China's AI race intensifies: From humanoid robots to billion-yuan subsidies

Cities across China are ramping up their AI ambitions. But as competition intensifies, analysts urge them to play to their strengths - not blindly copy one another.

A boy and his grandmother look at a robot at the world’s first 6S store in Longgang district, Shenzhen, which aims to bring robots into everyday life. (Photo: CNA/Melody Chan)

This audio is generated by an AI tool.

SHENZHEN/SHANGHAI: Drones zip through the air, swiftly picking up and dropping off orders like food and medicine. Robot taxis and driverless cars weave seamlessly in and out of traffic while life-sized “digital humans” guide commuters at busy metro stations.

This is everyday reality in Shenzhen, a vibrant tech hub at the forefront of the country’s artificial intelligence race. But this southern city is just one of several that’s vying for AI dominance.

Across the country, local governments are rolling out ambitious plans to position themselves as AI leaders.

Competition is fierce, analysts say, and success hinges on leveraging unique strengths. They warn that blindly copying other cities could backfire - even in a lucrative sector like AI - and caution against overinvestment without a clear, long-term strategy.

“Everybody wants to be ahead in the AI race but you have to … know where your strengths lie rather than trying to copy other cities and getting into the race blindly,” said Benjamin Cheong, deputy head of technology, media and telecommunications at law firm Rajah & Tann.

Other AI frontrunner cities include Beijing, Shanghai and Hangzhou.

Backed by substantial government support, Beijing is home to world-class AI research institutes and industrial parks. Its core AI industry is fast approaching 350 billion yuan (US$48.6 billion), nearly half of China’s total.

Shanghai, meanwhile, has leaned into its reputation as a global financial centre, hosting the annual World AI Conference (WAIC) in July and announcing 1 billion yuan in subsidies to help local firms and start-ups adopt AI solutions.

Also investing heavily is the unassuming city of Hangzhou located in eastern China, where firms like DeepSeek and Game Science, which produced the hit Black Myth: Wukong video game, make up a booming tech start-up scene.

But the big question is: can any of these cities become not just China’s AI capital - but the world’s?

THE FRONTRUNNERS

When it comes to Chinese tech advancements, Shenzhen might be one of the first cities that comes to mind.

Often dubbed the Silicon Valley of China, the city is renowned for its culture of rapid innovation.

It has been investing heavily in developing AI-powered humanoid robots capable of moving with precision and agility, performing tasks from patrolling streets to even competing in sports.

“From product design to market testing, turnaround is (quick),” said Lin Feng, CEO of Future Era, the world’s first “robot 6S” showroom and service store which recently opened in Shenzhen’s Longgang district.

Special grants and policies were announced in February to boost the city’s AI robotics scene, which included generous financial incentives of up to 4.5 billion yuan and subsidies to promote AI and encourage businesses to adopt the technology.

“Shenzhen will adopt even more ambitious and open policies, connecting global and national innovation resources,” Lin Yi, director of the Shenzhen AI Industry Office, told Chinese state media outlets.

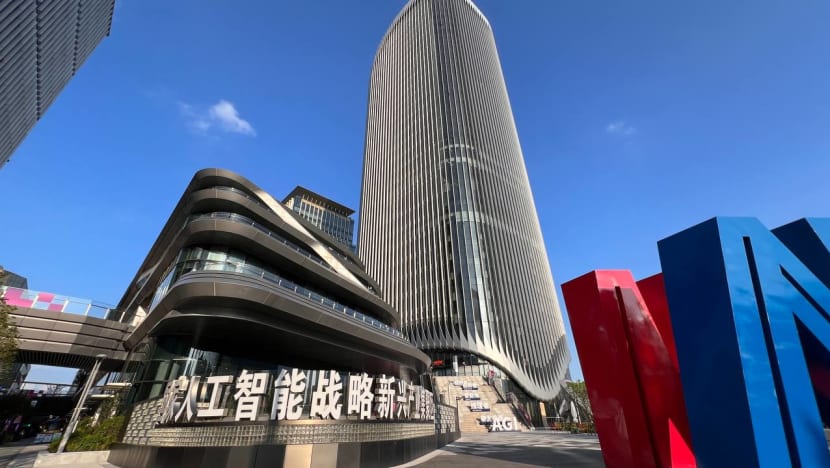

In May, the Shenzhen Longgang District Artificial Intelligence (Robotics) Administration was launched - China’s first government agency dedicated solely to robotics.

