‘Hidden in plain sight’: US may have found the answer for its rare earths problem

Washington has been racing to reduce its rare earth reliance on Beijing, pouring money into domestic mining and building partnerships with allies.

A large excavator in a quarry for the extraction of rare metals. (File photo: iStock)

This audio is generated by an AI tool.

AUSTIN, Texas: In the United States, rare earths have become one of the sharpest flashpoints in its rivalry with China, with sweeping implications for national security and the global economy.

The race to reduce rare earth dependence on Beijing has fuelled Washington’s scramble for overseas deals and mineral diplomacy.

But a potential solution is emerging much closer to home – and far above ground – in America’s own industrial waste.

Some researchers say the answer may be hiding in plain sight in the form of existing mine tailings, coal ash and mineral processing waste.

These materials could contain significant, recoverable amounts of rare earth elements – enough to meet much, if not all, of the US’ needs.

MINING AMERICA’S INDUSTRIAL LEFTOVERS

One such material is red mud, or bauxite residue – a rust-coloured sludge produced during alumina refining, a process that generates the white powder used to make aluminium.

At the last remaining alumina refinery in the US, located in the state of Louisiana, the caustic waste is typically stored in vast, reinforced ponds or dry-stacked.

Long considered an environmental liability, the material is now attracting interest from firms like ElementUSA, which specialises in resource recovery.

The company’s chief strategy officer Chris Young said that buried in the muddy waste is a gold mine of rare earth elements. It can contain around 6,000 parts per million – roughly 30 times higher than average concentrations found in the Earth’s crust.

ElementUSA is now extracting critical minerals from the mud while also analysing other mining waste like coal tailings and low-grade coal ores to determine which elements are present and how cost-effective recovery could be.

“As technologies develop … the need for these minerals, these rare earths, has really grown,” Young told CNA.“There's a growing recognition even (among) the general population that this is a big deal.”

