IN FOCUS: As US closes tariff escape route via Southeast Asia, what’s next for region’s firms, workers?

Chinese firms which have relocated operations to the region in a bid to seek lower tariffs on their US exports, as well as Southeast Asian businesses across the supply chain, are feeling the pinch from the 40 per cent US transshipment levy.

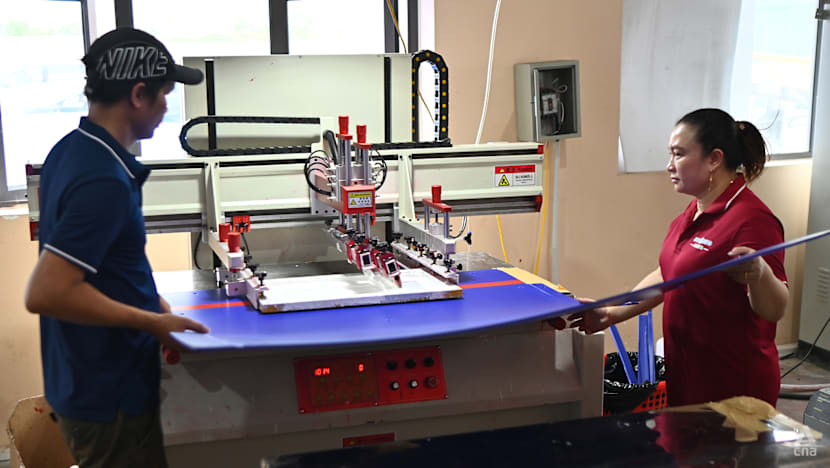

Huashuo Plastics workers inspecting the quality of the material used to make a hollow plastic board at its factory in Hai Phong, Vietnam. (Photo: CNA/Zamzahuri Abas)

This audio is generated by an AI tool.

HANOI: In recent years, Chinese firm Huashuo Plastics has moved a significant proportion of its operations from Guangdong in southeastern China to Hai Phong in northern Vietnam.

Before 2016, almost all of its production was focused in Dongguan - an industrial city in Guangdong - but today, around 80 per cent of its products are shipped from Hai Phong, located 100 km from Hanoi.

The firm exports 90 per cent of its goods - hollow plastic boards typically used to make delivery boxes - to the United States, with e-commerce giant Amazon among its key clients.

Qiu Ji De, chairman of Huashuo Plastics, told CNA that tariff penalties imposed by the US on China since a trade war began in 2018 have led the company and other Chinese firms to employ the China Plus One strategy.

It is a business move that attempts to diversify their supply chains in order to avoid US tariffs on goods from China.

However, Qiu added that these plans have been hit, first by US President Donald Trump’s “Liberation Day” tariffs in April, and then more significantly in July, when he announced a 40 per cent levy on goods deemed to be transshipped from China to the US through other countries.

In essence, transshipment, at its most basic, is the process of transferring goods from one mode of transport to another at an intermediary location to continue their journey to a final destination.

While Vietnam was initially hit with a 46 per cent reciprocal tariff rate on Liberation Day, Trump later announced in early July a “Great Deal of Cooperation” with Hanoi, reducing the levy to 20 per cent.

Additionally, some goods would also face an additional 40 per cent export levy for transshipments. It was reportedly supposed to come into effect in August, but details of what constitutes transshipment remain unclear.

“Before (both sets of) the tariff were imposed, production and delivery were going quite smoothly. But after the tariffs increased, things changed … our orders have been heavily affected,” said Qiu, whose factory in Hai Phong was rather quiet and stacks of boards laid in storage when CNA visited in early September.

“Because the decline has been pretty fast - pretty rapid - we had to respond by cutting staff members. We reduced about one-third of our workforce, which is quite a significant amount,” he added, declining to give absolute figures.

Trade experts said that the 40 per cent levy is Washington’s answer to the phenomenon termed as “Southeast Asia-washing”, which refers to Chinese companies trying to disguise the origin of their products by relocating operations to countries in the region.

