Scam cases in Singapore jumped almost 50% in 2023; most victims fell for job, e-commerce cons

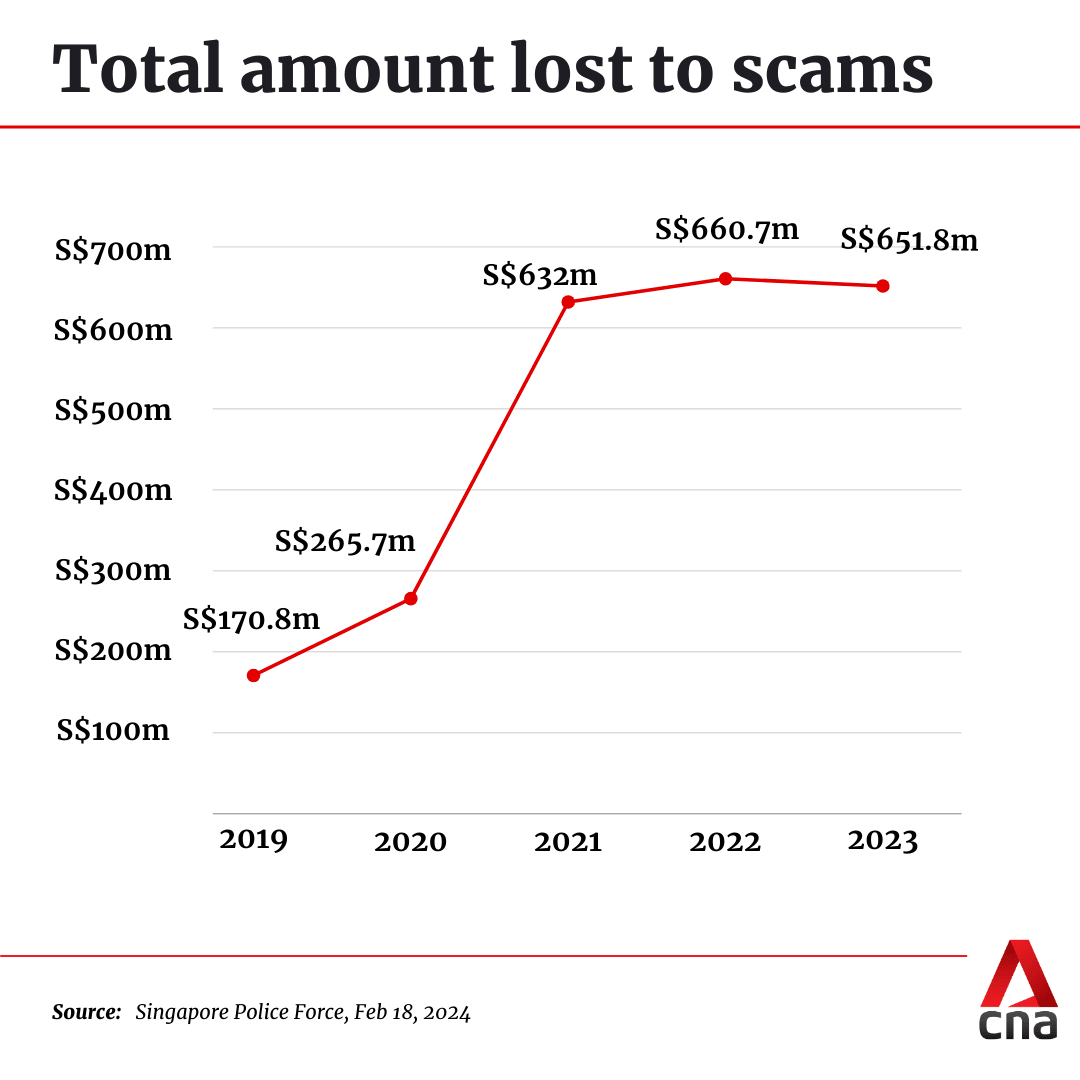

Fraudsters siphoned S$651.8 million from victims last year – the first time in five years that the total amount lost to scams has fallen.

