Budget 2026: Seven things you need to know

From cost-of-living support to a new CPF investment scheme, here are the key takeaways from Budget 2026.

Prime Minister Lawrence Wong arrives at Parliament House to deliver the Budget statement on Feb 12, 2026. (Photo: CNA/Wallace Woon)

This audio is generated by an AI tool.

SINGAPORE: Budget season is here again.

Against a backdrop of global uncertainty and what Prime Minister Lawrence Wong described as a more fragmented and dangerous world, this year's Budget focused on strengthening Singapore's resilience while supporting workers and households.

From cash payouts to CPF changes and free access to AI tools, here are seven key takeaways from this year’s Budget.

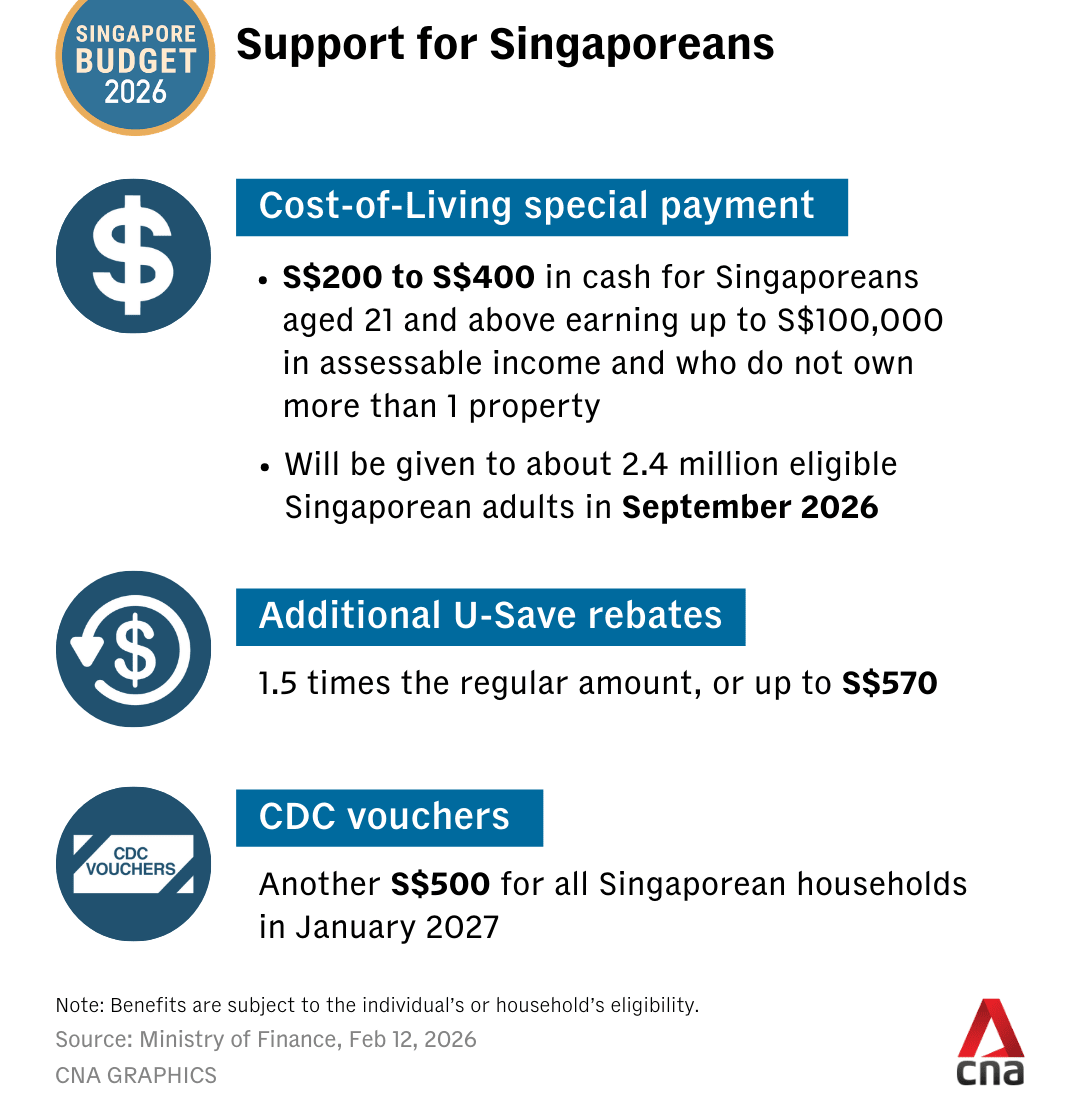

A CASH PAYOUT – AND MORE CDC VOUCHERS

There's another round of support for households.

Singaporean adults earning up to S$100,000 (US$79,000) in assessable income, and who do not own more than one property, will receive a one-off cost-of-living cash payment of between S$200 and S$400.

The payout will be disbursed in September and is expected to benefit about 2.4 million people.

Eligible HDB households will also receive enhanced U-Save rebates. For the 2026 financial year, they will get 1.5 times the usual amount – up to S$570 – to help offset utilities bills.

And yes, more CDC vouchers are coming.

All Singaporean households will receive S$500 in CDC vouchers in January 2027, half of which can be used at participating supermarkets and the rest at participating heartland merchants and hawkers. They will be valid until Dec 31, 2027.

MORE CHILD LIFESG CREDITS

Families with young children are getting a boost, too.

In July, families will receive S$500 in Child LifeSG credits for each Singaporean child aged 12 and below. For babies born in 2026, the credits will be given out in April next year.

The credits can be accessed via the LifeSG app and used at physical and online merchants that accept PayNow UEN QR or NETS QR.

They can help with everyday expenses like groceries, utilities and pharmacy items – the sort of regular costs that add up.

A NEW CPF INVESTMENT OPTION

If you’ve ever looked at your CPF and wondered how to grow it – but don’t want to actively manage investments – a new option is coming.

From 2028, the CPF Board will introduce a new voluntary scheme offering low-cost, diversified life-cycle investment products.

These products automatically adjust the investment mix over time, shifting towards less risky assets as members approach a target date, such as retirement.

The CPF Board will work with two to three selected providers, keeping choices simple rather than overwhelming.

