Can taxis still compete with ride-hailing? Yes, say industry players

As the number of taxis on Singapore’s roads dwindle, industry players discuss if traditional cabbies can still compete with ride-hailing on CNA’s Deep Dive podcast.

This audio is generated by an AI tool.

SINGAPORE: Think the good old taxis with their lighted roofs and metered fares are being booted out by ride-hailing apps like Grab and GoJek? That may not be the case, industry players said.

In fact, some cabbies like Ban Kum Cheong believe they are doing better than their private-hire car driver counterparts - just by almost exclusively charging metered fares.

Like many of his fellow drivers, the 53-year-old has jumped on the ride-hailing bandwagon, signing up on various apps to tap the market of passengers who only book rides using their mobile phones.

These apps charge fixed fares based on various factors, such as trip distances, time of day, and location. Customers can view the cost of their trips before making a booking.

But even on those platforms, Mr Ban, who has been ferrying passengers on Singapore’s roads for the past eight years, uses the “standard taxi” option, which charges customers by the meter.

“In the meantime, I just park my car in a taxi stand and wait for passengers. I don't lose out. If a booking happens, I just pick and go,” he told CNA’s Deep Dive podcast.

His ride-hailing counterparts have told him they are earning less than taxis, he said.

“I’m actually doing better than them. They can do about 30 jobs for S$200 (US$150) or S$300 for fixed fares. I do 20 over jobs for S$300 by meter,” he added.

However, a dwindling number of Mr Ban’s peers seem to be sharing his sentiment.

Since its heyday in 2014 with 28,736 cabs, Singapore’s taxi population has since shrunk by more than half to a new low of 13,330 in May this year, according to latest numbers by the Land Transport Authority (LTA).

Meanwhile, the number of private-hire cars, which includes self-drive rental and ride-hailing, has jumped by more than fourfold from 18,847 to 84,413 in the same period.

WHERE DID ALL THE CABBIES GO?

As ride-hailing soared in popularity in the last decade, many taxi drivers have made the switch to ride the boom, said industry players.

However, Mr Ban believes the exodus could be slowing down.

“In the beginning, a lot of taxi drivers went to private-hire vehicles. But recently, (many) came back to the taxi industry,” he said.

He said driving a taxi affords more freedom than driving a private-hire car, with more ways to get passengers.

All drivers can accept bookings but unlike ride-hailing drivers, cabbies can also pick passengers up at taxi stands, or get flagged down along the streets.

“Let's say I cannot find a passenger on the streets… I just go back to taxi stands. Or I go to the airport or places of interest where there's a surcharge,” said Mr Ban, adding that surcharges are another incentive for taxi drivers.

