One-off rebate for owner-occupied homes in 2024 to cushion impact of property tax rises: MOF, Iras

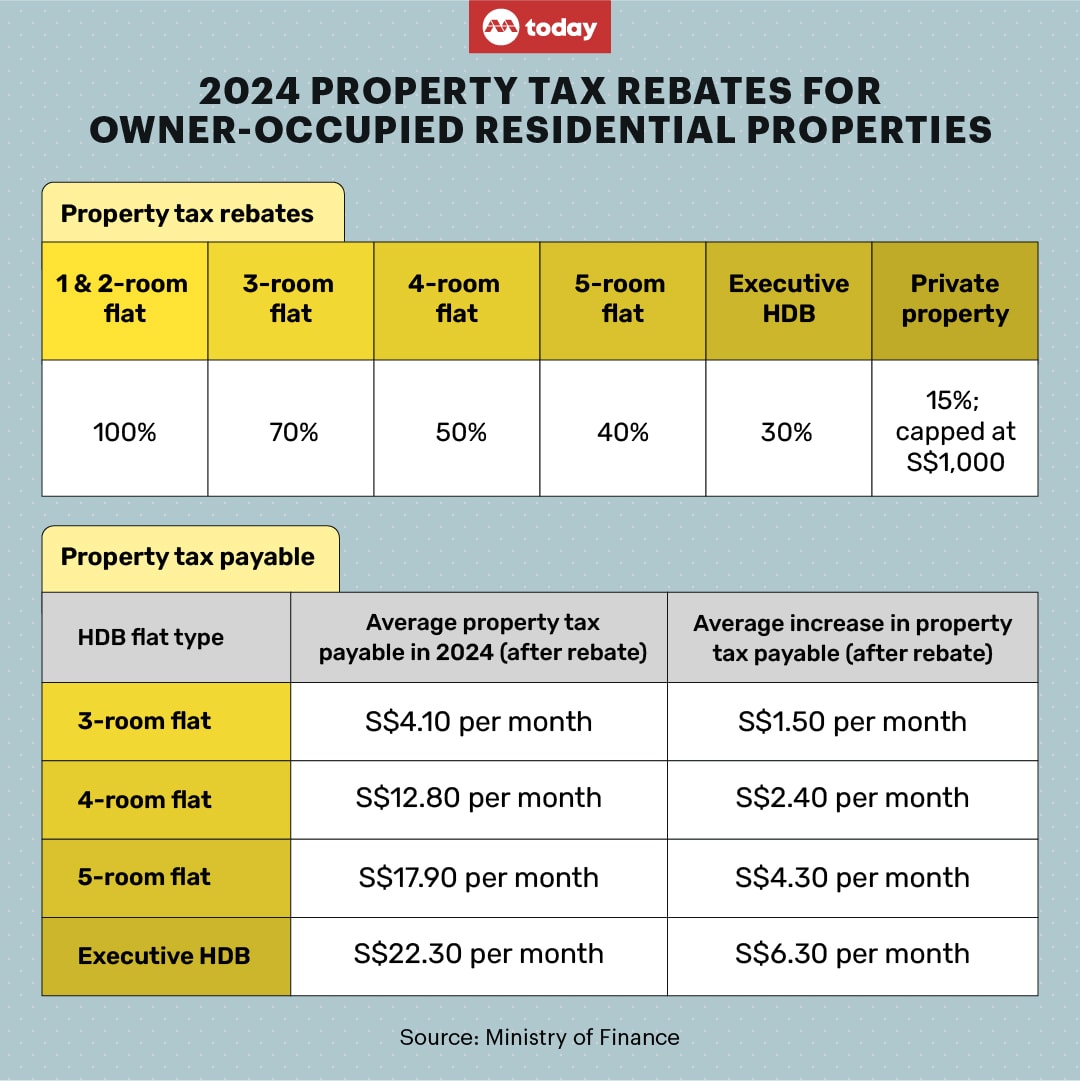

SINGAPORE — A one-off property tax rebate for owner-occupied homes, ranging from 100 per cent for the smallest public flats to 15 per cent for private properties, will be given next year to offset the expected rise in property taxes.

The rebate is expected to help cushion the tax increase in the midst of cost-of-living concerns, the Ministry of Finance (MOF) and Inland Revenue Authority of Singapore (Iras) said on Thursday (Nov 30) in announcing the move.

They also said that the higher property taxes to be incurred from Jan 1 next year are due to higher market rents and annual values for most residential properties, as well as an increase in tax rates for higher-value private residential properties being implemented this year and next year.

The amount of property tax payable is derived by multiplying the property tax rate with the property’s annual value, which refers to the estimated annual rent of the property if it were to be leased.

Owner-occupiers of one-room and two-room Housing and Development Board (HDB) flats will be given a 100 per cent rebate for their property tax.

“With the property tax rebate, all one- and two-room HDB owner-occupiers will continue to pay no property tax in 2024,” MOF and Iras said in the joint statement.

Owner-occupiers of these small flats did not have to pay property tax this year as their annual values remained below S$8,000.

The rebates are stepped down progressively for bigger public flats, with executive HDB flats getting a 30 per cent rebate.

Owner-occupiers of private properties will receive a 15 per cent rebate, capped at S$1,000.

The rebates will be automatically offset against any property tax payable.

MOF and Iras said that owner-occupiers of three-room or bigger public flats can expect to pay an average of between S$1.50 and S$6.30 more property tax a month after taking into account the rebate.

“The bottom half of private property owner-occupiers (by annual value) will experience a property tax increase of less than $15 per month,” MOF and Iras said.

“The increase in property tax will be higher for those with higher value properties.”

HIGHER EXPECTED PROPERTY TAX REVENUE

In Budget 2022, an increase in property taxes — Singapore’s principal means of taxing wealth — was announced, to take into effect in two steps in 2023 and 2024.

For owner-occupied residential properties, the property tax for the portion of annual value in excess of S$30,000 will be increased from the previous range of between 4 per cent and 16 per cent in 2022 to between 6 per cent and 32 per cent by 2024.

Finance Minister Lawrence Wong said then that when fully implemented, the changes will raise Singapore’s property tax revenue by about S$380 million a year.

Given the rising annual value of property, TODAY has asked MOF and Iras how much more revenue is expected.

In the announcement on Thursday, they said that the rebates for owner-occupied residential properties will be rolled out to cushion the impact of the higher property tax.

“The rebate is tiered to ensure that our property tax regime remains progressive, and those with greater means pay their fair share of taxes,” they added.