CareShield Life premiums and payouts to increase from 2026

From 2026 to 2030, those enrolled in the scheme will see their premiums increase by an average of S$38 annually, said the Ministry of Health.

A person holds the hand of an elderly patient in a hospital bed. (File photo: iStock)

This audio is generated by an AI tool.

SINGAPORE: Singaporeans on the national disability insurance scheme CareShield Life will pay higher premiums and receive higher payouts from 2026.

From 2026 to 2030, those enrolled in the scheme will see their premiums increase by an average of S$38 (US$29.50) and up to S$75 annually, said the Ministry of Health (MOH) on Wednesday (Aug 27).

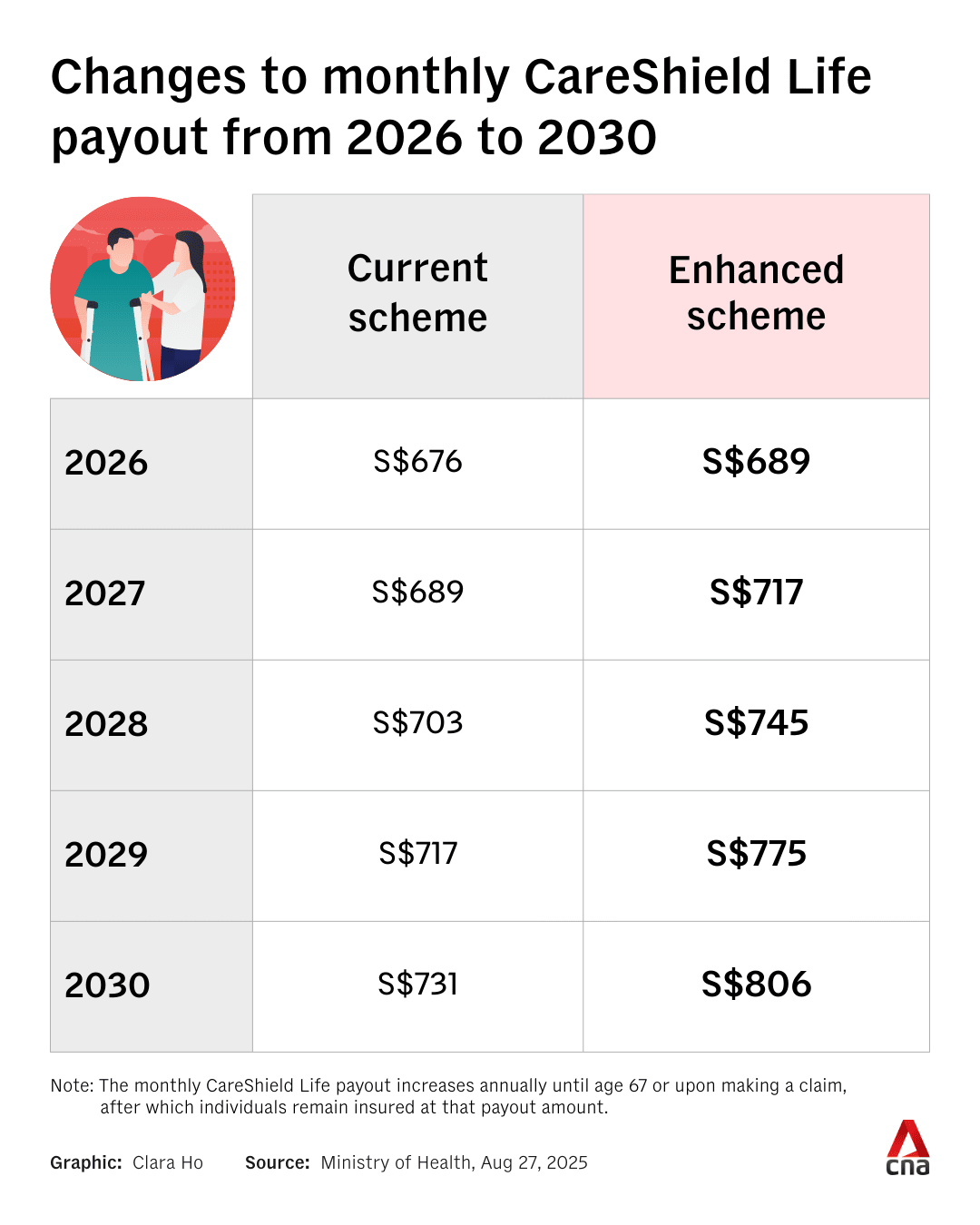

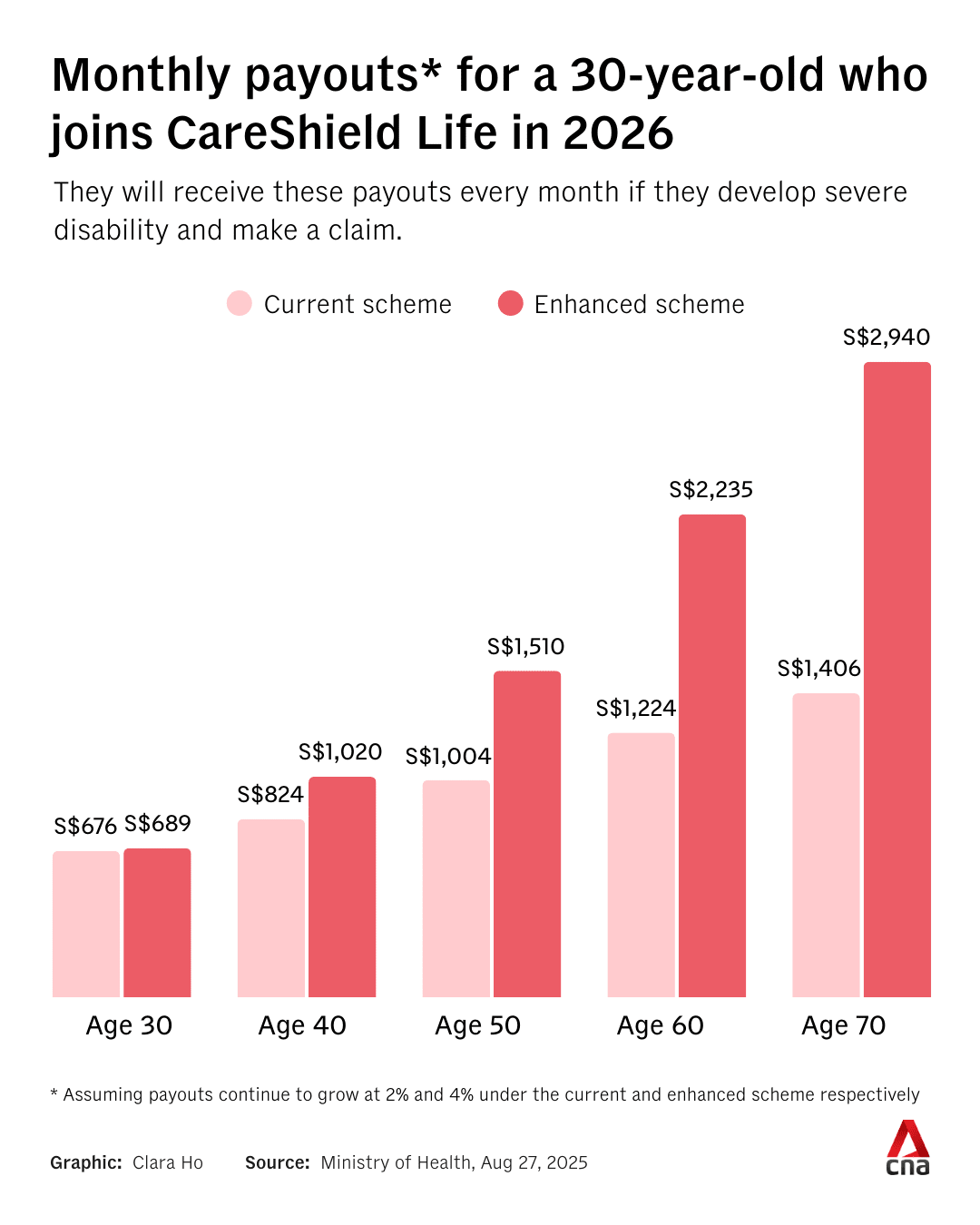

The annual growth rate of CareShield Life payouts will be doubled from 2 per cent to 4 per cent, with the same eligibility criteria for claims.

With the new growth rate, a policyholder making a claim in 2030 will receive S$806 per month, compared to the S$731 per month they would have received if the annual growth rate stayed at 2 per cent.

