As EVs gain ground and some Singaporeans shun car ownership, will car workshops survive?

As Singapore inches closer toward its cleaner vehicle targets, car workshops face mounting pressures – with some wondering if they will make it past the next decade.

As electric vehicles become more prevalent in Singapore, some car workshops worry that fewer routine services will make it harder to stay afloat. (Photo: CNA/Ooi Boon Keong)

This audio is generated by an AI tool.

Mr Dylan Chew has spent more than 25 years running Supreme Auto Service in Sin Ming, a small automotive repair workshop his father founded in 1974.

But the 48-year-old has no plans to pass it on to his daughter because he sees no viable future for his workshop.

Gone is the hustle and bustle at his workshop where cars waiting to be attended to used to spill out onto the road.

Nowadays, he has a couple of cars to work on each day and while his business situation is not dire, he estimates that his business has dropped by roughly 50 per cent compared to 10 years ago.

"For our workers, every day used to be very busy, but now it is much more relaxed," he said.

As for his three mechanics, most of whom are already in their fifties, Mr Chew said he has told them that in the next five years, they may no longer have jobs and need to think about what they want to do next.

For a number of years, younger Singaporeans have been shunning car ownership and increasingly turning to car-sharing services and ride-hailing apps, and the rental companies that supply these vehicles have their own tie-ups with larger workshops.

In more recent times, the rise of electric vehicles (EVs) plying Singapore's roads has made matters worse for car workshops.

"The notion that the market changes are totally affected by EVs right now – that's not true yet," said Mr Chew.

"But we can see where the industry is heading. It will be a problem for us in the future."

It has been almost five years since the government launched the Singapore Green Plan 2030, a multi-ministry roadmap to make the nation more environmentally sustainable.

The plan includes a target for all new vehicle registrations to be cleaner-energy models by 2030, and mooted the vision of all vehicles powered by cleaner energy by 2040.

