Budget 2024: Property tax to go down for some home owners with raising of annual value bands

The government will monitor the market and give another property tax rebate next year if necessary, says Deputy Prime Minister Lawrence Wong.

Private properties and HDB blocks in Singapore (File photo: CNA/Jeremy Long)

This audio is generated by an AI tool.

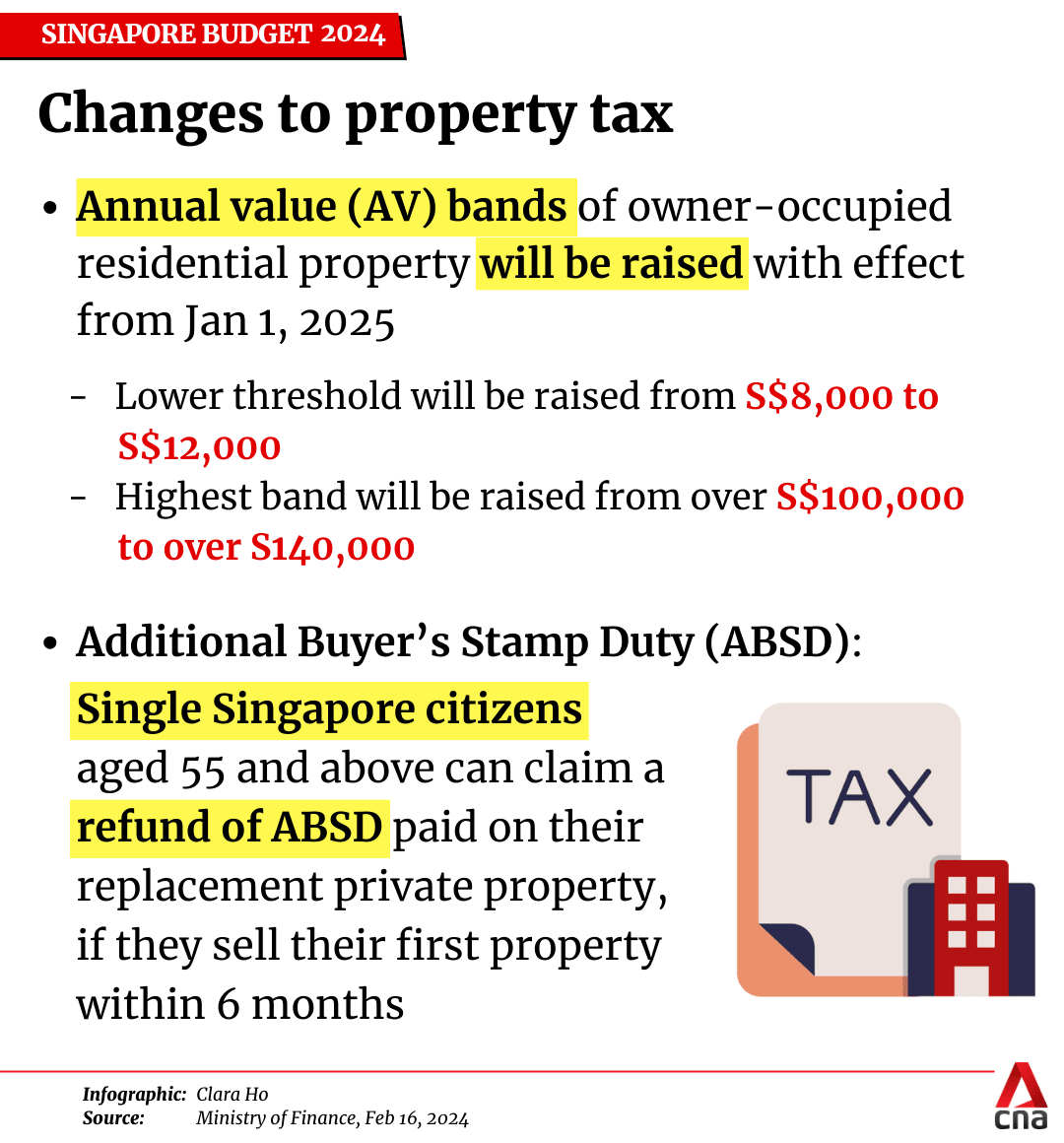

SINGAPORE: Some home owners will pay less property tax when the annual value (AV) bands for owner-occupied properties are raised next year.

