IN FOCUS: From feed to fuel - what's pushing fish prices higher in Singapore

As food prices rise, CNA traces the entire journey of fish, from sea or farm to the plate, to understand what is driving this increase.

Fish merchants and wet market vendors at Jurong Fishery Port on Jun 9, 2022. (Photo: CNA/Aqil Haziq Mahmud)

SINGAPORE: On a lazy Friday morning (Jun 3) at Tiong Bahru market, fishmonger Sheena Wong was getting exasperated.

The school holidays meant the crowds were thinner than usual, and Ms Wong still had some produce, including sea bass and prawns, left to sell. Wet market fish sellers told CNA they can only make a decent profit if they finish selling all their stocks for the day.

But it is not just the lack of sales that is leaving them worried. Their operating costs – rising fuel prices have driven up logistics and utility costs – have also soared, further hurting their margins.

Some of their fish suppliers have also raised prices. This comes as fishermen and fish farmers in neighbouring countries – Singapore imports about 90 per cent of the fish it consumes – have done the same, again due to rising operating costs.

"Everything has gone up," Ms Wong told CNA, a tinge of frustration in her voice.

"But I don't want to raise my prices; there is no business here. It's not that I don't want to raise my prices, I have to see if customers can take it. I'd rather sell my fish for less than keep them. At least I don't lose a lot."

Ms Wong said her supplier at Jurong Fishery Port has increased the price of sea bass, one of the most common types of fish eaten in Singapore, by about 20 per cent. And if the price continues to go up, Ms Wong will have no choice but to follow suit.

"I cannot always lose money, but I won't increase my prices by a lot," she said.

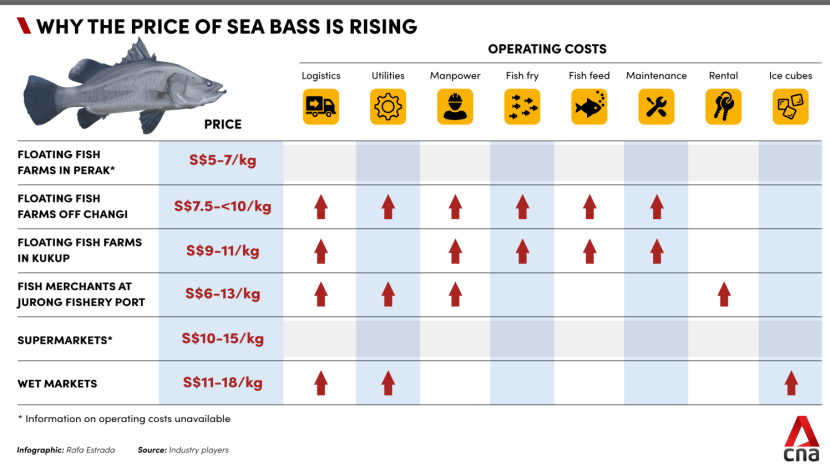

According to latest data from the consumer price index, which measures inflation, the price of fish and seafood rose 5.6 per cent year on year in April, up from 5.2 per cent in March. The price of sea bass also crept up, from S$11.26/kg in March to S$11.40/kg in April.

To understand why fish prices are going up, it is important to first look at the source.

