Beware of scams involving fixed deposit 'promotions'; at least S$650,000 lost since January

Scammers impersonating banks are luring victims via SMSes promising high interest rates.

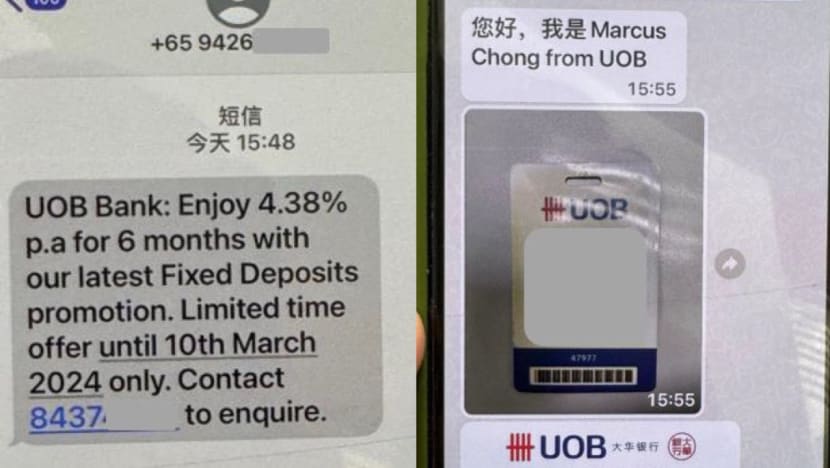

A screenshot of an SMS sent to a victim (left) and a scammer impersonating a bank officer. (Images: Singapore Police Force)

This audio is generated by an AI tool.

SINGAPORE: The police warned on Thursday (Apr 11) of a scam trend where criminals impersonate banks and offer victims fixed deposit scheme promotions.

At least 12 victims have fallen prey since January with total losses amounting to at least S$650,000 (US$480,000), the police said in a news release.

Victims would receive SMSes from unknown +65 local mobile numbers, purportedly from local banks, and be offered fixed deposit schemes with high interest rates.

The victims would then be instructed to contact a number provided within the SMS to indicate their interest and obtain more details about the promotion.

“Once contacted, scammers would pose as bank agents and provide fraudulent identification such as staff passes,” said the police.

“They would then seek victims' personal particulars to 'apply for the fixed deposit promotion' and subsequently claim to have registered a bank account under the victims' names.”

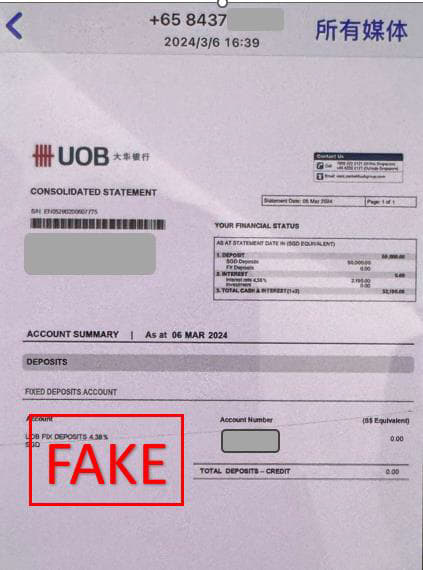

In some cases, victims would receive forged bank statements claiming that new bank accounts were now under their names. They would then be instructed to deposit or transfer money into these accounts.

To dissuade victims from seeking further verification, scammers would say that the accounts had been created "for them" or that the accounts were meant to "hold the funds prior to the creation of their account".

Individuals would realise that they had been scammed after logging into their banking applications and finding no changes to the system records.

“In some instances, the scammer would quote an 'activation period' which delays the discovery of the scheme,” said the police.

When victims eventually checked directly with the banks, they would discover that the accounts belonged to someone else.

PHISHING SCAMS

DBS put out an alert last week, warning customers about phishing SMSes containing fake promotions.

“These SMSes are scams, and the person on the other end is not a DBS representative,” said the bank.

It warned that scammers might try to trick customers into transferring money to their bank accounts.

Scammers might also ask customers for their login information and digital token approval code to steal funds or access their bank accounts without permission, said DBS.

The bank reminded its customers to ensure that they use DBS' official website or official mobile applications to conduct any bank-related requests.

At least 103 victims fell prey to phishing scams in December involving the impersonation of banks through spoofed SMSes. Another 219 DBS customers fell for such scams in the first two weeks of 2024, losing about S$446,000 in total.

Members of the public can find more information on scams online or call the Anti-Scam Helpline at 1800-722-6688.

Those with any information related to such crimes should call the police hotline at 1800-255-0000 or submit the information online.