Singapore rental market slows as tenants resist hikes, turn to alternatives

Rental listings are getting fewer enquiries from potential tenants, who now have more options, property agents and analysts say.

Housing Board flats, condominiums and other high-rise buildings in Singapore. (File photo: iStock)

SINGAPORE: The surge in home rents appears to be slowing amid a "growing disparity" in expectations, with tenants resisting increases and landlords reluctant to lower prices in the face of rising costs.

Property agents CNA spoke to said that they are getting fewer enquiries from potential tenants for Housing Board and condominium rental listings this year.

"The main reason is probably because there are a lot of new condos that have already been completed this year, and some more big ones that are scheduled to be completed in the second half of the year," said Mr Jack Sheo, a PropNex agent.

"We are seeing a situation where tenants have more choices."

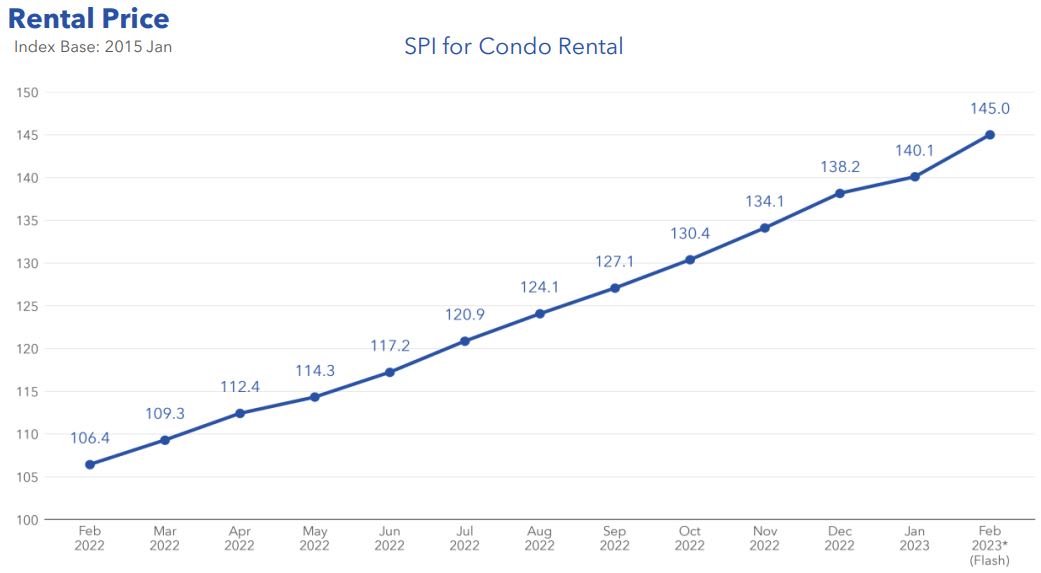

Flash estimates from property portals SRX and 99.co last week said that condo rents went up by 3.5 per cent in February. Year-on-year, condo rents have spiked by 36.2 per cent from February 2022, said the report.

But property analysts said increases are likely to taper off this year as the market adapts.

ERA analyst Eugene Lim and OrangeTee & Tie's Christine Sun both said demand will likely cool over the year as more HDB flats and private condominiums enter the market.

Tenants awaiting the completion of their new Build-to-Order (BTO) flats will also drop out of the market when their homes are ready, said Mr Lim, who is ERA's key executive officer.

"GROWING DISPARITY" OF EXPECTATIONS

Ms Sun said she has observed a “growing disparity between tenant and landlord expectations” amid eye-watering rent prices that made the headlines last year.

“Many landlords are holding firm to their asking rents while tenants are resisting rent hikes,” said the senior vice-president of research and analytics at OrangeTee & Tie.

PropNex agent Mr Sheo said some landlords, after seeing reports of the steep hike in rents, get "carried away" and ask for much higher rents.

"It make take some time before they realise that their unit is taking longer to move, then they start adjusting their expectations," he said.

But Ms Sun pointed out that landlords are facing increasing costs stemming from higher maintenance fees, property taxes and mortgage payments.

PropNex agent Ryan Tan echoed this, saying that some landlords are feeling squeezed by these cost increases.

He said that for one client, the monthly mortgage has exceeded the current rent, so the landlord is asking for a minimum rent of S$4,300 to cover her costs.

"The last transacted price was S$4,200 but prospective tenants are reluctant to pay that. They are bargaining at the price level of S$4,000. So there is this gap."

One landlord of a condominium unit in Tanah Merah said he had no choice but to raise his rental rate. The increase, from S$3,200 to S$4,300 a month, was just enough to cover his higher mortgage payments, Mr Wilfred Wong said.

