October BTO launch: Pricing, clawback rules to sway demand for new Plus flats, say analysts

Industry watchers generally expect the new Plus flats to be well received, although home buyers may also be weighing the tighter rules and pricing differences with nearby projects.

A view of public housing blocks in Singapore. (File photo: CNA/Jeremy Long)

This audio is generated by an AI tool.

SINGAPORE: While flats that will be offered under the new Plus category in next week’s Build-To-Order (BTO) sales exercise are bolstered by attractive locations, demand could still be tested by key details that remain unknown until closer to the launch.

These include pricing and the subsidy clawback rates, industry watchers said.

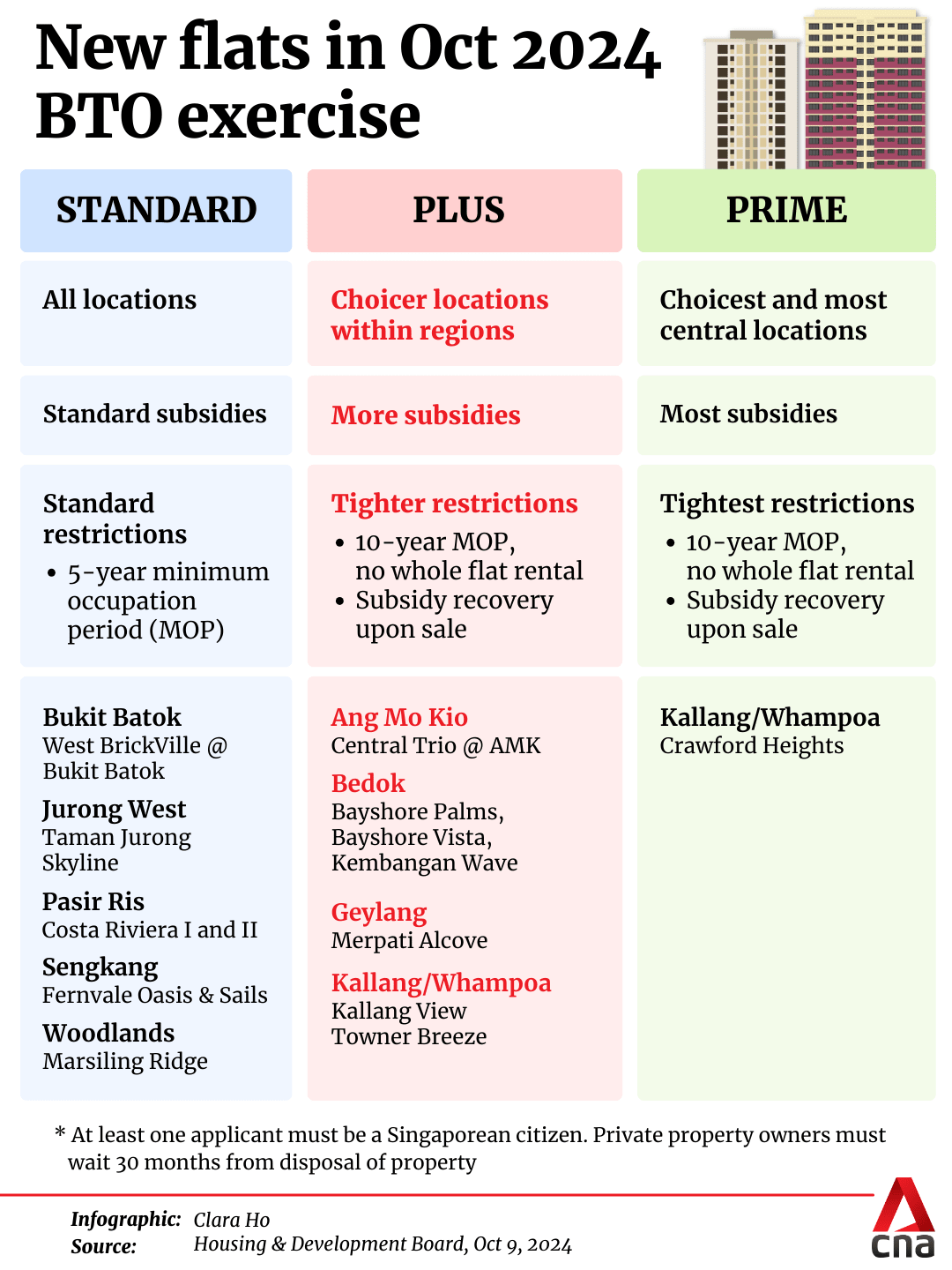

The Housing and Development Board (HDB) on Wednesday (Oct 9) announced it will launch 8,573 new flats across 15 projects under the new Standard, Plus and Prime classification in the upcoming BTO sales exercise.

Seven are projects under the Plus category, one in Prime and another seven Standard projects.

In general, Prime and Plus flats have superior locational attributes. They are priced with more subsidies to ensure affordability but will also come with stricter resale rules like a 10-year minimum occupation period and subsidy clawbacks. The clawback for Plus flats is lower than for Prime flats, in line with the smaller subsidy amount.

Meanwhile, standard flats have the same subsidies and restrictions currently applied to all BTO flats, such as a five-year minimum occupation period.

Authorities said these classifications and conditions of the BTO projects will be made known at the launch for buyers to make informed decisions.

BUYERS TO WEIGH PRICE DIFFERENCES, RESTRICTIONS

Industry watchers generally expect the Plus flats to be well received, although home buyers may also be weighing the tighter rules and pricing and differences with nearby projects.

This is especially the case for Kallang/Whampoa where there will be two Plus projects and one Prime project on offer next week.

These new developments are likely to receive “significant demand” based on the area’s close proximity to the city centre, said ERA key executive officer Eugene Lim. But the two Plus projects – Kallang View and Towner Breeze – may see some competition from Crawford Heights, the Prime project on offer.