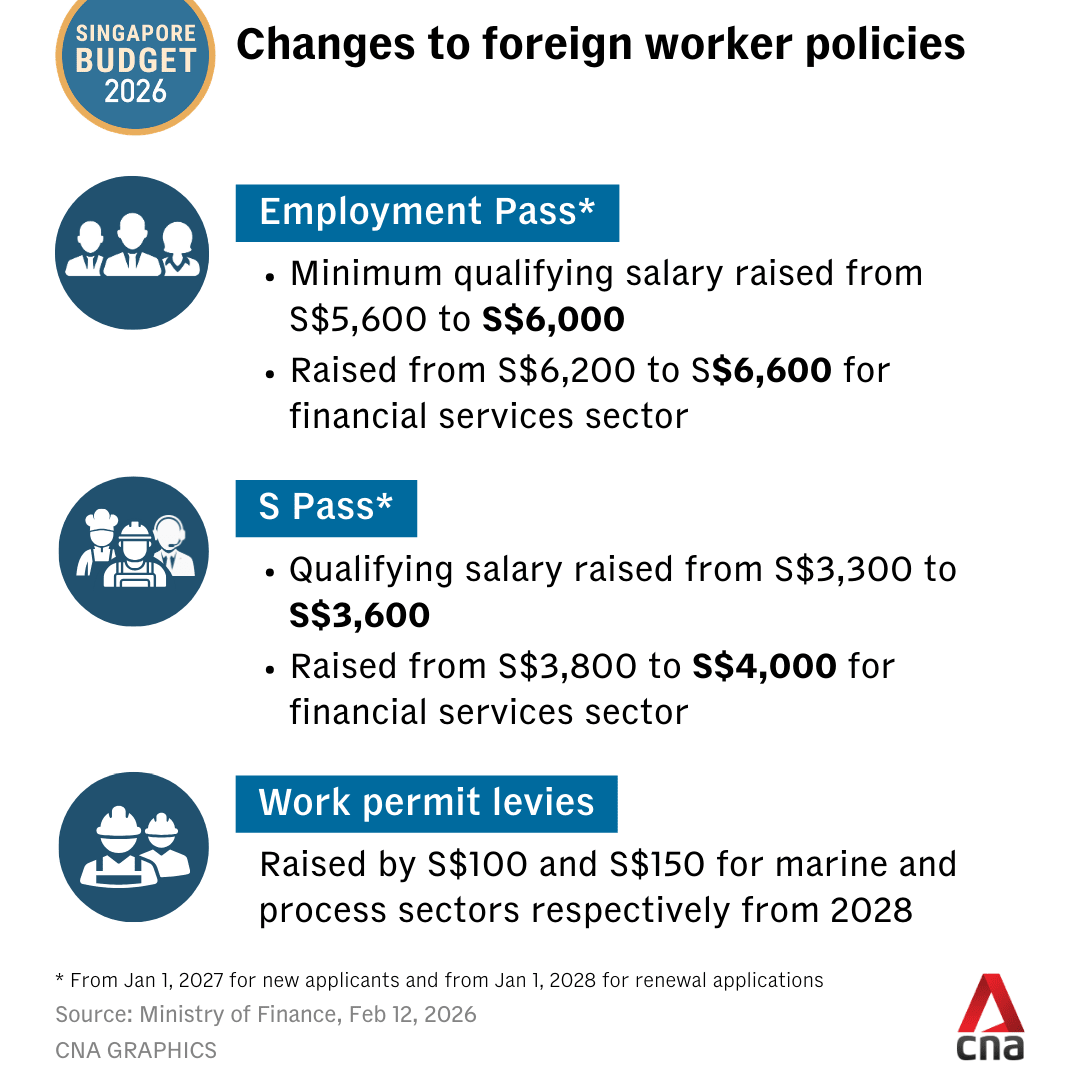

HIGHER SALARY THRESHOLDS FOR EP, S PASS HOLDERS

Minimum qualifying salaries for Employment Pass (EP) and S Pass holders will be raised.

From January next year, the minimum qualifying salary for EP holders will be raised from S$5,600 to S$6,000. In the financial services sector, which has higher salary norms, it will rise from S$6,200 to S$6,600.

For S Pass holders, the minimum will go up from S$3,300 to S$3,600. In financial services, it will increase to S$4,000.

These changes apply to new applications from Jan 1, and to renewal applications from Jan 1, 2028.

FREE ACCESS TO PREMIUM AI TOOLS

Singaporeans who take up selected AI training courses will get six months of free access to premium AI tools.

The idea is simple: Learning should translate into practice. Since advanced AI models typically require paid subscriptions, this gives people the chance to experiment and apply what they’ve picked up.

INCREASE IN TOBACCO EXCISE DUTY

Smokers will pay more for cigarettes.

All tobacco products will be hit with a 20 per cent increase in excise duty starting Feb 12.

This is part of the government’s efforts to discourage the consumption of such products.

