Commentary: The onslaught of scams in Singapore has made me a paranoid mess

The endless string of scams in Singapore has made people deeply anxious about getting duped, says CNA’s Erin Low.

This audio is generated by an AI tool.

SINGAPORE: It started innocently enough. A bank employee called me to say that she was my new account manager and offered to meet in person to share details about higher interest-earning products.

Normally I treat all cold calls from purported bank employees with scepticism. After all, scam cases in Singapore shot up by 50 per cent in 2023, and impersonating bank officials is a page straight out of the scammer playbook.

But I was anticipating this phone call, because banks tend to offer fixed deposit promotions around Chinese New Year. I asked the woman about my old account manager, and she told me that he had left the bank. I invited her to send me a text to schedule an appointment.

Niggling doubts started to creep in after the woman sent a WhatsApp message. First, her profile picture was an attractive though obviously photoshopped selfie - the same kind seen on shady accounts that send unsolicited job offers.

Next, her number was a WhatsApp business account, like most scam accounts I’ve seen on the messaging app. The account description simply read “Bank”.

Finally, upon closer inspection, her text message contained grammatical errors and inconsistent formatting.

Sufficiently spooked, I texted my old account manager. He informed me that he had not left the bank, and instructed me to ignore the woman while he figured out what was going on.

I started to freak out. How did the woman get my name and mobile number? How did she have information about the products I have with the bank?

As I was about to change all my passwords and wipe out my digital footprint, my old bank officer called again. He clarified there was a miscommunication. The woman was in fact an employee with the bank and was mistakenly assigned to be my new account manager when I already had one.

While relief washed over me, a more unsettling feeling crept in - a realisation of the paranoia deep in my psyche, entrenched by the endless string of scams that have made headlines in Singapore.

ANXIOUS ABOUT SCAMS

The thought did occur to me: What would a scammer masquerading as a bank employee benefit from meeting me in person?

But then I recalled how some scammers attempt to build rapport with their targets. What if at this meeting, the so-called bank employee charmed me into signing up for an elaborate investment scam, disguised as a high-return savings account? What if I was duped into downloading a malicious app, believing it to be a new digital banking product?

Contrary to popular belief, older and less savvy internet users aren’t the ones falling for scams - it’s millennials like me. In 2023, adults aged 30 to 49 made up the bulk of scam victims in Singapore.

Aware of this fact, I have developed not just a healthy suspicion about potential scams, but a general sense of technophobia. For instance, I’m loath to download new payment apps, say at a newfangled food court that only accepts a specific mobile wallet.

This is because I’m wary of the security risks that come with using payment apps. Users of multi-currency apps like YouTrip have reported fraudulent transactions carried out on their accounts while abroad. This might have resulted from the user dealing with a merchant that had been compromised in a data leak.

So when an eatery demands payment from one app, I piggyback off my companion and pay them back later.

IMPOSSIBLE TO KNOW WHO TO TRUST

In this scam-rife environment, it is impossible to know who we can trust. Those we trust might not even be who they are, amid rising deepfake scams. An employee in Hong Kong was recently swindled US$25 million by scammers impersonating their CEO on a video call.

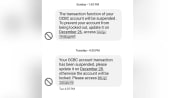

And it feels like banks are doing little to dispel doubt, if their cold calls and dubious text messages are any indication.

Banks have taken pains to verify user identity in online transactions, to prevent criminals from siphoning their customers’ hard-earned savings. From two-factor authentication to physical tokens, banks have ensured users are who they say they are.

But these verification methods are one-way when users don't have the means to verify bank officials. What would help a user know for sure that the Unknown Number calling them is a legitimate bank employee?

The prevailing guidance for customers is to not click on links sent by text or email, and to verify with the bank if the employee really exists. But hanging up on a bank official to check if they’re bona fide, then having no way to call them back, seems like a clunky workaround.

Cybersecurity expert Steve Kerrison wrote in a CNA commentary that businesses need to embrace new technology to give customers peace of mind. Apps like Singpass, for instance, establish trust between customer and vendor by guaranteeing that any information exchanged goes directly into a secure system.

From my limited consumer perspective, it doesn’t seem like a stretch for banks to do something similar. Users already have mobile authentication, where they click on a notification issued from the banking app to confirm their identity. Couldn’t users also request bank officers to verify themselves via the app?

My only hope is that whatever solution banks come up with is simple and intuitive. In the meantime, I’m hanging up on all these so-called bank officers and leaving them on read.

Erin Low is Deputy Editor, Commentary at CNA Digital.