About 3 million Singaporeans to receive up to S$600 cash in December under the Assurance Package

The cash payments are given out to eligible Singaporeans each December from 2022 to 2026.

A vegetable stall at a wet market in Toa Payoh. (File photo: CNA/Jeremy Long)

This audio is generated by an AI tool.

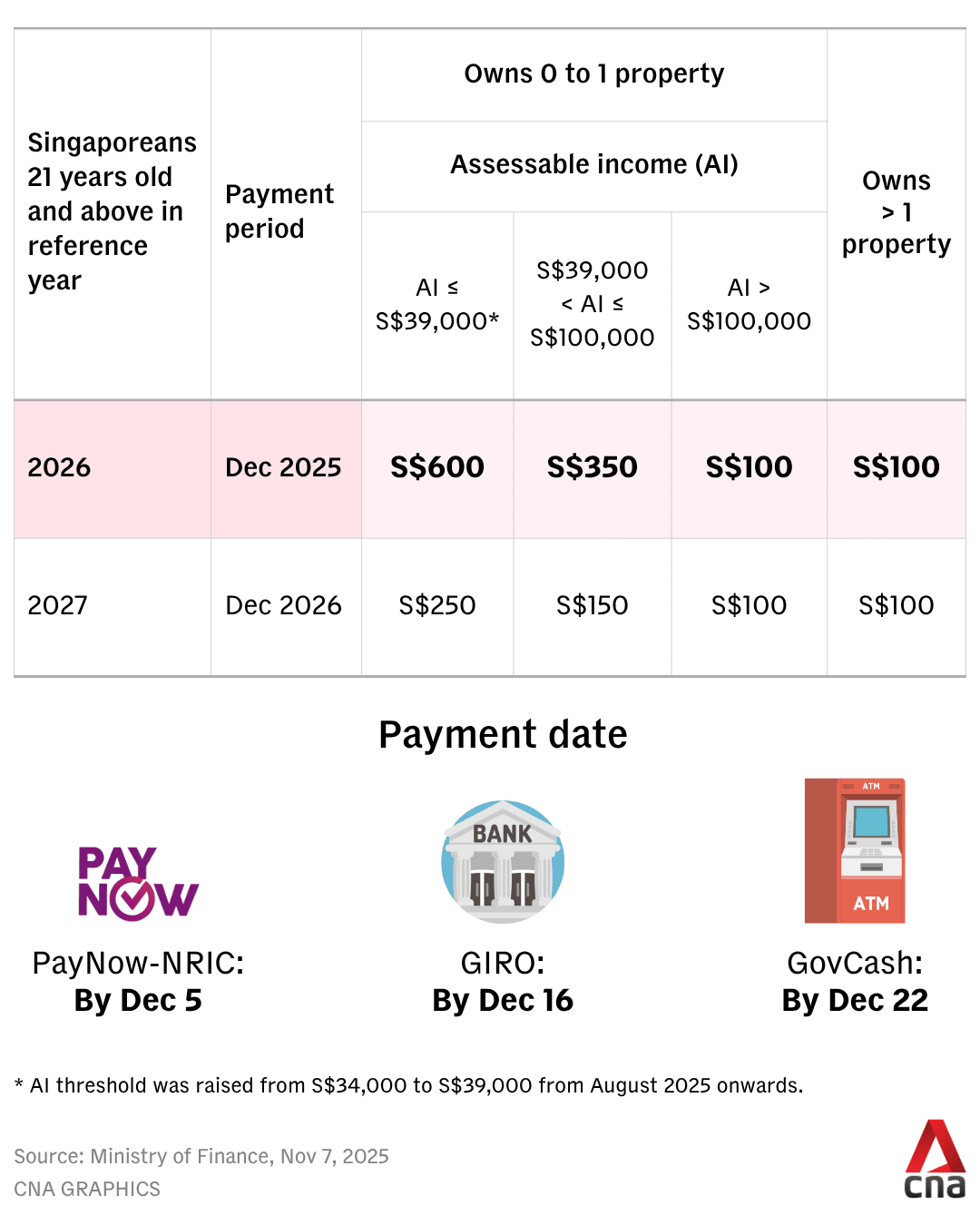

SINGAPORE: Singaporeans aged 21 and above in 2026 will receive cash payments of between S$100 (US$77) and S$600 from Dec 5, 2025.

This is part of the enhanced Assurance Package, which was announced in Budget 2023. It is aimed at helping Singaporean households defray living expenses, as well as provide more support to lower- and middle-income households.

The cash payments are given out to eligible Singaporeans each December from 2022 to 2026.

"In total, eligible Singaporeans will receive between S$700 and S$2,250 of Assurance Package cash over these five years," the Ministry of Finance (MOF) said in a media release on Friday (Nov 7).

The enhanced Assurance Package also includes rebates, Community Development Council Vouchers, as well as MediSave top-ups.

Singaporeans can check their eligibility on the govbenefits website by logging in with their Singpass.

The finance ministry encouraged Singaporeans to link their NRIC to PayNow by Nov 23 if they have bank accounts with participating banks in Singapore.

Doing so would enable them to receive the cash by Dec 5, the ministry added.

PayNow-NRIC has been the ministry's primary mode of payment for citizens who have linked their NRIC to PayNow through their bank.

Those without PayNow-NRIC-linked bank accounts but have a DBS, POSB, OCBC or UOB bank account, may provide their bank account information at the govbenefits website by Nov 29, 2025.

They will then receive the cash benefits via GIRO by Dec 16 this year.

For those without a valid bank account, the cash payment will be made via GovCash by Dec 22, 2025.

Singaporeans on GovCash may withdraw their Assurance Package cash at any OCBC ATMs islandwide by entering their payment reference number, which can be retrieved by logging into the govbenefits website with their Singpass, NRIC, and passing the facial verification.

An OCBC bank account is not required to withdraw their payment at the ATMs, the ministry said.

Citizens on GovCash can also use the LifeSG app to make payments to merchants by scanning their PayNow/NETS QR code, or transferring payment to their bank account via PayNow-NRIC if they subsequently register for this service.

"Eligible recipients will be notified via the gov.sg SMS Sender ID before and after the Assurance Package cash has been credited," said the ministry.

Recipients without a Singpass-registered mobile number will be informed through a letter sent to their address on their NRIC.

MOF reminded the public to guard against scams, reiterating that government officials will never ask people to transfer money or disclose bank login details over a phone call.

If you are unsure if something is a scam, call the ScamShield hotline.