Latest property cooling measures unlikely to ease prices by much: Analysts

Housing Board flats, condominiums and other high-rise buildings in Singapore. (File photo: iStock)

SINGAPORE: While higher additional buyer's stamp duties will dampen demand for investment properties, prices may not ease by much given that the hikes target a minority of buyers, analysts said on Thursday (Apr 27).

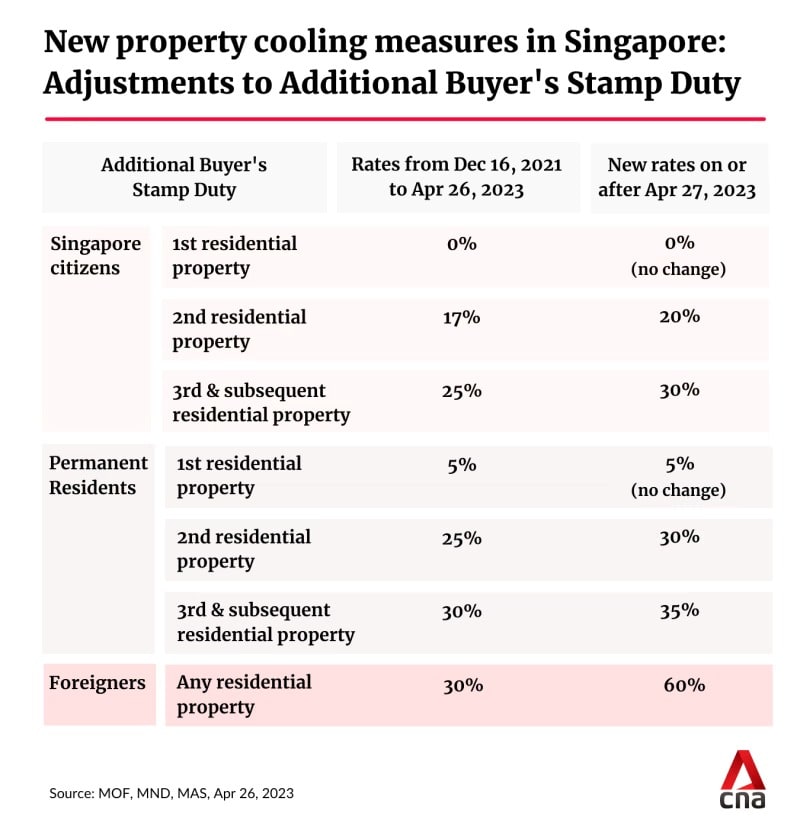

Late on Wednesday night, the government announced that additional buyer’s stamp duty (ABSD) will be doubled to 60 per cent for foreigners buying any residential property.

Singaporeans buying their second residential property will pay an ABSD rate of 20 per cent, up from 17 per cent, while those buying their third and subsequent residential property will have to pay an increased rate of 30 per cent, up from 25 per cent.

The rate of 30 per cent also applies to permanent residents buying their second residential property. PRs buying their third and subsequent residential property will pay an ABSD of 35 per cent, up from 30 per cent.

"The impact of the latest measures will not be evenly felt, with foreign buyers in particular taking a bigger hit. With what we think is a very restrictive 60 per cent ABSD rate, many foreign buyers will likely reassess their options," said Mr Ismail Gafoor, CEO of PropNex Realty.

"That being said, foreigners only account for a small proportion of private home sales in Singapore ... we do not expect the doubling of ABSD rate for foreigners to severely impact the overall market."

This means that these measures may have the greatest impact on higher-end projects in the core central region, said most analysts.

The most immediate impact would be that sales volumes would fall, as the revised ABSD rates have made it prohibitive for investors and foreigners to buy, said Ms Catherine He, head of research at Colliers.

Prices are likely to moderate for a few months, benefitting owner occupiers and first-time buyers.

"Genuine homebuying and upgrading demand remains unscathed, and will likely benefit from a more gradual price trajectory going forward," said Mr Lam Chern Woon, head of research & consulting at Edmund Tie.

