Incentives for buying EVs extended; hybrids no longer eligible

The Vehicular Emissions Scheme, which encourages drivers to buy vehicles with lower emissions, will be extended to the end of 2027.

A view of traffic in Singapore. (File photo: CNA/Lan Yu)

This audio is generated by an AI tool.

SINGAPORE: Two initiatives to encourage drivers to choose vehicles with lower emissions will be extended, but with scaled-down incentives, to support Singapore's aim to have all vehicles run on cleaner energy by 2040.

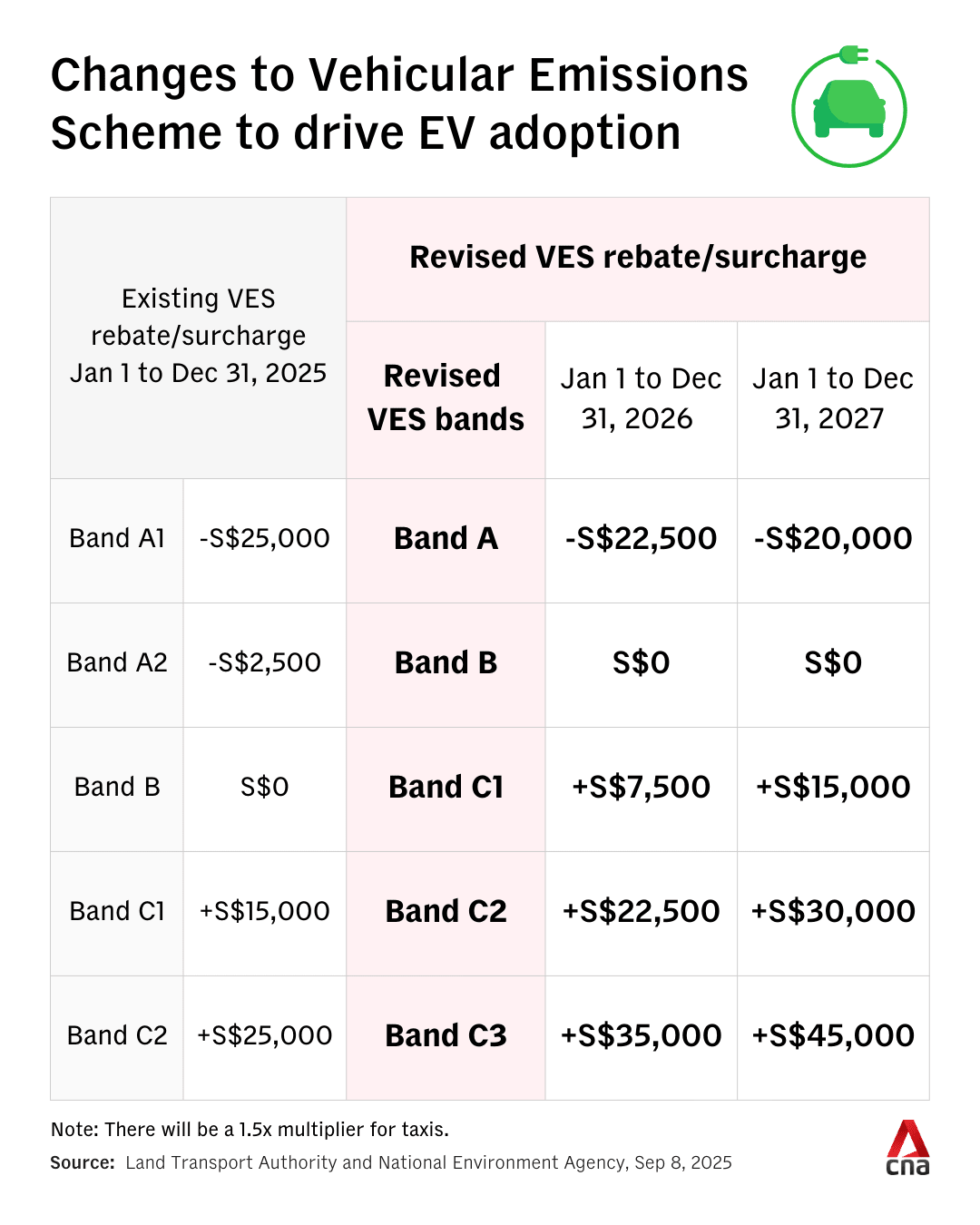

The Vehicular Emissions Scheme (VES) will be extended from Jan 1, 2026, to Dec 31, 2027, with revisions to its banding, rebates and surcharges, the Land Transport Authority (LTA) and the National Environment Agency (NEA) announced on Monday (Sep 8).

Under the scheme, which was introduced in 2018, buyers of cleaner cars receive rebates to offset the additional registration fee for their vehicles, while buyers of vehicles that produce more emissions are required to pay surcharges.

Going forward, only electric vehicles (EV) will receive VES rebates.

"Hybrid vehicles will no longer receive rebates, while more pollutive vehicles will have higher surcharges," the agencies said.