Mr Lim said: “In pricing BTO flats, the HDB has to take into account what buyers with a maximum household income ceiling of S$14,000 can afford to pay within a mortgage servicing ratio of 30 per cent.”

With that, he expects prices of Prime and Plus flats that are located in the same HDB town to “not differ much”.

“If prices are marginally different, we may see more buyers going for the Prime project (because) most may perceive that as a better deal,” Mr Lim told CNA.

Ms Christine Sun, chief researcher and strategist at OrangeTee Group, noted that the Crawford Heights project will also be piloting “white flats”, or HDB flats with a new open-concept layout. The novelty of the new concept is set to be a draw for some young couples.

“With the three projects located in the same town, the deciding factor for buyers will be the pricing and the rate of the subsidy clawback,” Ms Sun said.

“Some may say since I’m already decided on Kallang/Whampoa and I have a 10-year (minimum occupation period) anyway, then go for the Prime flat if the disparity in price and clawback rate is not much.”

Huttons Asia’s senior director of data analytics Lee Sze Teck reckoned that prices for a four-room flat in Crawford Heights may start from S$580,000.

This would be close to the starting price of S$568,000 for the same housing type in the Tanjong Rhu Riverfront I and II projects on offer during the June BTO sales exercise. These projects, also located in Kallang/Whampoa, were launched under the Prime Location Public Housing (PLH) model.

For the Plus flats in Kallang View and Towner Breeze, prices for a four-room flat may start from S$540,000, slightly lower than Crawford Heights.

With reference to the PLH scheme, Mr Lee expects the subsidy clawback for Plus flats to start at 6 per cent – the rate for clawbacks when the scheme was launched in 2021.

Rates will be higher for Prime flats to correspond to the extent of the extra subsidies given and Mr Lee expects that to be around 10 to 12 per cent, up from the current 9 per cent for PLH flats.

Another consideration for some people is the 10-year minimum occupation period for Plus and Prime flats, which is double that of the usual five years that home owners have to wait before selling their flats.