Singapore citizens and permanent resident first-time buyers are expected to be the key demand drivers in the months ahead, said Mr Eugene Lim, key executive officer of ERA Realty Network.

According to MND, this group accounts for about 90 per cent of residential property transactions based on 2022 data.

While the proportion of foreign buyers is small, it has gone up since the reopening of borders, analysts noted.

"There could be more liquidity flowing from family offices as there have been some headline deals made by foreign buyers. Further, with the reopening of China’s borders, we expect more buying interest from mainland Chinese," said Ms Christine Sun, senior vice president of research & analytics at OrangeTee & Tie.

From a low of 3.1 per cent in 1Q 2022, the proportion of foreign buyers has increased steadily to hit 6.9 per cent in 1Q 2023. This is the highest since 1Q 2018 when the proportion was 7.3 per cent, said Mr Lee Sze Teck, senior director of research at Huttons.

Huttons agents have also given feedback that the number of enquiries from foreigners is rising, said Mr Lee.

He expects that the mass market and city fringe projects are likely to go ahead with their launches as the buyers are predominantly Singaporeans and PRs. But the high-end market which is targeted at more foreigners may hold back for the time being for the market to absorb the impact of the announcement.

Minister for National Development Desmond Lee has said that the higher stamp duties are a "pre-emptive measure" to dampen local and foreign investment demand in Singapore's property market.

"If we don't take early preemptive measures, we may see investment numbers both by locals and by foreigners grow, and that will add stress to Singaporeans who are looking to buy residential property principally for own occupation," he said on Thursday morning.

Analysts pointed to data in the first quarter of 2023, saying that flash estimates of the price index for private residential property showed an increase of 3.2 per cent, compared to the 0.4 per cent increase in the previous quarter. At the same time, the Singapore economy contracted 0.7 per cent quarter-on-quarter.

"The juxtaposition of accelerating home price growth in 1Q 2023 with an economic contraction in the same quarter, coupled with unfettered housing demand going into 2Q 2023, has unsettled policymakers," said Mr Lam.

Some analysts also pointed to supply issues. Ms Sun said the prices of homes may not drop significantly as supply remains low in the market and sellers have "holding power".

Mr Lee said based on previous cooling measures, there will be a "knee-jerk reaction" and demand will ease in the next three months as buyers reassess their finances.

But prices may not go down given the low number of unsold units in the market, he added.

Related:

INVESTMENT IN OTHER PROPERTIES

The latest round of property curbs is expected to drive more investment demand to commercial and industrial properties, as well as other financial assets, said Mr Nicholas Mak, chief research officer at MOGUL.sg.

"Some investors may invest in real estate indirectly, such as through REITs or securities of property developers," he said.

It could also turn the preferences of home upgraders, especially those who are cash-strapped, to completed properties, he said.

This is as when a residential property owner buys another residential property that is under development, he has to pay the ABSD for the second property first, even if he plans to sell his existing property after moving into the new property.

He can apply for a refund of the ABSD within six months after the second property is completed.

"The higher ABSD would raise the financial hurdle for such homebuyers. It is challenging for some buyers to come up with the money for the ABSD, which could amount to hundreds of thousands of dollars for a typical family-size property," said Mr Mak.

Demand may also turn to executive condominiums as buyers of ECs are given upfront remission on ABSD.

In all, prices are expected to moderate but not fall.

On the back of this latest round of measures, Colliers revised its forecast for 2022 price growth from 3 to 5 per cent to 1 to 3 per cent, as prices will still be supported by higher land prices and strong employment.

Edmund Tie's Mr Lam said he expects overall home prices to rise by 4 to 6 per cent this year.

"The upshot of the latest measure is that home price growth will be curtailed in the coming months. The risks are also growing for a price correction in the latter part of this year as a storm builds up, increasing economic duress, difficult financing, possible rental correction, and the prospect of further policy intervention," he said.