“Our young engineers don’t just walk the well-trodden path, they carve (out) new ones,” said Zhao Bingbing, director of the Shenzhen Longgang District Artificial Intelligence (Robotics) Administration.

“This is the kind of place where components for a robot, upstream or downstream, can be sourced within an hour,” Zhao added.

Under a three-year action plan, more than 1,000 robot models - including humanoid assistants and “robot theatres” carrying out live tests and demonstrations - will be rolled out across public services, officials said.

Longgang District, best known as an industrial base housing companies like Huawei and EV giant BYD, launched a 10 billion yuan government procurement scheme, reserving 10 to 20 per cent of publicly funded projects for AI and robotics firms.

Chen Sanduo, founder of Lingqu AI Robotics, relocated to Shenzhen from Hunan province this year.

He told CNA that Shenzhen’s start-up environment was ideal.

“The upstream supply chain here is unmatched - parts, materials, motor customisation, even skin for robots,” he said, adding that his team was planning to open a second showroom in the city by the end of the year.

Robotaxi companies in the city are scaling up too. Pony.ai currently operates around 300 driverless-robotaxis and plans to expand its Shenzhen fleet to 1,000 in the coming years.

“We are at the dawn of large-scale commercialisation,” a Pony.ai spokesperson told CNA.

Beijing’s “high concentration of top-tier talent, world-class research institutions and role as China’s software hub” make it a strong frontrunner in China’s national AI race, said Ma Rui, a Chinese tech investor and analyst based in San Francisco.

“This combination has sustained momentum, giving it an unmatched edge in cutting-edge AI development and a talent pipeline difficult for other Chinese cities to replicate,” Ma said, calling Beijing “China’s AI capital”.

“It is home to leading universities and research institutes, with the strongest academic resources and a deep pool of algorithm talent,” noted Li Haizhou, Dean of School of Artificial Intelligence at the Chinese University of Hong Kong, Shenzhen (CUHK-SZ).

Across the city, there are countless AI labs, dedicated AI research institutes and facilities like the Beijing Academy of Artificial Intelligence and the flagship Zhongguancun Science Park.

Official statistics show that there are currently more than 2,400 registered AI companies and enterprises throughout the capital.

“In terms of AI investments, Beijing would be the top right now based on figures,” said Cheong from Rajah & Tann.

“It has money, the right R&D, is strong in research (and has) a long-established ecosystem for tech innovation,” he added.

“There’s a very big silicon valley in Beijing.”

Unlike Beijing’s research-heavy AI ecosystem, Shanghai has leveraged its reputation as a financial centre to forward its AI goals and ambitions, experts said.

“Shanghai’s strategic position at the heart of the Yangtze River Delta, combined with its global outlook, gives it a complete end-to-end industrial ecosystem - from R&D and manufacturing to supply chain and commercialization,” said Lu Yingxiang, co-founder and CEO of Infermove, a robotics firm whose bots have been deployed in office buildings, commercial parks, airports and residential households across the city.

Shanghai has different strengths, noted Cheong, adding that “it's the centre of China's modern financial industry, and has strong financial and international business links”.

Infrastructure has played a big role in Shanghai’s AI strategy. In 2021, it became the first city in the world to deploy a city-wide fully-optical network, supporting everything from industry and e-commerce to remote work and logistics.

“Shanghai brings together high-traffic, high-standard real-world application scenarios such as aviation hubs, international conventions … that provide (companies) with unparalleled conditions to validate and iterate our products,” Lu added.

Districts like Xuhui - home to the Shanghai Botanical Gardens, luxury malls and trendy cocktail bars - have transformed into vibrant AI hubs. Today, they host Shanghai-based AI companies generating substantial annual revenues.

By the end of Q1 this year, earnings exceeded 118 billion yuan - a 29 per cent year-on-year surge - with profits also rising 65 per cent, according to government data.

Shanghai hosted top industry players at its flagship WAIC event, which ran from Jul 26 to 28.

Also in the works are five planned major data centres and targeted AI subsidies amounting to 1 billion yuan, funding everything from computing power rental to data procurement.

On an official visit in April, Chinese President Xi Jinping called on Shanghai to speed up efforts to become a leading source of cutting-edge innovation and a globally influential tech hub.

“We need to intensify efforts to enhance policy support, nurture talent and strive to develop more high-quality, secure, and reliable AI products,” Xi said in quotes carried by the Xinhua news agency.

