Looking for a place to spend your golden years? Options galore as retirement villages sprout up across Southeast Asia

For Singaporeans hoping to get a place in senior living facilities abroad, visa hurdles and cultural gaps mean that the choice is not as simple as comparing price tags.

Retirement villages for seniors in Indonesia, Malaysia and Thailand sometimes offer a living environment that can be difficult to replicate in land-scarce Singapore. (Illustration: CNA/Nurjannah Suhaimi)

This audio is generated by an AI tool.

Every morning in the outskirts of Seremban, a city an hour away from Malaysia's capital of Kuala Lumpur, Mrs Peri Menon goes for a swim at the resort where she lives.

The air is fresh and the view is of a hillside enveloped by green vegetation. The 70-year-old then has a breezy farm-to-table breakfast at the restaurant by the pool before unwinding in the library with a novel.

She and her husband also walk around the resort's fitness garden daily, and ever so often at sunset, they make their way to the rooftop bar to enjoy an evening beverage with a view of Seremban town in the distance.

The Menons, who hold Indian passports, are long-term residents at Millennia Village, a purpose-built active senior living and wellness village built in 2023.

"We don't have time to get bored. Time seems to pass quite nicely," Mrs Menon said.

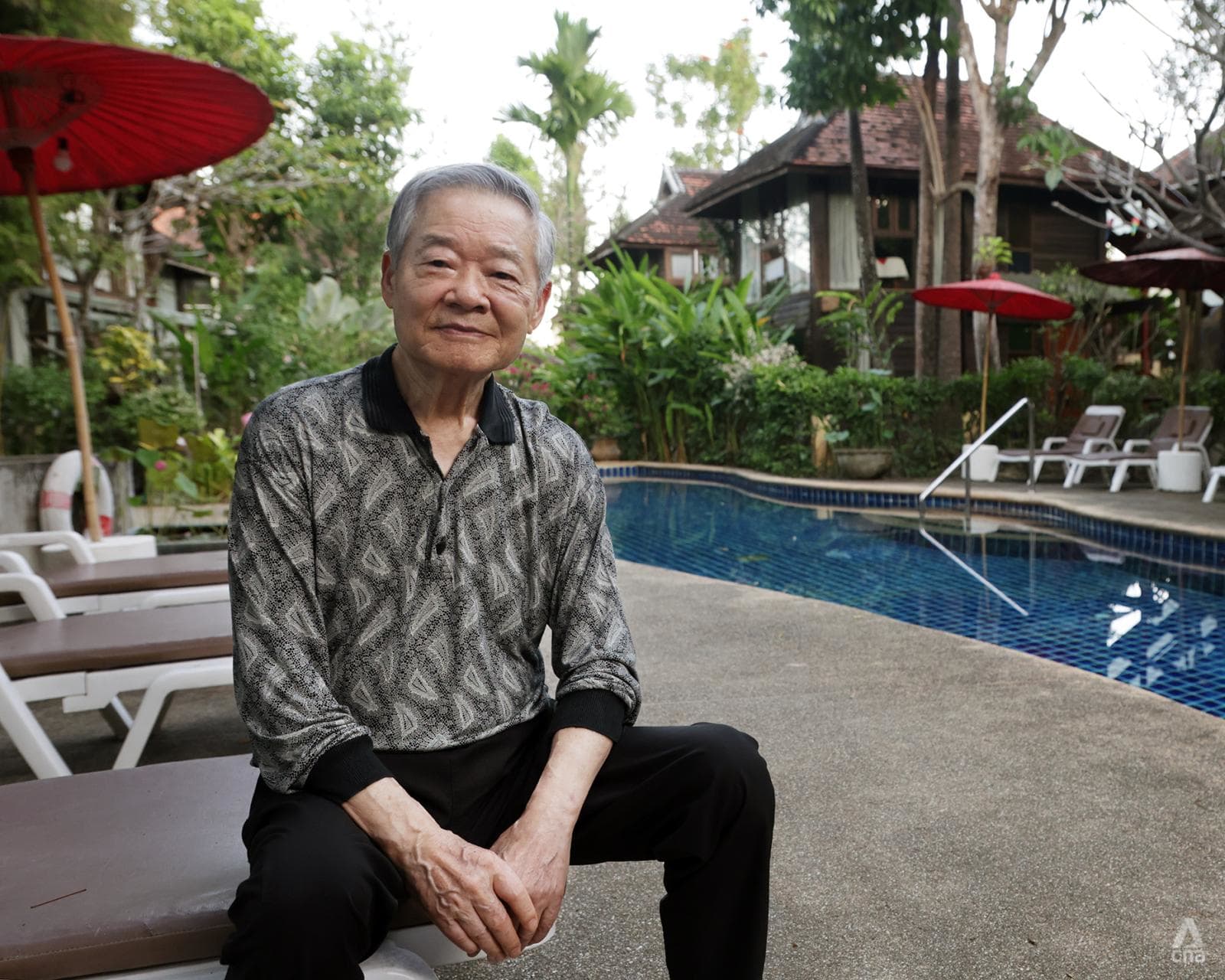

For Canadian retiree Robert Huang, who lives about 2,000km up north in a retirement village in Chiang Mai, Thailand, the days go by just as quickly.

Every week, Mr Huang participates in a range of activities organised by Ban Sabai Village for its residents – including going on day-trips to markets, temples and nearby mountains.

Its management also takes many of the 89-year-old's requests on board to make him feel more at home.

This includes hiring a Mandarin-speaking nurse to look after him and his wife, arranging for a taiji master to give residents weekly classes, and paying for a chef from Taiwan to teach its in-house cooking staff members to make Chinese dishes.

"This place is like paradise to me," Mr Huang said.

While the Menons and the Huangs live in different countries and cultures, their experiences reflect a broader trend taking shape across Southeast Asia.

In recent years, retirement villages for seniors, offering a mix of lifestyle amenities and varying levels of care, have been springing up across the region as Southeast Asia begins to age.

