First Mount Pleasant BTO flats to go on sale in October

The first of six projects will have about 1,500 two- to four-room units as well as public rental flats.

An artist's impression of the first Build-to-Order (BTO) project in the upcoming Mount Pleasant housing estate. (Photo: HDB)

This audio is generated by an AI tool.

SINGAPORE: The first Build-to-Order (BTO) project in the upcoming Mount Pleasant housing estate in central Singapore will go on sale in October, announced Minister for National Development Desmond Lee on Wednesday (Mar 5).

The project will have about 1,500 two- to four-room units, as well as public rental flats, in residential blocks that exceed 40 storeys.

Residents there can expect facilities such as an eating house and supermarket, as well as the Mount Pleasant MRT station. The station, part of the Thomson-East Coast Line, will open in tandem with the completion of BTO projects in Mount Pleasant.

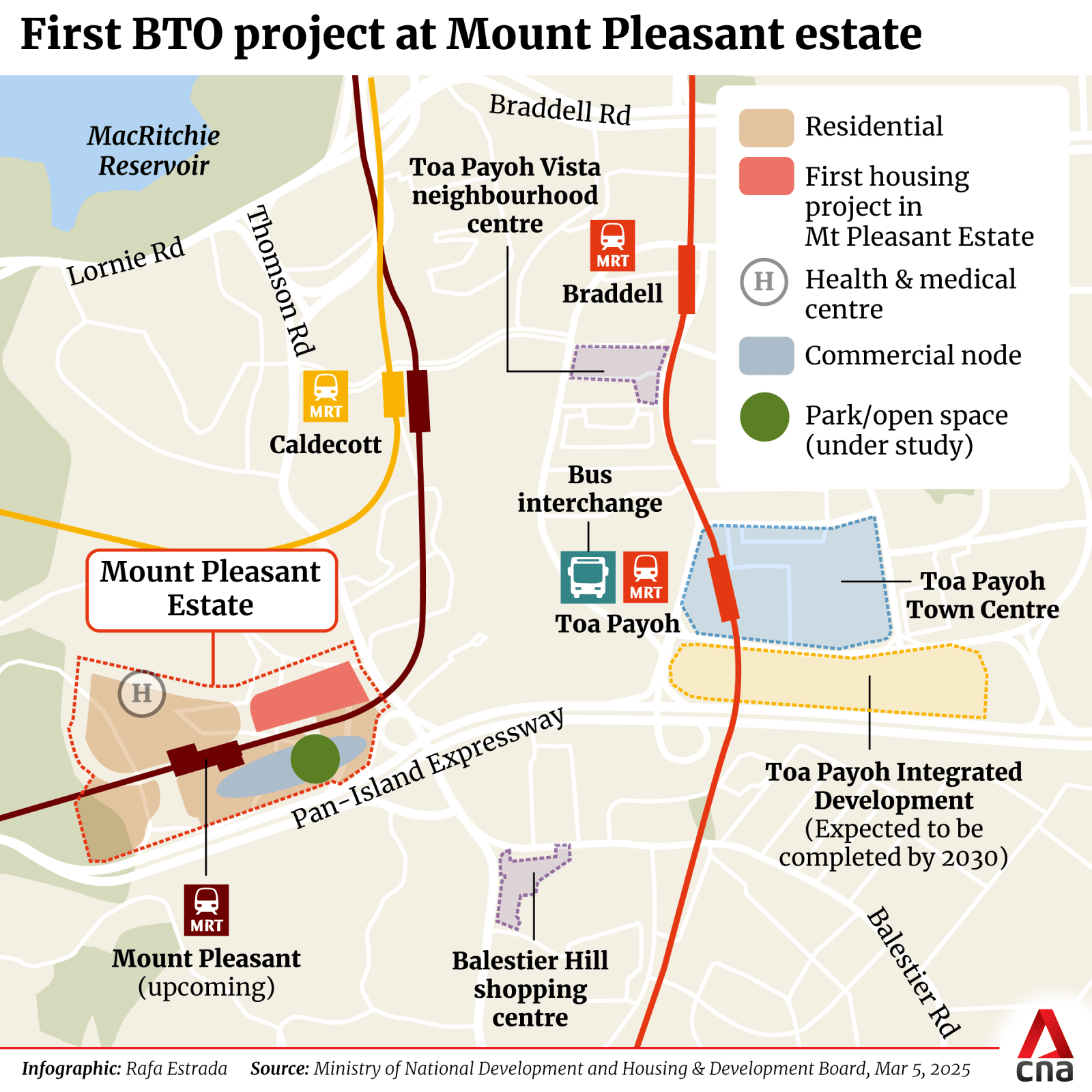

Bound by Thomson Road and the Pan-Island Expressway, the Mount Pleasant estate is located close to Toa Payoh town and MacRitchie Reservoir, giving future residents easy access to amenities and nature, said the Ministry of National Development (MND) and the Housing and Development Board (HDB) in a joint press release.

This is one of six BTO projects planned for the Mount Pleasant housing estate, which was first announced in November 2021.

In total, about 5,000 new homes are set to be built on a 33ha site that was once home to the Old Police Academy and pre-war black-and-white bungalows.