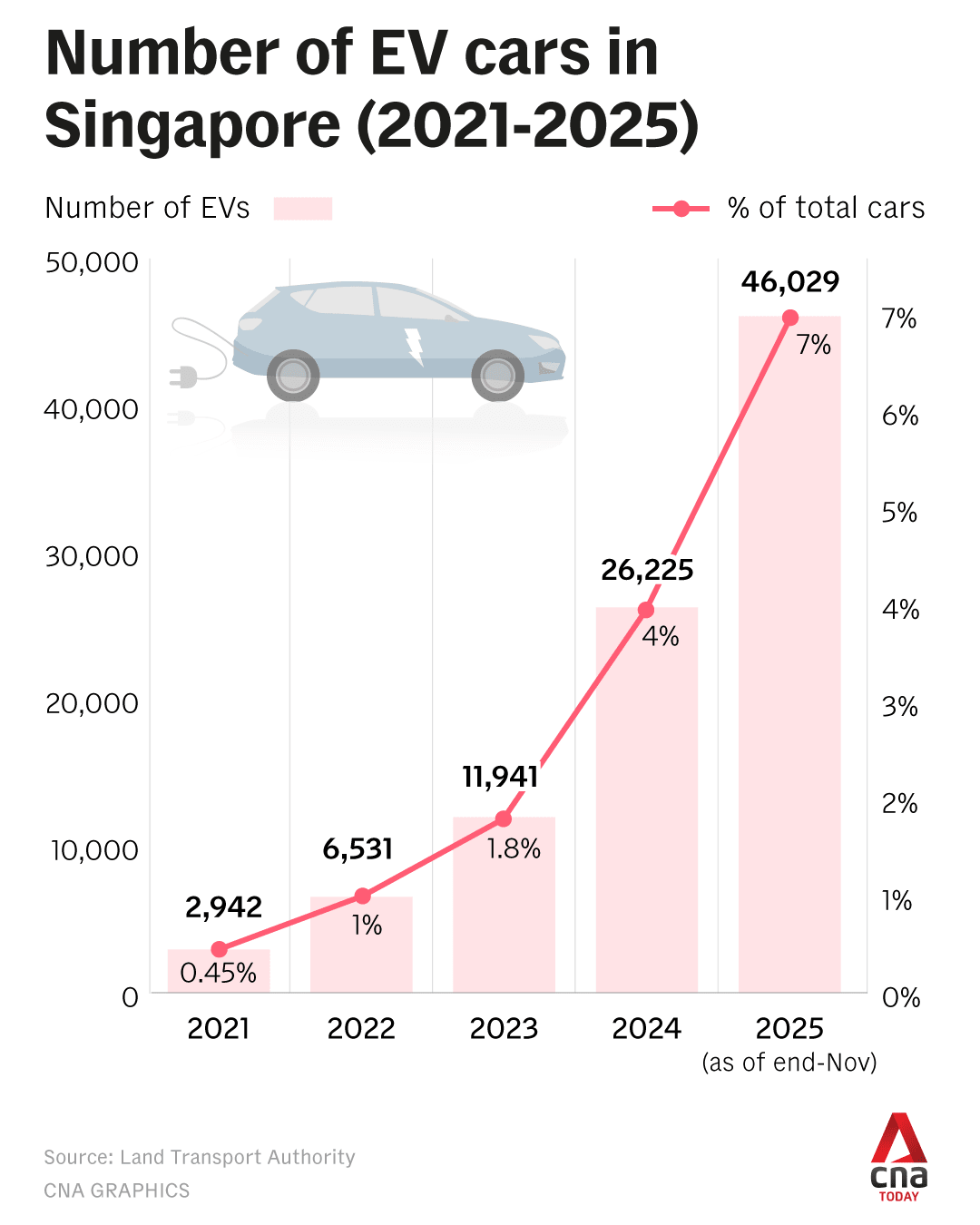

In 2021, Singapore had just 2,942 EV cars on its roads – making up a meagre 0.45 per cent of the total car population.

This number has increased to 46,029 as of November 2025, and EVs now make up 7 per cent of all cars according to the latest statistics from the Land Transport Authority (LTA).

EVs also made up 43 per cent of new car registrations in the first nine months of last year.

While the majority of vehicles on the road still run on internal combustion engines (ICE), some workshops CNA TODAY spoke to said that they expected to find it harder to survive in the long run.

The concern stems from how fundamentally different EVs are to maintain. EVs require far less labour to service than their petrol-powered counterparts, as EV vehicles do not use the same engine and transmission systems that require extensive maintenance in ICE vehicles.

Put simply, EVs have far fewer moving parts than ICE vehicles.

As a result, routine jobs that generate regular income for workshops, such as oil changes, timing belt replacements and engine-related servicing, simply disappear.

Said Mr Chew: "With EVs, the challenge is income sustainability. For petrol cars, every 10,000km, you have oil changes, filters and wear-and-tear parts. That generates regular income. EVs don't have this."

For many workshops, the work they can realistically take on for EVs is also limited. High-voltage systems and battery-related components are often handled by authorised dealers, while warranty concerns often lead many EV owners to return to the agent for mechanical repairs.

In practice, this generally leaves smaller workshops with body work, accident repairs, tyre changes and some wear-and-tear items.

Mr Adrian Ching, 58, the second-generation owner of Ching Motor Repair Shop in Sin Ming, for instance, said business is down by about 15 per cent compared to the start of 2025, partly due to some customers switching to EVs.

"They still need us now – we will probably still be around in five years," said Mr Ching. "But beyond that, it's hard to say."

While EVs are not yet a major factor affecting his business, Mr Chew said he is concerned about their longer-term impact.

"With all the existing competition already so intense, EVs could eventually edge workshops like ours out even further."

A "SUNSET INDUSTRY" UNDER PRESSURE

While EVs are often cited as a key disruptor, workshop owners told CNA TODAY that it is a confluence of factors that is making it harder for traditional mechanics and workshops to stay viable.

A more fundamental shift, they said, is a change in attitudes towards car ownership, particularly among younger Singaporeans.

"When I talk to people from the younger generation, they don't sound keen to buy cars," said Mr Chew of Supreme Auto Service.

"They'd say, 'Why should I buy a car when I can just rent one?' We didn't even have such choices last time."

LTA figures show that the number of private cars fell from 536,882 in 2014 to 524,418 in 2024, even as the overall vehicle population grew. In contrast, the number of private-hire cars surged nearly fivefold over the same period, from 18,847 to 90,383.

Mr Alfred Lee, 58, managing director of Lee Brothers Automotive at Autobay at Kaki Bukit, said that this shift towards rentals is not confined to just cars and is becoming increasingly common for lorries and small trucks as well.

Many business owners, he said, prefer not to deal with instalments, down payments, road tax or maintenance costs.

"For business owners, there is no certainty over how long the business will last. If you invest in 30 lorries but the business only runs for a year or two, it becomes unsustainable, and selling off those vehicles would mean taking a huge loss," he said.

He added that many rental companies operate their own in-house workshops or work exclusively with one or two workshops.

"Not all workshops can work with rental companies. You have to meet very strict terms and conditions. For those of us who don't, we can only rely on regular customers," he said.