Some, like Millennia Village and Ban Sabai, offer a living environment that can be difficult to replicate in land-scarce Singapore, noted Ms Chia Hui Xiang, a public health and policy researcher at the National University of Singapore (NUS).

"It’s a place where they can enjoy the scenery, the quiet lifestyle and a slower-paced life next to nature," she said. "This is something we don't really emphasise in Singapore."

The ASEAN (Association of Southeast Asian Nations) Key Figures 2025 report showed that the proportion of the population aged 65 and above in the region rose from 5.4 per cent in 2005 to 8.2 per cent in 2024.

Investors and operators are increasingly eyeing this demographic shift, seeing opportunity in a market that has gathered momentum in the years following the COVID-19 pandemic.

The retirement villages they have built cater to seniors with a wide range of needs – from those who are fully independent, to residents requiring help with daily activities, dementia care, or even intensive medical support.

CNA TODAY visited 11 senior living facilities across four cities in Indonesia, Malaysia and Thailand to understand how this emerging sector is taking shape.

MALAYSIA

For two years, 83-year-old Malaysian retiree Yazmeen Abdullah searched for a suitable place to live out the rest of her days.

A widow with no children, Dr Yazmeen visited multiple senior living facilities across the country, but most left her with what she described as a "claustrophobic feeling". They had typically small rooms furnished with little more than a desk and a chair.

"If you're an independent person like me, you don't like to be closed off," she said.

At some facilities, she recalled, residents even had to ask staff members for a flask to boil water.

"I don't think that should be the way to treat the elderly – it will make them dependent on others as they age."

She eventually found what she was looking for at Domitys Bangsar, a retirement village for independent seniors in Kuala Lumpur.

There, Dr Yazmeen was able to cook her own meals, decorate her apartment as she wished, and even maintain a small garden outside her unit. At the same time, she had the reassurance that help would be available in an emergency.

"They went out of their way to accommodate my wishes a lot," she said. "That made me choose them."

Dr Yazmeen's desire for independence, dignity and community was echoed across multiple interviews CNA TODAY conducted with residents of retirement villages in Malaysia.

Coupled with the country's rapidly ageing population, this growing preference has spurred businesses to invest in active senior living developments, hoping to tap into an emerging market.

