Authenticity and sincerity more important than 'perfect English', says businessman George Goh

Presidential candidate hopeful George Goh also said that his companies across different industries add up to meet the S$500 million shareholders' equity requirement to qualify for election.

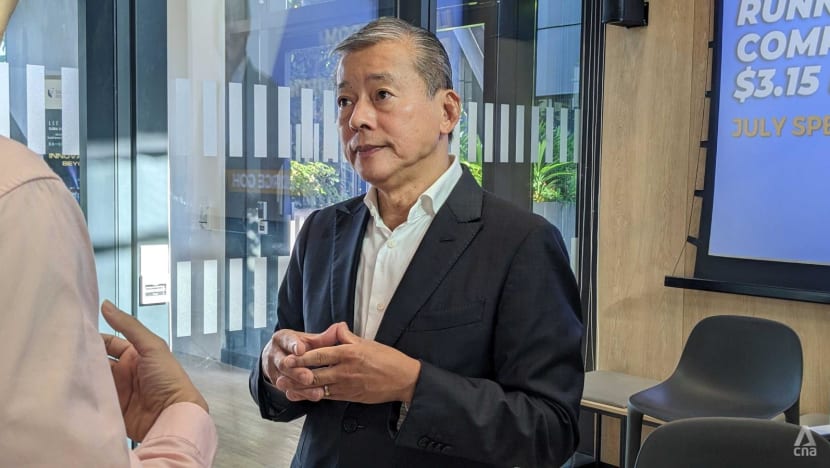

Businessman George Goh speaks to a participant at a fireside chat for entrepreneurs on Jul 10, 2023. (Photo: CNA)

SINGAPORE: Businessman George Goh on Monday (Jul 10) reiterated his belief that he would meet the qualifying criteria for the elected Presidency and also addressed questions about his English proficiency - by saying that it is more important to be "authentic" and sincere than speaking "perfect English".

Mr Goh, who was speaking to reporters after an event for entrepreneurs, said that his companies add up to meet the S$500 million requirement to run for President.

He added that his business interests are split across different organisations because they are in different industries.

"The way I have set up my organisation is like that ... I set up (in) a different industry a different organisation," he said.

"But anyway it's managed by me," he added. "It's the same. I am the chief executive who managed this."

Mr Goh, founder of Harvey Norman Ossia and chairman of SGX-listed Ossia International, last month announced his intention to run for the presidency.

He is the second person to put himself in the running after former Senior Minister Tharman Shanmugaratnam, who stepped down from his government positions on Friday.

President Halimah Yacob has said that she will not stand for re-election after her term ends on Sep 13.

There have been questions about Mr Goh's eligibility. Under the private sector requirement to run for President, a candidate must have been chief executive for at least three years with a company with at least S$500 million in shareholders' equity.

According to a company announcement filed with SGX, Ossia International had S$54.9 million in shareholders' equity – or net assets – in the financial year 2022/2023.

Mr Goh told reporters that businesses in the retail, water treatment and electronic industries "cannot" be put into one organisation.

"Structurally, not say wrong or right, you can create divisions (within an organisation). But most of the entrepreneurs don't like to do that," he said.

Doing so causes "confusion" if the company is publicly listed, and can also make it difficult to communicate the brand and story of a company that operates in many different industries, he said.

S$100 MILLION VS S$500 MILLION

On Monday, Mr Goh spoke to an audience of about 120 entrepreneurs during a fireside chat by entrepreneurship coaching company Super Scaling, held at the Singapore Management University.

Responding to a question from the audience about the differences running a large business now compared to a smaller business at the start of his career, Mr Goh drew a link to the presidential election criteria.

"The presidency (criteria) from S$100 million to S$500 million – it must be a difference, right?" he asked.

The private sector service requirement was raised from S$100 million paid-up capital to S$500 million shareholders' equity in 2016.

Mr Goh said that others have said if they can run a S$100 million company, they can run a S$500 million one. "That means to say, if the criteria (is) S$100 million and (if it is) S$500 million, is the same. I don't agree," he said.

Asked to elaborate on these comments, Mr Goh told reporters that the structure of a S$100-million organisation is not as complex as that of a larger organisation.

"If you run a billion-dollar, S$500 million (organisation), your system is slightly different, your internal structure, from the HR to your finance department, sales and marketing department, even your compliance are quite different."

He also drew an analogy to buildings, saying that the structure and foundations of a 10-storey building are different from those of a 50-storey building.

SUPPORT FOR AN SME BANK

Answering a question from the audience about integrating environmental and social metrics into his business, Mr Goh said that doing so was difficult for small and medium enterprises, which operate "hand-to-mouth" and have tight cash flows.

He commented on how Singapore's banking system, dominated by the three main local banks, contributed to SMEs' funding challenges.

"Because they're a big institution, big machinery, they take up all the money. This is not good," he said. "We must have an SME bank. Now we don't have this. So all depends on the three big banks. This is not a healthy structure."

Asked by reporters to elaborate, Mr Goh said that when businesses try to get capital from the three main banks in Singapore, "it's very difficult to get funding unless you have a huge asset base to mortgage to the bank".

He cited the now-defunct Keppel Bank, Tat Lee Bank and Overseas Union Bank as examples of smaller banks that used to exist in Singapore's financial ecosystem.

He said that this was his view as a businessman, and that it was up to the government to determine what to do.

"Of course, the policymaker ... they themselves have to look into it. I mean, for me, I'm just an entrepreneur, this is my view."

ON ENGLISH PROFICIENCY

Mr Goh was also asked about finding and working with business partners in other countries, which led to a discussion on language barriers.

"If you cannot sell by language, it doesn't matter," he told the audience. "Sometimes don't need to speak perfect English, okay? It's more authentic. If you speak perfect English, you cannot get the deal one.

"When you want to sell to a billionaire, don't speak too well," he said, adding that showing good character and a sound understanding of the business' cost structure are more important.

"They want to know whether you're (an) honest guy or not ... So your body language becomes very important, and your pitch, sincerity, very important. To win people's heart, you have to be very sincere."

Later, asked by reporters whether he felt his English proficiency would be an issue if he were to represent Singapore on the international stage as President, Mr Goh disagreed.

"As a businessman, I mean, we have to master not only one language. We have to master a few," he said. "Now, if the language is the barrier, how can we go so far? How can we convince 50, 60 brands' international owners to trust in us?"

He said that there are other ways to show sincerity.

"At some point in time people will know whether you tell the truth, because they look (in) your eye, they look at the way you talk, they will know, I can do business with you, I can trust you. This is important," he said.

"Of course if you can speak well, it's good. But without the rest, sincerity ... even people look at you they know – I cannot trust you, I know this man can talk very well but he cannot perform, so no point."