Amid Trump tariffs, ASEAN summit to prioritise new trade links with other powers: Analysts

The 46th ASEAN Summit in Kuala Lumpur this week could see steps towards greater cooperation with China and Gulf states, experts say. Malaysia Prime Minister Anwar Ibrahim has urged ASEAN to engage “new partners” such as India, Pakistan, Russia and the European Union.

Malaysia is set to host the 46th ASEAN Summit at the Kuala Lumpur Convention Centre. (Photo: CNA/Fadza Ishak)

This audio is generated by an AI tool.

KUALA LUMPUR: Diversification is likely to be the underlying theme at the upcoming 46th Association of Southeast Asian Nations (ASEAN) summit, as the bloc seeks new partnerships and closer ties with other major powers to cushion the impact from United States President Donald Trump's tariffs and isolationist policies, analysts say.

The US will not be present at the summits held at the Kuala Lumpur Convention Centre on Monday (May 26) and Tuesday, but Trump's shadow looms large as uncertainty lingers over what he might do after a 90-day pause on steeper reciprocal tariffs slapped on most of the world ends in July.

"Malaysia, as the ASEAN chair, may push for ASEAN to diversify economic partnerships to minimise the impact of Trump's tariffs," said Abdul Rahman Yaacob, a research fellow in the Southeast Asia programme at the Lowy Institute think tank in Australia.

"Trump’s tariffs are an accelerator for ASEAN to expand its strategic partnerships."

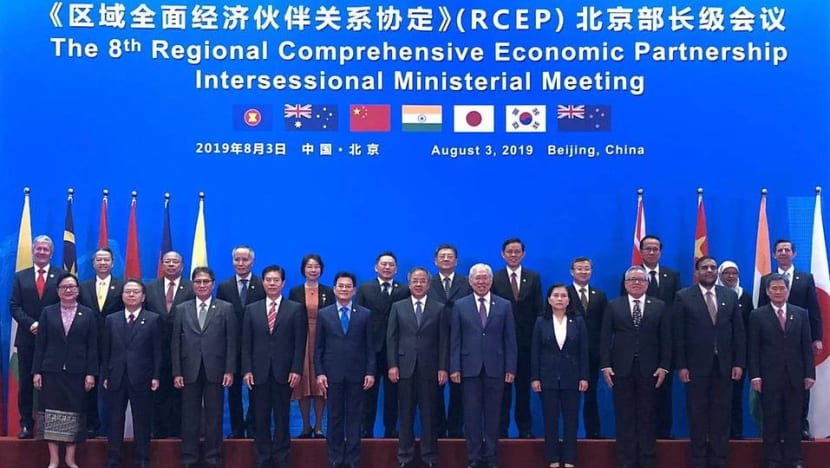

Gathering at the foot of the iconic Petronas Twin Towers, leaders of the 10 ASEAN member states could discuss a potential expansion of the Regional Comprehensive Economic Partnership (RCEP), the world’s largest free trade agreement (FTA) comprising 30 per cent of the world’s total gross domestic product and population, observers said.

The ASEAN-driven RCEP comprises the 10 ASEAN countries as well as Australia, China, Japan, South Korea and New Zealand.

The first-ever ASEAN-Gulf Cooperation Council (GCC)-China summit, a brainchild of Malaysia Prime Minister Anwar Ibrahim, will also be held on Tuesday, with Chinese Premier Li Qiang attending.

The GCC comprises six Arab states including major oil producers Saudi Arabia, Kuwait and Qatar. The GCC's total commodity trade with China reached almost US$298 billion in 2023 while the bloc accounted for 36 per cent of China's total crude oil imports that year, according to United Nations figures.

This trilateral summit could yield more infrastructure and digital cooperation under China’s Belt and Road framework, said Jamil Ghani, a doctoral candidate at the S Rajaratnam School of International Studies in Singapore.

But Jamil, who has done research on Malaysia’s foreign policy, said these moves do not mean ASEAN is choosing sides in times of economic uncertainty.

"These engagements reflect diversification, not realignment,” he told CNA.

“ASEAN continues to value ties with the US, but recent frustrations – particularly over the limited progress under the US’ Indo-Pacific Economic Framework – have created room for China and the GCC to expand their influence.”

At a briefing with local and foreign media on May 21, Anwar said ASEAN will discuss Timor-Leste’s potential membership, the Myanmar issue, improving intra-ASEAN trade, as well as economic collaboration amid the US tariffs.

Anwar was asked if ASEAN would continue its policy of maintaining good relationships with both the US and China, and if this position could be abused by either power to their advantage.

“As a trading nation, if we do not venture to new markets and build up that resilience nationally and also regionally, we will not win. So, that’s the most pragmatic decision we should make,” Anwar said, speaking for Malaysia.