Launched in 2020, CareShield Life is a national long-term care insurance scheme designed to provide financial assistance for individuals with severe disabilities. It is replacing the ElderShield scheme.

The scheme is compulsory for those born in 1980 or later, and older cohorts have the option to enrol. Policyholders with severe disabilities – defined as the inability to perform at least three out of six daily living activities, such as washing, feeding or dressing – receive monthly cash payouts.

CLAIMANTS EXPECTED TO INCREASE OVER TIME

Earlier this year, Second Minister for Health Masagos Zulkifli announced that the scheme would undergo its first review to ensure that it remains effective.

On Wednesday, MOH announced that the government had accepted the recommendations from the review, including the recommendation to double the growth rate of payouts from 2 per cent to 4 per cent.

“This will help payouts better keep pace with rising long-term care costs, providing Singaporeans with greater assurance for their long-term care needs,” said Ms Jeanette Wong, who chairs the CareShield Life Council that conducted the review.

As of 2024, there are 1,821 active claimants under the scheme, with more than S$26 million paid out in claims. The claimants are aged between 30 and 93, and have a median age of 52.

This indicates that about half of the claimants under CareShield Life are in their 30s and 40s, said the ministry.

As of December 2024, S$2.8 billion in CareShield Life premiums had been collected, including about S$800 million of government premium support, said MOH in response to media queries.

“Over a longer time horizon, as the policyholder pool ages, we expect significantly more claimants over time,” said MOH, noting that the total claims paid out under ElderShield and CareShield Life since 2020 had crossed S$100 million.

“The low payout ratio is expected as most of the premiums collected are intended to help the scheme meet its future payout obligations when more of its policyholders are older and likelier to claim. This is in line with the design of CareShield Life as a pre-funded scheme.”

When the scheme was introduced in 2020, payouts started at S$600 per month and grew by 2 per cent each year. Those who make claims from 2025 will receive S$662 per month.

HIGHER PREMIUMS WITH TRANSITIONAL SUPPORT

Premiums will need to increase to sustain the higher payouts, MOH said.

