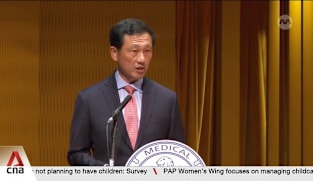

Alvin Tan on bankruptcy applications and mortgagee listings

Nine hundred and fifty-nine bankruptcy applications were filed by individuals in the first quarter of 2023 - slightly higher than the average quarterly figure of 912 last year. The number could rise further as “a small segment of more vulnerable borrowers” faces higher risks of financial distress amid higher interest rates and slower economic growth, said Monetary Authority of Singapore (MAS) Board Member Alvin Tan. In Parliament on Tuesday (May 9), Mr Tan also said there has been no pick-up in property-related foreclosures so far this year. Five commercial and five residential loans were foreclosed by financial institutions in the first quarter, compared to an average of four commercial and 12 residential foreclosures per quarter in 2022. Mr Tan was replying to an MP’s questions.

Nine hundred and fifty-nine bankruptcy applications were filed by individuals in the first quarter of 2023 - slightly higher than the average quarterly figure of 912 last year. The number could rise further as “a small segment of more vulnerable borrowers” faces higher risks of financial distress amid higher interest rates and slower economic growth, said Monetary Authority of Singapore (MAS) Board Member Alvin Tan. In Parliament on Tuesday (May 9), Mr Tan also said there has been no pick-up in property-related foreclosures so far this year. Five commercial and five residential loans were foreclosed by financial institutions in the first quarter, compared to an average of four commercial and 12 residential foreclosures per quarter in 2022. Mr Tan was replying to an MP’s questions.