Commentary: Thai PM’s first 100 days in office follow a populist path

After 100 days as Thailand Prime Minister, Srettha Thavisin has a strategy of economic populism that looks a lot like Thaksin Shinawatra’s, except for the audacious attempt to roll out a 10,000 baht digital cash handout, says Thai politics researcher Prem Singh Gill.

This audio is generated by an AI tool.

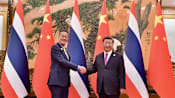

BANGKOK: Thai Prime Minister Srettha Thavisin’s first 100 days in office have shown a notable emphasis on populism as a remedy for the country’s economic challenges. His metaphorical portrayal of the economy as a “sick person” in urgent need of healing seems to be resonating with the public.

It is reminiscent of his party Pheu Thai’s founder and former prime minister Thaksin Shinawatra’s own playbook. Mr Srettha has promised to revive the economy through subsidies, welfare programmes and debt moratoriums for farmers.

While it is important to align with public sentiment and alleviate cost of living burdens, such populist measures are surely also aimed at repairing Pheu Thai’s reputation after the party joined forces with military parties to form the government in August.

The critical question emerges: Will this path lead to sustainable economic recovery or will the appetite for quick wins risk worsening the challenges facing Thailand?

POPULISM IS BAD FOR ECONOMIC HEALTH

An immediate concern is the fiscal impact of Mr Srettha’s populist policies when Thailand’s economy is still grappling with a significant post-pandemic budget deficit. The risk that short-term political gains will come at the expense of long-term sustainability is cause for concern.

Economic populism might struggle to address the root causes of Thailand’s economic woes: Issues like falling investor confidence also touch on political stability, the rule of law and transparency – underlying structural issues crucial for sustained growth. Industry leaders have called for more sector-specific strategies for economic recovery, including for long-term vision for a resilient tourism industry.

Thailand’s economy grew less than expected in the third quarter (1.5 per cent), reflecting sluggish exports and reduced post-pandemic government spending.

Still, household consumption grew 8.1 per cent and private sector investment accelerated. The National Economic and Social Development Council forecasts a 2.5 per cent growth in gross domestic product for the year.

Populist strategies may have had some positive impact, but relying on consumption-focused policies for growth isn’t a magic bullet. A resilient economy requires diversity, considering risks like inflation, climate change and pandemics.

PHEU THAI’S FLAGSHIP DIGITAL HANDOUT PLAN

One measure that stands out is the Thai government’s flagship 10,000 baht (US$277) digital cash handout, totalling US$14 billion or about 3 per cent of GDP. Mr Srettha said this marked “the beginning of Thailand’s economic shift”.

Eligibility is set at age 16 and above, which emphasises inclusivity, with a cap on monthly income or bank savings added on after much public criticism. About 50 million Thais, of a population of more than 70 million, are expected to receive the payment.

There is strategic direction in restricting the use of the digital cash – among prohibited items are alcohol and cigarettes – and where Thais can spend it. It can only be spent within 4km of the recipient’s registered address, to ensure the economic impact of the stimulus is felt locally.

This policy is portrayed not as a form of welfare but as a partnership between the government and the people.

Mr Srettha also highlighted the use of blockchain technology to ensure transparent fund management and that the government wanted to be transparent by submitting a bill seeking a special loan to finance the programme for parliament scrutiny.

BYPASSING THE REGULAR BUDGET PROCESS

But this signature electoral campaign pledge raises concerns on two fronts. First, will this promote sustainable economic growth?

Mr Srettha’s government projects that spending 500 billion baht will add at least 2 trillion baht to the economy, including billions in value-added tax expected to be collected as result of the increased spending power.

Critics point out this would do little in terms of structural changes. For Thailand to thrive post-pandemic, reforms are needed in education, innovation and governance – even the controversial appointment in October of a new police chief fast-tracked through the ranks will require clear handling to maintain public trust. To borrow Mr Srettha’s sick person metaphor, Thailand’s economy needs better medicine, not more plasters.

Then there are the concerns about whether the proposed special legislation to borrow 500 billion baht for the programme are in compliance with the country’s financial regulations. Article 53 of the 2018 State Fiscal and Financial Discipline Act sets out the basis for special loans bypassing the regular annual budget process – the need for urgent and continual action to address a crisis.

Main opposition Move Forward Party has already slammed the government’s plan to borrow money to finance the digital handout, suggesting it will violate existing laws and pose risks to fiscal discipline, worsening its public debt problems.

In response, Mr Sretta has emphasised short-term economic benefits and a commitment to repaying the borrowed funds within four years.

AN AUDACIOUS PLAN INTO THE DIGITAL ERA

At the 100-day mark of Prime Minister Srettha Thavisin’s term, granting the benefit of doubt to a newly elected government seems fair. He should get credit for audacity: Even if handouts are a classic populist strategy, doing this with a digital wallet is an innovative approach and signals a commitment to leveraging technology for economic stimulation.

Thailand's push for a Central Bank Digital Currency (CBDC) and a national digital payment infrastructure could potentially propel the country into a digital era, fostering efficiency and financial inclusion. However, concerns linger around issues of privacy, security, economic stability and the potential unsustainability of exclusive reliance on digital payments, especially for citizens who may feel insecure in the digital realm.

The digital wallet policy holds potential for success and failure. Mr Srettha’s fate will likely be closely tied to it.

Prem Singh Gill is a Visiting Research Fellow at Universitas Muhammadiyah Yogyakarta, Indonesia and a Scholar in Thailand.