(File photo: iStock)

This audio is generated by an AI tool.

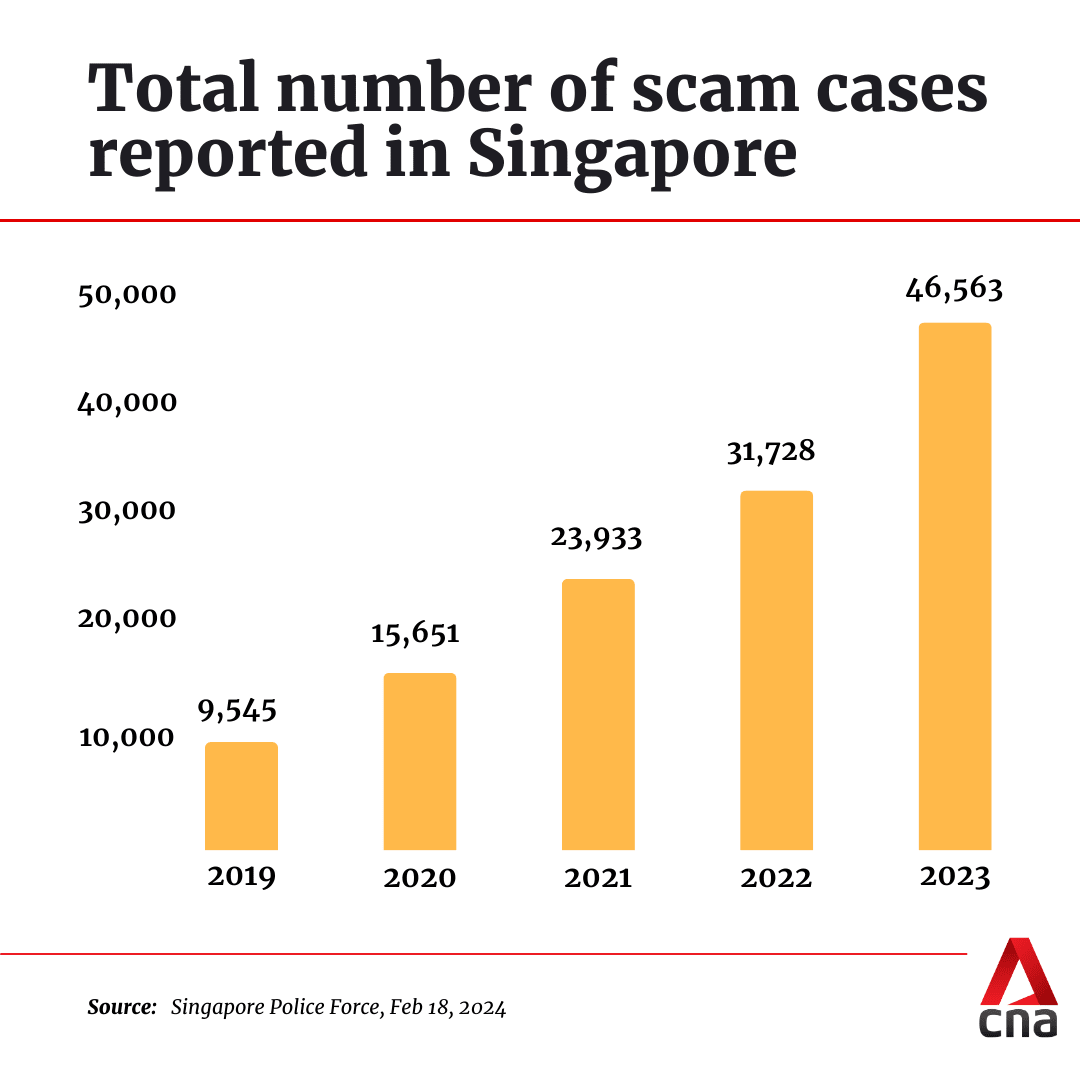

SINGAPORE: More than 46,000 scam cases were reported in Singapore in 2023, marking an eight-year climb in scam figures even as the amount of money lost by victims fell slightly by 1.3 per cent, according to figures released by the Singapore Police Force (SPF) on Sunday (Feb 18).