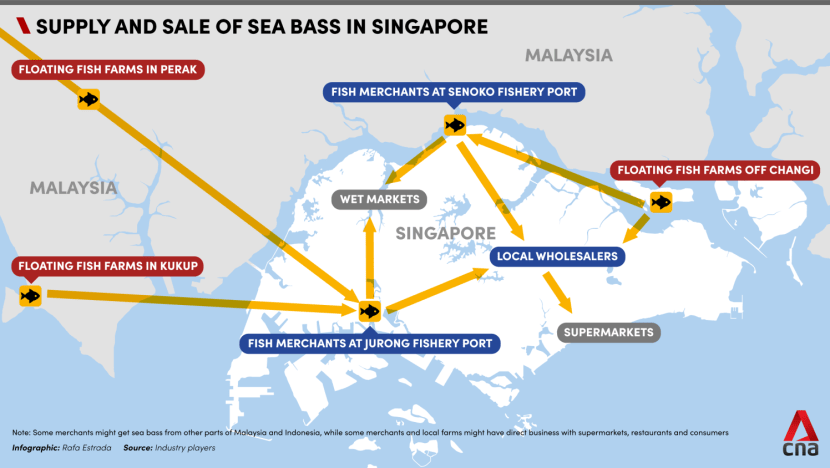

In 2020, Singapore imported 134,000 tonnes of seafood worth S$760 million, mostly from countries in the region such as Malaysia and Indonesia. Depending on the species, this could either be caught from the sea or farmed.

Some of the price rise is caused by one-off dynamics. For instance, there is a recent lack of supply of fish caught from the sea, industry players said, attributing this to fishermen in Malaysia and Indonesia being out of action for longer, as the easing of pandemic restrictions allowed them to celebrate Hari Raya for an extended period in May.

"The (unpredictable) weather also means fishermen do not want to risk going out to sea," said Mr Goh Thiam Chwee from Kah Huat Song Kee Fish Agent, one of at least a hundred fish merchants that do business at Jurong Fishery Port.

The chairman of Malaysia's National Fishermen Association, Mr Abdul Hamid Bahari, earlier told CNA that "extreme" weather over the last few months, from warm and hot to stormy with strong winds, stopped fishing vessels from operating.

Unusual weather patterns, likely due to climate change, can have a big impact on the production of food destined for Singapore. Earlier this year, vegetable farmers in Johor were dealing with the impact of floods and high temperatures, lower yields and rising prices.

Rising fuel prices, due to the ongoing war in Ukraine, have also deterred fishermen from going out to sea, Mr Goh said, adding that they are worried about making a loss amid the higher costs of operating their vessels.

Mr Goh, who is also honorary secretary of the Singapore Fish Merchants' General Association, said these reasons have caused his suppliers to raise prices, and that he in turn has had to push up his prices by about 10 per cent to 20 per cent.

Mr Goh's company imports fish from countries like Malaysia, Indonesia and Thailand and sells them to wet market vendors, restaurants and supermarkets.

The merchant also gets farmed sea bass from floating farms off Tanjung Piandang, in the northern Malaysia state of Perak near Penang, at S$5/kg to S$7/kg, its marketing manager Cai Siang told CNA.

"If the volume of wild caught fish is down, the price of farmed fish will go up," he explained.

Mr Cai said rental and utility costs at Jurong Fishery Port have gone up by about 30 per cent to 40 per cent since February. "Of course, this affects the price of our fish," he said. "We need to raise our prices. If not, we cannot make a profit."

Mr Jason Lim, director of Kiang Huat Sea Products, another merchant at Jurong Fishery Port, told CNA that merchants also price their fish based on supply and demand.

For instance, during the Hari Raya holiday when supply was already low, Mother's Day a few days later further drove up demand, he said.

"So, there was a huge demand for fish but there was a very low supply. Prices during that time went up mad for a while," he said, adding that his logistics costs have also surged.

"Once the supply of wild-caught fish drops, I think that fish farmers (abroad) would jack up the price of bred fish – even if they have enough supply – for more profits."

MALAYSIAN FISH FARMS NOT SPARED

But in the sleepy town of Kukup in Johor, on the southwestern coast of Peninsular Malaysia, fish farmer Ee Long Chian said the farmers there were also contending with a supply shortage, together with a rise in operating costs involving the price of fish feed, fingerlings (juvenile fish) and fuel.

Fish feed typically accounts for more than half of fish farmers' production costs. The Russian invasion of Ukraine has pushed up prices of commodities including corn and wheat, which are important ingredients for fish feed.

The floating fish farms in Kukup supply about 26 tonnes of fish, including sea bass, red snapper, golden pomfret and fourfinger threadfin, each week to Singapore.

"During Malaysia's lockdown last year, we did not dare rear so many fish because there was no demand," Mr Ee told CNA on May 31 at the main jetty in Kukup, where boats from the farms unload their produce onto lorries bound for Jurong Fishery Port.