From Jan 1, 2025, the lowest AV band threshold will be raised from S$8,000 (US$5,900) to S$12,000. The highest threshold will increase from over S$100,000 to over S$140,000. Corresponding adjustments will be made to bands in between.

This means that home owners can expect to pay the same or lower property taxes at each band, assuming that there is no change in their AVs and before any rebate.

Property taxes are calculated based on AVs, which are based on the estimated yearly rent if a property was rented out. Owner-occupied homes – where the owner lives in the property – pay lower tax rates.

| Property tax rate | Current annual value band | From January 2025 |

|---|---|---|

| 0% | S$0 to S$8,000 | S$0 to S$12,000 |

| 4% | >S$8,000 to S$30,000 | >S$12,000 to S$40,000 |

| 6% | >S$30,000 to S$40,000 | >S$40,000 to S$50,000 |

| 10% | >S$40,000 to S$55,000 | >S$50,000 to S$75,000 |

| 14% | >S$55,000 to S$70,000 | >S$75,000 to S$85,000 |

| 20% | >S$70,000 to S$85,000 | >S$85,000 to S$100,000 |

| 26% | >S$85,000 to S$100,000 | >S$100,000 to S$140,000 |

| 32% | >S$100,000 | >S$140,000 |

The raising of the AV bands was announced by Deputy Prime Minister and Finance Minister Lawrence Wong in his Budget 2024 speech.

The change will still ensure that those residing in higher-value properties continue to pay their fair share of taxes, said Mr Wong.

In Budget 2022, he had announced a two-step increase in property tax rates for residential properties. This had been meant as a wealth tax targeted at investment properties and the higher-end segment of owner-occupied private properties.

In the preceding five years before that announcement, market rents had been relatively flat, he noted. However, rents increased significantly from 2022 due to a combination of strong demand and COVID-19-related supply constraints.

"As a result, the annual values also increased sharply," he said.

While the government had expected the property tax changes to impact the top 7 per cent of owner-occupied residential properties, the AV increases resulted in nearly 13 per cent of owner-occupied properties being affected.

The raising of the AV bands come in light of these market trends, said Mr Wong.

The government earlier announced a rebate to cushion the impact of property tax changes this year. It will continue to monitor the property market and provide another rebate next year if needed, Mr Wong added.

To help retirees living in higher-end residential homes who face cash flow issues, the Inland Revenue Authority of Singapore will offer them a 24-month instalment plan without interest.

UPDATES TO ADDITIONAL BUYER'S STAMP DUTY

Currently, Singaporean married couples can get a refund of the additional buyer's stamp duty (ABSD) paid on a second property – if they sell their first property within six months.

To support seniors who want to "right-size" their homes, this ABSD concession will be extended to single Singaporeans aged 55 and above, with effect from Friday.

They can claim the refund if they sell their first property within six months after purchasing a lower-value replacement private property if the unit is completed.

If the unit is not completed at the time of purchase, seniors can claim a refund of their ABSD within six months after the temporary occupation permit or certificate of statutory completion of the replacement residential property is issued, whichever is earlier.

Housing developers may also benefit from an update to the ABSD regime.

Developers are granted an ABSD remission provided that they sell all the units in their development within a prescribed sale timeline. However, developers sometimes face difficulties in meeting the timeline requirement, and are then subject to a full clawback of the ABSD.Currently, developers purchasing residential land on or after Dec 16, 2021 are subject to 40 per cent ABSD, comprising a 35 per cent upfront remittable component. Developers who purchased residential land between Jul 6, 2018 and Dec, 15 2021 are subject to 30 per cent ABSD, comprising a 25 per cent upfront remittable component.

Both these remittable components are clawed back fully with interest if the housing development does not commence within two years from the date of the acquisition of the site, and the housing development is not completed and all units sold within five years from the site acquisition date.

With the update, developers that sell at least 90 per cent of each development within five years from the land acquisition date will have a lower ABSD clawback rate if the commencement and completion of housing development timelines are also satisfied.

In a joint press release following the Budget statement, the Ministry of Finance and Ministry of National Development said that the reduction in the ABSD remission clawback rate will depend on the proportion of units sold by the developers within the remission sale timeline, and will apply to projects on residential land acquired on or after Jul 6, 2018.

The update ensures that housing supply continues to be released promptly, while providing some flexibility to the developers, said Mr Wong.