DARK HORSES

Smaller contender cities have also been gaining ground in China’s AI race, according to observers.

Hangzhou’s rise has been particularly striking, said Jeffrey Towson, a partner at Techmoat Consulting firm.

Beyond longstanding players like Alibaba, Hangzhou is also home to DeepSeek, Black Myth developer Game Science, robotics firms Unitree and DEEP Robotics, neurotechnology company BrainCo, and spatial intelligence firm ManyCore - the so-called “Six Little Dragons” making waves in the global tech scene.

More than 200 robotics-related companies have been registered in Hangzhou as of December 2024.

Hangzhou city officials also have ambitious plans for AI development in 2025.

The local government is offering subsidies of up to 60 per cent to help start-ups and companies.

Revenue from the city’s core AI sector is projected to surpass 390 billion yuan, with support for more than 700 key AI enterprises and high-impact applications across manufacturing, healthcare, and finance.

Hangzhou ranks highly alongside Beijing and even over Shenzhen in some AI city polls.

Its proximity to Shanghai, just a two-hour drive away, has also made it a magnet for spillover talent and fresh graduates seeking tech jobs.

“Hangzhou has traditionally been a strong tech centre started by Alibaba,” said Cheong.

“Then you have others like DeepSeek coming into the picture - building on a genuine base of technological strength and not just jumping onto the AI (bandwagon) because it’s popular.”

The Sichuan capital of Chengdu, traditionally known for pandas, mahjong and hotpot, is undergoing rapid technological evolution.

The city is now home to more than 1,000 registered AI firms and semiconductor companies like HiSilicon.

Chengdu’s AI sector crossed the 100 billion yuan mark in 2024, and is expected to reach 130 billion yuan this year, according to figures released by Chengdu’s Economic and Information Technology Bureau.

Chengdu leads in AI-powered healthcare and robotics, with breakthroughs such as surgical AI systems enabling remote operations and exoskeleton robots that help patients walk.

Yet it still has some way to go in catching up with major players like Beijing, Shenzhen and Shanghai.

To close the gap, Chengdu would need to attract more global tech names and focus on areas where it already has an edge, rather than trying to pivot into fields where it lacks a strong base, experts said.

“I think it's not prudent for any city to ignore their traditional strengths and overly focus on AI solely for the reason that it’s the hot thing at the moment,” said Cheong from Rajah & Tann.

AI CAPITAL OF THE WORLD?

Analysts agree that no single city is leading China’s AI charge.

“Multiple cities are advancing in parallel,” said Ma, the tech investor based in San Francisco.

“The ambition across these hubs is inherently global, with a strong focus on exports and revenue from the outset.”

Others cautioned against cities entering the AI race blindly.

“China's economy has slowed down in recent times … and the issue is (those) blindly investing in AI without even knowing whether (the local conditions) are stable or reliable in the long run,” said Cheong.

While local governments race to gain an edge in AI, the central government appears cautious about the risk of overinvestment in this field.

Xi criticised local governments for their “herd mentality” in launching new energy and AI projects, during the central urban work conference in July.

Addressing the attendees, Xi questioned why “whenever a project is proposed, it always involves a few things: artificial intelligence, computing power, new energy vehicles”.

“Does every province in the country have to develop industries in these directions?”

Xi’s blunt warning was published in People's Daily, the Communist Party’s official newspaper.

According to Tom Nunlist, associate director for tech and data policy at Trivium China, the comments reflect a growing concern over an investment frenzy and the risk of overcapacity.

“I think at this point the risk of wasteful overinvestment is higher than underinvestment,” he said.

Experts describe China’s AI landscape as chaotic and fragmented - a reflection of a rapidly developing industry.

The AI landscape in China is “totally new”, said Towson from Techmoat Consulting firm.

“There’s action everywhere. Everyone is starting AI companies all over (China) and it’s just chaos.”

Others say China’s AI ambitions should not be confined to its borders.

Shenzhen, for example, shouldn’t just be the Chinese AI capital, said Zhao, director of the Shenzhen Longgang District Artificial Intelligence (Robotics) Administration.

“If Shenzhen becomes a global AI capital, it will be because of the thousands of young researchers and workers who have been relentlessly pushing boundaries.”

That spirit of broad-based innovation is echoed by Cheong from Rajah & Tann.

“In China, there’s this phrase called ‘bai hua qi fang’, let a hundred flowers bloom,” he said.

“And then hopefully, something like a big unicorn will rise.”