UOB raises maximum interest rate for flagship savings account to 7.8%

The maximum bonus interest rate on the UOB One account, at 7.8 per cent per annum, is the highest in the flagship savings account's seven-year history.

The UOB office building in Singapore on Aug 29, 2019. (File photo: AFP/Roslan Rahman)

SINGAPORE: UOB has raised the interest rates for its flagship savings account on Thursday (Dec 1), joining other local banks in a second round of revisions amid a rising rate environment.

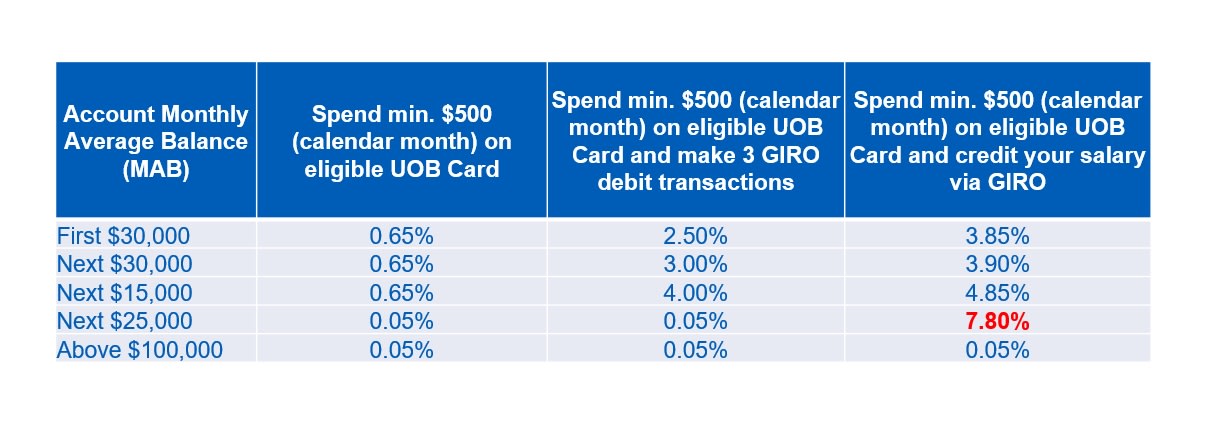

With the latest move, UOB One account holders will be able to earn a maximum rate of 7.8 per cent per annum on balances between S$75,000 and S$100,000. The rate will be applied to deposits between S$75,000 and S$100,000 if they credit their salary to the bank and meet a minimum spend of S$500 a month on an eligible credit and debit card.

This is up from 3.6 per cent previously and marks the highest interest rate offered since the One account was introduced seven years ago.

The tiered interest rates for balances up to S$75,000 while meeting the same salary and card spending criteria was also raised to a range of 3.85 per cent to 4.85 per cent, up from 1.4 per cent to 2.5 per cent previously.

Those who meet the minimum card spend and perform three Giro transactions in a month will also see higher interest rates.

For example, interest earned on balances up to S$75,000 has been raised to a range of 2.5 per cent to 4 per cent per annum, up as much as 2.15 percentage points. There are no changes to interest rates under this category for balances above S$75,000.

Like those offered by DBS and OCBC, the UOB One account offers tiered interest rates that are stepped up as customers grow their account balance or spend a minimum on select cards and conduct other transactions.

Alongside the rate changes, UOB also said it has included salary payments via PayNow as an eligible salary credit so that more customers can qualify for the bonus interest.

“We hope that the updated rates for our UOB One Account will help our customers in reducing some of the inflationary impact on their hard-earned savings,” said the bank’s head of group personal financial services Jacquelyn Tan.

“Together with our highly competitive fixed deposit offerings, we are committed to doing right by our customers by providing a safe haven for them to grow their finances during these turbulent times.”

OCBC and DBS made similar moves last month as the fight for deposits intensifies.

The former raised the interest rates for its flagship 360 savings account on Nov 1, paying 4.65 per cent per annum for balances up to S$100,000 and if customers credit their salary, save and spend with the bank. This rate goes up to 7.65 per cent a year when account holders also invest and buy insurance through the bank.

DBS followed up by raising interest rates on its Multiplier account on the same day, increasing the maximum interest rate to 4.1 per cent per year from 3.5 per cent.

The tiered interest rates apply to savings of up to S$100,000 and are tiered according to salary, spending and transactions in categories.

To achieve the maximum rate of 4.1 per cent, customers need to credit their salary, dividends or SGFinDex to the account. They also need to spend S$30,000 or more in any three categories – credit card spending, home loan instalments, insurance and investments.