"Now as demand picks up, we do not have as many fingerlings. So, there is also a lower supply of mature fish."

CNA took a 10-minute boat ride from the jetty to visit Mr Ee's 2,000 sq m farm, where he raises sea bass and other types of fish.

At the farm, Mr Ee grabbed a scoop net and started showing off his fish. The sea bass fingerlings he buys from Johor Bahru take up to six months to get to a weight of 500g, which is plate-sized and ideal for selling in Singapore.

Beyond the lack of fingerlings, Mr Ee said the price of these fish fry has gone up by "a bit" too, as breeders rush to meet demand. The price of sinking fish feed, or pellets, used for the sea bass also increases every three to four months, he said.

"The salary of my workers has gone up by 10 per cent since half a year ago," he continued, pointing out that one of his three workers returned to Indonesia after working for him for 10 years.

These reasons, coupled with rising fuel prices, meant Mr Ee has had to raise the price of his sea bass to S$11/kg from S$9/kg last October.

"The price of all types of fish from Kukup has gone up," added Mr Ee, who has run his farm for more than two decades and is also chairman of the Kukup Fish Farmers' Association.

The Kukup farms deliver fish every Monday, Wednesday and Friday, depending on what merchants in Singapore want. The merchants will quote the farms a price based on demand, Mr Ee said, adding that red snapper is popular in Singapore right now.

JOURNEY TO SINGAPORE

The next day at around 3pm, two vehicles – a large cargo truck and a smaller lorry with a crane – reversed onto the jetty, which by then reeked of an earlier delivery of dead small fish used as fish feed.

Trucker Mohd Arshad Shukor hopped off the cargo truck and began unloading empty plastic crates used during the previous trip to Singapore. Long boats from the farms, carrying crates of fish packed in ice, motored by the jetty and stopped in the muddy and shallow water.

The crane from the smaller lorry hauled the crates onto the large truck, where Mr Arshad was waiting to organise his load. His journey to Singapore takes around four hours depending on congestion and customs clearance.

Mr Arshad, who has been in the job for three years, confirmed that the price of diesel used by his lorry has just increased to RM3 (S$0.94) per litre from about RM2 per litre, and that his salary has also gone up.

Nevertheless Mr Kyle Yeo, who runs Xin Chen Aquaculture fish farm in Kukup and is also in charge of the delivery of fish to Singapore, said he has yet to increase his logistics fees.

"We are trying to help each other out, but it's hard now (due to the rising prices)," he said.

NIGHT AT THE FISHERY PORT

As merchants process their deliveries of sea bass and other types of fish into the wee hours of the morning, wet market vendors descend on the port to purchase their stocks for the day.

Around 1,500 fish retailers, fish processors and institutional buyers go to the port daily to buy fish, according to the Singapore Food Agency website.

On Jun 9 at 3.30am, CNA followed Mr S Kogu, who runs the Fish2Go stall at Bedok 58 market, to the port to see how wet market vendors buy their fish.

Visitors to the port, which was the site of Singapore's largest COVID-19 community cluster until September last year, must prove their vaccination status. The port is one of only a handful of places here that still require such checks.

The retail area inside was a large, old-school wet market, with merchants sitting at tiny booths surrounded by plastic crates and Styrofoam boxes of fish.

Some of the fish were laid in melting ice on the wet floor, as porters yelled at each other and pulled buckets of fish using hand pallet trucks.

The port was heaving with activity, but Mr Kogu said it used to be busier before the pandemic forced a number of merchants and wet market vendors to retire.

He has been in the business for 20 years, so he was familiar with many of the people at the port, teasing and cussing as he haggled over prices.

One merchant tried to sell prawns to him at S$32/kg, but he asked for a lower rate of S$28/kg. "There is nobody (at the market)," he insisted to the merchant in Hokkien.

"Sometimes, we just want the price to go down so that we can sell cheaper," he later told CNA. "If you sell to customers at whatever price you want, they won't believe you."

