HDB resale transactions fall 12.7% in Q1

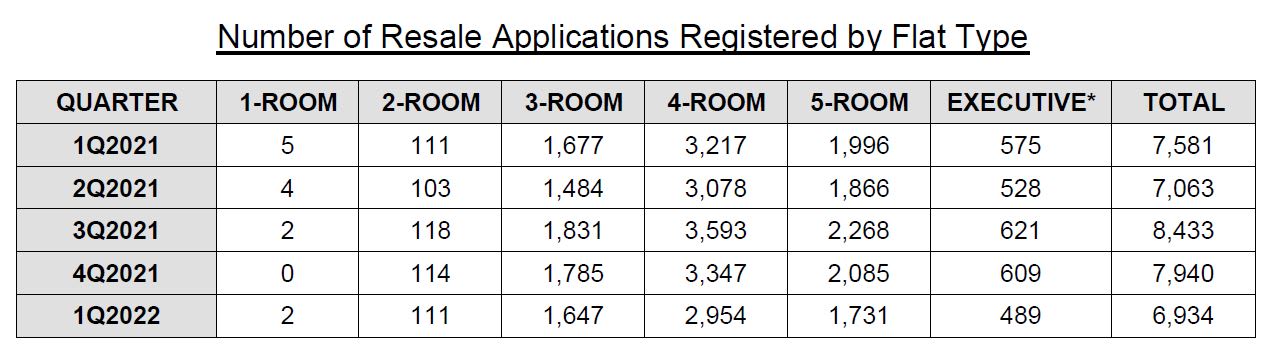

SINGAPORE: HDB resale transactions fell by 12.7 per cent in the first quarter of 2022, as compared to the previous quarter, according to data released by the Housing and Development Board (HDB) on Friday (Apr 22).

There were 6,934 resale transactions between January and March, a decrease from the 7,940 cases in the last quarter of 2021.

This is the first time in nearly two years that sales volume dipped below 7,000 units, said Ms Christine Sun, senior vice president of research and analytics at OrangeTee & Tie.

She added that the previous low was in the second quarter of 2020, when sales fell by 41.9 per cent during the circuit breaker period.

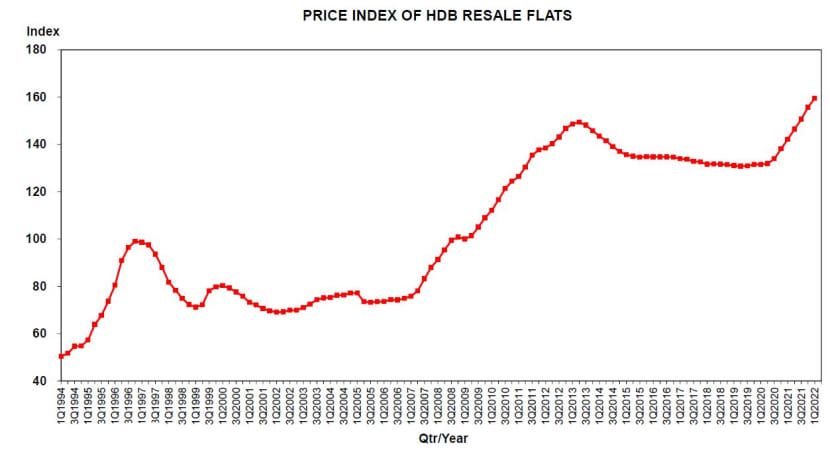

HDB resale prices also increased 2.4 per cent from the previous quarter. This slightly higher than the 2.3 per cent rise in flash estimates provided by HDB earlier this month.

This is the lowest price growth since the third quarter of 2020 when prices rose 1.5 per cent, said Ms Sun.

Ohmyhome analyst Mohan Sandrasegeran said the slower growth can be attributed to "the property cooling measures in place, the drop in demand, the presence of viewing restrictions, the strong interest for February’s Build-To-Order (BTO) exercise and likely price resistance setting in as well".

Cautious buyers may have been assessing the market conditions before "pulling the trigger", he added.

The resale price index, which provides information on the general price movements in the resale public housing market, was 159.5 in the first quarter, up from 155.7 in the last quarter of 2021, HDB data showed.

By flat type, four-room units were the most popular, with 2,954 resale applications registered in the first quarter. This was followed by five-room flats with 1,731 applications and three-room flats with 1,647.

"We anticipate that resale transactions may fall this year to between 25,000 and 28,000 units," said Ms Sun.

"Resale prices may continue to rise but at a slower pace of between 5 and 8 per cent this year."

Mr Sandrasegeran added that with "lingering uncertainties in the construction industry", buyers with urgent housing needs will continue to rely on resale flats as opposed to BTO flats.

In the rental market, HDB approved 10,189 applications in the first quarter, a decrease of 10,551 from the previous quarter.

At the end of the first quarter of 2022, there were 56,340 HDB flats rented out, a drop of 0.5 per cent over the previous quarter’s 56,596.

Many would-be homebuyers who were priced out of the market are boosting demand for rentals and pushing rents higher, said Ms Sun.

"Some flat owners may also be renting in the interim while they wait for the completion of their new flats," she added.

Singapore could also see renewed demand from returning foreigners, she said.

"More Malaysians are expected to head home as safe management measures are further lifted," Ms Sun said.

"We are also expecting more work pass holders to return, which may drive rental demand higher especially in areas near the Causeway.

"The northern region like Yishun, Sembawang and Woodlands, and the western part of Singapore like Jurong may be popular too."

In May, HDB will offer about 5,300 BTO flats in towns and estates such as Bukit Merah, Jurong West, Queenstown, Toa Payoh and Yishun.

It will also offer about 6,300 to 6,800 BTO flats in towns and estates such as Ang Mo Kio, Bukit Merah, Choa Chu Kang, Jurong East, Queenstown and Woodlands in August.

These are subject to review as more project details will be firmed up closer to the launch date, HDB said.