There has been a focus on Vietnam being used as a gateway for Chinese goods destined for the US, allowing Chinese exporters to take advantage of Hanoi’s lower tariffs and avoid high US duties on goods from China.

Based on the latest tariff numbers, compared to the 20 per cent tariff that Vietnam faces, the US has imposed a 55 per cent levy on Chinese imports, as announced by Trump in June.

Meanwhile Chinese duties on US imports stand at over 10 per cent, as announced in May.

However, there is still a chance that the numbers could be much larger, threatening trade between both countries.

The US had earlier announced a 145 per cent tax on Chinese goods while the Chinese tariffs on US goods were set to hit 125 per cent, but both countries extended a tariff truce until Nov 10 as discussions continue.

However, firms, logistics exporters as well as trade analysts whom CNA spoke to stressed that there is widespread uncertainty over how the US government will define and enforce the additional 40 per cent levy on transshipped goods.

There are question marks over the US government's criteria for the rules of origin of a product and especially what percentage of Chinese-made components of each product would trigger this levy.

This levy is targeted at Chinese firms which have allegedly been exploiting this loophole, and shipping their products through Southeast Asian countries to avoid high tariffs and restrictions.

The uncertainty has left Chinese companies in a limbo, while also impacting local Southeast Asian companies in the supply chain, triggering pauses in production and layoffs. The situation is playing out in Vietnam most significantly, as well as in other Southeast Asian countries like Malaysia and Thailand.

In some cases, trade experts said it has raised the question over whether the region is now still a viable tariff escape route for Chinese firms, prompting some businesses to diversify to other regions such as South Asia and Europe to expand their customer base.

In the bigger geopolitical context, the transshipment tariffs are seen as Trump's attempt to squeeze China out directly, by pushing the likes of Vietnam, Malaysia and Thailand to reduce the amount of Chinese content in their supply chains.

Experts told CNA that it remains to be seen if some of these Southeast Asian countries - which are strategically important allies for Beijing - will distance themselves from their top trading partner in Asia.

“Washington wants ASEAN to cut the Chinese inputs out of its supply chains. In practice, that is a tall order,” said Nguyen Khac Giang, a regional political and economic expert who is also a visiting fellow at ISEAS-Yusof Ishak Institute’s Vietnam Studies programme.

“Southeast Asia is not just a staging ground for ‘Made in China’ goods, it is welded into a deeply integrated East Asian production network that keeps costs down and output up,” he added.

BLOW TO EXPORTS, GDP GROWTH IN ASEAN

The term “Southeast Asia-washing” refers to Chinese companies trying to disguise the origin of their products by relocating operations to countries in the region.

The practice reportedly surged after the first rounds of US-China tariffs in 2018-2019 as a trade war unravelled, peaking around 2022 to mid-2024, especially in the solar and electronics supply chains.

According to reports, the practice is widespread in Vietnam, Malaysia, Thailand and Cambodia - hubs for industries like solar, electronics and textiles routed from China.

However, the much higher tariffs imposed on Southeast Asian countries this year, along with the penalties on transshipped goods, have reduced the payoff for Southeast Asia-washing, with analysts suggesting that the practice of transshipment and relabelling could be ending.

Northern Vietnam’s burgeoning industrial towns like Bac Ninh and Hai Phong - which over the last few years saw an influx of Chinese firms - have seen production slowed in recent months.

An employee who works in a logistics company which ships goods from Hai Phong port to the US told CNA that the volume of products has dipped by more than half compared to last year.

The employee, who spoke to CNA on condition of anonymity due to corporate sensitivities, said that based on feedback from his clients, this can be attributed to the uncertainties surrounding the 40 per cent transshipment levy and how the possible enforcement of this has spooked some US importers from proceeding with orders, given the potentially higher costs.

“We have seen this trend across a variety of industries - garments, manufacturing, electronics. It's a chain effect - the levies trigger fewer orders, companies produce less, and everyone including us are impacted,” the official added.