The total number of cases increased by 46.8 per cent from 31,728 in 2022 to 46,563 in 2023. This is the highest since the police began tracking scams in 2016.

On the other hand, the total amount lost to fraudsters dropped from S$660.7 million (US$490.6 million) to S$651.8 million during that same period.

The police attributed the slight decrease in losses to efforts by the authorities and the private sector, including banks, to stop or mitigate scams while the scam process is still ongoing. This has led to scammers extracting less money from each victim before they are stopped.

Nevertheless, SPF stressed that the amount lost is still "very significant", and it remains crucial for everyone to be more discerning against scams.

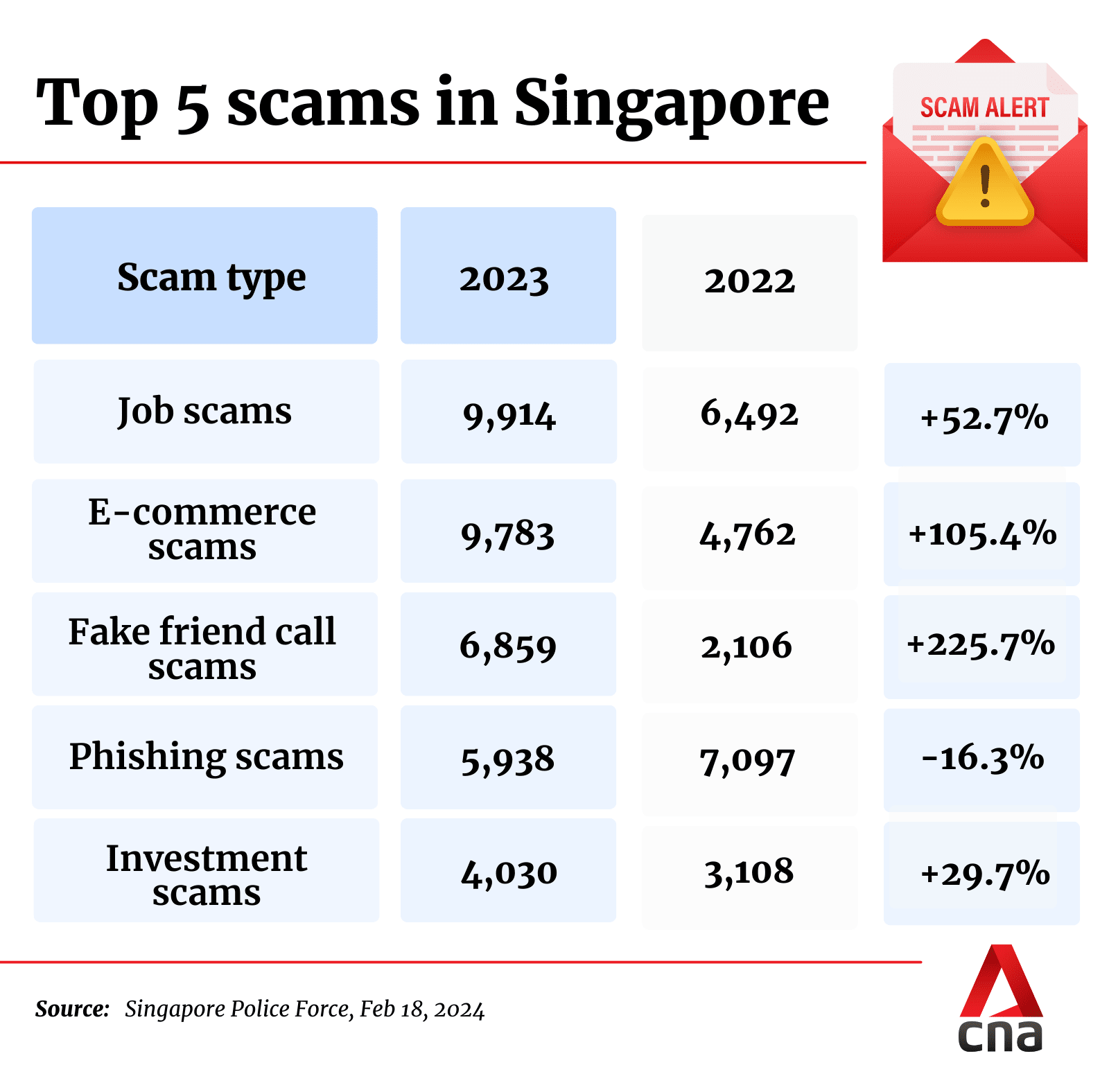

Job scams were the top type of scams that people fell for, followed by e-commerce scams, fake friend call scams, phishing scams and investment scams.

Similar to the first half of 2023, the police flagged malware-enabled scams involving Android devices, which exploded last year and prompted a slew of measures by banks and the government. The total amount lost to malware scammers in 2023 came up to at least S$34.1 million.

This was the second year that SPF released its annual data on Singapore’s scam and cybercrime cases separately from physical crime figures. Spikes in scam numbers in recent years have skewed the overall crime indicator.

The total number of scam and cybercrime cases also rose by 49.6 per cent to 50,376 in 2023, compared to 33,669 cases in 2022.

30- TO 49-YEAR-OLDS MOST SUSCEPTIBLE

Adults aged 30 to 49 made up the largest proportion of all scam victims last year – 43.1 per cent.

As for how they were targeted, scammers overwhelmingly continued to use Facebook, WhatsApp and Instagram – which are all owned by Meta – to contact potential victims and carry out the frauds.

