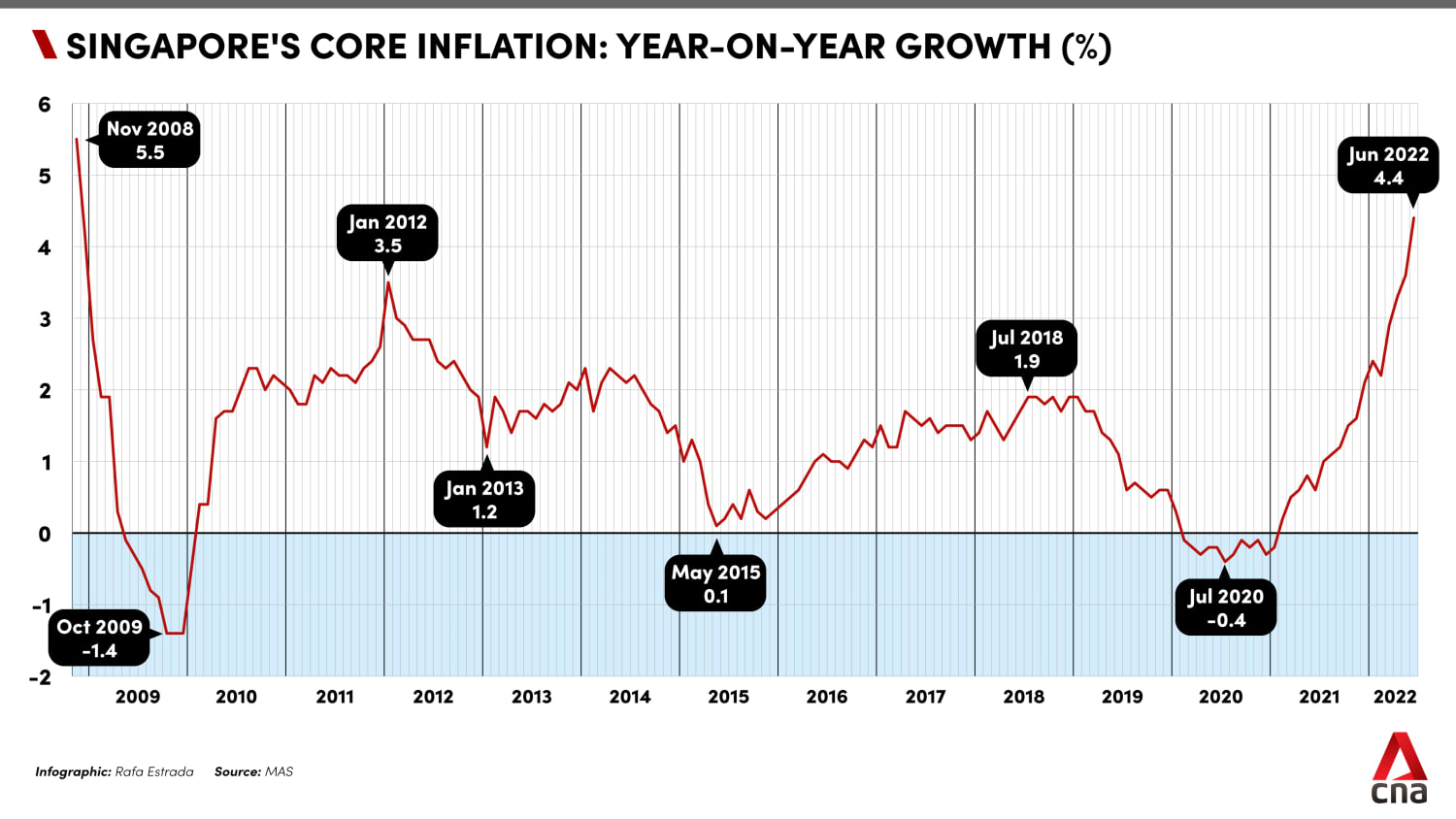

Singapore’s core inflation rises to 4.4% in June, highest since November 2008

SINGAPORE: Singapore's core inflation in June hit its highest level since November 2008, with stronger price increases across most categories such as services, food, retail, as well as electricity and gas.

Core inflation, which excludes accommodation and private transport costs, came in at 4.4 per cent year-on-year in June, up from 3.6 per cent in May, official data released on Monday (Jul 25) showed.

The last time Singapore reported higher year-on-year growth was in November 2008, when core inflation was 5.5 per cent.

