Commentary: Budget 2026 – why CDC vouchers are still given in a time of economic recovery

Amid exceptional economic growth and rising incomes, here’s why Singapore is still providing sizeable cost-of-living support, says the Institute of Policy Studies’ Clara Lee.

A CDC voucher sign at a wet market at Punggol Plaza on Jan 2, 2026. (Photo: CNA/Jeremy Long)

This audio is generated by an AI tool.

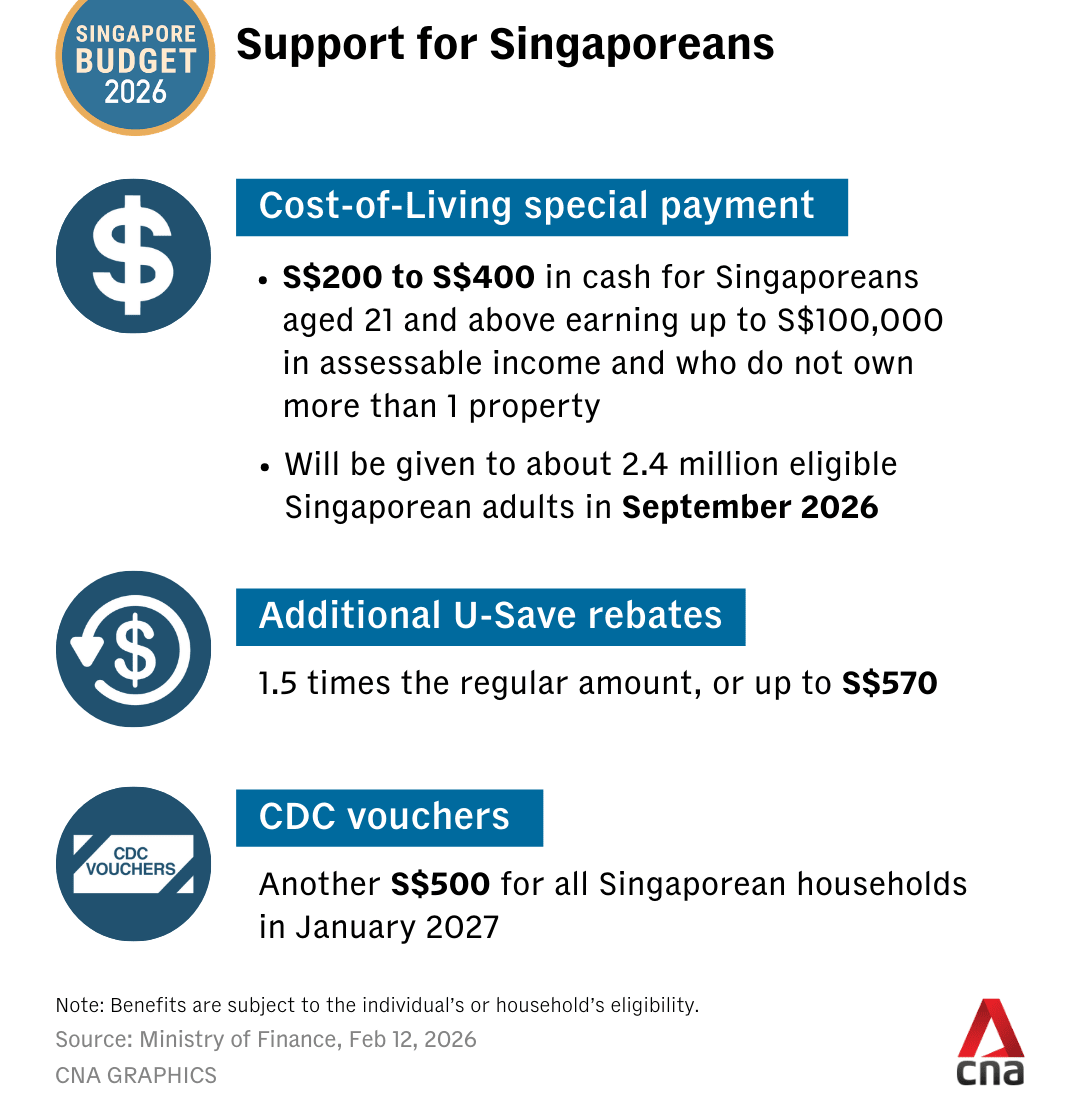

SINGAPORE: On Thursday (Feb 12), many Singaporeans were likely watching out for one Budget 2026 announcement more closely than the rest - the amount of Community Development Council (CDC) vouchers and other cash payouts they would receive. In this Budget, households will get S$500 (US$396) in CDC vouchers to help with daily expenses, with a S$200 to S$400 Cost-of-Living special payment for eligible Singaporeans.