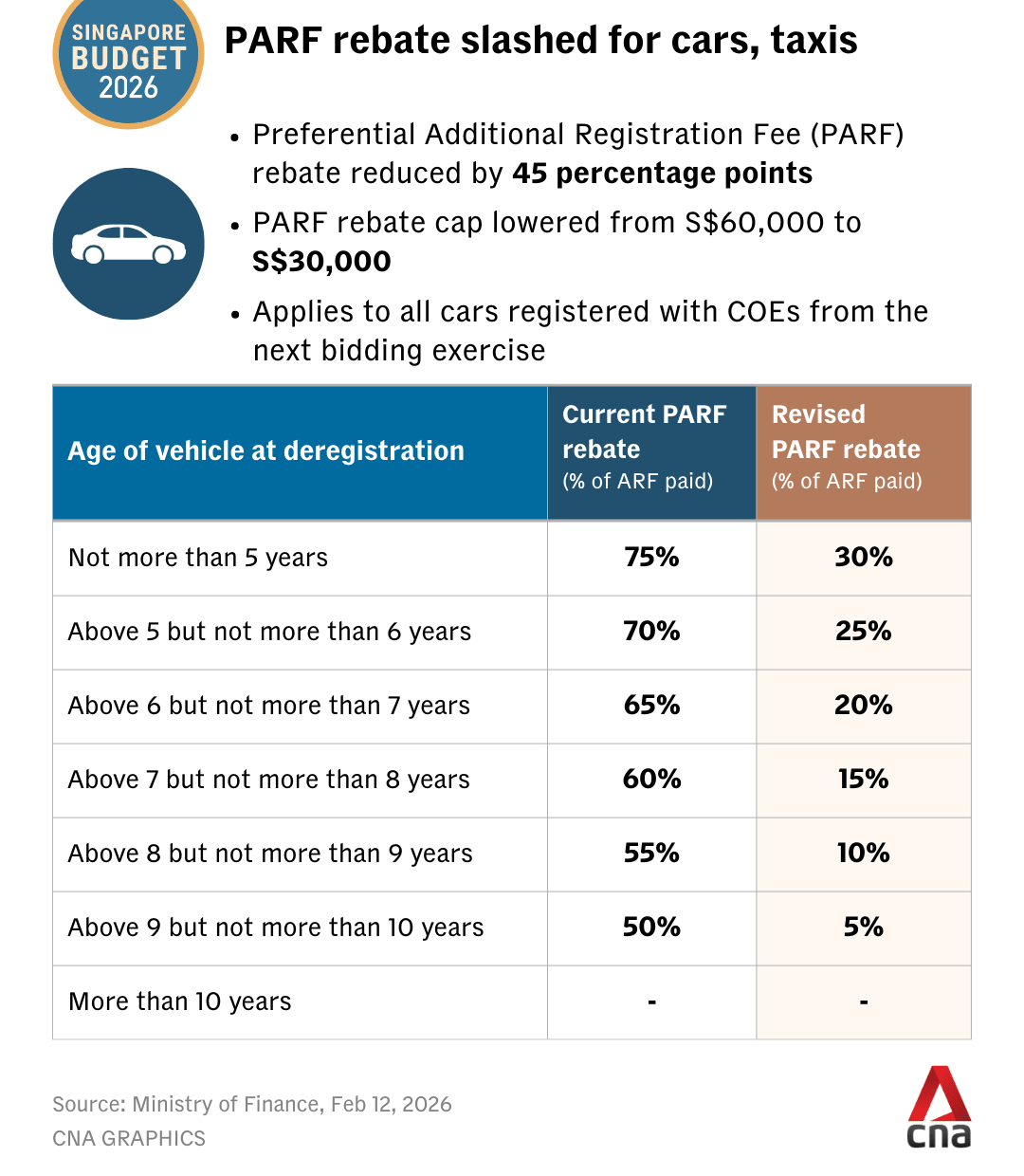

LESS REBATES FOR SCRAPPING CARS EARLIER

Car owners will receive lower rebates when they deregister their vehicles, as the Preferential Additional Registration Fee (PARF) rebate will be reduced by 45 percentage points.

PARF was introduced to encourage people to replace older cars earlier, helping to reduce emissions.

However, with electric vehicles becoming more common, Mr Wong said there is now less need to encourage people to deregister their cars earlier.

The maximum rebate you will receive will also be reduced from S$60,000 to S$30,000.

The changes apply to new cars registered with Certificate of Entitlement (COEs) from the next bidding exercise, which begins on Feb 16.