In a press release, SPF noted their concern over a “sharp increase” in the number of scams carried out through such social media and messaging platforms, including Telegram.

META "RESISTANT" TO COOPERATION WITH POLICE ON ANTI-SCAM MEASURES

Scammers contacted victims via social media in 13,725 cases last year – up from 7,539 cases in 2022. The numbers were similar for messaging platforms – 12,368 last year, up from 7,599 in 2022.

In response to CNA's queries, the police said that they and the Ministry of Home Affairs have "consistently engaged" online platforms to implement anti-scam measures.

"Unfortunately, we have experienced varying levels of cooperation across platforms. While platforms such as Carousell and Shopee have indicated willingness to work with us to implement the necessary safeguards, other platforms such as Meta have been resistant," added the police.

"Given the above challenge and the continued increase in scams, we will use legislative levers to require online platforms, including Meta, to step up their safeguards."

These levers include the Online Criminal Harms Act, which was recently passed in parliament and will be progressively operationalised from this month onwards.

Under the Act, the government can issue directions to online platforms to prevent scam accounts or content from interacting with or reaching Singapore users, as well as issue Codes of Practice to require designated providers of online services to put in place systems, processes and measures to disrupt scams affecting people Singapore.

TOP SCAM CONCERNS

Job scams made up 21.3 per cent – or 9,914 cases – of all scam types in 2023. This was a 52.7 per cent increase from 6,492 cases in 2022.