Chinese national Gao Wen Ming, who manages a BYD Forklift distributor facility in Bac Ninh on the outskirts of Hanoi, told CNA that his partner companies, such as Chinese consumer electronics firm TCL Technology, have been impacted by the tariffs as they export their products heavily to the US.

BYD Forklift, a subsidiary of the Chinese automaker BYD, supplies forklifts and pallet trucks to BYD factories and other companies in the region.

Since it moved operations from Shandong in China to Bac Ninh in 2024, BYD Forklift has grown its Vietnam operations from a small one-room office to an entire warehouse.

But stalled orders from some US importers working with BYD Forklift’s clients have paused the company’s expansion and as a result, the firm has had to implement layoffs in recent months, but Gao declined to specify how many workers had been let go.

“Our workforce operates under a constant process of natural selection, survival of the fittest,” he said.

According to United Nations estimates, US tariffs could slash up to one-fifth of Vietnam’s exports to the US, equivalent to more than US$25 billion, making it the worst-hit country in Southeast Asia.

Some experts have projected a 5 per cent dip in the country’s gross domestic product (GDP) if the tariffs persist.

According to US trade data, Vietnam was the world's sixth-largest exporter to the US last year with US$136.5 billion worth of shipped goods, the largest among Southeast Asia countries.

Dan Martin, a Hanoi-based international business adviser at consultancy firm Dezan Shira & Associates, told CNA that Vietnam has had a huge appeal to international companies because it is one of two Association of Southeast Asian Nations (ASEAN) member states which have a free trade agreement with the European Union, the other being Singapore.

“I think a lot of companies - American companies, European companies and also Chinese companies that are based in China - see the writing on the wall about the intended policy of the United States, which is to go and peel companies off (from) China,” said Martin.

He added that northern Vietnam’s geographical advantages - it shares a massive land border with China and has an extensive coastline with several deepwater ports to ship goods further afar, including to the US - boost the Southeast Asian country’s value proposition as an investment destination for Chinese companies.

However, these advantages are not sufficient to defray the costs of doing business there now, especially after Trump slapped Vietnam with a 20 per cent tariff, along with a 40 per cent levy for Chinese firms which transship goods, he said.

“(Many companies have adopted) a wait-and-see approach which started basically back in September-October 2024 and it’s continued up to this point,” said Martin, referring to the period where it increasingly became apparent that Trump was the slight favourite to win the 2024 US presidential election.

“If you’re a company with ties to the US market, it would make a lot of sense to not come to Vietnam, and other countries in the region, because people don’t have a strong understanding of where the tariff numbers are going to land.”

Other countries in the region are also not immune.

In Thailand, the government has estimated that its actions to closely scrutinise exports for transshipment could reduce its exports to the US by US$15 billion, equivalent to one-third of its trade surplus with Washington last year.

According to local reports, Thai exporters to the US must convincingly prove that their goods are sufficiently “Thai”, and that sectors that rely heavily on imported inputs - electronics, auto parts and industrial machinery - are at risk.

Thailand has also promised to look more closely at foreign investments in areas such as the burgeoning electric vehicles industry, where Chinese companies have invested to bring their own suppliers into the country.

In September, the Thai government said it will set up a special task force to manage millions of certificates of origin expected to be required under US trade rules.

The US reduced its tariff on Thai imports to 19 per cent, after initially proposing a 36 per cent levy. Yet, products suspected of being rerouted to conceal their origin could face additional duties of 40 per cent.

Meanwhile, Thailand’s southern neighbour Malaysia has seen overall export numbers increase but in lower numbers than expected.

Total exports rose 1.9 per cent in August from a year earlier, according to data from Malaysia’s Investment, Trade and Industry Ministry released in September, lower than the 3 per cent median estimate in a Bloomberg survey.

Moreover, shipments to the US fell 16.7 per cent year on year, while imports declined 36.7 per cent. Trade with its third-largest trading partner slumped by 25 per cent.