Managed by hospitality group The Ascott Limited, Domitys Bangsar was formerly operated as serviced apartments before being rebranded and refurbished in 2022 with senior-friendly features.

Ms Ng Bee Fong, Ascott Malaysia's country director for brand and marketing, said it was these "conducive market conditions" that brought about the group's move into senior living.

She noted that Kuala Lumpur's established healthcare ecosystem and urban convenience appeal to seniors who value a hospitality-style environment, while still wanting independence and opportunities for social interaction.

However, Ms Ng acknowledged that the market remains in the "early stages" of adopting lifestyle-based senior residences.

That uneven uptake is evident both in the capital and beyond.

In Seremban, the Millennia Village was initially conceptualised as a purpose-built retirement village for active seniors.

However, lower-than-expected demand had led its management to expand its target market, opening the sprawling property to corporate events and group bookings alongside its long-term senior residents.

Another example is ReU Living, launched by property group IGB Berhad. It is one of the most advanced rehabilitation centres in Malaysia for post-operative, post-hospitalisation care and it has a stroke recovery programme.

It is located within the premises of a five-star hotel in the heart of Kuala Lumpur.

The facility is equipped with a multidisciplinary care team, including occupational therapists, physiotherapists and nurses, with nursing staff members stationed on every floor.

Ms Estee Tan, the chief executive officer of ReU Living, said that while the facility caters to both independent and assisted living, the majority of its 65 residents require some form of care.

"If they are independent – meaning they can drive their car, go shopping and walk around, it is unlikely that they would choose to move into a retirement home," she said.

To bridge that gap, some operators have turned to continuing care retirement community models, such as the one offered by Penang Retirement Resort.

Under this arrangement, residents can enter as independent seniors and transition to assisted living as their needs change. Should their condition improve, they also have the option of returning to independent living.

Taken together, these developments reflect a highly varied senior living landscape.

For now, while many of these establishments receive a fair share of interest from overseas retirees, the majority of long-term residents are still Malaysians.

Operators said that this was partly due to visa constraints, which made it difficult for foreigners to stay beyond short periods.

To qualify for the Malaysia My Second Home visa, applicants must place a fixed deposit of at least US$150,000 (S$192,000) in a Malaysian bank and buy a property worth a minimum of RM600,000 (about S$189,000) – requirements that industry players said can deter otherwise interested retirees.

THAILAND

Among the countries in ASEAN, Thailand has the second-highest proportion of persons aged 65 and above at about 14 per cent and is projected to become a super-ageing society by 2031.

Its longstanding reputation as a global medical tourism hub has also helped fuel the growth of senior living and retirement villages across the country over the past decade, many of which are explicitly geared towards foreign retirees.

One such development is Vivobene, a Swiss-backed luxury senior care facility nestled in the hills of Chiang Mai. Spanning about two hectares, the facility began operations around 10 years ago and markets itself on the promise of “Swiss healthcare standards”.

It focuses primarily on nursing care, with a caregiver-to-guest ratio of 2:1, though it also accommodates seniors who are active and mostly independent.

Residents live either in standalone villas with private gardens or in apartments within bungalow-style blocks, depending on their care needs.

Monthly prices range from 100,000 to 160,000 baht (about S$4,100 to S$6,600), which include meals, daily housekeeping, planned activities, laundry services and four massages a month.

Around 20 to 30 per cent of the facility's guests are from Switzerland, with the rest coming from other parts of Europe and several Asian countries.

Mr Pascal Pidoux, Vivobene's guest relations manager, said it is intentional for the atmosphere of the compound to be akin to a resort: "We don't want to come across as an elderly home or a nursing home."

He added that Chiang Mai's appeal lay in its balance between nature and urban convenience.

"Chiang Mai isn't a big city, but it still has many things to offer," he said. "It doesn't have the traffic jams of larger cities, yet it has plenty of restaurants and activities."

Vivobene, he noted, is located about 20km outside the city, surrounded by greenery, offering residents a sense of calm without being too far removed from urban amenities.

