Income for all employed households rose last year

TODAY file photo

SINGAPORE — Many employed households here enjoyed strong real income growth last year but the road ahead may not be as smooth, with individual income growth set to moderate due to more subdued demand for labour this year. The Government has also warned that should productivity improvements continue to lag behind income growth, Singapore’s competitiveness would be affected.

Commenting on the Key Household Income Trends 2015 paper released on Friday (Feb 26) by the Department of Statistics (Singstat), Trade and Industry (Industry) Minister S Iswaran said: “The only sustainable way to keep real wages growing is for them to be underpinned by productivity growth, because that will ensure that workers are able to earn a higher income, whilst we preserve the competitiveness of the economy and of the businesses and sectors (here).”

Figures released on Friday showed that real income for resident employed households rose for all groups last year, with the bottom 20 per cent of households seeing the fastest growth.

Mr Iswaran, who was speaking on the sidelines of the 2016 Singapore International Chamber of Commerce Awards, noted that although real median income has risen by three per cent annually over the last five years, productivity growth has grown by 0.4 per cent yearly, on average.

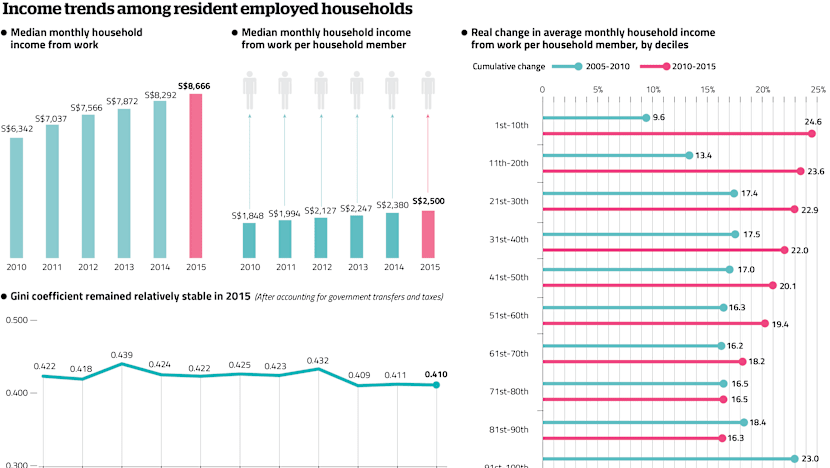

Median monthly household income from work, per household member, grew 5.4 per cent last year for resident employed households after accounting for inflation, Singstat said.

The increase, from S$2,380 in 2014 to S$2,500 last year, was due to a tight labour market as well as the increase in employer Central Provident Fund contribution rates. Resident employed households refer to households headed by a Singapore citizen, or permanent resident, with at least one working person. Household income from work refers to income from employment and business, and does not include income from non-work sources such as dividends and rent.

The median monthly household income from work among resident employed households last year was S$8,666, up from S$8,292 in 2014.

The bottom 20 per cent of households on the work-income ladder saw increases of 10.7 per cent for the bottom 10 per cent and 8.3 per cent for the second-lowest decile. This was thanks to ongoing initiatives to help low-wage workers, said Singstat.

The latest statistics mean that for the last five years, income growth for the lower-income groups has slightly outpaced that of the higher-income groups — unlike the trend from 2005 to 2010, when the work incomes of high earners generally increased faster.

In absolute terms, the average monthly household income from work, per household member, among resident employed households in the bottom 10 per cent was S$541, while the same average for the top 10 per cent was S$12,816 last year.

Government transfers last year amounted to S$3,985 per resident household member on average, 13 per cent higher than in 2014. This was due to higher GST Voucher disbursements, additional transfers such as income tax rebates, top-ups to Child Development Accounts, MediShield Life subsidies and other schemes. More was given to the lower-income: Resident households in one- and two-room flats received S$9,318 per member on average last year, while households with no working person received S$5,548 per member on average from government schemes.

(click to enlarge image)

Economists expect real income growth to remain positive – albeit modest – over the next five to 10 years if slow economic conditions persist.

“If (economic) growth in the next five to 10 years continues to fall within the one to three per cent range, the underlying wage growth will likely remain modest as well,” said CIMB Private Banking economist Song Seng Wun.

Agreeing, OCBC Bank head of treasury research and strategy Selina Ling noted that as economic growth weakens, there will be a “tapering in terms of both jobs growth and wage growth”.

Barclays chief economist Leong Wai Ho said, however, that while wage growth will moderate, the Republic is likely to push into new areas of services that are “niche and higher-paying”. This means a good chance that wage growth can be sustained in the upper-income segment.

Even as economic growth is forecast to be sluggish, economists do not expect Government transfers to lower-income households to take a hit.

Mr Song said the Government’s coffers remain “very healthy” despite the gloomy economic climate and efforts to help lower-income groups are an ongoing process. “If you don’t have a gradual process, you’ll get a very immediate impact on inflation, because underlying wages will spike up much faster.”

Apart from the lower-income group, economists said particular attention should be paid to middle-income earners, particularly the professionals, managers, executives and technicians (PMETs).

Mr Leong said the PMETs were a particularly “vulnerable” segment experiencing rising unemployment. “The organic growth engines are slowing and this means slower growth in employment for the middle income (earners).”

As economic growth slows and companies re-examine their priorities, Mr Iswaran acknowledged that it would be harder to achieve productivity growth. But by pushing on with productivity efforts, Singapore will be in a better position to take advantage of an economic recovery that is just a “question of time”. “(It) is the responsibility of not just the Government, but of the businesses and also of the general workforce,” he stressed.