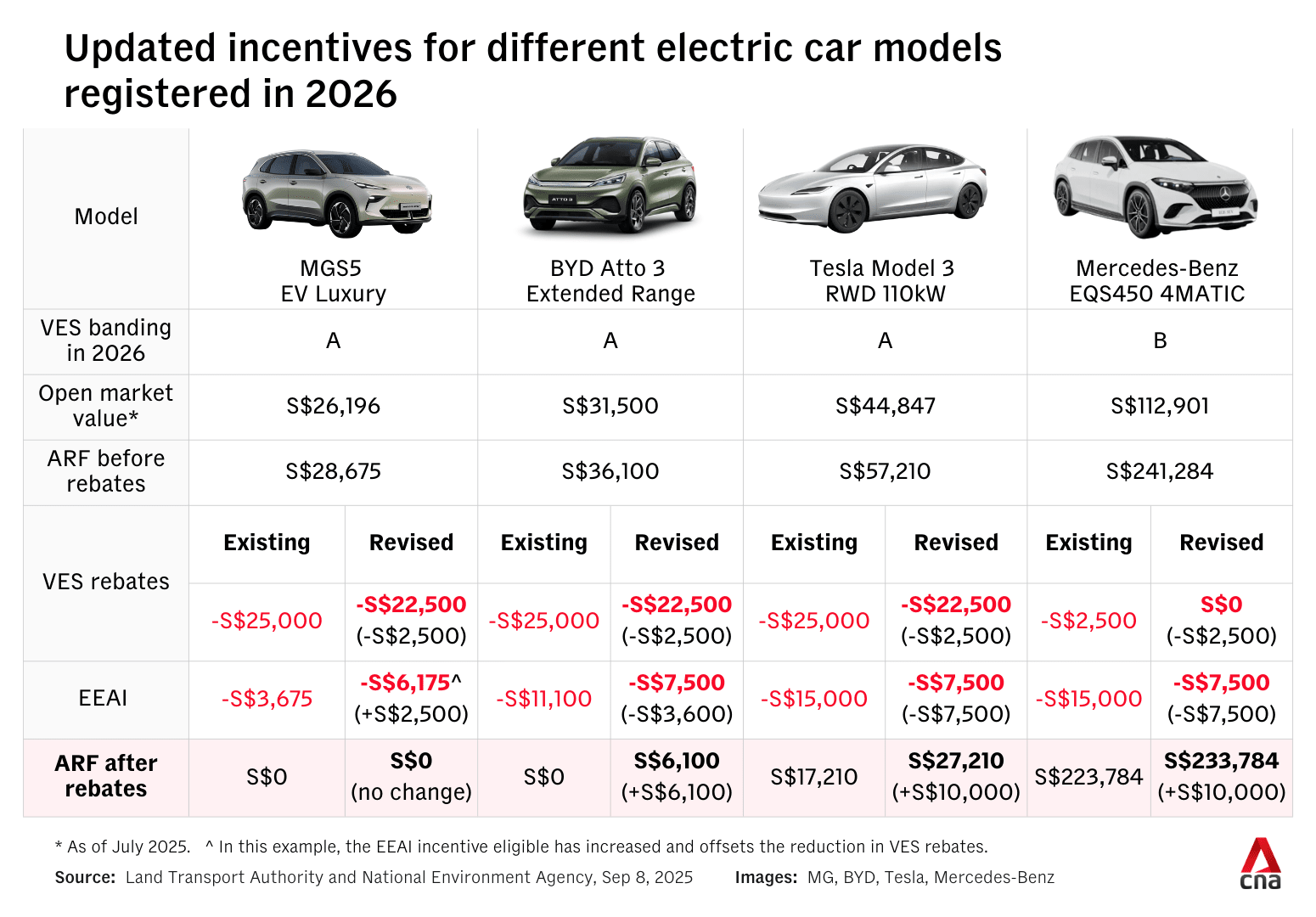

The Electric Vehicle Early Adoption Incentive (EEAI) will also be extended until Dec 31, 2026. The scheme allows owners of fully electric cars and taxis to receive a rebate of 45 per cent off the additional registration fee.

The additional registration fee is a tax paid when registering a vehicle and is calculated based on a percentage of a vehicle’s open market value – the cost of a vehicle imported into Singapore.

With the changes to the schemes, authorities said they expect a short-term increase in COE prices.

"Potential car buyers are strongly encouraged to be prudent in bidding for COEs," the agencies added.

Both VES and EEAI have supported the adoption of cleaner energy vehicles over the past few years.

From January to August, 80 per cent of newly registered cars and taxis were cleaner energy models, with about half being electric models, the agencies said.

“This is encouraging as EVs do not generate tailpipe emissions and are the cleanest vehicle option,” they added.

Since 2021, more than 39,000 electric cars and taxis have benefited from the VES rebates and/or EEAI, according to NEA and LTA.

REVISIONS TO THE SCHEMES

The extended VES will see revisions to its bands, rebates and surcharges.

Only EVs will receive rebates while more pollutive vehicles will have higher surcharges. Hybrid vehicles will no longer receive rebates.

