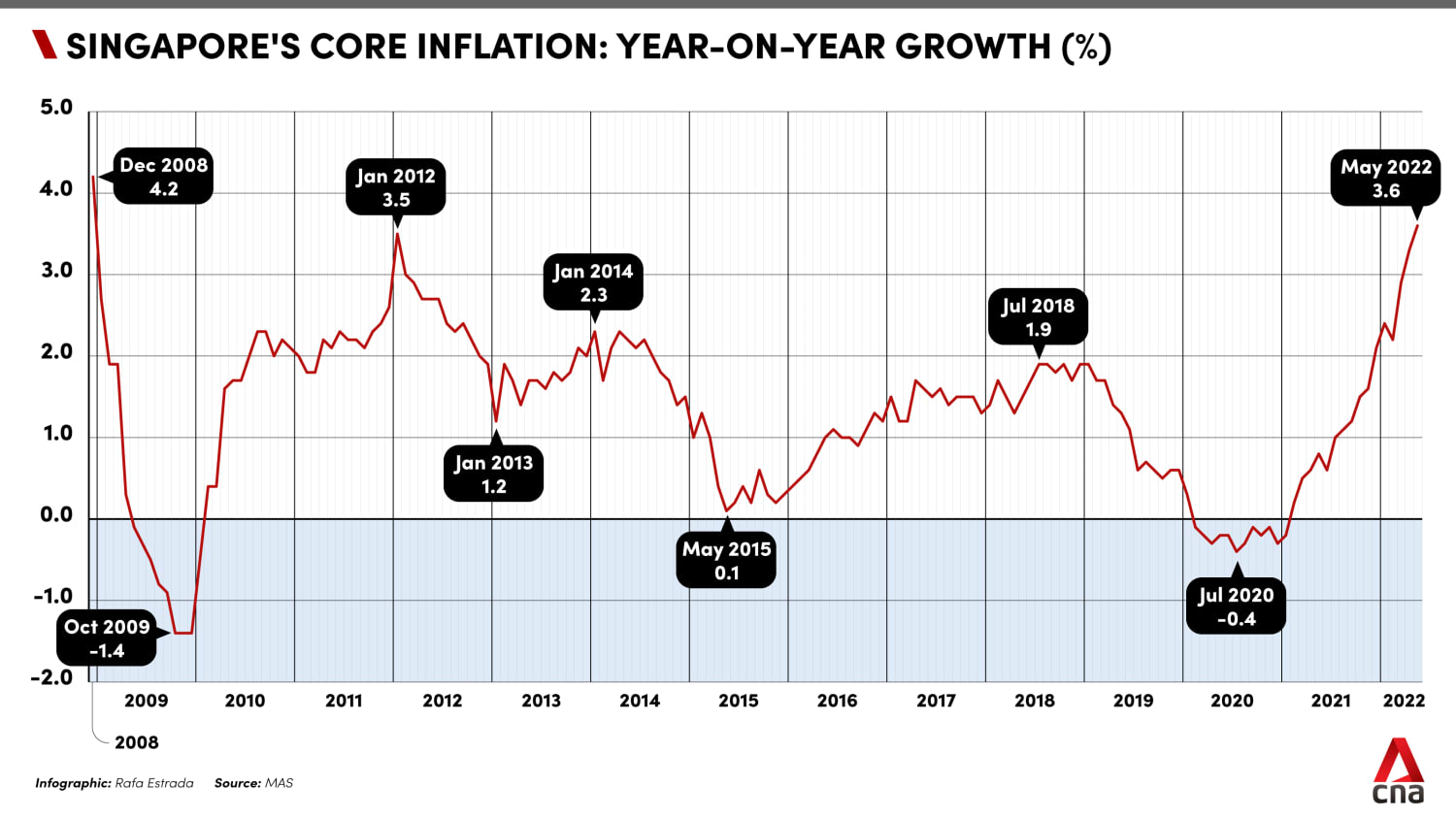

Singapore's core inflation rises to 3.6% in May, highest in more than 13 years

People gather along the Marina Bay waterfront in Singapore on Jun 1, 2022. (File photo: AFP/Roslan Rahman)

SINGAPORE: Singapore’s core inflation in May hit its highest level in more than 13 years, led by rising prices of food and utilities.