After about an hour browsing at different stalls, comparing prices and whipping out a wad of cash to pay, Mr Kogu settled on his produce for the day. He bought about 50kg of seafood in total, including sea bass, stingray, red snapper, red grouper and two types of prawns.

His regular merchants have not increased their prices, he said, adding that he does not need to haggle much with them.

SOME FISH PRICES RISE IN WET MARKETS

When CNA visited the Bedok 58 market on Jun 3, Mr Kogu's Kukup sea bass, priced at S$18/kg, had sold out. He said he has not had to raise the price of his sea bass as his supplier has not done the same.

While Mr Kogu acknowledged that logistics and utility costs have gone up, he accepted that these were "part and parcel" of business operations.

"You cannot just increase everything," he said. "Most of our customers are all regulars; they have been supporting me for many years. An increase in price does not really help them."

Some wet market vendors were not as fortunate.

One of them at Bedok 58 market, who only wanted to be known as Mr Chua, said his supplier at Senoko Fishery Port raised its price of farmed sea bass from Kukup and Penang by about S$1/kg to S$2/kg. Therefore, he has had to do the same.

"My costs have also gone up, especially the price of diesel," he said, noting that it now costs S$3.06 per litre up from S$1.72 per litre years ago. "The price of ice cubes (used when displaying fish) has also gone up by 50 cents per packet."

Mr Chua said some customers ask why the prices have increased and choose to buy cheaper fish instead. "My profit margin is very little as we go by volume," he said, adding that he can earn S$400 only if he finishes selling the 6kg of fish he bought for the day.

Mr Jeffrey Tan, who runs the Dish The Fish stall at Tiong Bahru Market, said he has had to raise the price of his sea bass, wild caught in Indonesia, by 15 per cent to 20 per cent as logistics and fuel prices spike.

The prices of his other fish that come from the region are also up by about 20 per cent to 25 per cent, while the price of his salmon has gone up "significantly".

According to the consumer price index, the price of salmon was S$35.29/kg in April, steadily increasing from S$29.90/kg last December.

"We import our salmon from Vancouver, so prices are increasing almost every other month," he said. "Logistics costs have tripled – it used to be US$2.20/kg (S$3.02), now it's going to be more than US$6."

Mr Tan is trying to tackle this by diversifying his business operations.

Dish The Fish has an e-commerce site that now makes up almost half of his business, up from one-fifth three years ago. It also has a physical store in Serangoon with a cold room, so fish can be bought in bulk and stored for "better economies of scale", Mr Tan said.

"We are also doing value-added stuff, like cooking our own broth using leftover bones. We also work with a few local farms, but the supply there is irregular," he added.

This lack of supply from local fish farms is a sentiment shared by Mr Kogu and Mr Cai. Official data showed that just 9 per cent of the fish consumed in Singapore last year was produced locally.

LOCAL FISH FARMS HIT BY RISING COSTS TOO

Mr Timothy Ng, who runs a fish farm off the north-western coast of Pulau Ubin, said he too is facing rising operating costs, including in utilities, manpower, logistics and maintenance.

The cost of fingerlings has gone up to 50 cents a fish up from 30 cents a year ago, he said, while the cost of fish feed has increased by more than S$1 for a 25kg bag in the same period.

The price of Balau wood, the material used for the wooden planks that form a fish farm's structure, has also climbed from S$100 a tonne to S$340 a tonne, he said.

Mr Ng's farm produces 10 tonnes of sea bass, snapper and grouper each year, with sea bass making up half of his yield. He has maintained his price of sea bass at S$7.50/kg despite the rising costs, as the local wholesalers he sells to would not buy them if it was more expensive.

Mr Ng attributes this to the low prices of sea bass from Malaysia, like the S$5/kg ones from Tanjung Piandang.

"All these years, that has been our main challenge," he said, adding that fish faming was his "passion" and that he has not made a profit after almost two decades of doing it.

"I’m a price taker; I cannot press (the local wholesalers). I'm not such a big player to say that, 'Sorry if you buy from me at this price, I won't sell you' and then they bend down. Most of the farms here are all small farms – we are price takers."

