CNA Explains: What Nvidia's blockbuster results tell us about an AI bubble

Was the talk of an AI bubble overblown? Nvidia CEO Jensen Huang pushed back at sceptics as the tech giant announced solid quarterly earnings.

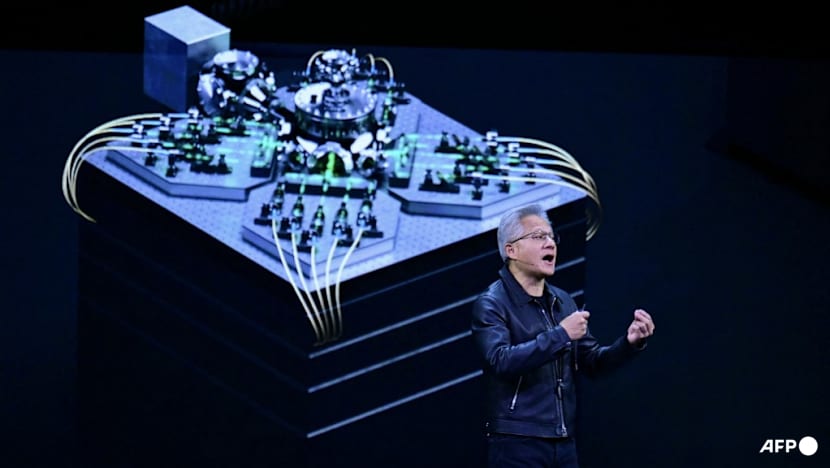

Nvidia CEO Jensen Huang speaks during the Live Keynote Pregame during the Nvidia GTC (GPU Technology Conference) in Washington, DC, on Oct 28, 2025. (File photo: AFP/Jim Watson)

This audio is generated by an AI tool.

SINGAPORE: Nvidia’s shares climbed on Wednesday (Nov 19) after posting solid quarterly profits and revenue that exceeded Wall Street’s expectations.

The closely watched results provided a pulse check amid concerns about an artificial intelligence bubble – and Nvidia’s earnings appear to have cooled worries, for now.

Was the talk of an AI bubble overblown, and what’s in store for Nvidia?

JENSEN HUANG QUELLS JITTERS

In a conference call, Nvidia CEO Jensen Huang seized the moment to push back against the sceptics.

“There’s been a lot of talk about an AI bubble. From our vantage point, we see something very different," Huang said.

“Blackwell sales are off the charts, and cloud GPUs are sold out,” he added, referring to the company’s most advanced chips.

He reiterated a forecast from last month that the company had US$500 billion in bookings for its advanced chips through 2026.

“The reason why developers love us is because we're literally everywhere," he added. "We're everywhere from cloud to on-premise to robotic systems, edge devices, PCs, you name it. One architecture. Things just work. It's incredible.”

Nvidia reported third-quarter profits of US$31.9 billion, up 65 per cent from the quarter a year ago.

Revenue climbed 62 per cent to US$57 billion.

The world’s most valuable company also predicted that its revenue for the fourth quarter will come in at about US$65 billion. That’s nearly US$3 billion above analysts' projections, in an indication that demand for its AI chips remains feverish.

Huang's comments appear to have been effective in boosting investor confidence.

"He provided clearer visibility on AI demand, highlighted a strong product roadmap, and reinforced Nvidia’s dominant position in the AI ecosystem," James Ooi, market strategist at Tiger Brokers, told CNA.

NVIDIA'S RISE

Nvidia, founded in 1993, was already a leader in making GPUs, the components that generate images on a computer screen.

The Silicon Valley company later discovered that it could tailor GPUs from powering video games to helping train powerful AI systems.

When generative AI started to make headlines three years ago, fuelled by OpenAI’s launch of ChatGPT, demand for Nvidia’s products skyrocketed.

Its top-of-the-line Blackwell range of chips, in particular, is highly sought after.

BUBBLE FEARS

Amid the frenzied spending on AI technology, not just by Nvidia, investors started to question whether the AI boom has outrun fundamentals.

Central to those fears are questions about the circular funding deals that Nvidia and other chipmakers have formed with AI companies.

In September, for instance, Nvidia decided to invest up to US$100 billion in OpenAI and supply it with data centre chips.

But any concerns about a potential circular AI economy have not stopped Nvidia from making more deals.

On Nov 18, Nvidia and Microsoft announced that they are committed to investing up to a combined US$15 billion in AI developer Anthropic, which in turn committed to buying US$30 billion in computing capacity from Microsoft Azure, running on Nvidia chips.

Yik Ban Chong, research analyst at Phillip Securities Research, believed that the risks of circular financing “are still immaterial”.

