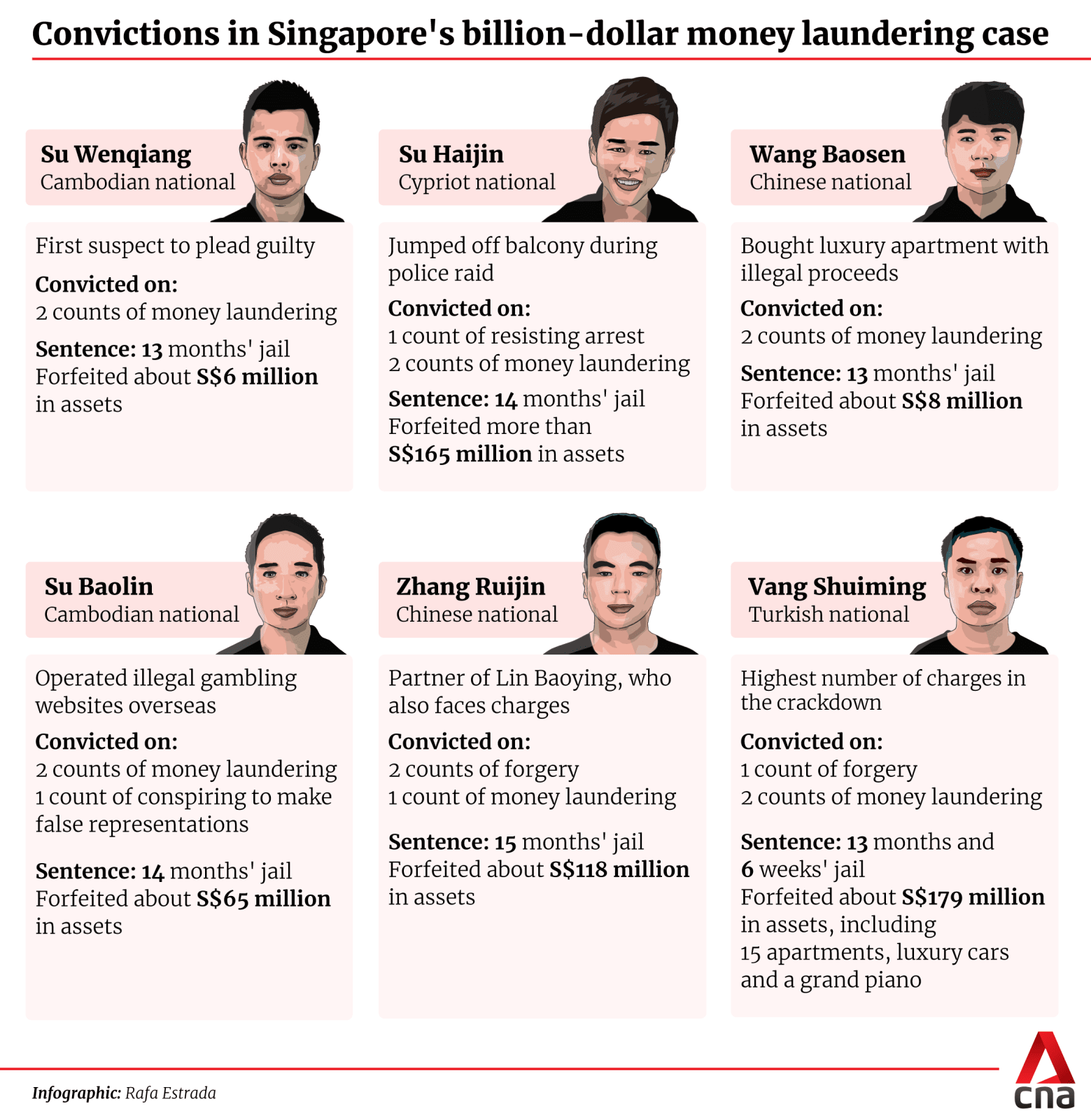

Billion-dollar money laundering case: Sixth suspect jailed, forfeits largest sum yet of S$180 million

Vang Shuiming surrendered about 90 per cent of the assets seized from him, including apartments in Clarke Quay and Beach Road.

This audio is generated by an AI tool.

SINGAPORE: The suspect with the highest number of charges in Singapore's multibillion-dollar money laundering crackdown was sentenced to 13 months and six weeks' jail on Tuesday (May 14).

Vang Shuiming, 43, faced a total of 22 charges. He pleaded guilty to three of them, and the remainder were considered for sentencing.

His offences involved the possession of about S$2.4 million (US$1.8 million) in suspected criminal proceeds, and the use of documents he had reason to believe were forged.

He also voluntarily forfeited about S$180 million in assets to the state. This is the largest amount that any accused person in the money laundering case has forfeited so far.

It came out of more than S$198 million in assets seized from him, including assets that he paid for but were held in the name of his wife, Wang Ruiyan.

These included 10 apartments in Clarke Quay and one at Tomlinson Road that are under construction, and four apartments in the Beach Road area.

Other items included a S$240,000 Kawai grand piano, a green Rolls-Royce Phantom worth S$1.8 million and a white Bentley Flying Spur worth S$1.3 million.

