Condo sellers face longer waits, more selective buyers amid flurry of new launches

While demand remains steady, property agents say some condo units are now taking months rather than weeks to sell.

Residential buildings are seen in this view of the Singapore skyline. (File photo: iStock)

This audio is generated by an AI tool.

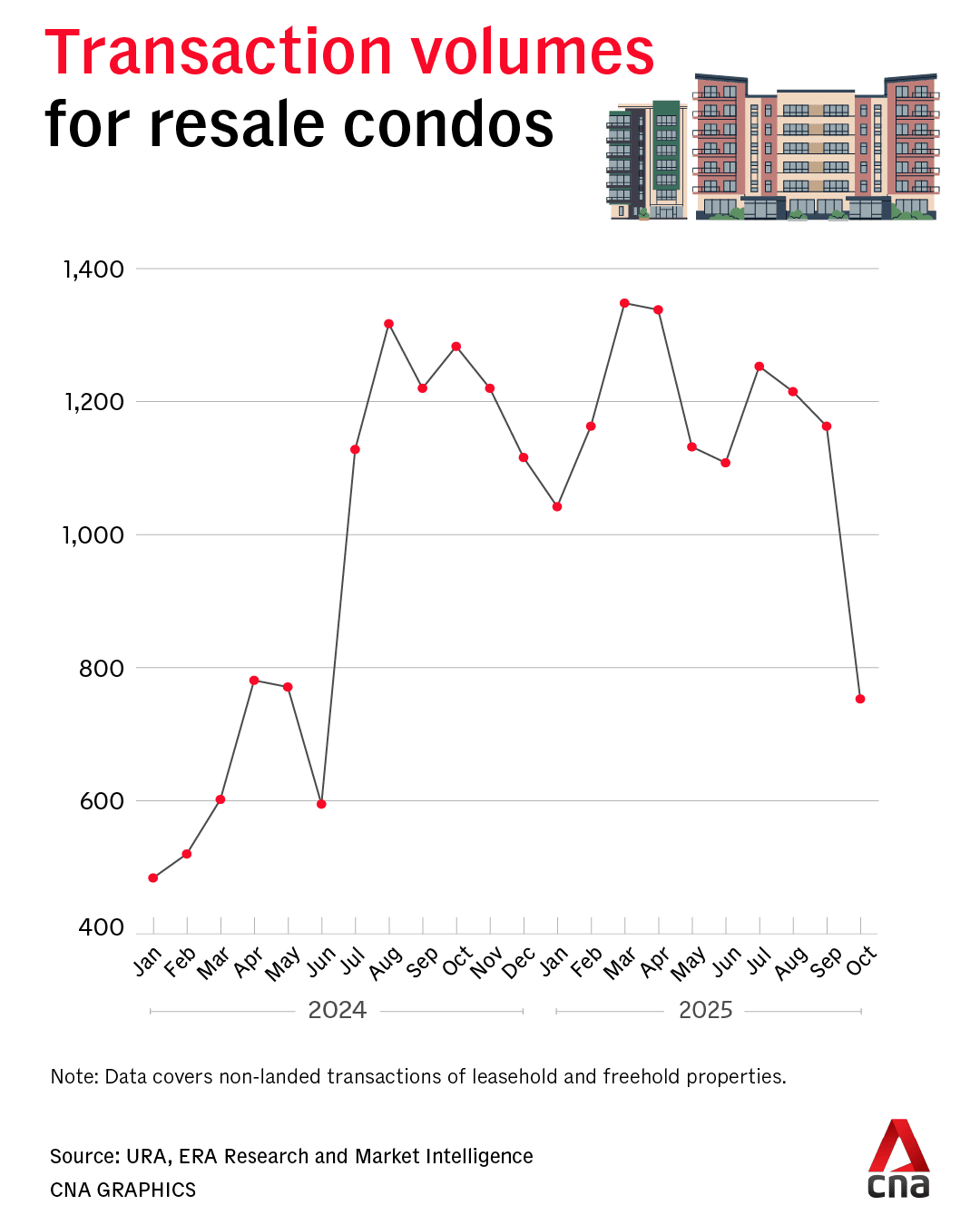

SINGAPORE: A wave of new condominium launches in October drew buyers away from the resale market, pushing transaction volumes to their lowest level in 16 months, based on data provided to CNA.

Data from ERA Research and Market Intelligence and the Urban Redevelopment Authority (URA) showed 753 condo units were resold in October, a 35.3 per cent drop from September's 1,163 units.

This marked the third straight month of decline and the lowest volume since June 2024.

