CareShield Life participation incentives extended for a year

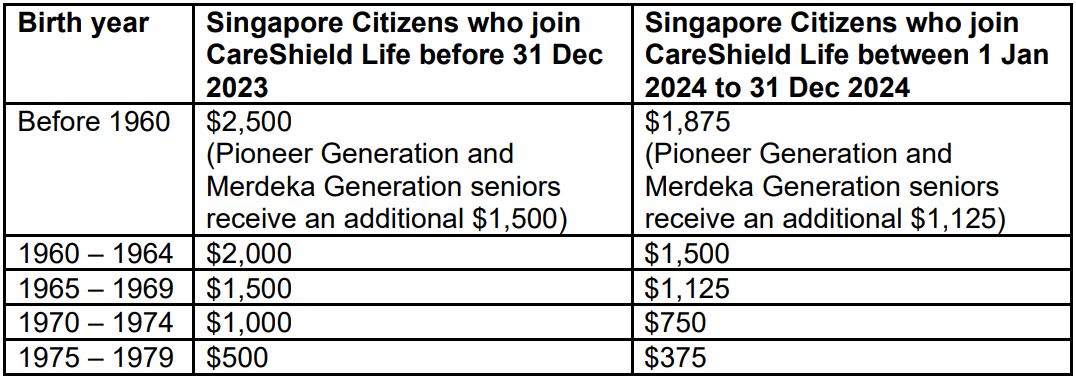

Eligible Singaporeans who sign up for the national long-term care insurance scheme in 2024 will still receive incentives, but at a lower amount of up to S$3,000, instead of a maximum of S$4,000.

In this file photo, elderly people are seen in Chinatown. (File photo: CNA/Calvin Oh)

This audio is generated by an AI tool.

SINGAPORE: Monetary incentives for a national long-term care insurance scheme will be extended for another year to encourage more people to sign up, the Ministry of Health (MOH) said on Tuesday (Nov 14).

Singaporeans born in 1979 or earlier now have until the end of 2024 to enjoy incentives of up to S$3,000 if they join CareShield Life. The incentives will be spread over 10 years to help offset annual premiums.Those who sign up and are covered under the scheme before Dec 31, 2023, remain eligible for the original incentive of up to S$4,000, said MOH.

The national scheme for disability insurance was launched in October 2020 and is already compulsory for those born in 1980 or later. It replaces the ElderShield scheme.

CareShield Life provides basic financial support in the event of severe disability. The insured must be born before 1980 and without severe disability.

Monthly payouts for the long-term care insurance scheme start at around S$600 in 2023 and will rise annually until the policyholder is 67 years old or makes a claim.

Existing ElderShield policyholders will continue to be covered under ElderShield if they choose not to upgrade to CareShield Life.

HIGHER LIFETIME PAYOUTS

The CareShield Life and Long-term Care Bill was passed in Parliament in 2019 to provide long-term care for Singapore's ageing population.

Enrolment in CareShield Life is encouraged as it will provide better protection than ElderShield through higher and lifetime payouts, said MOH.

CareShield Life provides payouts for life during the entire duration of severe disability, whereas ElderShield provides up to 60 or 72 months of payouts, said the ministry.

Unlike ElderShield, CareShield Life has premium support to ensure no one loses coverage due to an inability to pay, it added.

Since November 2021, more than 205,000 Singaporeans have benefited from the participation incentives and joined CareShield Life to get better coverage for severe disability, said MOH.

CareShield Life premiums can be paid fully through MediSave and those interested in signing up can do so on CareShield Life website, where they can also check their what premiums they have to pay.