“The value of the mentioned circular financing deals is estimated to make up less than 10 per cent of Nvidia's US$500 billion in bookings for its GPUs until end-2026,” he told CNA.

Ooi from Tiger Brokers also said circular funding does not pose an immediate crisis for Nvidia or the broader ecosystem.

“While it can ‘artificially’ lift early revenue, it also serves a purpose: it helps companies build up AI capabilities and scale until real, organic demand emerges. In that sense, circular funding can accelerate ecosystem development rather than distort it,” he said.

“It only becomes problematic if real, sustainable AI demand fails to materialise, leaving highly leveraged companies unable to service their debt.”

SIGH OF RELIEF, FOR NOW?

As one of the torchbearers of the artificial intelligence revolution, Nvidia’s results were seen as a bellwether in the industry.

Some analysts said its stellar third-quarter results showed that concerns of an AI bubble were overblown.

“Most of us thought that the AI bubble narrative was more for media scare than reality, because we all know AI is here to stay,” Michelle Schneider, chief strategist at MarketGauge, told CNA.

“(Jensen Huang) also talked about the fact that they are completely sold out of their GPUs, and that’s really basically the picks and shovels.”

Wedbush analyst Dan Ives referred to Nvidia earnings as a “pop the champagne” moment for the tech sector and a sign that worries of an AI bubble are overstated.

The figures show that “we are still in the early stages of a multi-year AI infrastructure super-cycle,” added Ooi from Tiger Brokers.

“Real demand continues to build, and the main risk ahead is that many AI stocks are priced for perfection - not that the AI story is falling apart,” he told CNA.

Melissa Otto, head of Visible Alpha Research at S&P Global, suggested that people might have different interpretations of what a bubble might be.

“When I think about a bubble, I think about like the Japanese bubble in the 80s, or the internet bubble around 2000 - there was so much debt, these companies were very levered. And what I see now, I don't see a lot of debt. I see companies leveraging their cash flow,” she told CNA.

“These are very rich, very profitable companies investing in AI infrastructure to build that next generation of foundation that's ultimately going to give us that compute power and take us to AI. So I think when we do start to see significant levels of leverage come into this whole industry, perhaps at that time, then maybe I would be a bit more worried.”

Nvidia’s results prove that data centre scaling is a central need for virtually every tech business in the world, said Thomas Monteiro, senior analyst at Investing.com.

“Against this backdrop, it's fair to say that today's report answers a lot of questions about the state of the AI revolution, and the verdict is simple: it is nowhere near peak, neither from the market demand nor the production or supply chain sides, for the foreseeable future,” he said in a commentary on LinkedIn.

Some analysts, however, said the earnings report may not be enough to quell AI bubble fears.

"The concern that AI infrastructure spending growth is not sustainable is not likely to ebb," Stifel analyst Ruben Roy told Reuters.

Kinngai Chan, analyst at Summit Insights, said: "While results and outlook were stronger than consensus expectations, we think investors will remain concerned about the sustainability of its customers' capex spending increase and the circular financing in the AI space."

THE CHINA FACTOR

Factors beyond Nvidia's control could impede its growth, as the AI giant is caught up in US President Donald Trump's trade war with China.

Sales of H-20 GPUs, which are designed for the Chinese market due to US restrictions on exports of AI chips to China, tallied only US$50 million in the quarter, according to chief financial officer Colette Kress.

"Sizable purchase orders never materialised in the quarter due to geopolitical issues and the increasingly competitive market in China," Kress said on an earnings call.

Beijing has been urging Chinese businesses to rely on local suppliers instead.

"To establish a sustainable leadership position in AI computing, America must win the support of every developer and be the platform of choice for every commercial business, including those in China,” Kress added.

But Wedbush’s managing director Dan Ives is optimistic that all sides will settle on a deal.

“The biggest chip on the poker table in US-China negotiations is Nvidia chips. China wants him, and that's negotiation. But Trump also doesn't want to give some of that IP to China. And that continues to be the sort of tightrope that they're walking,” he told Reuters earlier this week.

“I believe in 2026, Nvidia and in some form is going to be able to sell chips into China, even some of their next-gen chips, but probably a restricted version."

Nvidia's earnings report on Wednesday shows that organic demand for AI chips is still strong, said Chong from Phillip Securities Research, who played down the China risk.

He noted that even with minimal orders from China, Nvidia's third-quarter revenue still rose 62 per cent year on year, powered by its Blackwell GB300 ramp and demand for its networking technology.

"I believe the main challenge for Nvidia is how fast it can keep up its supply of GPU and product cadence next year to match its demand," Chong told CNA.

"Nvidia works with a number of stakeholders – TSMC foundry, memory and packaging vendors. How fast it can ramp its supply to meet GPU demand would be key to its growth next year."