“Domestically, we have problems with all our neighbours as a maritime country. And people say, ‘Oh, you're being biased towards China, because you don't seem to say that there are problems.’ I said we have problems with all our neighbours.”

While Anwar acknowledged Malaysia's dependence on the US for trade and investment, he said he cannot accept a “tendency to dictate”.

Countries must be allowed to decide in their own interests and not be swayed by rivalries between major powers, he said, calling on ASEAN to engage “new partners” such as China, India, Pakistan, Russia and the European Union.

“It's a call for assertiveness and independence,” Anwar added.

According to a draft statement expected to be issued by ASEAN leaders after they meet on Monday, the bloc will express "deep concern" over Trump's tariff blitz, AFP reported on Friday.

Trump's unilateral levies "pose complex and multidimensional challenges to ASEAN's economic growth, stability, and integration", the draft said.

WHAT TO EXPECT FROM ASEAN-GCC-CHINA SUMMIT

Anwar first invited Chinese President Xi Jinping to join the ASEAN-GCC summit during his official visit to Shanghai and Beijing in November last year.

It was during that time that Trump emerged victorious in the US presidential election, with countries around the world already wary of how the US-China trade war might escalate regardless of who won.

“The plan to invite China to the second ASEAN-GCC summit was conceived before the US elections, in which Donald Trump won a landslide victory,” noted a December 2024 article by ThinkChina, a Singapore-based online magazine focused on China.

“The election results prompted these partners to expand their coordination. All three have varying degrees of uncertainty and concerns about future US policies.”

The first ASEAN-GCC summit took place in Riyadh, Saudi Arabia in 2023, where both regional blocs outlined their five-year agenda and decided to hold a biennial summit, alternating between the GCC and ASEAN regions.

A joint statement from that summit agreed to “enhance trade and investment flows”, with a focus on areas like sustainable infrastructure, petrochemicals, agriculture, manufacturing, healthcare, connectivity and digitalisation.

Anwar said at the May 21 briefing that the GCC nations have good ties with both the US and China, and are “really focusing on ASEAN”.

“So, we thought that we should use this occasion to try and build up probably some projects that involve a few countries – sub-regional, if not regional. There is probably a fund, so that we can work together,” he said, without elaborating on what type of fund this would be.

Sharon Seah, senior fellow and coordinator of the ASEAN Studies Centre at Singapore’s ISEAS-Yusof Ishak Institute, said the ASEAN-GCC-China summit is the first time that one of ASEAN’s inter-regional summits has been expanded to involve a dialogue partner.

“The ASEAN-GCC summit itself, having only met once prior, has not found a comfortable pace and tempo to their discussions,” she told CNA.

“The deviation from the usual bilateral format of engagement to a trilateral engagement makes it somewhat challenging in terms of agenda setting.”

China has said it is prepared to collaborate with ASEAN and GCC member states to enhance mutually beneficial partnerships and safeguard the legitimate development rights of all parties, Bernama reported on May 9.

China’s relative silence on the expected outcomes of this trilateral might be an indication that Beijing is unsure what it can derive from the summit, Seah said.

“While we can understand PM Anwar’s strategic rationale behind convening a trilateral with China – promotion of greater South-South cooperation, diversifying ASEAN’s strategic options and forming new trade alliances in the face of the US’ tariff war – it is difficult to see how and what deliverables the summit can produce,” she said.

“Nonetheless, it would be another useful occasion for China to repeat its call to uphold international rules-based order and oppose unilateralism.”

Abdul Rahman said he does not expect an “immediate impact or outcome” from the ASEAN-GCC and ASEAN-GCC-China meetings, other than a general statement expressing concerns about Trump’s tariffs, or a statement of intent or memoranda of understanding to work closer together on the economic front.

Despite that, Jamil said the GCC is becoming a more important partner for ASEAN in energy, food security, Islamic finance, and investment flows.

This has certainly been the case at the bilateral level. For instance, Malaysia and the United Arab Emirates signed a Comprehensive Economic Partnership Agreement on Jan 14 this year.

Indonesian President Prabowo Subianto went on a five-nation Middle East tour in April and announced that Qatar is set to invest US$2 billion in his country’s new sovereign wealth fund Danantara.

Premier Li Qiang’s expected presence reaffirms China’s strategic interest in Southeast Asia, Jamil said.

“ASEAN, however, will likely calibrate its messaging to avoid the impression of strategic alignment with Beijing," he added.

ROPING IN OTHER COUNTRIES

Beyond China and the Gulf states, Seah said Malaysia as ASEAN chair could discuss an expansion of RCEP membership to include more of ASEAN’s major trading partners, such as the United Kingdom and European Union.

ASEAN could also explore other ways to diversify trade outside of the region, including with Latin American countries, she said.

“Trade has always been the lifeline of ASEAN so I expect that the ASEAN Geoeconomics Task Force will give a preliminary update to the leaders on its progress and plans going forward,” she said.