Core inflation, which excludes accommodation and private transport costs, came in at 3.6 per cent year-on-year in May, up from a previous 10-year high of 3.3 per cent in April, official data released on Thursday (Jun 23) showed.

The last time Singapore reported higher year-on-year growth was in December 2008, when core inflation was 4.2 per cent.

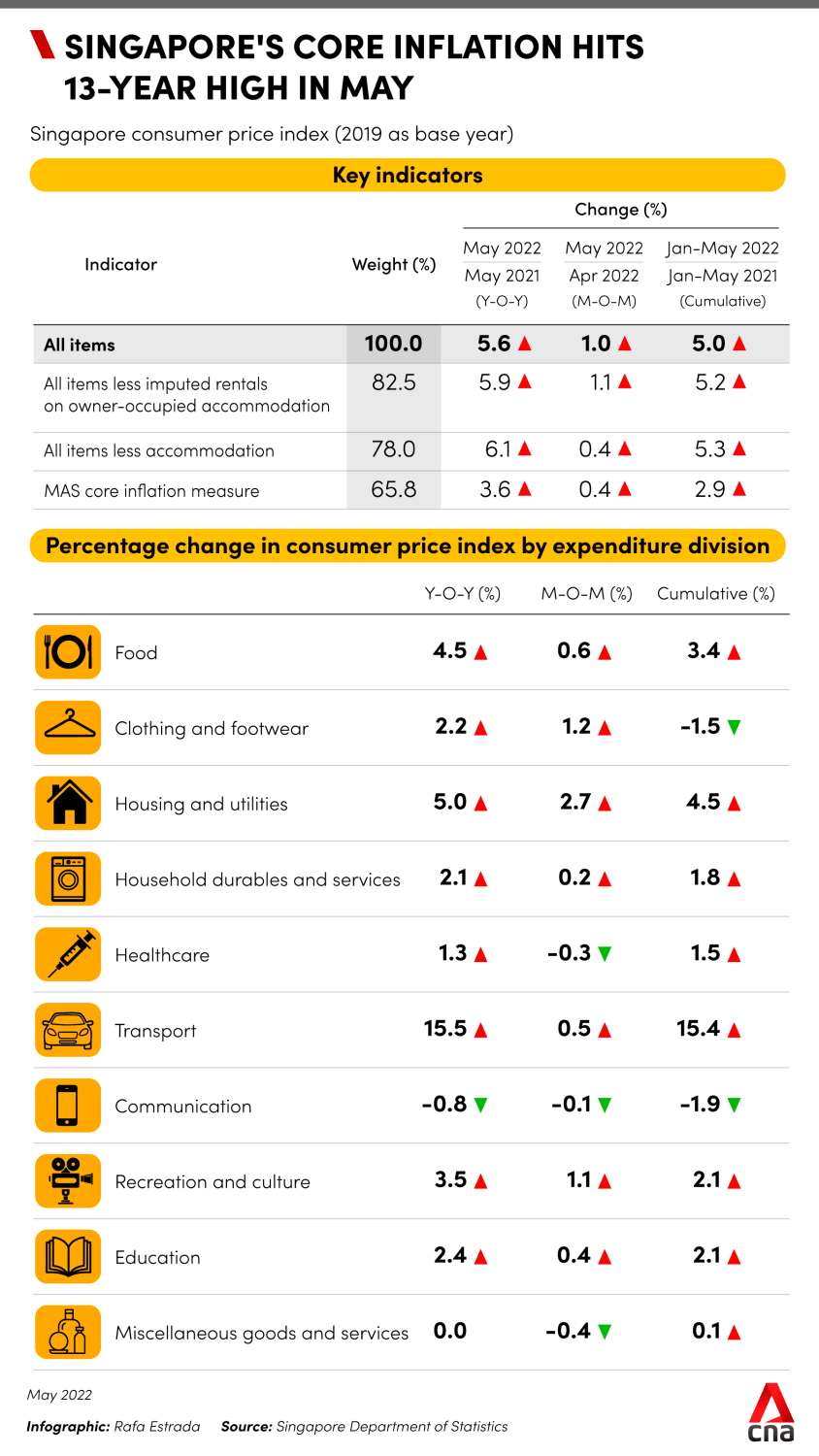

The headline consumer price index, or overall inflation, rose to 5.6 per cent year-on-year in May, exceeding the 5.4 per cent reported in both April and March.