“The overall decline in trade with the US may reflect the early impact of recent tariff adjustments introduced by the US government,” the ministry said in a statement on Sep 19.

As for Singapore, some media reports have cited how Chinese companies like Shein, ByteDance and BYD are setting up operations in the city state purportedly to circumvent tariffs and barriers.

But observers have said that though Singapore is a transshipment hub, the act of companies disguising their product’s origin is not as prevalent due to more stringent enforcement.

During a forum event in September, Singapore’s Deputy Prime Minister Gan Kim Yong, who is also Minister for Trade and Industry, warned that companies thinking of arbitraging US tariffs through Singapore should “be careful” of the risk of stiff penalties.

Additionally, Singapore Customs issued a circular in June reminding exporters and agents to accurately declare the country of origin on import, export or transshipment permits.

A list of frequently asked questions on Singapore’s government agency EnterpriseSG’s website explicitly states that the US can verify origin directly with manufacturers in Singapore and that Singapore Customs will even facilitate US authorities verification visits when asked.

Political and economic expert Giang said that Southeast Asian countries like Vietnam “cannot dodge the fallout” from the tariffs, but if the reciprocal rates stay at around 20 per cent as it is presently, the impact is manageable.

He said that Vietnam’s general statistics office projected that economic growth would be shaved by less than a single percentage point.

“That is hardly painless, but it is nowhere near the worst-case scenario of a 3–5 percentage-point hit under the 46 per cent (original Liberation Day) tariff scenario,” said Giang.

“Still, the mood among firms is one of limbo, waiting for Washington to clarify how deep the knife will cut on the transshipment clause,” he added.

UNCERTAINTY OVER TRANSSHIPMENT DEFINITION

The slowdown in trade in some countries in Southeast Asia can be attributed to uncertainties with how the US defines transshipment and how it enforces the 40 per cent levy, which could be the death knell for certain industries, said analysts.

Trump’s executive order of Jul 31 - on new tariff rates for dozens of countries - stated that these are goods transshipped through other countries “to evade applicable duties” instead of coming straight from the country of origin. It added that these goods will face the 40 per cent transshipment levy.

Additionally, this 40 per cent tariff will be on top of whatever tariffs that would have applied if the goods had come directly from the country where they were originally made.

For instance, goods transshipped to the US via Vietnam would face a 20 per cent reciprocal tax plus a 40 per cent transshipment levy.

Steven Okun, chief executive officer of APAC Advisors - a geostrategic and investment consultancy based in Singapore - told CNA that it is presently illegal for companies to manufacture a product in China, send it to Vietnam or other Southeast Asian countries, change the label and declare the certificate of origin to be from Vietnam or elsewhere, and export the finished product to the US.

However, he said that taking a good manufactured in one place, sending it to another country, transforming them into a new product and then exporting, constitutes trade and is legal, though he and other analysts point out that the issue lies in how much of “transformation” constitutes a new product.

Okun said it is even possible that the US has made illegal transshipments permissible with the 40 per cent tariff.

“There is no clarity on if or how the US will expand the definition of an illegal transshipment. Washington could broaden the definition at any time,” said Okun.

“Until then, companies remain uncertain about whether goods assembled in places like Vietnam with a certain amount of made in China constitute Vietnamese origin product when it comes to tariffs.”

Deborah Elms, head of trade policy at the Hinrich Foundation in Singapore, echoed similar sentiments, stressing that firms and other governments are still waiting for greater clarity on what the US administration means by transshipment.

“Goods are supposed to be “substantially transformed”, going beyond simple assembly or disassembly (so as not to be considered as transshipped). But this (transhipment) threshold is still unclear,” she added.

Chinese companies CNA spoke to in Vietnam denied outright that their goods should be subjected to this transshipment tax since they claim the products were produced wholly in Vietnam. They also said that they have not been subjected to the 40 per cent transshipment levy since it came into effect in August.

But they acknowledged that the uncertainty surrounding the definition of transshipment goods has impacted orders and slowed production.