More than S$137,000 in donations were also surrendered and held in police custody.

Deputy Public Prosecutor David Koh sought a jail term of 14 to 16 months, while Vang's defence lawyers from Drew & Napier argued for 13 months.

Vang is the sixth of 10 suspects to be dealt with in this case. Five individuals pleaded guilty before him and were sentenced to between 13 and 15 months in jail.

The accused persons all hold various foreign nationalities. Deportations have already begun for those who have finished serving their sentences.

Vang is listed as a Turkish national in court documents and has passports from China, Vanuatu and Türkiye. He is linked to three other suspects who are on the run, including his brother.

VANG SHUIMING'S OFFENCES

When Vang was nabbed in a Good Class Bungalow along Bishopsgate in Tanglin on Aug 15, 2023, he had funds totalling about S$2.42 million across four Singapore bank accounts.

The funds were suspected of being benefits of criminal conduct, and Vang was unable to satisfactorily account for how he came by the money. This became the subject of four of his charges.

When dealing with banks, Vang said the funds were his shareholder profits from two purported e-commerce companies – Xiamen Likanghang Trading and Xiamen Yetian Trading.

After his arrest, he admitted they were not the source, but claimed the funds came from his loan business in China, Xiamen Mingxin Guarantee.

Vang "maintained this story" through 18 statements to police from Aug 15 to Sep 4, 2023, said the prosecution.

But on Sep 26, 2023, he admitted this was untrue. He then claimed that the money came from "his gambling winnings and profits from real estate investments in the Philippines".

Vang has not substantiated this claim, the prosecution noted.

The bulk of Vang's charges – 18 of them – were for submitting documents that he had reason to believe were forged to multiple banks in Singapore.

Vang used these documents when questioned by the banks about the sources of funds in his accounts.

For the proceeded charge, Mr Koh described how Vang arranged for more than HK$229 million (US$29 million) to be sent to his Citibank account from an Indonesian remittance agent in April and May 2021.

Citibank asked Vang about the source of the funds and his relationship with the remittance agent, since he was not a resident of Indonesia.

Through one Wang Qiming, who was then his relationship manager, Vang provided a certificate purportedly from the remittance agent, stating that it received the funds as "first party inflow" from the accused.

The remittance agency also said that through an authorised agent in China named "Chen Ze Long", it received funds equivalent to HK$8 million from Vang in August 2021.

When Citibank's compliance department asked for more documents to verify these claims, Vang provided a purported bank statement from a China Merchant Bank account in his name, showing transfers from "Chen Ze Long".

But in the course of investigations after his arrest, Vang admitted that he did not have any China Merchant Bank account and the statement was a forgery.

The other forged documents purported to be financial statements of Xiamen Likanghang, Xiamen Yetian and Xiamen Mingxin. Vang submitted these to UOB Kay Hian in June 2022 and Bank Julius Baer & Co in July 2022.

"The accused represented to the banks, either directly or through his external asset managers, that his wealth came from three companies in China of which he was a shareholder," Mr Koh said.

"These financial statements were forged, and the accused had reason to believe they were forged."

Related:

ARGUMENTS ON HARM CAUSED AND FORFEITURE

The prosecution stressed the need for a "suitably lengthy" jail term to discourage Vang and like-minded individuals from using Singapore as a money laundering haven.

Mr Koh pointed out the transnational element of Vang's offences and the substantial amount of money involved, which he argued were aggravating factors.

In mitigation, defence lawyer Wendell Wong said that Vang's early plea of guilt and voluntary forfeiture indicated his remorse, and also saved the state time and resources.

"Mr Vang had moved his family (including his wife, his young children and his elderly parents) to Singapore in or around 2019 as he wanted to start a new chapter of their lives here," he said in submissions.

"They will suffer the consequences of his conviction now," the lawyer told the court.

He also said that "Mr Vang did not want to cause any trouble in Singapore or for Singapore", but District Judge Sharmila Sripathy-Shanaz took issue with what she called a "curious and ultimately strained characterisation" of the man.

Instead, she agreed with the prosecution that Vang's conduct reflected "a broader abuse of Singapore's financial infrastructure".

Parties also discussed the significance of the absolute amount and the proportion of the assets that Vang forfeited.

Defence lawyer Mr Wong pointed out that Vang's S$180 million forfeiture was the highest among all the related convictions so far.

He contrasted this with Wang Baosen, who forfeited about S$8 million, and whom he used as a reference in sentencing arguments.

But Judge Sripathy-Shanaz noted that Vang was forfeiting about 90 per cent of his seized assets, while Wang forfeited 100 per cent of his assets.

When this was pointed out to the defence, Mr Wong asked the judge to consider "the pain factor" involved in the different amount of money at stake for Vang.

The judge gave Vang's forfeiture "significant weight" in her decision on the sentence.

But she also said it was "crucial to consider not merely the absolute value of the property forfeited, but rather the proportion forfeited relative to the total assets seized".

She also observed a "distinct sentencing trend" for the offences of having criminal proceeds in the money laundering case so far, and saw the need to ensure consistency in sentencing.

_0.jpg?itok=yhFrEcJw)