While luxury developments like Vivobene cater largely to international retirees, Thailand's senior living sector also includes operators focused on domestic demand.

One of the country's fastest-growing senior care brands is Baan Lalisa, which operates around 17 branches nationwide and serves seniors across the care continuum. Its primary focus, however, is on nursing care for Thai residents, reflecting capacity constraints in the country’s eldercare system.

Demand has been so strong that whenever a new branch opens, occupancy typically reaches about 90 per cent within six months, its chief executive officer Athiporn Poolsawaddi said.

However, at one of Baan Lalisa's branches in Chiang Mai, it is mostly foreigners who call that place home. Prices for a room there start at 25,000 baht a month.

Mr Poolsawaddi expects international demand for retirement living in Thailand to grow.

"First of all, the world economy isn't doing too well, so any service that is cheaper with the same standard becomes an option to consider," he said.

He added that greater connectivity has also made it easier for families to explore overseas options.

"In the past, family members would come to Chiang Mai for site visits," he said. "Now, it's much more common for people to request an online video tour before making a decision."

Thailand's appeal to foreign retirees is also bolstered by a relatively clear and accessible retirement visa framework. Foreigners aged over 50 can apply for a Non-Immigrant O or O-A retirement visa, which allows a long-term stay provided applicants meet basic financial and health requirements.

These include having a security deposit of 800,000 baht (about S$30,000) in a Thai bank, or a monthly income of at least 65,000 baht.

INDONESIA

Like much of Southeast Asia, Indonesia is undergoing a significant demographic shift, too.

Data from Statistics Indonesia show that the proportion of elderly people rose from 9.78 per cent in 2020 to 11.75 per cent in 2023, or around 32 million people.

And by 2030, more than 14 per cent of its population is expected to be aged 60 and above.

Yet despite its rapidly ageing population, Indonesia's senior living sector remains in its infancy, with only a handful of formal operators across its major cities.

Mr Herman Kwik, the chairman of the Indonesian Senior Living Association, said that strong cultural norms like filial piety continue to shape how families care for their elders.

"Like Singapore and other Asian countries, there's a unique dependence on engaging household staff. If people feel like they need help caring for their parents, they often bring help into their homes instead."

Even so, Mr Kwik noted that there are many non-profit nursing homes, known locally as "panti jompo", already operating at full capacity – a sign that demand for senior care is growing faster than supply.

It was against this backdrop that Mr Kwik first opened Rukun Senior Living in 2012. Today, it is Indonesia's only continuing care retirement community, offering accommodation and care for seniors who are independent, require assisted living, or live with dementia.

Contrary to expectations, Mr Kwik said the industry's growth is unlikely to be driven by today's seniors. Instead, he believes demand will come from the next cohort of retirees.

"It's the people who turn 70 years old in five to 10 years," he said.

"Their kids, who belong to Generation Y (in their 30s to 40s), are more independent and less constrained by the idea that they must personally care for their parents."

Located in Sentul, south of Jakarta, Rukun Senior Living now serves around 75 residents, predominantly Indonesian, from the middle- to higher-income groups.

The facility features a mix of villa-style homes and apartment units, alongside amenities including a swimming pool, fishing lake, sauna and landscaped gardens. Its fees are about 20 million rupiah (about S$1,500) a month.

While senior living in Indonesia has largely developed around domestic demand, Bali stands apart. The island is Indonesia's largest tourism draw and consistently ranks as the top destination for both international visitors and domestic travellers.

Industry players said that its global reputation, combined with sustained government investment in infrastructure and healthcare, positions Bali as a potential future hub for senior living.

At present, however, options remain limited.

One of the few operators on the island is Hovi Care, a Finnish brand that provides assisted living and day-care services for seniors.

Its assisted living facility is located on the fourth floor of Kasih Ibu Hospital in Saba, Bali, which provides seamless access to medical services for its mostly foreign residents, who often do not have the same inhibitions that Indonesians do about being in a care facility.

It has 17 rooms available and it hires caregivers who have graduated with a nursing degree.

Some hotels in Bali have also begun experimenting with senior-friendly offerings.