Qiu of Huashuo Plastics told CNA: “This kind of public opinion - once it exists - creates an atmosphere that isn’t very friendly.”

However, Le Minh Ngoc, who runs a local ceramics exporting firm in Bat Trang near Hanoi, told CNA that the practice of transshipment is widespread in Vietnam, and that his firm acts as a middleman for Chinese pottery companies which wish to export to the US.

Some of these products include vases, pots and statues of historical figures in Chinese and Vietnamese history.

“On average, we export about six to seven containers to the US annually, using the largest 40-foot containers,” said Minh.

“Thanks to the trade war, some clients are now considering moving part of their production to Vietnam to ease the pressure. This is actually a benefit for us,” added the 27-year-old, who confirms that Chinese products passing through his firm are relabelled before being exported to the US.

When asked if the transshipment tax impacts his business, Minh said Chinese firms are willing to take risks and pay the additional costs on their end.

However, not all local firms have benefited from the transshipment tariffs.

Nam, a manager of a silk boutique firm located in Hanoi who declined to give his full name, told CNA that increased competition from Chinese firms and higher reciprocal tariffs have made it no longer viable to export products to the US. His firm previously exported 20 per cent of its goods to the US.

“I’ve had to cut 30 per cent to 40 per cent of my workforce since COVID-19 (and the implementation of tariffs thereafter). Profits have decreased. We haven’t been able to sell as much as before - sales have dropped by around 20 per cent to 30 per cent,” said the 35-year-old.

Countries and major cities in Southeast Asia are also uneasy with being labelled as a transshipment hub for Chinese goods.

Penang, widely known as the Silicon Valley of the East as it serves as a key hub in the global supply chain for semiconductors, is increasingly seen as a viable location for Chinese firms under the China Plus One strategy.

It refers to a supply-chain diversification strategy in which Chinese firms keep production in China but add at least one additional manufacturing base elsewhere - often in Southeast Asia - to reduce costs, leverage on free trade agreement networks and to take advantage of government tax incentives offered.

The phenomenon began in the early 2000s when Chinese firms, especially those in the textile industry, began exploring alternatives like Vietnam and Cambodia.

It expanded to countries like Thailand and Malaysia following the escalation of the US-China trade war between 2018 and 2020.

In the first half of 2025, northern Malaysian state Penang recorded RM1.85 billion in approved manufacturing investments from China, accounting for nearly 15 per cent of the state’s manufacturing investment in that period.

In comparison, for the same period in 2024, it recorded RM411.8 million in manufacturing investments from China, or only a quarter of the 2025 figure.

In a written response to queries from CNA, Penang’s chief minister Chow Kon Yeow stressed that while Penang welcomes investment from China, it is prioritising projects that “bring high value-added activities to the state” and less so to accommodate companies which transship products.

“We prioritise projects that contribute to local capabilities and innovation, rather than those focused solely on transshipment,” said Chow.

“As such, companies seeking to establish operations purely for transshipment purposes may find Penang less aligned with their needs,” he added.

He did not elaborate on how Penang ascertained whether companies are transshipping goods.

IS THE SOUTHEAST ASIA TARIFF ESCAPE ROUTE CLOSED?

Trade experts whom CNA spoke to stressed that the transshipment tax imposed by the US has diminished Southeast Asia’s appeal as a tariff escape route for Chinese firms.

At the same time, Chinese companies said that they are considering relocating to other regions where the spotlight on transshipment is less intense than countries like Vietnam.

For instance, Qiu of Huashuo Plastics told CNA that his firm is considering relocating some of its operations to India, in a move to diversify its client base beyond the US to include the European Union.

The employee who works in the logistics company which ships goods from Hai Phong port to the US told CNA that Chinese firms operating out of Vietnam are diversifying their client base by exporting to Europe and the Middle East beyond just the US.

Meanwhile, local businesses in Southeast Asia are also feeling the pinch with increased competition from Chinese firms and these countries too could implement protectionistic measures, said Okun.