ERA Singapore’s key executive officer Eugene Lim attributed the October drop to a slew of new condo launches: Zyon Grand at River Valley, Faber Residence in Clementi, Penrith in Queenstown and Skye at Holland in Holland Village. The four projects achieved take-up rates of between 84 and 99 per cent during their launch weekends.

Across the island, developers sold 2,424 new homes in October, nine times more than in September and the highest monthly sales figure this year, according to URA data released this week. The figure excludes executive condominiums.

The August and September declines were expected due to the Hungry Ghost Festival, a traditionally quiet period for the local property market.

SELLERS ADJUSTING EXPECTATIONS

While market observers say demand for resale condos remains relatively steady, property agents are seeing a noticeable shift on the ground – some homes are now sitting on the market for months.

“By comparison, when the market is hot, properties sell in under a month and some even on the first day of showing,” said Ms Vivian Chong, an associate senior district director at Huttons Asia.

Concerns about the economy and jobs have made buyers more cautious, realtors said.

Also, with more than 20 new condo launches this year adding to an already substantial pool of resale units, buyers have become more selective.

“In terms of volume, the market is not falling … but there may be a slower pace of sale because too many choices and people (are taking) longer to decide,” said ERA's Mr Lim.

PropNex’s senior associate division director Jack Sheo said buyer sentiment has been volatile in 2025. The resale market started the year strong amid expectations of falling interest rates, cooled in the second quarter due to global economic uncertainties, perked up in the third quarter then turned subdued again as new launches captured attention.

His longest-running listing – a three-bedder in D'Leedon – has been on the market for more than seven months. While located in the prime Farrer area near top schools like Nanyang Primary and Raffles Girls’ Primary, the unit is currently tenanted, hampering viewing availability and deterring buyers seeking immediate occupancy.

With the tenancy ending, “serious offers” have come in, said Mr Sheo, adding that the unit’s owner has been understanding about the long search for a buyer.

But not all home owners can afford to wait. For sellers needing to move quickly, price adjustments have become necessary.

This was the case for Mr Ric Kua. In need of a bigger space for his family of four, the sales manager put his 872 sq ft two-bedder on the market in March. He had expected a quick sale like his previous home, which sold within six weeks. Instead, the search for a buyer this time took almost three months, with offers falling short of expectations.

He eventually accepted an offer of S$1.6 million (US$1.23 million), about 5 per cent below his target, mindful of the time needed to secure a new home for his family returning from overseas.

His agent attributed the sluggishness to increased buyer alternatives and lingering uncertainty following the April announcement of "Liberation Day" tariffs by US President Donald Trump.

A BUYER'S MARKET?

Ms Chong from Huttons Asia described the current situation as a “buyer’s market”, where the speed of sale now depends on the value proposition of each unit – location, layout and pricing.

One-bedroom apartments, for example, have seen softer demand since the COVID-19 pandemic shifted buyer preferences towards larger homes.

“That said, if a one-bedder has unique features like an unblocked view, high ceiling, and is priced competitively, it can still move quite easily,” said Ms Chong.

“While the resale market has slowed, demand has not disappeared. Buyers are just more selective,” she added.

Property agents themselves are feeling the impact. Ms Ong, an agent with 14 years of experience, estimated that she has spent 20 to 30 per cent more on boosting her listings this year. Her longest current listing – a one-bedroom unit in the River Valley district – has been on the market for three months.

“But everyone is also having the same problem so they are also spending more, and it gets even more competitive,” said Ms Ong, who wanted to be identified only by her surname as she had not sought her agency’s permission to speak to the media.

DEMAND FOR RESALE CONDOS STILL STEADY

Despite agents' experiences, data shows the condo resale market is far from a drastic slowdown.

About 11,515 condo units changed hands in the first 10 months of 2025, compared to 8,701 over the same period in 2024 and 11,037 for the whole of last year, according to data from ERA and URA.

