in 2022. There were only eight transactions from Norway and 24 from Swiss buyers.

“There may be more pressure on developers with CCR projects to rethink their product and pricing strategies. For those CCR launches which are nearing completion or ABSD deadline with unsold inventory, buyers may expect some discounts,” said Ms Song.

Mr Kwek pointed out that a planned launch, Newport Residences located in the central business district, has just decided to postpone the preview date until further notice.

“They were hoping to sell their most expensive penthouse units to foreigners as usually only they will purchase and not locals,” he said.

For rents, Mr Leong said that with the economy slowing and more condominium units being completed, rental rates for the mass market should stabilise but rents in the CCR would continue to be “hot”.

But he and other observers agreed that the new ABSD rate is unlikely to be the sole factor that determines a high-net-worth individual’s decision to move to or invest in Singapore.

Mr Richard Loi, Deloitte Private Southeast Asia leader, said there has been ongoing interest in the Overseas Networks & Enterprise Pass - a new work pass programme targeting high-level foreign talent - as well the Global Investor Programme that grants permanent residency to significant foreign investors.

Apart from these programmes, other factors that still make Singapore an attractive place for foreign high-net-worth individuals include Singapore's reputation as safe haven, a favourable tax regime and ample investment opportunities.

He pointed out that Singapore has a territorial tax system, which means that income earned outside of the country is not taxed.

Yuen Law associate director Tris Xavier added that Singapore's competitive advantage lies in its good governance, stability and business-friendly environment.

“While there will be some impact on some property purchases, it is likely to remain an attractive destination for the ultra-rich and ultra HNWIs (high-net-worth individuals). Family offices, in turn, will likely diversify more into non-property investments, but are unlikely to wholly move away from property,” he added.

Dr Joe Kwan, managing partner for real estate at Raffles Family Office, also said that the new ABSD is unlikely to significantly impact the decisions of HNWI to relocate or establish family offices in Singapore, as that is not the sole consideration for them.

“One consequence of the new ABSD rate could be a shift in property investment trends among HNWIs, favouring smaller-scale commercial real estate investments like strata offices and shophouses," he added.