Okun added that there is evidence that Chinese capacity being diverted into Southeast Asia has been threatening local industries, citing how over the past two years, more than 4,000 Thai factories have shut and tens of thousands of those working in Indonesia’s textile sector have lost jobs.

“This is a clear signal that the spillover is already underway, and governments will take measures to protect themselves,” he added.

On the other hand, a mass exodus of Chinese firms out of Southeast Asia is unlikely as experts said that it is not realistic to take China out of the region’s manufacturing base in the foreseeable future.

Giang told CNA: “Supply chains are sticky. Once you build a factory, train workers, and establish supplier networks, you do not pack up overnight.”

However trade experts told CNA that ultimately, the intent behind the transshipment law by the US is to persuade Southeast Asian countries to sequester China and move away to other trading partners.

Various news reports have said that the US is pursuing a strategic decoupling from China, and is demanding its trade partners in the region do the same.

Experts also noted how Trump’s trade adviser Peter Navarro called Vietnam a “colony of China”, claiming that as much as a third of its exports to the US were, in fact, Chinese goods rebranded as Vietnamese.

Okun added that Vietnam’s deal to reduce its reciprocal tax from 46 per cent to 20 per cent suggests it has agreed to some form of decoupling from China in order to appease the US and achieve a more favourable tariff outcome.

However, he maintained that a complete decoupling is impossible in the "foreseeable future”.

“The US may seek to limit the level of Chinese content. It cannot eliminate it entirely. The policy is really about containment, not complete separation,” said Okun.

CHINA MNCs STILL PRESSING ON WITH GROWTH

Amid the global uncertainties, some Chinese multinational corporations (MNCs) which export to the US have pressed on with their expansion in the region.

However, they are doing so cautiously, and in some cases, have had to pull back their plans and lay off workers.

In May, Chinese fashion retailer Shein opened a huge warehouse near Ho Chi Minh city spanning 15 hectares while BYD confirmed in August that it would be setting up an assembly plant in Perak, Malaysia.

Taiwan manufacturer Pou Chen, a contract supplier for sport fashion brands like Nike and Adidas, has increased its presence in Indonesia and Vietnam in recent years, according to media reports.

A contract supplier is a company that produces components or finished products for other businesses based on the client's specifications.

However amid this expansion, Pou Chen was forced to do multiple rounds of layoffs, including firing 6,000 workers in its Ho Chi Minh mega-factory through late-2024, citing weak orders and demand slump from US and European buyers.

Nguyen Huong, a 43-year-old who works in Pou Chen’s factory in Ho Chi Minh, told CNA that she fears being axed from her job every day.

“Since the company has had fewer orders since June, I haven’t been able to work overtime. That means no extra income for my family. Life feels very unstable, so I just try to get by as best I can,” said Huong.

Meanwhile, Shein has enacted small corporate layoffs, including 17 staff members at its Singapore headquarters in 2024 amid a restructuring exercise.

Trade expert Elms told CNA that given that the tariffs levels in Southeast Asia are relatively high - especially taking into consideration the punitive 40 per cent transshipment tax - Chinese companies are less incentivised to move out of China.

Yet, she stressed that because Chinese content is embedded in the region’s supply chain, it would be unlikely that the system changes in a major way.

“This issue was much more relevant when tariffs on China reached 145 per cent and the incentives to reroute goods elsewhere became imperative. Now that Chinese tariffs are not far from the levels applied elsewhere, some of the urgency has been lifted,” said Elms.

“But it’s also important to note that most of the economies in Asia are very reliant on Chinese content in their overall supply chains and reconfiguring these may be difficult or costly,” she added.

As to what the future holds, firms told CNA the only certainty to be expected is uncertainty.

Gao of BYD Forklift told CNA: “When it comes to expectations, honestly, it’s hard to say - especially with the US under Trump’s leadership. His approach can be quite hegemonic, and sometimes things change based on just one decision or statement from him.

“This kind of hegemonic behaviour is something we have no control over,” he added.