Properties such as The Sakala Resort in Nusa Dua have previously marketed extended stay offers for active, healthy seniors. They provide medical attention on call and all resort areas are accessible via elevators and ramps.

There is also at least one purpose-built retirement village catering to the Australian market, reflecting growing interest in Bali as a long-term living destination.

To be eligible for Indonesia's retirement visa, known as the Retirement Kitas, one must be at least 55 years old and have a means of sustaining oneself financially without having to work.

The visa is valid for one year and can be renewed annually for up to five years. After that, you become eligible for a permanent residence permit.

ARE THESE REGIONAL HOMES VIABLE FOR SINGAPOREANS?

For many Singaporeans, the idea of retiring overseas holds a certain appeal, whether it is to enjoy a slower pace of life, experience a cooler climate, or simply stretch their retirement savings further.

And across Southeast Asia, retirement villages have increasingly positioned themselves as alternatives to ageing in a dense, high-cost city.

CNA TODAY's interviews with operators in Indonesia, Malaysia and Thailand revealed that Malaysia is the most attractive option for Singaporean retirees due to its geographical proximity, cultural familiarity and cost advantages.

HOW SINGAPORE'S SENIOR LIVING MODEL DIFFERS

Come 2030, almost one in four Singaporeans will be aged 65 and above.

Yet unlike many of its regional neighbours, Singapore's approach to senior living has been shaped by a fundamental constraint: land scarcity.

As a result, it has prioritised "ageing in place", enabling seniors to grow old within familiar neighbourhoods rather than developing large, self-contained retirement villages.

In his National Day Rally speech last year, Prime Minister Lawrence Wong underscored this philosophy, saying Singapore does not want its seniors to “live in separate isolated places”.

Instead, he announced the rollout of Age Well Neighbourhoods – beginning with Toa Payoh – describing the concept as akin to a retirement village, but embedded within existing communities.

Under the scheme, physical touchpoints such as Active Ageing Centres will be made more accessible, home-based services that include housekeeping and meal deliveries will be expanded, and healthcare facilities such as hospitals and rehabilitation centres will be brought closer to where seniors live.

This stands in contrast to the retirement villages for active, independent seniors that have become increasingly common in parts of Asia and Australia, which often offer lifestyle amenities in resort-like settings.

For now, Singapore's living options for elders remain more limited and more tightly regulated.

Opened in 2018, Kampung Admiralty was the country's first elder-focused housing development, integrating public housing with healthcare, social services, retail spaces and a hawker centre.

More recently, the government launched community care apartments as an affordable assisted-living option. Demand for these units has been strong.

Residents buy a 15- or 35-year lease and must also subscribe to a mandatory basic service package – covering services such as a 24-hour emergency response system, basic health checks and simple home maintenance – which costs about S$175 to S$185 a month.

Beyond the public sector, private assisted-living operators such as St Bernadette's Lifestyle Village and Red Crowns Senior Living offer residences with monthly fees ranging from around S$2,000 to more than S$6,000, depending on care needs and amenities.

At the upper end of the market is Perennial Living, a luxury assisted-living development at Parry Avenue managed by Perennial Holdings, slated to open in the first quarter of this year. Prices are reported to range from S$8,900 to S$17,000 a month.

At the Penang Retirement Resort in Malaysia, senior marketing executive JJ Tan said that it receives "five to 10" enquiries from Singapore every week.

"It is much more cost-effective. The space they might get in a similar home in Singapore is much smaller, while here they have more amenities at a more affordable price point."

In Ipoh, operators at GreenAcres Retirement Village described what they called a "Singaporean tsunami" – a steady stream of visitors making short stays to experience retirement living there firsthand.

Each month, the facility receives around 16 to 17 enquiries, with four to six Singaporeans travelling down to view the premises.

Interest is also strong just across the Causeway.

Mr Jimmy Yeap, founder of Haywood Senior Living in Johor Bahru, said that four out of every 10 enquiry calls his team receives come from Singapore.

Ms Estee Tan of ReU Living in Kuala Lumpur said that she often receives requests from Singaporeans urging her to set up a branch in Johor Bahru.