But such broad-based support measures were introduced in extraordinary circumstances – a global pandemic and then the sharp surge in global inflation. While more help is always welcome, what does it mean to continue them when the economic backdrop appears to have improved?

The latest data tells us that household incomes are rising, economic growth has outperformed expectations and inflationary pressures have moderated.

In 2025, the median monthly household income rose to S$12,446, a real increase of 6.8 per cent after adjusting for inflation. Median monthly household income per household member also rose 7.5 per cent in real terms. Over the past decade, real wages have increased across all income levels, with lower-income workers seeing the strongest gains.

Singapore’s economy grew 5 per cent in 2025, exceeding earlier forecasts. Growth expectations for 2026 have been upgraded to between 2 per cent and 4 per cent. Inflation has moderated significantly, with both core and headline inflation projected to be between 1 per cent and 2 per cent.

If macroeconomic conditions have improved so significantly, how should we understand the role that cost-of-living support plays?

FROM CRISIS RESPONSE TO CALIBRATED CONTINUATION

The CDC voucher scheme, in particular, has evolved visibly and grown in importance over the years. It is now a familiar feature of our conversation and behaviour. We know how to claim vouchers through Singpass and RedeemSG. We remind each other to use them before they expire. We check if shops and food stalls accept them.

Its strong continuity can be partly explained by its high uptake and utilisation. A large majority of eligible households claim and spend their vouchers. In 2025, 89 per cent of voucher spending went towards food, beverages and daily essentials, suggesting the scheme is serving its intended purpose.

It began in June 2020 as pandemic relief targeted at lower-income households and heartland businesses, and was expanded to all Singaporean households in 2021, starting at S$100. Subsequent tranches grew in value, and in 2025, households received a total of S$800 across two tranches.

Merchant participation has also expanded significantly, from about 10,000 heartland merchants and hawkers in 2021 to more than 24,000 in 2026, alongside eight participating supermarket chains.

There has also been substantial institutional investment. Digital infrastructure has been built and refined. Administrative systems, merchant onboarding processes and public communications have been scaled up.

CDC vouchers have become visible and easy to use, and this familiarity matters for policy.

Cash transfers like the Cost-of-Living special payment are also attractive policy instruments. They are administratively simple, highly visible and politically resonant. Tiering and eligibility criteria – such as an annual income cap – also mean that support can be targeted to those who need it more.

This payment was first introduced in 2022 as a temporary shield against soaring inflation. Eligible adults received between S$300 and S$500, with another S$200 to S$400 in 2023 and again in 2024.

EFFECTS OF HIGH INFLATION PERSIST

Policymaking is shaped not only by macroeconomic indicators, but also by lived experience.

Even as growth strengthens and inflation moderates, cost-of-living anxieties persist because prices that rose sharply rarely fall back. Instead, they plateau at a higher level.

A drop in inflation from 5 per cent to 2 per cent does not undo the cumulative increases of previous years; it simply means that prices are rising more slowly from an already expensive base. Households feel it tangibly in groceries, meals and utilities – this is frequent and visible consumption.

While median incomes have grown strongly, real income recovery may be uneven across sectors too. Some households may still be adjusting to higher mortgage rates and public transport fares. Perceptions of financial strain often lag behind improvements in macroeconomic indicators.

Global uncertainty also remains. Geopolitical tensions, supply chain disruptions and shifts in global demand can spill over quickly into a small and open economy like Singapore’s.

In that context, calibrated support is prudent, not because the crisis persists but because the external environment remains volatile.

Singapore’s strong fiscal position provides room for such pre-emptive cushioning. Growth that is stronger than expected has supported revenues. Maintaining moderate support does not necessarily compromise fiscal sustainability, especially if it remains targeted.

MANAGING EXPECTATIONS FOR THE FUTURE

Even after successive Budget appearances, it’s worth noting that CDC vouchers and the Cost-of-Living special payment remain consistently framed as discretionary, not permanent entitlements. Singapore’s governing philosophy emphasises self-reliance, fiscal prudence and temporary support tied to exceptional circumstances.

However, these continued measures may start to shape public expectations. They are now familiar, tangible and in some instances, anticipated.

The more significant question then is not simply the amount of support this year, but the trajectory ahead.

Managing expectations about future relief measures will be as important as managing the fiscal position. A sudden withdrawal could be politically jarring, particularly if households still perceive cost pressures.

However, permanent institutionalisation would mark a shift away from Singapore’s traditional emphasis on structural and targeted support rather than broad and permanent measures.

Budget 2026 suggests that while the acute phase of inflation has passed, the government remains cautious. Macroeconomic recovery does not automatically eliminate household anxiety. For now, cost-of-living support continues, calibrated and moderated.

Dr Clara Lee is research fellow at the Institute of Policy Studies Social Lab, National University of Singapore.