SURCHARGE BOTH A BOON AND A BANE

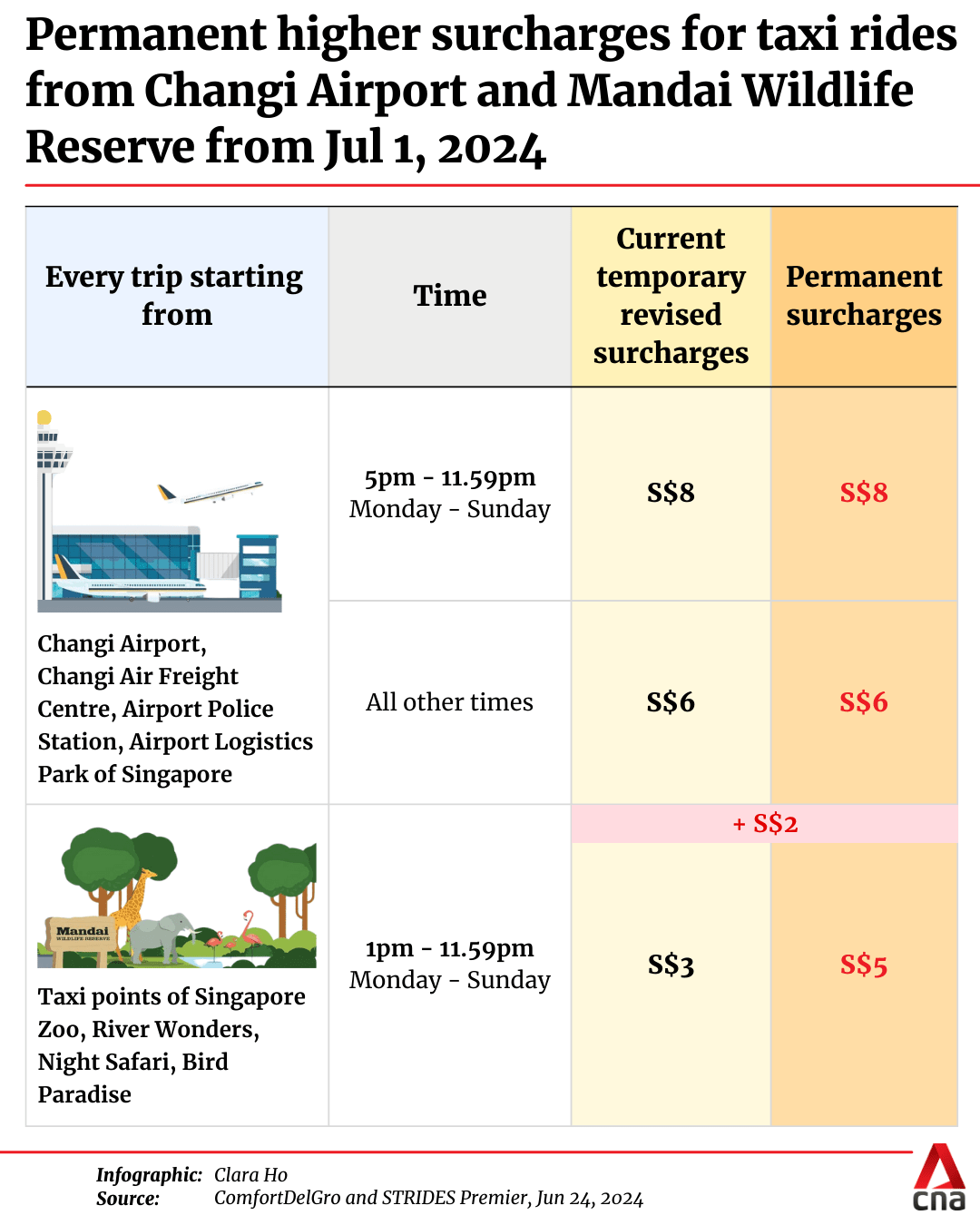

This month, a temporary hike in surcharge from Changi Airport and attractions at Mandai Wildlife Reserve was made permanent.

The higher surcharges were introduced more than two years ago to cushion the impact of fuel prices and ensure a better supply of taxis at those locations.

Industry players said that location surcharges, which also apply to other areas including Singapore Expo and Gardens by the Bay, are put in place to incentivise taxi drivers to travel there.

“If there are repeated complaints by venue operators and tourists that they can't get a taxi, that's a sign that the fares are not competitive enough to convince drivers to be there. That's why (the surcharge) has to go up,” said transport economist Walter Theseira.

“The fare system has to try to balance supply and demand,” the associate professor of economics from the Singapore University of Social Sciences added.

However, there are fears that increases in such surcharges could turn even more passengers away from taxis and push them towards ride-hailing, causing more cabbies to also hop over.

HOW DID RIDE-HAILING OVERTAKE TAXIS?

Many consumers today choose booking a car on ride-hailing platforms over taxis as they prefer the certainty of knowing the fare in advance – unlike a metered fare, and the option to compare prices between different apps.

“The market has shifted very decisively towards ride-hailing,” said Prof Theseira, who was on the same podcast.

“Booking through an app is the way most consumers in Singapore want to go. The share of rides by metered fare has been going down continuously, and will probably go down further.”

Aside from a large number of potential passengers on apps, drivers are also choosing ride-hailing due to the cheaper rental of a private car compared with a taxi.

However, observers said that the income could even out at the end of the month, as the operating model for the two sides differ.

Taxi companies do not take commission from metered fares – drivers get to keep all they earn, after paying for rental and fuel. Ride-hailing firms, on the other hand, earn from commission, which means drivers earn less per trip.

Authorities have been trying to pump the brakes on the taxi’s decline by lowering operating costs, reducing vehicle rentals and making it easier for more people to get licences.

Taxi companies, too, have been adapting, as the two sides try to offer the best of both worlds to cater to different consumers.

For instance, the booking platforms of taxi firms now have a flat-fee model, which mirrors the ride-hailing fare model, and gives users an option other than metered fares.

TAXIS ARE HERE TO STAY

Industry players believe good old taxis will not be phased out.

Demand for transport by car remains as high as ever – particularly during peak hours – and there is room in the congestion for the different models of hiring a ride, they said.

“For most commuters in Singapore, most of us no longer care whether our request is fulfilled by a taxi or a private car. We go with whichever is cheaper,” said Prof Theseira.

“In fact, major platforms now do cross booking. So when you book a ride, it could be a taxi or a private hire car, but you pay the same fare regardless. The ultimate source of demand is about the same.

“So, ride-hailing (may have) killed the old taxi model, but it didn't kill the taxi per se.”

The taxi sector is far from being considered a sunset industry, Mr Ban said.

“When autonomous vehicles come out, that might be a problem for taxi drivers. But at the moment, I think taxis are very resilient. Taxis are here to stay,” he added.