WHY RARE EARTHS MATTER

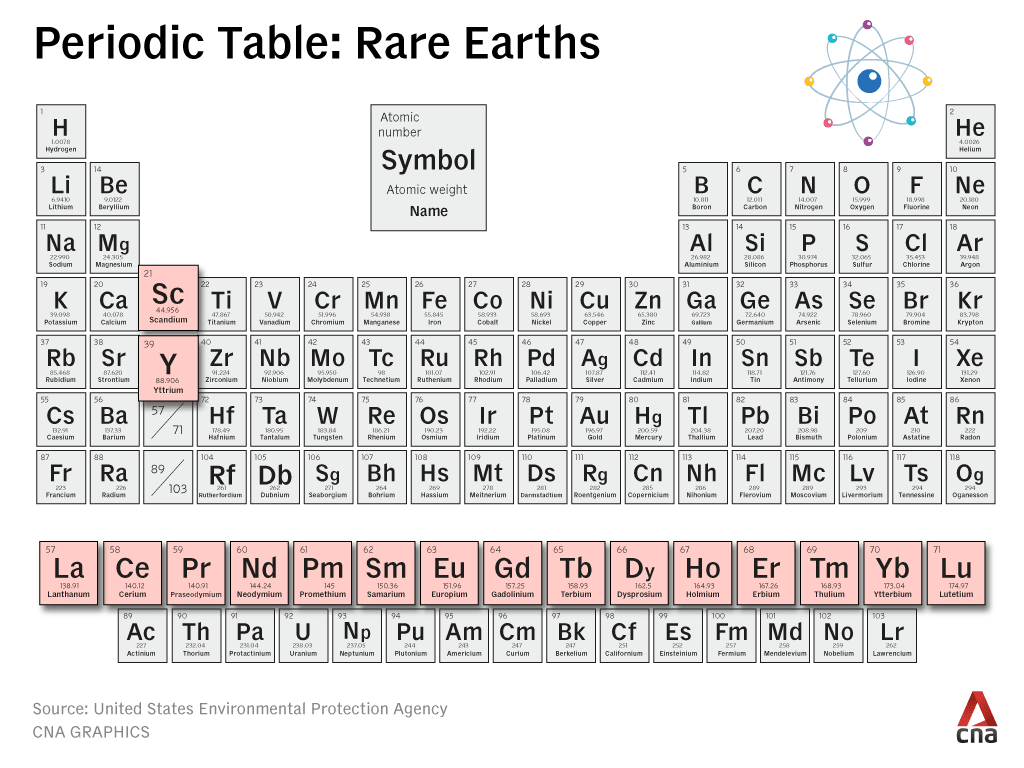

Rare earths are a group of 17 metallic elements, including the 15 lanthanides found near the bottom of the periodic table with tongue-twisting names like praseodymium and neodymium.

While these critical minerals are not exactly rare as they are abundant throughout the Earth's crust, they are difficult to extract and separate.

They are essential for high-performance magnets that power modern life, from smartphones and medical equipment to electric vehicles and wind turbines. They are also crucial for semiconductor manufacturing and advanced weapons systems.

Each F-35 fighter jet contains more than 400kg of rare earths, while a Virginia-class submarine uses more than 4,000kg, largely in engines, radar systems and weapons guidance.

This makes rare earths not just an economic concern, but a national security priority for Washington.