Authorities have said these heritage elements will be “sensitively integrated” into the design of the new estate, with plans to conserve six buildings from the Old Police Academy.

Mr Lee said the first Mount Pleasant BTO project will be launched as either Plus or Prime flats, under the new framework.

Prime and Plus flats are those located in superior locations. They are priced with more subsidies than Standard flats to ensure affordability but also come with tighter restrictions on resale and rental to curb the “lottery effect” of owning flats in prime and central locations.

For example, flat owners must live in their unit for at least 10 years before they are allowed to sell their flat on the open market, more than the usual five years for Standard flats. Owners will also be subject to a subsidy clawback upon selling the flat.

Mr Lee Sze Teck, senior director of data analytics at Huttons, noted that the new flats are located less than 1km away from the mature town and schools such as CHIJ Primary (Toa Payoh).

He expects the project to be categorised as a Prime project, noting that resale prices are “quite high” in nearby Toa Payoh, which means that the government may have to provide more subsidies to keep the BTO flats in Mount Pleasant affordable.

Prices for four-room flats in the upcoming project could start from S$525,000, while flats on the top floors may be priced above S$700,000, given how these “may potentially have unblocked views towards the city”, said Mr Lee.

The Mount Pleasant BTO project is part of the 19,600 new flats that will be launched by HDB this year. Two Sale of Balance Flats (SBF) exercises will be held, with the first in February being the largest ever with 5,500 units on sale.

Mr Lee said this year alone, HDB will be launching BTO flats in around 60 per cent of towns and estates.

BTO QUOTA RAISED FOR SECOND-TIMER FAMILIES

Speaking in parliament during the debate on his ministry’s budget, Mr Lee also announced that the allocation quota for three-room and larger BTO flats for second-timer families will be raised by 5 percentage points.

Second-timer families refer to households that have previously enjoyed one housing subsidy and qualify for less subsidies for a second home.

HDB last adjusted in August 2022 the proportion of BTO supply set aside for BTO applicants.

Then, in view of strong demand from first-time applicants, it was announced that at least 85 per cent of three-room flats and 95 per cent of four-room and larger flats in non-mature estates would be set aside for first-timer families, up from 70 and 85 per cent previously.

Application rates for first-time families have since come down, amid government efforts to balance demand-supply disruptions brought on by the COVID-19 pandemic, said Mr Lee.

He noted that BTO application rates for first-time families have stabilised to below pre-pandemic levels – from 3.7 times in 2019 to 2.1 times in 2024. In the most recent BTO sales exercise in February, first-time families’ application rate fell further to 1.5 times.

With that, the government will look at the needs of other groups, including second-timer families.

“We also hear the concerns of second-timer families who need to buy another subsidised flat and these include families who have grown and others who may wish to right-size due to financial reasons,” he said, adding that the change in allocation quota for this group will take effect from the next BTO exercise in July 2025.

“We do not expect significant impact on the application rate for first-timer families, as we are continuing to build more BTO flats to meet demand,” said Mr Lee.

SUPPORTING FAMILIES IN PUBLIC RENTAL FLATS

Separately, larger grants given out under the Fresh Start Housing Scheme will kick in from the next BTO sales exercise in July, said Minister of State for National Development Muhammad Faishal Ibrahim.

The Fresh Start scheme was rolled out in 2016 to help second-timer families with young children and living in public rental flats to purchase their own HDB flats again.

Associate Professor Faishal said 85 families have moved into their flats through support from the scheme. Another 28 have booked their flats and are waiting for their keys.

Under the scheme, two-room flexi and three-room flats are offered with shorter leases of 45 to 65 years to make them more affordable. They also come with a 20-year minimum occupation period.

Currently, eligible families can get up to S$50,000 (US$37,140) in grants. This will be raised to S$75,000 to provide lower-income families with more support, as earlier announced by Prime Minister Lawrence Wong in his Budget statement in February.

Those eligible will receive an upfront disbursement of S$60,000 into their Central Provident Fund (CPF) Ordinary Account before collecting their home keys. Another S$15,000 will be disbursed in equal tranches over five years after key collection, said MND and HDB in their press release.

The Fresh Start scheme will also be tweaked to allow first-time home buyers with young children and living in public rental flats, to purchase flats on shorter leases.

But they will not receive the S$75,000 grant, as they will be eligible for the Enhanced CPF Housing Grant which disburses up to S$120,000.

First-timer families can apply for the scheme from April. Those successful will be able to book flats starting from the first BTO exercise next year, MND and HDB said.

The enhancements to the Fresh Start scheme are expected to cost an additional S$3 million a year, with about 13,000 families with children living in public rental flats “broadly eligible”.

But not all families will have the stability and financial means to move on to home ownership, so only a “small proportion of a few hundred families” are expected to tap on the scheme, the authorities added.

As part of efforts to uplift families in need, the government will continue to improve its Public Rental Scheme which serves as a social safety net for lower-income and vulnerable households.

Applications for rental flats had surged during the COVID-19 pandemic, with waiting times rising up to 11 months, said Assoc Prof Faishal.

“Since then, HDB has streamlined the flat selection process, and reduced waiting times to an average of five months,” he told the House, adding that about 5,000 public rental flats will be built by 2030 to further reduce waiting times.