CNA Explains: How does CPF nomination work and what happens if you don't make one?

Questions have been raised about CPF nomination after a recent court case highlighted the fact that divorce does not automatically revoke a pre-existing nomination.

A stock photo showing a woman working in front of a laptop and making notes. (Photo: iStock/AzmanJaka)

SINGAPORE: The issue of CPF nomination has been put in the spotlight after the recent case of an elderly man who assumed that his only daughter - and not his estranged ex-wife - would inherit his CPF savings.

A High Court judge said on Wednesday (Mar 8) that it was "puzzling" that divorce did not automatically revoke a pre-existing nomination, even though a pre-existing nomination would automatically be revoked upon marriage.

The judge ordered that the CPF savings of the elderly divorcee, Mr Toh Kim Hiang, be released to his daughter, even though he twice failed to nominate her as the beneficiary.

Mr Toh died shortly after his second nomination attempt. It was later discovered that he had keyed in the wrong identity card number of his second witness, which was likely why the new nomination could not be completed.

If you are planning to make a CPF nomination, here’s what you need to know about the process.

What happens to my CPF savings when I die?

The CPF, or Central Provident Fund, is a national savings scheme that is a key pillar of Singapore's social security system. Its core objective is to help Singaporeans and permanent residents with their retirement, housing and healthcare needs.

When a CPF member dies, any remaining money in the accounts will be transferred to legally entitled beneficiaries such as spouses, or people who were nominated to inherit the funds.

These include CPF savings, unused CPF LIFE premiums and discounted Singtel shares.

Upon death, the CPF Board will get in touch with the nominees to facilitate the distribution of the CPF money.

If there is no valid CPF nomination, the money will be transferred to the Public Trustee’s office to be distributed via intestacy laws to legally entitled beneficiaries - usually family or next-of-kin.

Why make a nomination?

As CPF funds cannot be distributed through a will, making a nomination will allow you to decide who will receive your CPF savings according to your wishes - and how much each person should receive.

It would also avoid potential disputes among family members over your CPF savings.

Also, nominations would allow your loved ones to claim your CPF savings quickly. If the money is distributed via intestacy laws, it would take time to locate the legally entitled beneficiaries.

There could also be changes to one's circumstances - for instance, if a couple divorces, if a nominee dies, or if you want to include your child as a nominee.

Note that while it is not necessary to notify the CPF Board of your marriage, any CPF nomination you had made previously will be revoked upon your marriage.

"You are strongly encouraged to make a new CPF nomination so that your CPF savings will be distributed according to your wishes," the agency said.

What happens in the event of divorce or the death of a nominee?

The case involving Mr Toh has prompted questions about whether CPF procedures should be reviewed when it comes to divorce, with the judge saying it "could be a matter for the CPF Board to consider".

According to the CPF website, the treatment of CPF nomination is similar to that of wills, which are not revoked upon divorce.

"Some members may still wish to bequeath their CPF savings to their ex-spouse and/or children via their existing nominations, and therefore, it is best for members to review their latest personal circumstances and update their nomination accordingly," the agency stated.

In the event your nominee dies before you, the share will be given to the surviving nominees in the same proportion you have specified.

However, if there are no surviving nominees, the nomination is considered revoked. The person's CPF savings will be transferred to the Public Trustee's Office for distribution under Singapore's intestacy laws or Muslim Inheritance laws.

Who are the default recipients if there is no nomination?

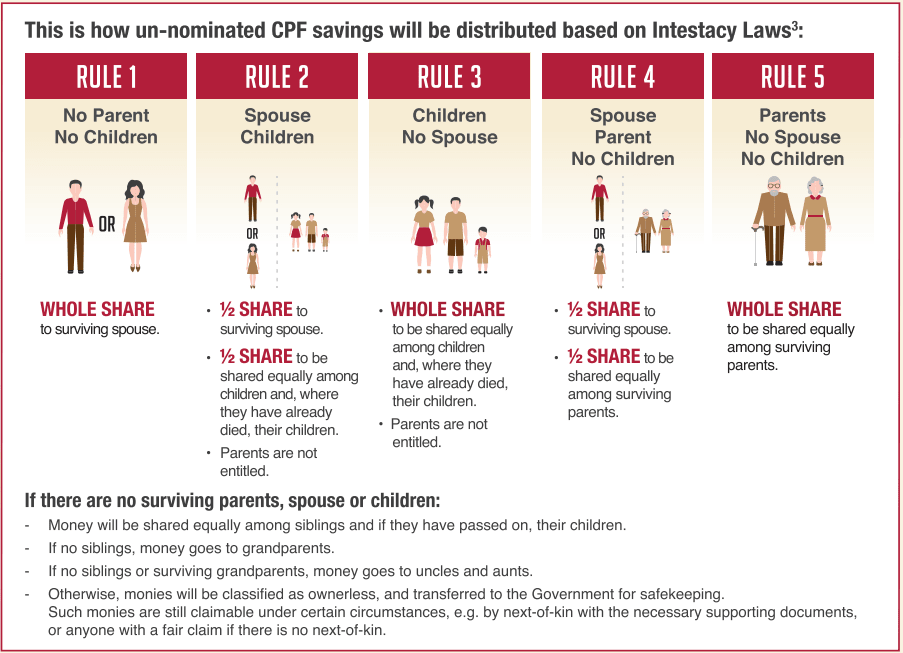

If there is no nomination, CPF savings will be distributed according to intestacy laws, which determine who gets what.

For instance, a surviving spouse will receive the whole share of savings if the deceased has no children or no parents.

If the deceased has children, half of the share will be given to the surviving spouse and the other half will be shared equally among the deceased's children.

If the deceased has no spouse, the whole share of savings will be shared equally among their children.

Who can I nominate?

You can nominate any person or organisation to be the beneficiary of your CPF savings. There is no limit to the number of nominees you can appoint.

For nominees who are below 18 years old at the time of the claim, the share of your savings will be transferred to the Public Trustee's Office and held in trust until the nominee reaches 18 years old.

How does the nomination process work?

A nomination can be made online or at any of the CPF service centres. It can also be made at ServiceSG Centres and ServiceSG@CCs.

Two witnesses are required while making a nomination. They must be at least 21 years old, must not lack mental capacity and must have a SingPass account if the nomination is made online.

People who are making their CPF nomination in person at a CPF service centre can also have the board’s customer services executives act as witnesses during the nomination.

The person making the nomination and their nominees cannot be witnesses to their own CPF nomination.

People making a CPF nomination must also inform their witnesses of their intention to make one. The witnesses will be required to declare they have been informed by the person to witness the nomination.

In the case of Mr Toh’s attempts to change his nomination, he did not directly communicate his intention with his second witness.

Can I change a nomination on someone's behalf?

According to the CPF Board, a nomination can only be personally made or revoked by the CPF member. However, if a CPF member lacks capacity under the Mental Capacity Act, only the courts are allowed to make or revoke a nomination on behalf of the person.

Those interested to make or revoke a nomination on someone’s behalf can apply to the court to do so. The court would decide in the interest of the CPF member who is lacking in capacity, whether to accept the application.

For CPF members who are seriously ill but wish to make a nomination, they can do so provided they are conscious and must not lack mental capacity when doing so.

A nomination can be changed by making a new one, which will supersede the existing nomination that was made. There is no limit to the number of times a person can change their nomination.

Editor’s note: This story has been updated to accurately reflect why Mr Toh’s second nomination attempt was invalid. We apologise for the error.