Despite the interest, Malaysian operators noted that there were few Singaporeans who had made the move to retire in Malaysia, because of one major stumbling block: securing a long-term visa for retirement.

At GreenAcres, two Singaporeans are now long-term residents after leasing units there.

However, they have to make regular "visa runs", leaving and re-entering Malaysia every 30 days, or by repeatedly applying for visa extensions at nearby immigration offices.

Operators across Malaysia said they hope the government will eventually introduce a more tailored retirement visa, which could unlock significant demand from regional retirees.

While retirement villages in Thailand and Indonesia do receive occasional enquiries from Singaporeans, the numbers are markedly lower than in Malaysia.

One key reason, industry players said, is community. The presence of a familiar social and cultural environment matters deeply for seniors.

Mr Poolsawaddi of Thai senior care operator Baan Lalisa said that this was often the deciding factor.

"We do get some enquiries from Singapore," he said. "But the main concern for international clients is the sense of community. When they move, they don't want to feel like they are away from home."

Most of Baan Lalisa's international residents in Chiang Mai are Westerners, he noted. "For Singaporeans, I think they still feel there’s a lack of a local community in my centres for them to make the decision to come to Thailand."

Cost, too, is not always straightforward.

Mr Poolsawaddi noted that for seniors requiring frequent medical attention, retiring overseas may not make financial sense.

"When people consider a nursing home, they look at two prices – medical costs and the cost of care," he said.

In countries where hospital fees are heavily subsidised by the state, it makes less sense to fly to a different country, pay full hospital prices and pay for care on top of that.

However, for seniors with conditions such as dementia, who may require more long-term caregiving rather than frequent hospital visits, overseas retirement can be significantly cheaper, Mr Poolsawaddi said.

Dr Kelvin Tan of SUSS said that the strong Singapore dollar amplifies this appeal.

"With a strong Singapore currency, the savings can be translated to higher purchasing power for a better quality of life overseas," he added.

"Our neighbouring countries are going to be more appealing to even middle-class Singaporeans, who could seek temporary homes overseas while maintaining Singaporean status."

RETIRING IN SINGAPORE

Ms Chia the NUS researcher believes that Singapore's subsidies for residential long-term care will continue to make ageing within one's home country an attractive option for most Singaporeans.

However, she noted that assisted living services here remain costly.

"That is why there is a lot of interest in going to Malaysia," she said. "If the government wants more people to stay in Singapore, there needs to be more subsidies for residential assisted living."

Beyond affordability, Ms Chia argued that Singapore's senior living landscape also lacks something less tangible: aspiration.

"The concept of a retirement village is meant to be aspirational," she said. "But in Singapore, we're much more practical when it comes to ageing."

In places such as Taiwan, she noted, retirement villages are framed as places seniors look forward to – spaces associated with friendship, leisure and fulfilment.

"The mindset is, 'I have worked hard all my life. Now I get to enjoy myself in a beautiful place with my friends'," she said. "It’s not, 'my kids are abandoning me'."

We have managed to provide for Singaporeans of the Pioneer and Merdeka generations, now we have to do so for the ones that will be part of a super-ageing Singapore.

While Singapore may not have the luxury of sprawling greenery or seaside retirement towns, Ms Chia believes that there is room to reimagine existing spaces more creatively.

"Can we imagine active ageing centres sited in parks, near beaches or around reservoirs?

"These are spaces that are under-utilised, which could potentially be spots for meaningful activities for seniors," she said.

However, reimagining spaces may not be enough if the market itself remains risk-averse.

Dr Tan of SUSS pointed out that developers and investors have been cautious about providing senior housing here.

This has resulted in what he described as a "lack of creativity and supply", with most new developments still geared towards younger families with purchasing power rather than ageing residents.

"The market seems to be missing a new solution … (and) leaving the market forces to decide with a limited war-chest is unlikely to yield new thinking," he said.

He argued that Singapore now faces a defining challenge.

"We have managed to provide for Singaporeans of the Pioneer and Merdeka generations, now we have to do so for the ones that will be part of a super-ageing Singapore," Dr Tan added.

"If we fail to do so, we will be a society that is less empathetic."