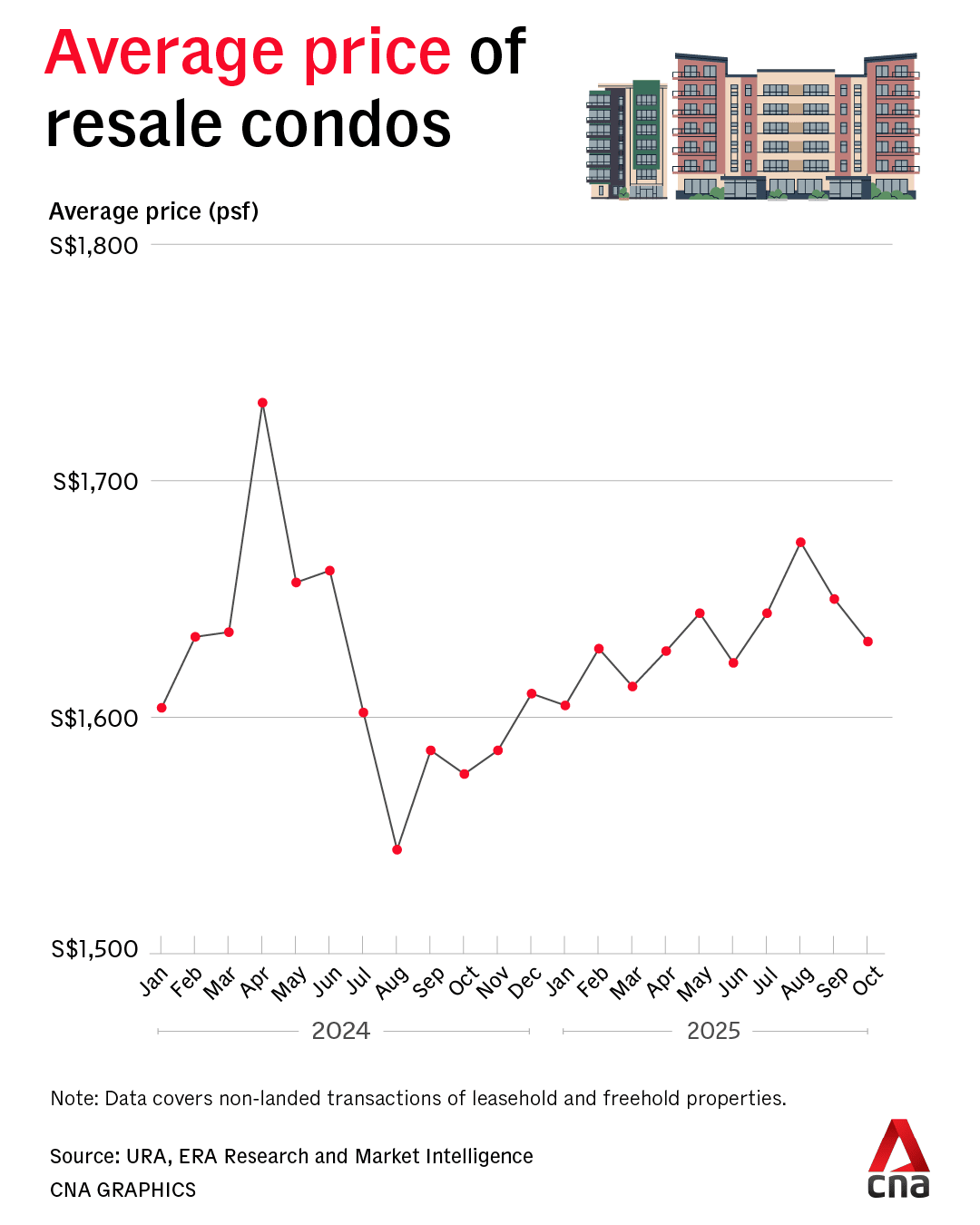

Average resale prices have also edged up roughly 2 per cent year-to-date, from S$1,605 per sq ft in January to S$1,632 in October.

“Unless we see a drop (in volume) consistently over a six-month period, there’s nothing to be worried about,” Mr Lim said.

Ms Christine Sun, chief researcher and strategist of Realion (OrangeTee & ETC) Group, also dismissed concerns about a persistent slowdown, pointing to in-house quarterly data showing continued growth in non-landed private home resale volumes and prices.

She attributed the perceived slowness partly to comparisons with brisk activity in the new launch market. Many sellers are “still holding firm to higher asking prices”, which has led to a “persistent price gap” that slows down transactions, she said.

However, new project launches are expected to drop sharply next year. Realion Group's latest private residential market outlook report forecasts just 16 launches with 8,223 units in 2026, down from 26 launches with 11,430 units this year, excluding executive condominiums.

This reduced supply could redirect buyers to the resale market, especially in areas where demand starts to outpace supply, Ms Sun said.

Other positive factors include Singapore's economic stability and lower borrowing costs from easing global interest rates, Mr Lim noted. A recent check by CNA showed two- and three-year fixed home loans from local banks had rates ranging from 1.55 to 1.65 per cent.

Some buyers are already returning to the resale market after failing to secure favourable queue numbers at new launches, said PropNex's Mr Sheo, who added that he was speaking based on his personal observations.

“In 2025, there were a number of new home projects with very strong selling points. They found favour with buyers. It remains to be seen if buyers continue to favour the upcoming new launches in 2026 over resale homes,” he added.