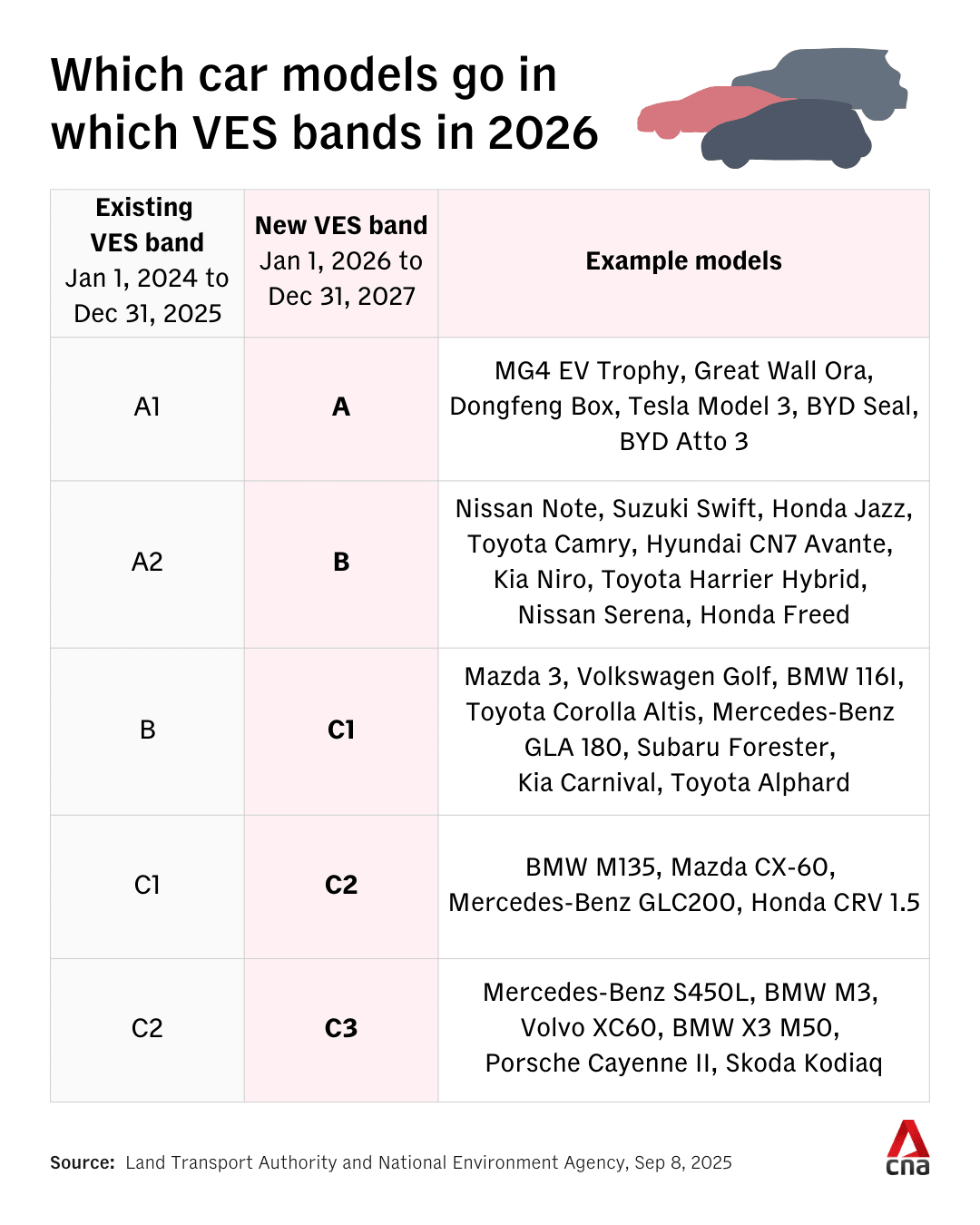

Vehicles currently in Band A2 will fall into the neutral band B under the revised VES banding structure and no longer enjoy rebates.

For example, the Honda Jazz, currently in band A2, previously benefited from a VES rebate of S$2,500. When it shifts to the neutral B band from 2026, it will no longer be eligible for rebates, but will also not face any surcharges.

Vehicles currently in Bands B, C1 and C2 will also fall into revised Bands C1, C2 and C3, respectively, and face new surcharges.

For example, The Mazda 3, which will be downgraded from B to C1, will face a VES surcharge of S$7,500 in 2026 and S$15,000 in 2027.

There is no change to pollutant thresholds, added LTA and NEA.

For the EEAI, owners who register electric cars and taxis in 2026 will receive a rebate of 45 per cent off the additional registration fee, capped at S$7,500, down from S$15,000.

The scheme's extension comes as the adoption of EVs increases and the upfront cost gap between electric and Internal Combustion Engine cars and taxis narrows, said LTA and NEA.

With the revised EEAI and VES, buyers will receive combined cost savings of up to S$30,000 and S$20,000 off the additional registration fee for electric cars registered in 2026 and 2027, respectively, said NEA and LTA.

The S$0 additional registration fee floor for electric cars and taxis will also be maintained until Dec 31, 2027, they added.

“The overall benefits will continue to be tapered as Singapore gets closer to 100 per cent cleaner energy vehicles by 2040, in support of our national target to achieve net-zero emissions by 2050.”