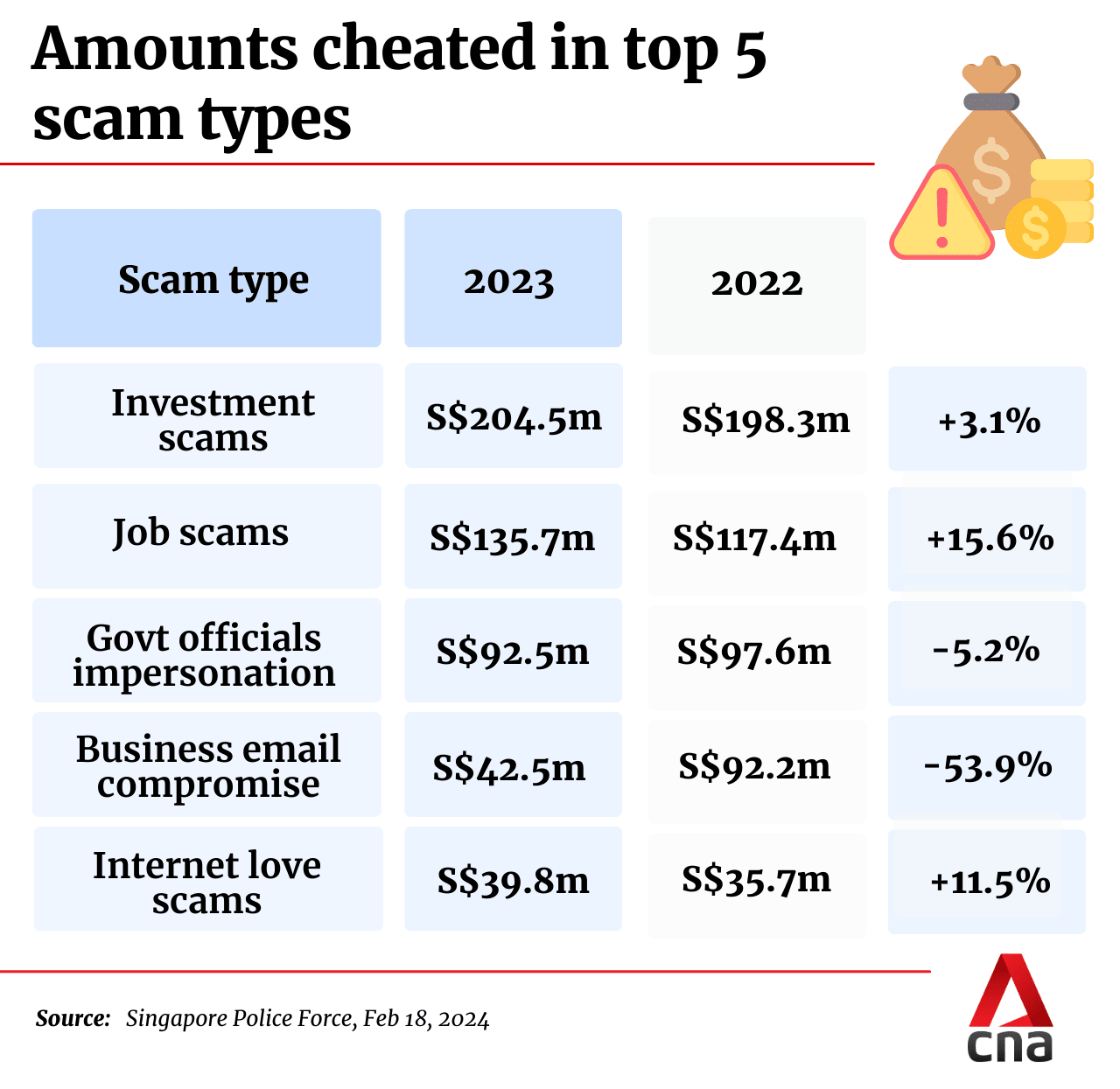

Job scam victims lost more last year compared to 2022 as well. The total amount of job scam losses in 2023 came up to at least S$135.7 million – a 15.6 per cent increase from at least S$117.4 million in 2022.

However, the average amount lost per case dropped from S$18,089 in 2022 to S$13,692 in 2023.

A majority of job scam victims were aged 30 to 49, making up 45.4 per cent of all victims.