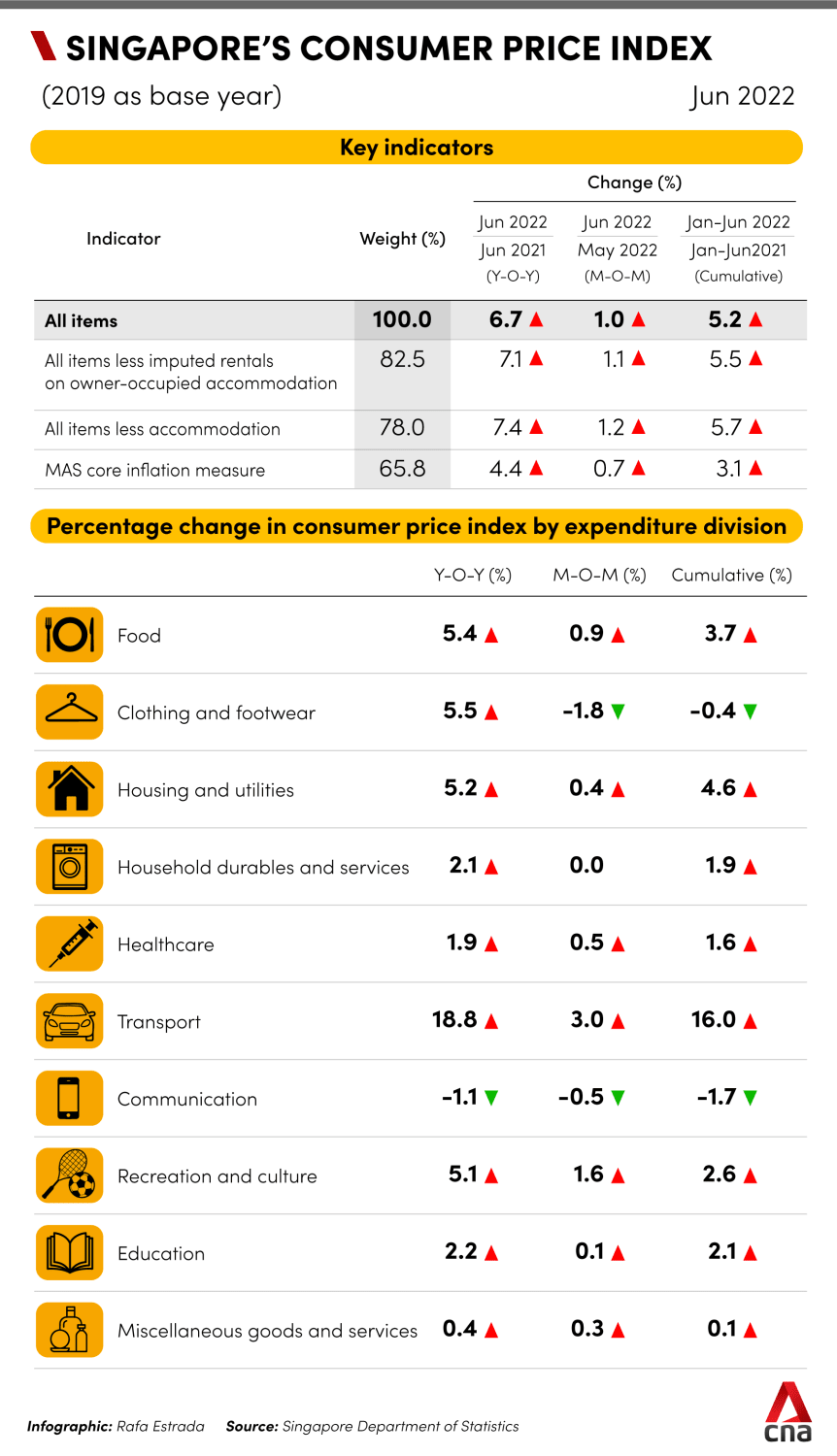

The headline consumer price index, or overall inflation, rose to 6.7 per cent year-on-year in June, surpassing the 5.6 per cent reported in May.

INFLATION ACCELERATES FOR ALL SECTORS

Food inflation hit 5.4 per cent in June compared to 4.5 per cent in May as a result of larger increases in the prices of both food services and non-cooked food, said the Monetary Authority of Singapore (MAS) and the Ministry of Trade and Industry (MTI) in a joint media release.

Inflation for retail and other goods also picked up, coming in at 3.1 per cent in June from 1.8 per cent in May, as the cost of medicines and health products rose, and the price of clothing and footwear recorded a steeper increase.

Electricity and gas prices edged up, with inflation at 20 per cent in June compared to 19.9 per cent in May as the average prices of electricity plans offered by Open Electricity Market (OEM) retailers rose at a faster pace, said MAS and MTI.

Services inflation rose to 3.4 per cent from 2.6 per cent in May due to a faster pace of increase in the costs of holiday expenses and point-to-point transport services, as well as airfares.

Accommodation inflation rose 0.2 per cent to hit 4.2 per cent in June due to a larger increase in housing rents.

Private transport inflation jumped to 21.9 per cent from 18.5 per cent in May amid rising car prices and petrol costs.

MAS said in its annual report earlier this month that core inflation is projected to increase to a peak of 4 to 4.5 per cent in the third quarter, before easing towards the end of this year at around 3.5 to 4 per cent.

This is much higher than what Singapore has been used to, said MAS managing director Ravi Menon on Jul 19.

With inflation rising, the MAS tightened monetary policy four times in the last nine months, including two off-cycle moves in January and July.

For the year as a whole, core inflation is projected to average between 3 per cent and 4 per cent, while headline inflation is forecast to come in at between 5 per cent and 6 per cent, said MAS and MTI on Monday.

They noted that globally, supply chain frictions have eased slightly and some increases in commodity prices have levelled off.

"Nevertheless, global inflation is likely to stay elevated as key commodity markets continue to face supply constraints and the labour market in many major economies remain tight," they added.

"In addition, the recovery in domestic demand in some regional economies as COVID-19 restrictions are eased could raise inflation. Hence, upward pressures on Singapore’s import prices are expected to persist."

On the domestic front, the labour market remains tight and wage growth is expected to be strong.

“Amid firm consumer spending, businesses are likely to pass on the increases in the prices of fuel, utilities, and other imported inputs, as well as labour costs, to consumer prices. Hence, inflationary pressures will remain elevated in the months ahead,” MAS and MTI said.

MAS and MTI cautioned that there remain upside risks to inflation from fresh shocks to global commodity prices, as well as domestic wage pressures.

Earlier in July, Deputy Prime Minister Lawrence Wong announced a S$1.5 billion support package to help the lower-income and more vulnerable groups cope with rising costs.

Measures include a special GST Voucher payment of up to S$300 in cash for about 1.5 million Singaporeans, as well as a S$100 utilities credit for all Singaporean households.