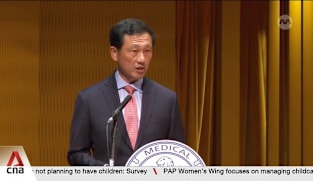

Don Wee on Financial Services and Markets (Amendment) Bill

Singapore's position as a financial and business hub has been strengthened after the COVID-19 pandemic, and it is seeing a record number of family offices and high-net-worth individuals transferring their assets to the country, said MP Don Wee. Speaking in Parliament on Tuesday (May 9), he said it is important for the Monetary Authority of Singapore to highlight the risks and implications of money laundering and terrorism financing with their bankers and fund managers. This could include the development of tailored training programmes and seminars, as well as the dissemination of information and guidance materials to promote greater awareness. Mr Wee also sought clarifications on the Bill. These include the risk of abuse of data and the costs of strengthening the risk monitoring of the financial sector.

Singapore's position as a financial and business hub has been strengthened after the COVID-19 pandemic, and it is seeing a record number of family offices and high-net-worth individuals transferring their assets to the country, said MP Don Wee. Speaking in Parliament on Tuesday (May 9), he said it is important for the Monetary Authority of Singapore to highlight the risks and implications of money laundering and terrorism financing with their bankers and fund managers. This could include the development of tailored training programmes and seminars, as well as the dissemination of information and guidance materials to promote greater awareness. Mr Wee also sought clarifications on the Bill. These include the risk of abuse of data and the costs of strengthening the risk monitoring of the financial sector.