OCBC enhances security measures following spate of SMS phishing scams

An OCBC branch in Singapore. (File photo: iStock)

SINGAPORE: OCBC Bank on Friday (Jan 21) said that it had further enhanced security measures in light of the recent spate of SMS phishing scams, involving customers losing a total of at least S$8.5 million.

In a media statement, the bank said that the enhanced security measures include those "introduced in the recent ABS and MAS announcement" in response to the SMS phishing scams.

OCBC said that by Jan 31, it will have a 24-hour "cooling off" period for key account changes.

Its dedicated customer service care team that was set up to handle customer queries and reports on fraud will now be made permanent. Additionally, the OCBC hotline now contains a a dedicated option for customers to escalate reports of suspected scams.

"We will continue in our ongoing efforts to educate and inform customers about scams through multiple channels such as our social media channels, email, SMS, and on our website and mobile banking login pages," said OCBC.

"We would like to again remind consumers to be alert, protect their bank account login credentials, and to only perform banking transactions through the Bank’s official website and mobile banking apps."

EXISTING SECURITY MEASURES

In its statement, OCBC highlighted its existing anti-scam security measures, including the ability for customers to adjust their account-to-account and overseas funds transfer limits for online banking.

Funds transfers can also be deactivated completely by setting a S$0 limit.

A request to change a customer's mobile number or email address will also trigger a transaction notification sent to their existing numbers or emails registered with the bank.

Transaction notifications for funds transfers and payments for PayNow and FAST transfers have been set at S$0.01 on Friday, OCBC said.

It also implemented the removal of clickable links in marketing emails or SMSes since Jan 11.

On Jan 14, the bank had also reduced the default funds transfer daily limit for PayNow from S$5,000 to S$1,000. Its customers are able to "adjust it to their needs", to a minimum of S$100. The amount allowed to be transferred per transaction has also been reduced to S$200, from the default of S$1,000.

A 24-hour cooling-off period was implemented for digital token provisioning on Dec 31.

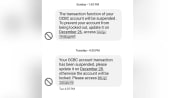

Nearly 470 people fell victim to similar SMS phishing scams involving OCBC in December.

OCBC said on Monday it had begun making "goodwill payouts" to its affected customers covering the amount they lost. It then said on Wednesday that all affected customers would receive their full payouts by next week.

The Monetary Authority of Singapore said on Monday it takes a "serious view" of the scam and will consider taking supervisory action against OCBC.

On Wednesday, UOB and DBS banks also issued warnings to customers that scammers are targeting customers via suspicious login alert messages.