CHINA’S GRIP ON RARE EARTHS

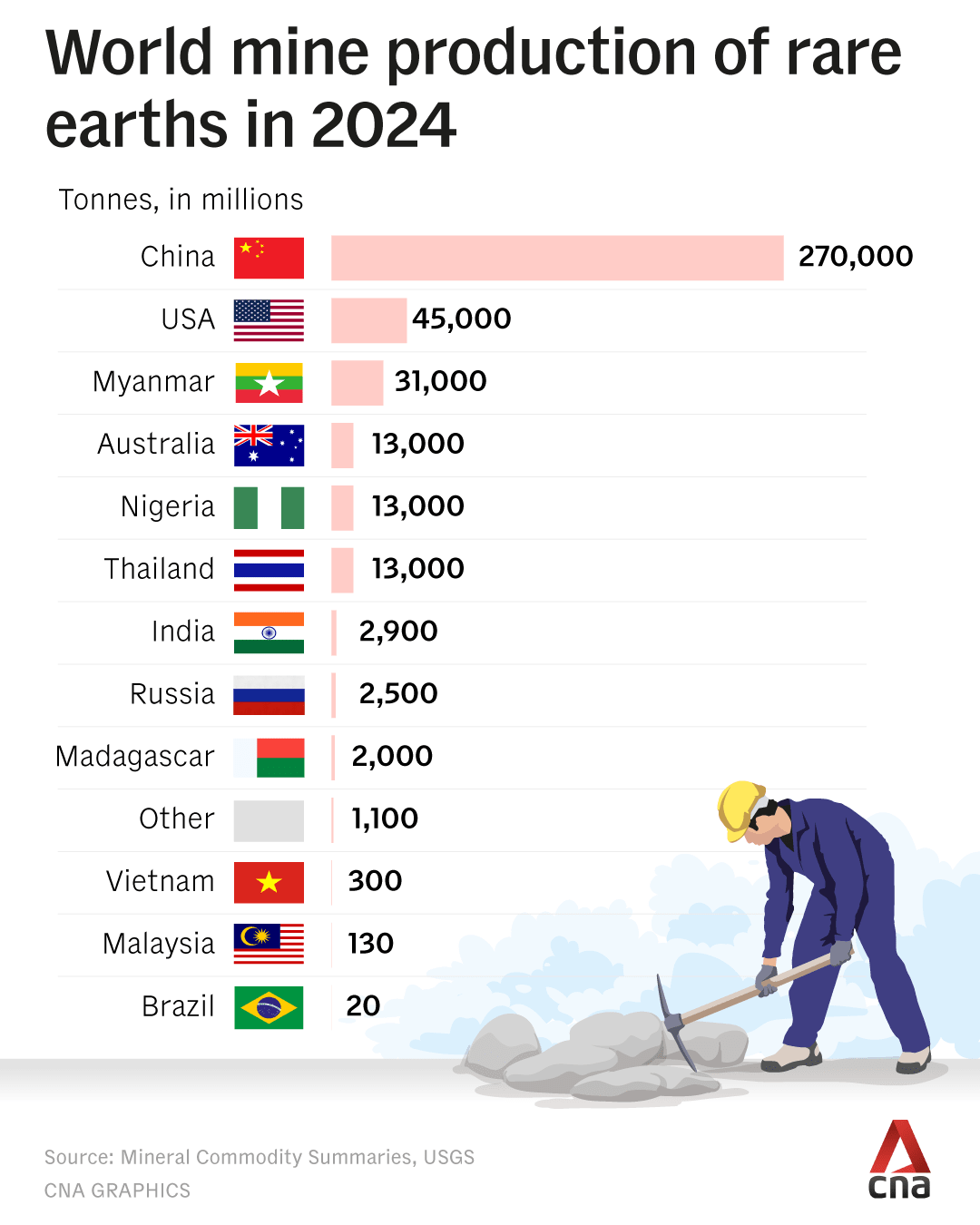

Despite their importance, the US relies almost entirely on its biggest rival to meet its rare earth needs. It imports up to 80 per cent of supplies from China, which dominates global production and processing.

“We’re essentially being held hostage by China,” said Gracelin Baskaran, director of the Critical Minerals Security Program at Washington-based think tank Center for Strategic and International Studies.

She added that rare earths have become one of Beijing’s most powerful negotiating tools.

Last year, China imposed export controls on several rare earths critical to the defence and energy sectors, citing “national security concerns” during tariff negotiations with Washington. The restrictions are currently suspended for a year.

US President Donald Trump has since launched an international deal blitz, forging multi-billion-dollar partnerships to develop mining and processing capacity with countries including Malaysia, Thailand, Cambodia, Japan and Australia.

But experts warn progress will be slow, saying the US rare earths sector is decades behind China’s, with only one active mine and limited capacity to refine or manufacture magnets.

“Mining is not an industry you turn on and turn off when there's conflict. We are looking at a lead time to get ourselves where we need to go. We are not prepared for a long conflict,” said Baskaran.

REBUILDING US’ RARE EARTH SECTOR

To speed things up, Washington has poured billions of dollars into reviving domestic production, partnering with private companies to support rare earth startups.

Texas-based Noveon Magnetics, for example, has received more than US$35 million from the US Defense Department in recent years. It is currently the only manufacturer of high-performance rare earth magnets in the country, producing millions of them each year.

Its CEO Scott Dunn said the company aims to reduce America’s dependence on China, but is realistic about how quickly that can happen.

“We're not going to displace – on any timeline that's reasonable – China altogether,” he told CNA. “(But we can become) a high performance, high-quality magnet producer that at least offers some sort of a strategic second source for the US government (and) American end users.”

The firm is also turning to waste, recycling rare earth magnets from end-of-life products such as MRI machines and electric vehicles.

A LONG ROAD TO SELF-SUFFICIENCY

At the University of Texas at Austin, researchers Bridget Scanlon and Brent Ellis are evaluating rare earth concentrations in industrial waste.

One recent study found coal ash from US power plants could contain up to 11 million tonnes of rare earths – nearly eight times the amount in known domestic reserves.

Scanlon said the bulk of US demand could potentially be met through extraction from waste, though challenges remain.

“There are a lot of factors – the concentration, extractability, economics and price volatility,” he said.

Working through those bottlenecks will not be easy or cheap.

But with the International Energy Agency projecting demand for rare earths to rise as much as seven-fold by 2040, and US-China tensions simmering, America may need all the waste it can get its hands on.