"This is becoming a sunset industry."

Other cost pressures are compounding the problem. Mr Pang, who runs Ong Guan Choon Motor, said rising demands for higher wages and the increasing cost of spare parts have made the business less viable.

"When cars themselves are so costly in Singapore, people look for cheaper alternatives," said Mr Pang, who declined to give his full name. "They buy parts or do repairs in Johor (instead)."

Another reason for the slowdown in business, Mr Chew said, is changes in the market and increasingly stiff competition, particularly from authorised dealers, which was not always the case.

"Right now, authorised distributors are competing very aggressively for market share. Compared to 20 years ago, car dealers were not very interested in maintaining cars after three or four years," he said.

"Today, dealers are much more focused on keeping customers servicing with them for longer."

NOT ALL DOOM AND GLOOM

Despite mounting pressure, some workshop owners are confident that accident-related car repairs, as well as regular wear-and-tear-related work, will be enough to keep them afloat.

Ms Kuah Lay Hoon, 59, director of Lee Sheng Auto, said: "Brakes, shock absorbers and the gearbox system will still need replacement. EVs will still have undercarriage parts that need attention."

Some in the industry are also sceptical that EVs will become ubiquitous in the near term.

Mr Joey Lim, president of the Singapore Motor Workshop Association (SMWA), said the proportion of EV registrations in 2025 does not yet amount to what he would consider a "home run", even with strong government incentives in place.

"Even with the big rebate given by the government, we still do not see more than 50 per cent of sales going to EVs," said Mr Lim, who is also managing director of Harmony Motor.

What, then, would qualify as a decisive shift? While Mr Lim declined to name a specific figure, he said it would need to be "significantly" higher than the combined share of hybrid and petrol vehicles.

Similarly, some workshop owners are dismissing the notion that EVs will dominate the market.

Mr Amos Mok, 57, general manager of Juzz For Cars, said it is "not possible" for Singapore to completely do away with petrol-only cars.

"To me, electric vehicles are a passing fad. Give it another decade, and EVs will probably die a natural death," he said.

"Whatever comes next, hydrogen combustion engines will probably take centre stage."

Hydrogen combustion engines burn hydrogen to produce water vapour, operating like conventional internal combustion engines. While they emit no carbon dioxide at the tailpipe, they can still produce nitrogen oxides, and their adoption remains limited by cost, infrastructure and the availability of low-carbon hydrogen.

Mr Mok said he has had a number of conversations with customers who are hesitant to take up an EV.

The 2025 Mobility Consumer Index (MCI), released by consultancy EY on Jan 9, offered some support for Mr Mok's sentiments.

It found that 32 per cent of Singapore respondents plan to buy petrol cars in the next two years, up from 26 per cent a year earlier, with concerns over charging infrastructure and hidden costs cited as key reasons.

Mr Mok recounted how a friend who drives an electric van struggled to charge his vehicle after encountering repeated payment system failures at multiple public charging points. Eventually, they had to abandon the van temporarily and look for help elsewhere.

Mr Mok added that this friend has since returned to using a petrol-powered vehicle.

RESKILLING NOT ON THE CARDS FOR MOST

Most workshops CNA TODAY spoke to have no plans to reskill their workers to prepare for an EV future.

For one, the cost of reskilling workers by sending them overseas for training has proven substantial and may not justify the returns they bring – immediate or otherwise.

Even when workshops do invest in training, the business payoff may not come quickly. Mr Lim of SMWA said that many EVs come with extended warranties that last five to seven years.

As a result, workshops trained in EV servicing may start seeing work only once those warranties expire. Even then, the volume remains uncertain.

The scope of available training options also remains limited, said Mr Lim, explaining that the National EV Specialist Safety certification focuses mainly on basic electrical engineering concepts and safety, including how to handle high-voltage and three-phase electricity.

"It does not impart brand-specific automotive repair knowledge and skills," he said. "After going through the course, technicians will not be able to repair EVs."

Training in diagnosing and repairing specific EV models from Tesla or BYD, for example, is currently available mainly through authorised agents and dealers, who have direct access to manufacturers, Mr Lim added.

He said SMWA is working with training partners to bring such courses to workshops, but these efforts are still ongoing and there is no implementation timeline as yet.

For some workshop owners, time is simply not on their side.

Madam Candice Yee, 64, has run the repair workshop Premium Carz Services with her husband since 2014. The couple has no intention of training their mechanics to repair EVs.

"Some (workshops) will live and some will die. The government has already (shown) the direction they are going, and there's nothing we can do.

"We will already be retiring after this."