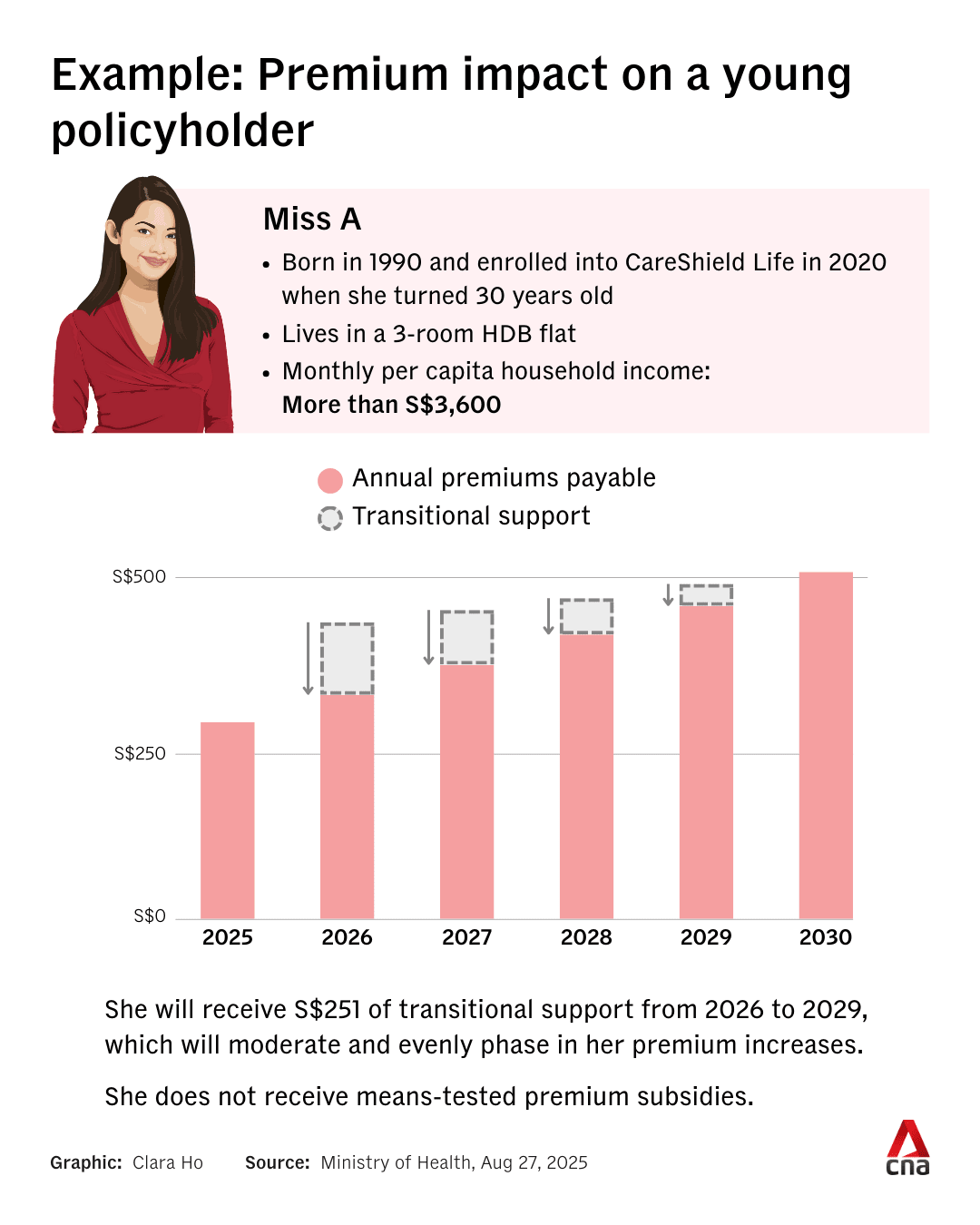

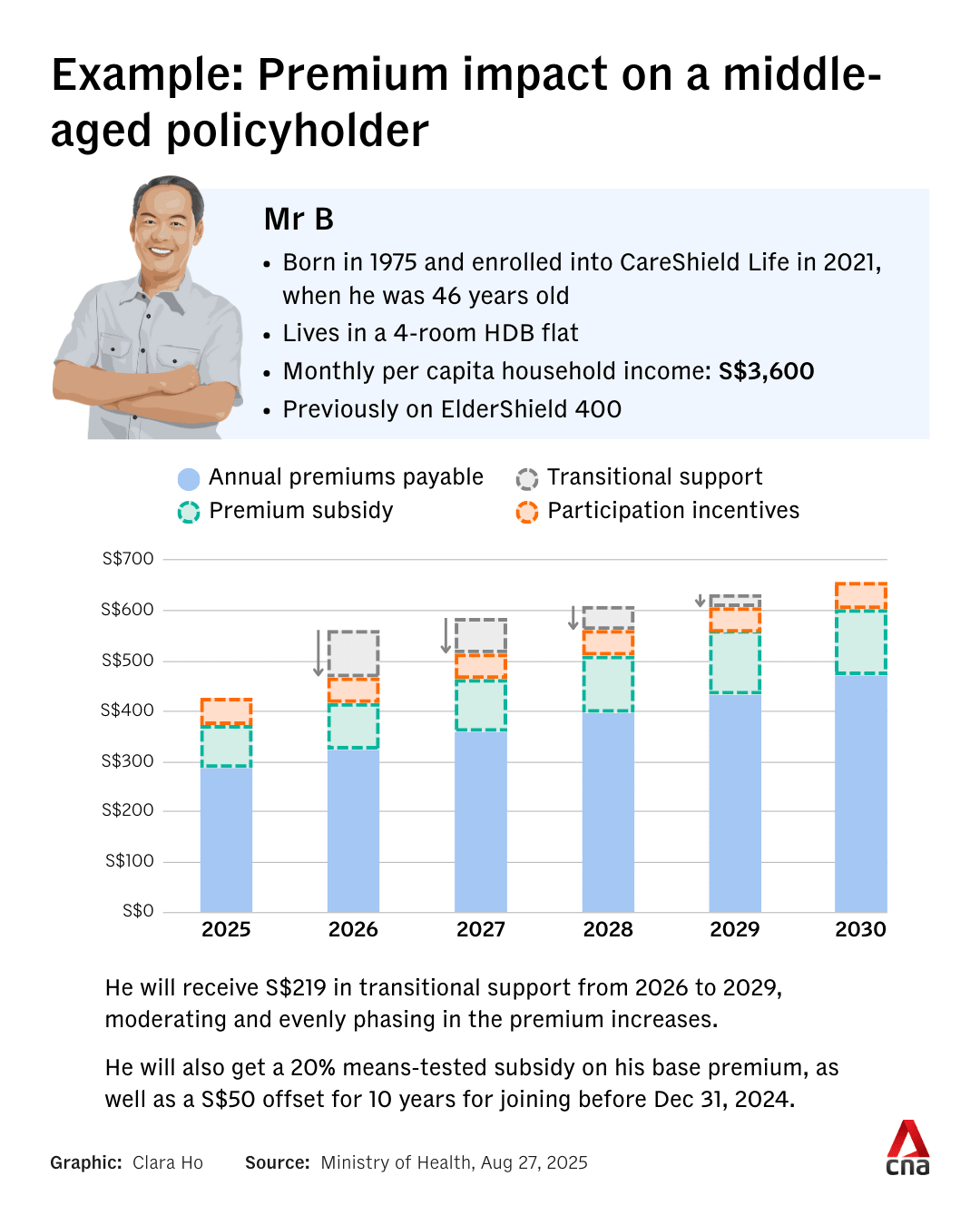

There will be a one-step increase in premiums in 2026, and they will then grow at 4 per cent each year, the ministry said, noting that CareShield Life premiums are only collected for a limited duration while the scheme's payouts are for life.

To keep premiums affordable, the council recommended that the government provide transitional support to policyholders.

On top of existing premium subsidies, the government will provide S$570 million in additional support.

Of this sum, S$440 million will be used to moderate the premium increases for all affected policyholders, said MOH in a media release on Wednesday.

The remaining S$130 million will be used to offer more support to low- to middle-income policyholders, with premium subsidies of up to 30 per cent for those who are eligible.

Without these support measures, annual premiums would have increased by S$126 on average in 2026 and grown by 4 per cent after that, instead of the expected average increase of S$38 per year.

“The government is committed to helping Singaporeans manage the upcoming premium increase, and will ensure that no one will lose coverage due to an inability to pay their premiums,” said MOH.

The enhanced payouts and premiums will apply from 2026 to 2030, and will be reviewed after that, the ministry noted.

The council noted that some Singaporeans may be concerned about increasing premiums, which is why it recommended additional support to cushion the impact, said Ms Wong.

REINSTATING UNDERWRITING FOR PRE-EXISTING DISABILITIES

At the recommendation of the CareShield Life Council, the government will also reinstate the scheme’s underwriting criteria, MOH said in the press release.

From CareShield Life’s launch, older individuals with mild and moderate disabilities could enrol in the scheme. This was a “time-limited measure” to enable more to benefit from the scheme, said MOH.

With sign-up rates for those born in 1979 and before dwindling since the grace period was extended in 2021, the council recommended reinstating the underwriting.