Besides RCEP, Seah said it could be worth “thinking outside the box” about how other trade agreements like the CPTPP might benefit from the admission of others looking to join, referring to China, Taiwan, Uruguay, Costa Rica and Ecuador.

The Comprehensive and Progressive Agreement for the Trans-Pacific Partnership (CPTPP), the successor of the Trans-Pacific Partnership FTA abandoned by the first Trump administration, comprises 12 economies.

They are Australia, Brunei Darussalam, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, the United Kingdom and Vietnam.

Malaysia’s Investment, Trade and Industry Minister Tengku Zafrul Abdul Aziz said ASEAN is seeking to expand its membership in RCEP and CPTPP, the Vietnam News Agency reported on May 20.

The minister said the matter was discussed when he chaired the ASEAN Caucus Meeting held in Jeju, South Korea. He noted that only four ASEAN members were part of the CPTPP.

The US tariffs have had a significant impact on intra-ASEAN trade dynamics as well as that with trading partners, particularly in sectors entrenched in the global supply chains, Tengku Zafrul added.

ASEAN could think of spearheading a supply-chain resilience network with its most important trading partners like China, Japan, South Korea and the European Union, Seah said.

Ninety per cent of ASEAN’s enterprise landscape comprises small- and medium-sized enterprises (SME), and Southeast Asian SMEs form a “significant part” of the global supply chain, she said.

“SMEs are the first casualties of any disruption given their size and lack of capacity to deal with volatile changes,” she added.

“ASEAN countries might think of setting up a dedicated SME subgroup under the Geoeconomics Task Force to help ASEAN SMEs survive the trade war.”

BOOSTING INTRA-ASEAN ECONOMIC LINKS

Within ASEAN, Malaysia is expected to call on members to speed up regional economic integration, roll back protectionist behaviour, and commit to “aggressively remove” non-tariff barriers among members, Seah said.

Malaysia is also expected to push for supply chain diversification, acceleration of RCEP implementation, and the Digital Economy Framework Agreement (DEFA) as a digital economic counterweight, Jamil said.

ASEAN members are hoping to conclude discussions on its DEFA, touted as the first regional digital trade pact of its kind, by the end of 2025.

It aims to transform ASEAN into a leading digital economy, through greater digital integration as well as inclusive growth and development.

“While the formal agenda will avoid controversy, digital sovereignty – including concerns over data governance, artificial intelligence, and digital infrastructure – may quietly emerge in sideline discussions, given increasing strategic competition in this space,” Jamil said.

ASEAN is unlikely to issue a collective response to new US tariffs, given its non-binding, consensus-based structure, Jamil said.

However, he expects ASEAN to “adopt language around ‘inclusive, rules-based trade’ - signalling concern over global protectionism without naming the US”.

Jamil said Russia’s “growing presence” in Southeast Asia – particularly through defence and energy diplomacy – might also be “acknowledged quietly at the summit’s margins”.

During his four-day visit to Russia earlier in May, Anwar had invited Russian President Vladimir Putin to attend the East Asia Summit in October, one of several meetings involving ASEAN dialogue partners.

The May trip was Anwar’s second visit to Russia in less than a year, coming as Malaysia pushes for full membership in the BRICS grouping of emerging economies.

The group comprises Brazil, Russia, India, China and South Africa, among other countries, and in January this year Indonesia became the first ASEAN member to formally join. Malaysia, Thailand and Vietnam are partner countries.

Indonesia’s Prabowo had also visited Russia as president-elect in July last year, and he will make his first official visit to the country in June, with the signing of a Eurasian bloc trade deal reportedly high on the agenda.

BRICS has been “surprisingly low on activity” in the face of Trump’s tariff war, Seah said.

The group, like ASEAN, could only go as far as issuing a statement on a collective position as members pursue their own bilateral negotiations with the US, she reckoned.

“I do not foresee more ASEAN members expressing an active interest in BRICS apart from those who are already partner members,” she added.

“If any other ASEAN countries were interested, it would be useful to take a wait-and-see approach during this time while waiting for the trade volatility to come down a little and to see what obligations Indonesia needs to fulfil as a member of BRICS.”

ASEAN member states’ interest in partnering BRICS countries does not mean the Southeast Asian bloc is “shifting towards China or Russia”, Abdul Rahman said.

"Traditionally, ASEAN has always been non-aligned and neutral,” he said.

In the longer term, Abdul Rahman pointed to a likely shift for ASEAN states: Relying less on the US in economy and trade, and expanding economic cooperation with other partners to “soften the blow of an unpredictable US”.

“Establishing more partnerships with China and Russia, or any other blocs such as the GCC, means that ASEAN does not want to be overly reliant on one power, but wants to broaden its engagements with as many partners as possible,” he added.