Mr Lim used the example of a 31-year-old who may only be able to collect keys to his or her new home at 35, assuming the flat takes four years to build. This means that he or she will only be able to sell the unit at 45 when the 10-year minimum occupation period is up.

“That leaves (the home owner) with just a maximum of 20 years tenure for the next housing loan,” he said, adding that a 20-year runway could mean a lower housing loan quantum or higher monthly loan payments.

SOME SURPRISES IN CLASSIFICATION OF BTO PROJECTS

The move away from classifying estates as either mature or non-mature was first announced last year, as a necessary step to ensure home ownership continues to be affordable, estates have a good social mix and the system is kept fair for everyone.

When preliminary information about the BTO projects for the October sales exercise was made available in June, industry watchers predicted that nearly half of the new flats could fall under the Plus category.

But as it turned out, Standard flats accounted for about six in 10 of the flats that will be on offer. In particular, the two developments in Pasir Ris were the surprise ones that did not make the cut for Plus, contrary to analyst expectations.

Singapore Realtors' head of research Mohan Sandrasegeran was one of those who thought Costa Riviera I and II "seemed like strong candidates for the Plus classification” given how they are located next to Pasir Ris MRT station and the town centre.

“While the decision to classify Pasir Ris as Standard flats may come as a surprise, it highlights the nuanced approach HDB has adopted in this new classification system,” he said.

“The authorities likely considered factors beyond just the estate's general appeal, such as the exact location within the estate, connectivity, or the long-term development plans for the area.”

Mr Sandrasegeran said the October BTO launch will likely “serve as a baseline for future evaluations” of the new classification framework, and it would be helpful to find out more about how HDB distinguishes between Standard and Plus flats, especially in mature estates like Pasir Ris.

“For example, questions around how factors such as distance from key transport nodes, proximity to future developments, or availability of amenities influence classification would provide valuable insights for homebuyers and analysts alike,” he told CNA.

IMPACT ON RESALE PRICES OF NEARBY FLATS?

On whether the announcement of the Plus and Prime BTO projects could affect the resale prices of nearby flats, analysts appeared to have varying views.

Huttons Asia’s Mr Lee, for one, said parallels can be drawn from the PLH model where buyers also have to wait 10, instead of the usual five, years before selling their units.

That has deterred some buyers, who in turn went for nearby resale flats. That has contributed to the increase in resale prices of non-PLH flats in the vicinity of these new launches, said Mr Lee, citing City Vue @ Henderson where a five-room unit sold for an eye-watering S$1.59 million in June.

ERA’s Mr Lim echoed that resale flats near Plus and Prime units may see some demand from buyers who prefer a home in the same location but with fewer restrictions.

“Being locked in for at least 14 to 15 years, including the construction period, may not be for everyone,” he said. “Prices for these flats (could) increase.”

On the other hand, Ms Sun said studies done by her team on the resale market around PLH projects in Bukit Merah and Queenstown have been less conclusive.

“There was an increase in the resale prices in these areas, but it is in tandem with the overall increase islandwide… We didn’t see a very apparent faster pace of increase in resale prices in these areas,” she said.

Other reasons could be a lack of new flats reaching the minimum occupation period in these areas and how Bukit Merah is predominantly an old estate.

But anecdotally, property agents have observed “more sellers asking for higher prices” in hope of capturing some demand from buyers who may find the extended minimum occupation period too restrictive.

“But it’s only anecdotal evidence for now. We don’t have enough data points,” said Ms Sun.

Ms Sun also posited that the longer-term trend of resale prices may be less certain, with the effects of the new classification system being an unknown.

“If there will be more Plus and Prime flats nearer to the city centre, and more Standard flats in the suburban areas, does it mean that in 5 to 10 years’ time, we will see a disparity in resale market activity?”

With price growth closely linked to market activity, she added: “Places with standard flats may see faster price increases, by virtue that they are put up in the market at a faster rate.

“If that’s the case, does it mean that the city centre may see a hiatus of 10-15 years? Will price growth be slower then?”