This means that from 2026, only individuals without pre-existing disabilities will be able to enrol in the scheme. Someone with a chronic condition like diabetes can still enrol in the scheme as long as they are not disabled.

As of June 2025, 1.93 million Singapore citizens and permanent residents aged 30 and above are covered under CareShield Life, with 535,000 covered under ElderShield, said MOH.

This means that about 8 in 10 Singapore citizens and permanent residents aged 30 and above are covered under CareShield Life or ElderShield.

Singapore’s annual national long-term care expenditure has almost doubled from S$1.7 billion to about S$3 billion in the last five years, MOH noted.

“This is as more seniors require long-term care, with an ageing population. Costs are also increasing, due to evolving care needs of the population and inflation, driven by manpower and technology costs. Some of these trends are structural in nature, and likely to persist in the future,” the ministry said.

Among those who develop severe disabilities, half would stay in that state for at least four to five years, while three in 10 could remain in that state for 10 years or more, said MOH.

When asked about calls to relax the criteria for claims from being unable to perform at least three daily living activities down to two, Ms Wong noted that CareShield Life is a not-for-profit scheme.

“We took into consideration the balancing between affordability and recognising that the scheme is pre-funded and only for a pre-limited amount of time, 37 years. But yet we pay out on the scheme for life. So we had to work around affordability for all Singaporeans as well as how fair it is when we look at having to pay out for life,” she added.

From the focus group discussions on possibly relaxing the criteria, there was a strong sentiment that the government should make sure that the scheme is affordable, said MOH, noting the “trade off” between affordability and the scheme’s features.

Individuals who can afford to do so can also enrol in private schemes with more coverage or a lower threshold, said MOH.

Those who are willing to pay more can assess those products, the ministry added.