How a gold trading platform’s collapse sparked rare protests in Shenzhen

The downfall of Jieworui has shone a spotlight on shadow markets that have gained traction amid volatile prices.

Shuibei, often dubbed China’s “jewellery capital”, is home to thousands of traders, manufacturers and wholesalers.

This audio is generated by an AI tool.

SHENZHEN: Rare public protests erupted in Shenzhen last month after the collapse of a gold trading platform operated by Jieworui, a company based in the city’s Shuibei district.

The firm’s downfall has drawn attention to shadow markets – informal trading arrangements operating outside official exchanges – that have gained popularity amid sharp swings in global gold prices.

Analysts say such volatility has helped fuel speculative activity, as retail investors sought to lock in gains from short-term price movements.

WHAT HAPPENED AT SHUIBEI

Shuibei, often dubbed China’s “jewellery capital”, is home to thousands of traders, manufacturers and wholesalers, and sits at the heart of the country’s gold and jewellery supply chain.

The area has been under scrutiny since mid-January, following allegations that Jieworui had defaulted on hundreds of millions of yuan in payments to customers who traded gold and other precious metals on its platform.

The number of affected users is estimated to run into the tens of thousands, based on the volume of people queueing for payouts on Jieworui’s trading platform since payment issues first emerged.

According to local media reports, some users had been unable to withdraw funds or retrieve physical gold since around Jan 20, with daily withdrawals later capped at small amounts.

The withdrawal limits, which some investors said amounted to only a fraction of their holdings, prompted many to travel to Shenzhen to seek redress in person.

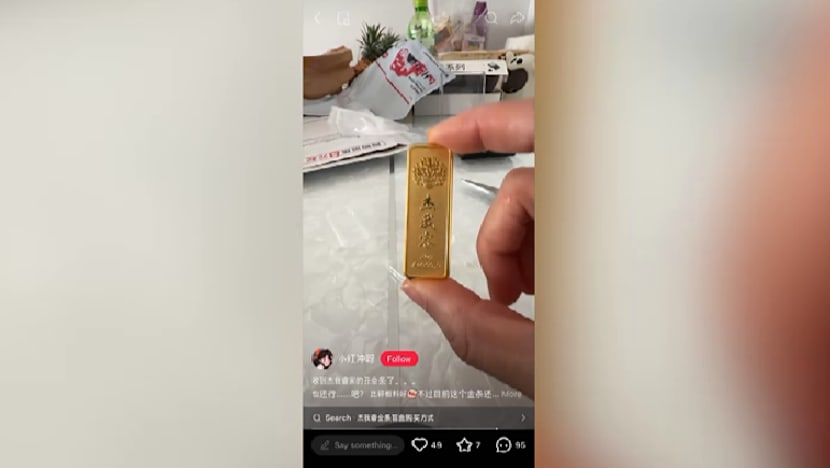

Videos shared online showed groups of protesters gathering outside the Shuibei market, demanding repayments.

Other footage captured tense exchanges between security personnel and investors at the front desk of Jieworui’s office in the area.

MONEY MAY NEVER BE RECOVERED

CNA spoke by phone with an alleged victim in her 30s from neighbouring Fujian province.

She said she and her husband had invested hundreds of thousands of yuan through two separate transactions on Jieworui’s platform. They now fear their money may never be recovered.

According to the woman, her husband deposited physical gold with Jieworui as a form of investment.

She said her own intention was to exchange gold to make a new bracelet, after being drawn in by a promotional campaign run by the platform ahead of the Spring Festival.

The Chinese New Year period is traditionally a peak season for gold purchases in China.

The woman said she discovered Jieworui through promotions on Chinese social media platform Xiaohongshu, and was persuaded by positive reviews shared by other users.

She then introduced the platform to her husband.

Her experience mirrors accounts shared by other victims online, many of whom said they were attracted by the platform’s low entry thresholds and convenience.

RETAIL INVESTORS AT RISK

Forward contracts are common among companies at Shuibei, allowing wholesalers to lock in prices, manage volatility and secure supply.

Such contracts allow a party to buy or sell an asset at a fixed price on a specified future date.

However, with gold and silver prices rising sharply, these arrangements have increasingly been marketed to retail customers.

In Jieworui’s case, price-locking products resembling forward deals were offered through online mini-programmes, allowing users to participate with small upfront deposits, according to media reports.

These arrangements enabled short-term trades that functioned much like futures contracts but with low entry thresholds and without the regulatory oversight or investor protections found in formal exchanges.

Such structures can leave platforms vulnerable to liquidity crunches when prices swing sharply or when many investors seek to withdraw funds at the same time.

LOCAL AUTHORITIES STEP IN

The local government of Luohu district, where the Shuibei market is located, said it has set up a task force to work with Jieworui’s management to raise funds and begin processing repayments.

Authorities added they are verifying investor claims as part of efforts to stabilise the situation.

Reports said some victims were offered settlement options involving steep losses, or “haircuts”, in exchange for waiving criminal complaints against the company.

Some investors had reportedly been offered only about 20 per cent of their principal, a level that many said they could not accept.

Officials have not given a timeline for repayments, and it remains unclear how much investors may ultimately recover.