INFLATION ACCELERATES FOR ALL SECTORS

Food inflation hit 4.5 per cent in May compared to 4.1 per cent in April, as the price of food services rose more strongly, said the Monetary Authority of Singapore (MAS) and the Ministry of Trade and Industry (MTI) in a joint media release.

Inflation for retail and other goods also picked up, coming in at 1.8 per cent in May from 1.6 per cent in April, as prices of clothing and footwear, personal effects and personal care products increased.

Electricity and gas prices edged up, with inflation at 19.9 per cent in May compared to 19.7 per cent in April as the average prices of electricity plans offered by Open Electricity Market (OEM) retailers rose at a faster pace, said MAS and MTI.

Services inflation also rose slightly to 2.6 per cent from 2.5 per cent in April, due to a faster pace of increase in the costs of holiday expenses and point-to-point transport services.

Accommodation inflation rose 0.1 per cent to hit 4 per cent in May due to a larger increase in housing rents. Private transport inflation rose to 18.5 per cent from 18.3 per cent in April, with petrol costs increasing in the face of higher global oil prices.

MAS and MTI said that external inflationary pressures continue to be strong amid elevated global commodity prices, as well as ongoing supply chain frictions driven by both the Russia-Ukraine conflict and the regional COVID-19 situation.

“In the near term, heightened geopolitical risks and tight supply conditions will keep crude oil prices elevated,” they added.

“Prices of other commodities, such as food, are also expected to stay high amid supply-demand mismatches, as well as disruptions to global transportation and regional supply chains.”

On the domestic front, the labour market is expected to “remain tight, which will support a firm pace of wage increases”.

“Alongside improving demand, a greater pass-through of accumulating business costs to consumer prices is likely to occur, thus keeping core inflation significantly above its historical average through the year,” MAS and MTI said.

Core inflation is forecast to pick up further in the coming months, MAS and MTI said, although it is expected to moderate towards the end of the year as “some of the external inflationary pressures recede”.

However, they cautioned that upside risks remain from geopolitical and pandemic-related shocks.

“With private transport and accommodation inflation expected to stay firm in the near term, headline inflation will pick up by more than core inflation this year,” MAS and MTI added.

For the year as a whole, headline inflation is forecast to come in at between 4.5 per cent and 5.5 per cent, while core inflation is projected to average between 2.5 per cent and 3.5 per cent.

Related:

SUPPORT ON THE WAY

On Tuesday, the Government announced a S$1.5 billion support package targeted at providing immediate relief for lower-income and more vulnerable groups to counter rising inflation.

The package was "designed carefully" so that it does not spark more inflation in Singapore, Deputy Prime Minister Lawrence Wong said on Tuesday.

Some of the key measures:

- Eligible Singaporeans will get a one-off GST (Goods and Services Tax) Voucher cash special payment of up to S$300

- All Singaporean households, including those in private properties, will receive a S$100 rebate on utilities

- Permanent enhancements to ComCare assistance schemes

- For businesses, there are higher subsidies for the Progressive Wage Credit Scheme and an Energy Efficiency Grant for local small- and medium-sized enterprises

- Enhancements to the Enterprise Financing Scheme

- Chicken slaughterhouses affected by Malaysia’s chicken export ban will get a one-month foreign worker levy waiver

- Eligible taxi main hirers and private hire car drivers will receive a one-off relief of S$150 in August

The support package is funded from surpluses as there were higher revenues from the financial year 2021 due to the stronger economic recovery, while spending on COVID-19 measures was lower than anticipated, said the Ministry of Finance. There will be no further draw on past reserves.

Mr Wong, who is also the Finance Minister, said that there will be no supplementary Budget at this point.