Worried about falling victim to an Android malware scam? Look out for these red flags

Scammers might pose as friends, bank employees or government officials to gain trust, and they might even have some acting skills.

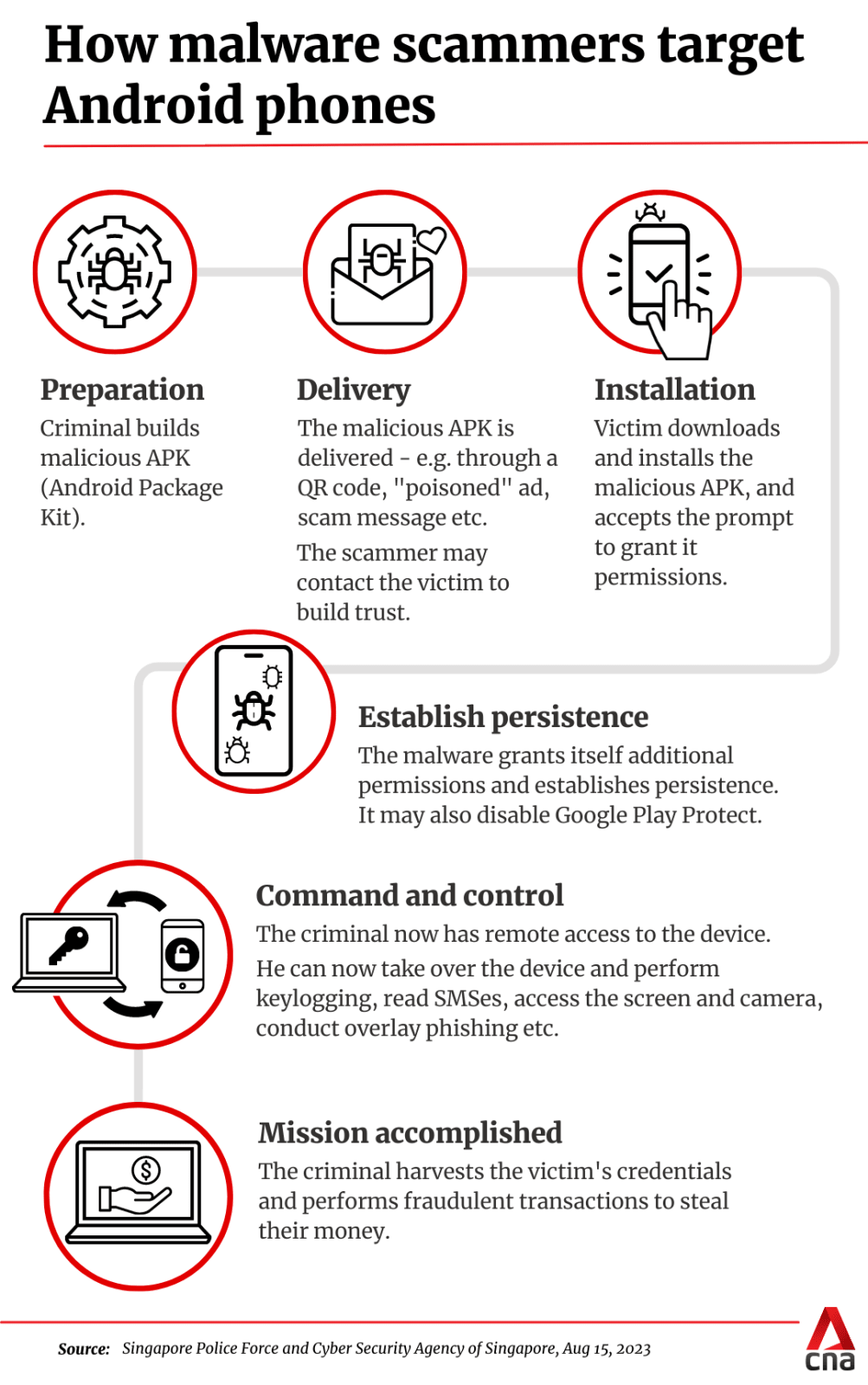

SINGAPORE: Malware scams affecting Android users are becoming more prevalent, with fraudsters deploying increasingly sophisticated schemes to deceive people into installing malicious apps.

The next step? Scammers then remotely access the victim’s device and steal sensitive information to perform fraudulent monetary transactions, siphoning away funds and even Central Provident Fund (CPF) savings.

Noting the increasingly widespread occurrence of such scams, the Singapore Police Force (SPF) and Cyber Security Agency of Singapore (CSA) issued a joint advisory on the matter on Tuesday (Aug 15).