Local wholesalers are another component of the fish supply chain in Singapore, usually in charge of sourcing for fish from merchants.

Business like supermarkets and restaurants sometimes get fish through these wholesalers as they do not have dedicated staff who go to the fishery ports every other day to secure the day's stock. Wholesalers can also deliver the fish to different outlets around the island.

Mr Ee, the Kukup fish farmer, said merchants would sell his sea bass to local wholesalers for S$13/kg, who then sell them on to restaurants at S$17/kg.

However, some merchants and local fish farms have direct contracts with supermarkets and restaurants around the island.

When Mr Ng was asked if he has tried going direct to the retail market, he said this was "easier said than done".

"I don't have kind of a fixed person (to sell to) and say, 'I can supply you so much.' Farming cannot be so definite, sometimes because of mortality and different things," he said, highlighting that some of the bigger local fish farms have foreign investment and thus can do more.

"I suppose one or two farmers have just gone on the Internet to sell their fish, so I don't how much they are making."

Mr Malcolm Ong, who runs floating fish farms in the waters off Changi that produce sea bass, snapper and milk fish, has had more luck.

On top of selling to local wholesalers, his company The Fish Farmer is in direct business with supermarkets, restaurants and food service companies. He has achieved this by selling what he called "value-added" products, including ready-to-eat Teochew- or Thai-style sea bass.

"We work with processors who cut everything nicely and package it together with the sauce. You don't need to wash your pot, knife or chopping board. Just heat up in hot water and it can be served already," he said.

"We are doing this because Singaporeans are so busy. We have to of course give some convenience or value to customer, and at the same time we can command a little better pricing."

Mr Ong said he has had to raise the price of his sea bass by about 20 per cent similarly due to rising operating costs, although he would only say that it is now going for below S$10/kg.

"We have value-added services, so we can charge a little bit more," he said, adding that restaurants are short-handed and might have special requests for fish, including, for instance, buying fillets of a certain size while also needing the fish's head.

Mr Ong is also confident that locally farmed sea bass, while darker in appearance, is as good as the ones from Kukup "if not better".

Many years ago, a lot of the sea bass consumed in Singapore had a "muddy taste" as they came from land-based farms, Mr Ong explained.

"Kukup sea bass was raised in seawater farms, so they enjoyed that advantage (of being tastier). But this advantage is no more because a lot of the fish farms here are seawater farms," he said, adding that the Government is also very strict about environmental and food safety standards.

FAIRPRICE MONITORING FISH PRICES

FairPrice supermarket, which sources its sea bass from farms both in Singapore and Malaysia, said it gets imported seafood through wholesalers "to offer an extensive range of harvested fishes that meet our product specifications".

"For locally sourced seafood, we would work directly with local fish suppliers and farmers as they are able to meet required quality standards," a spokesperson said, adding that this is part of a nationwide initiative to support locally grown food.

While FairPrice did not say if it has increased the price of sea bass sold at its outlets, the spokesperson said its fish prices have "remained stable in the past few months".

"As a retailer, NTUC FairPrice is a price taker and our product prices are subject to fluctuations due to market conditions. This includes market forces of demand and supply, climate conditions, international trade agreements, taxation and currency fluctuations," the spokesperson said.

"Other considerations also include overheads like manpower, infrastructure and transport."

Representatives for Dairy Farm Group, which manages Giant and Cold Storage supermarkets in Singapore, did not respond to requests for comment. Sheng Siong supermarket declined to comment.

Back at Tiong Bahru market, Ms Wong the fishmonger tried to convince a customer to buy more fish that cost S$10 a piece.

"Take two lah, (why) just one only, aiyo. Okay, you take two, I charge you S$18," said Ms Wong, who switched from her job as a private hire driver less than a year ago because she thought she was not earning enough then.

When the woman sheepishly declined, Ms Wong turned to this reporter and said: "See? Difficult or not?"

"Here, a lot of the stalls are old, so they have a lot of regular customers," she added.

"For me, I try to get new customers. So, I cannot increase my prices. I cannot. It's not that I don't want to."