Victims are typically offered online jobs that can be performed from home. They are asked to perform tasks for a commission such as making advance purchases, liking social media posts, reviewing hotels or restaurants or airlines, completing surveys, “boosting” the value of cryptocurrencies, or “rating” mobile apps to improve their rankings in app stores.

Victims can also be asked to transfer funds to bank accounts provided by the scammers, in exchange for a small commission.

Scammers then ask for more funds for purportedly higher earnings, but the victims would eventually be unable to withdraw money from the bank accounts or the scammers would become uncontactable.

Separately, the number of fake friend call scam cases rose sharply from 2,106 in 2022 to 6,859 in 2023.

The total amount lost also increased significantly from at least S$8.8 million in 2022 to at least S$23.1 million in 2023.

The majority of victims were aged 50 to 64, making up 37.5 per cent of all victims. They were typically contacted by scammers through phone calls and WhatsApp who pretended to be their acquaintance.

During the conversation, the scammers would claim they had lost their mobile phone and changed numbers. After establishing rapport, they would seek money for various reasons such as paying contractors for renovation fees.

Victims would transfer funds via PayNow to bank accounts, before discovering they had been scammed when they contacted their actual acquaintance.

Meanwhile, government officials impersonation scam victims suffered the highest average losses in 2023 at about S$103,600 per case. This was followed by investment scams at about S$50,700 per case, and internet love scams at S$43,677 per case.

SCAM VICTIM PROFILES

In line with past years, younger people have proven more susceptible to scams. Those aged below 50 formed 73 per cent of all scam victims last year.

Youths aged 19 or below made up 5.3 per cent, while young adults aged 20 to 29 made up 24.6 per cent. Adults aged 30 to 49 made up 43.1 per cent. All three age groups tended to fall for e-commerce, job or phishing scams.

“Young seniors” aged 50 to 64 formed almost 20 per cent of scam victims. About a quarter of these young seniors fell for fake friend call scams.

ANTI-SCAM MEASURES

SPF gave some updates on anti-scam measures rolled out by SPF and other government agencies, such as the Infocomm Media Development Authority (IMDA).

From Apr 15, people will only be able to purchase and register a maximum of 10 post-paid SIM cards.

This comes after SPF and IMDA have observed signs of such SIM cards, which are predominantly bought by locals, being increasingly misused for scam purposes.

Fraudulently registered post-paid SIM cards can act as an anonymous communications channel for illicit activities, which include scams and unlicensed moneylending.

The police said that the higher cap of 10 cards is meant to cater to the needs of legitimate users who may register SIM cards for family members, while limiting illicit usage. IMDA will review the limit over time to ensure it continue to be relevant.

This will only apply to new registrations. Subscribers who currently have more than 10 post-paid SIM cards will not be affected but will not be able to register more of such cards.

Pre-paid SIM cards have usually been of concern, with people still only being allowed to buy a maximum of three pre-paid cards today.

The Ministry of Home Affairs, which oversees SPF, will be introducing new offences to criminalise the abuse of SIM cards. More details will be announced shortly, said SPF.

Last year, 11 people were arrested during four island-wide operations targeting 17 mobile phone shops. They were suspected to have helped scammers by fraudulently registered SIM cards using others’ particulars.

ANTI-SCAM COMMAND

The police’s Anti-Scam Command, which was set up in March 2022, froze more than 19,600 bank accounts and recovered more than S$100 million.

Staff from six banks as well as the Government Technology Agency were also deployed to work at the Anti-Scam Command to speed up responses to scam cases and flag unusual activities in Singpass accounts.

Since Jan 30, staff from popular e-commerce platform Carousell have also been working at the Anti-Scam Command to better take down “scam-tainted online monikers and suspicious advertisements”, said SPF.

“The fight against scams must continue and the responsibility cannot rest with law enforcement alone,” said Mr David Chew, director of SPF’s Commercial Affairs Department.

“Scams will continue to evolve, so a discerning and vigilant public is essential. The police will continue to work closely with stakeholders and other government agencies to safeguard Singapore against scams.”