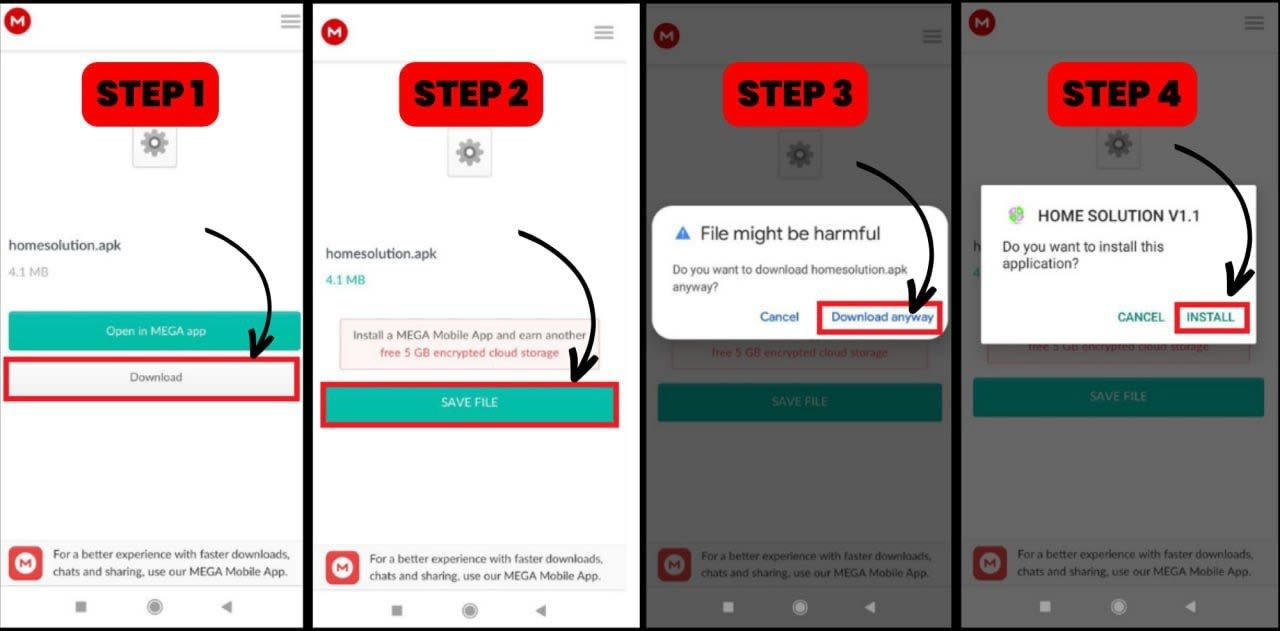

The authorities highlighted some of the tactics used by scammers on social media platforms and e-commerce websites during the "delivery" phase of malware scams – where a scammer is finding a means of delivering a malicious app to a victim.

Here is what you should be wary of.

Enticing promotions

Seen a deal that is too good to be true? It just might be.

"Scammers often attempt to lure users with attractive offers and promotions, through eye-catching advertisements or under the pretext of joining, or voting in fake campaigns allegedly organised by local brands on various social media platforms," SPF and CSA said.

Examples of fraudulent ads include ads for cleaning services and food products.

Inauthentic behaviour and bots

You might have taken extra steps to verify that a deal or service is legitimate, but scammers are also taking that into consideration.

"To enhance the illusion of legitimacy, scammers may deploy bots or fake accounts that exhibit human-like behaviour," explained SPF and CSA.

"These automated accounts may respond to messages, leave positive reviews and even share seemingly genuine experiences from using the goods or services."

Efforts to build trust

Scammers might pose as friends, bank employees or government officials to gain trust, and they might even have some acting skills.

"Scammers often try to build genuine trust with the victims via phone calls or text messages," said the authorities.

These fraudsters may even use local colloquialisms or Singlish, speak with a local accent or sound professional.

"These serve to create a false sense of familiarity, which may lower the victims' vigilance and lead to misplaced trust," they added.

Suspicious questions

If a line of questioning goes in an unusual direction, it could be a red flag.

"Scammers may use social engineering techniques to gather information about the victims," SPF and CSA said, noting that they may ask seemingly perceptive questions, such as the victims' address and dietary preferences, under the guise of processing their orders.

"Scammers may also gather personal information belonging to the victims that can later be exploited."

Deceptive documents and deposit requests

A proper invoice does not guarantee legitimacy, and if you receive a request for a small deposit, think twice.

"Scammers may employ other tactics to deceive victims, such as requesting a small deposit or issuing a professional-looking invoice to enhance the appearance of legitimacy and make the transactions seem genuine."