“The rental income is to pay mortgage, maintenance fees and all the costs of owning a condo,” the 33-year-old said, adding that the interest on his home loan is expected to rise to 4 per cent.

“I feel bad for the tenants but the increase in rent is definitely helpful to me as a landlord because of the equally steep increase in mortgage interest rates.”

But with rents having already risen substantially over the past year, tenants are now unwilling to pay more, Ms Sun said.

Some have moved to cheaper locations such as suburban areas or selected more affordable housing options like HDB flats instead of accepting higher rents.

“This could be why rents rose the most in the Outside of Central Region last month,” Ms Sun said.

Rents in the Outside Central Region saw the highest increase of 4 per cent month-on-month in February, according to the SRX and 99.co figures. Rents in the Core Central Region rose by 3.6 per cent and by 3 per cent in the Rest of Central Region.

Property agents said that they have seen signs of this. OrangeTee agent Susan Mariam told CNA she has seen six transactions this year where tenants who lived in condominiums moved to HDB flats.

She added that these were usually tenants with rental budgets of about S$2,800 to S$3,000 a month.

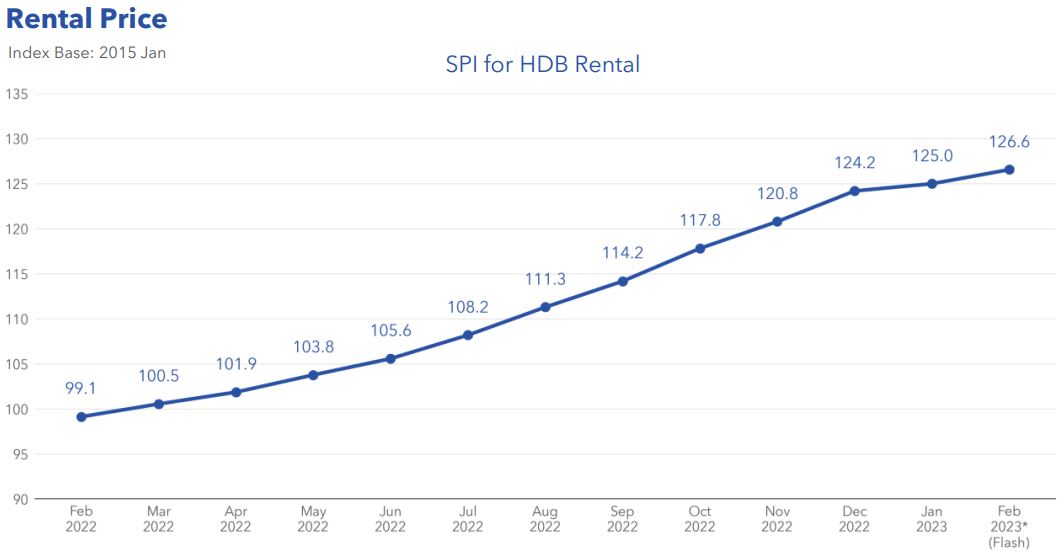

While rents for HDB flats have not stayed still, they remain more affordable. HDB rents increased by 1.2 per cent in February and were up 27.7 per cent year-on-year, said the SRX and 99.co report.

ERA's Mr Lim said that the HDB rental index has been growing at a slower rate since December last year – an indication that rents will hit their peak soon.

Some tenants are also opting to buy their own place, rather than fork out a higher rent.

Mr Steven Chung, 49, has been renting a condo in Kovan for close to six years but has decided to buy a home instead after the rent spiked from S$3,050 to S$5,000.

Mr Chung and his family, who are Singaporean, had owned a smaller condo unit but decided to move out after his second child was born as they needed more space.

They had been leasing out their former home to finance the rental of the bigger unit, but have since sold the unit.

"We want to buy a property now as the new rental is just too high to make financial sense for us, and we are looking for a bigger unit to bring my mum over to live with us," said the senior executive in the tourism industry.

“RELIEF” LATER IN THE YEAR

The tussle between the forces of demand and supply will lead to moderation but not a softening, according to analysts.

Savill’s executive director of research Alan Cheong said in a report last month that relief is expected to come only from the second half of 2023 when the slowing economy and the fallout in the tech sector start to work their way through the demand side of the rental market.

“On the supply side, about 18,000 new private residential units, most of which are non-landed, are expected to be completed this year. Together they should help to reduce the rental pressure,” he said.

“However, even if rents were to correct, it could be mild and not likely to retrace in any significant manner the rise which has taken place since 2021.”

Huttons’ senior director of research Lee Sze Teck said that the rental market will face “headwinds” in 2023.

“Incremental demand is lower due to companies slowing their hiring plans in view of economic uncertainties," he said, predicting that private and HDB rents are likely to increase at a slower rate of 10 to 15 per cent in 2023.