China sticks to 'around 5%' growth target for third year despite worsening trade war

China has maintained the same GDP target since 2023, signalling confidence in economic growth amid trade tensions and global uncertainties, analysts say.

People ride past a screen showing live coverage of Chinese Premier Li Qiang speaking at the opening session of the National People's Congress (NPC) outside a shopping mall in Beijing on Mar 5, 2025. (Photo: AFP/ Greg Baker)

This audio is generated by an AI tool.

SINGAPORE: China will target economic growth of “around 5 per cent” this year for the third consecutive time as it seeks to boost domestic demand, Premier Li Qiang said on Wednesday (Mar 5).

Delivering the 2025 Government Work Report at the opening of China’s National People’s Congress (NPC) as part of the annual Two Sessions, Li outlined key economic priorities and the government’s strategy to achieve its targets.

"We have taken into account the need to stabilise employment, prevent risks, and improve the people's wellbeing, as well as the potential for growth and the conditions supporting growth," Li said.

Among other key targets unveiled - China aims to create over 12 million new urban jobs in 2025, with surveyed urban unemployment rate at around 5.5 per cent.

Reflecting weak consumer demand, Beijing has slashed its consumer price index (CPI) target to around 2 per cent, markedly down from last year’s target of 3 per cent.

The Chinese government also announced a budget deficit of around 4 per cent of GDP this year - the highest level in more than three decades.

Observers say these targets indicate a focus on helping households and boosting consumer spending, to counter a potential drop in tariff-sensitive exports.

REALISTIC YET CAUTIOUS TARGETS

China's economy expanded by 5 per cent in 2024, with gross domestic product (GDP) reaching 134.9 trillion yuan (US$18.77 trillion).

While China has maintained the same growth target of around 5 per cent since 2023, achieving it this year will require overcoming mounting external threats and domestic pressures.

On the foreign front, a trade war is escalating, with the US doubling duties on Chinese goods to 20 per cent, effective Mar 4.

Beijing has retaliated with additional tariffs of up to 15 per cent on American agricultural and food products from Mar 10. This is on top of tariffs announced last month, including 15 per cent on US coal and liquefied natural gas.

In his speech, Li warned that “changes unseen in a century are unfolding across the world at a faster pace”.

Back home, the world’s second-largest economy is grappling with sluggish domestic demand, a prolonged property sector crisis, an ageing population and rising youth unemployment.

“We must face these difficulties and problems head-on and have stronger confidence in our development,” said the Chinese premier.

Analysts describe the around 5 per cent target as realistic yet cautious, signalling Beijing's confidence in supporting economic growth.

Lim Tai Wei, a professor of business at Japan's Soka University, said the targets are “well within expectation” given that China has been facing headwinds recently.

“China has a uniquely highly centralised political system, which allows them a wide breadth of control to shape the economy.”

He cited the effectiveness of subsidies in the consumer goods trade-in programme and the “mobilisation of netizens” in promoting Nezha 2, which boosted cinema ticket sales and tourism, as examples of successful economic stimuli.

“Thus, in the worst-case scenario in 2025, should the trade war worsen, they can take similar actions. So, 5 per cent is doable, and there is now a track record for this.”

Associate Professor Alfred Wu from the Lee Kuan Yew School of Public Policy (LKYSPP) agrees that this is a widely expected GDP target, noting that there is “realistically not much room … for policy changes” given the economic downturn.

“With concerns about debt, the government will adopt a piecemeal approach in strengthening demand-side policies to counter external geopolitical headwinds,” said Gary Ng, senior economist at Natixis and research fellow at the Central European Institute of Asian Studies (CEIAS).

“But the key problem is whether this will translate into household income and corporate profits.”

Analysts also commented on the CPI target this year of around 2 per cent, which marks the first time it is set below 3 per cent, since China started specifying the figure in the annual work report 20 years ago.

The adjustments come after its CPI, a key inflation measure, rose only 0.2 per cent in 2024 and 2023 - the lowest increase since 2009.

"Lower CPI targets suggest Beijing is not expecting a sharp rebound in consumer spending anytime soon," said Dr Lizzi C Lee, a fellow on Chinese economy at the Asia Society Policy Institute's (ASPI) Center for China Analysis (CCA).

Meanwhile, Mr Donald Low, a senior lecturer and professor of practice in public policy at the Hong Kong University of Science and Technology, considers the historically low CPI target to be “quite ambitious”.

Given that China has been grappling with deflationary pressure for the past two to three years, “setting an explicit inflation target is actually quite a big deal”, he said.

With a record budget deficit of around 4 per cent of GDP this year, the government is planning to spend more to improve livelihoods and disposable incomes, and in turn encourage consumption.

While an expansionary fiscal policy is a “good thing”, Low said he is “disappointed” at the lack of specific measures to boost consumption.

As outlined in the work report, ultra-long special treasury bonds totalling 300 billion yuan will be issued to expand the consumer goods trade-in programme, for which Beijing allocated 150 billion yuan in last year’s work report.

Commenting on the new trade-in programme subsidy, Ng said that there are no fundamental changes and that this is “not enough”.

“Consumers don't really want to spend more but if there is a subsidy, they may buy something they want, or roll back some of the other consumption,” he said, adding that it will take some time to observe the effect.

Assoc Prof Wu described the measures announced as “very much incremental in nature.”

He cited property measures in the report, including plans to reduce property transaction restrictions and “intensify efforts to redevelop urban villages and renovate old and dilapidated houses”, as a step forward but only incremental.

On the other hand, Lim noted that the focus of this year’s work plan has shifted from national security to the private sector, signalling a “change in targets amid headwinds”.

AI TAKES THE LEAD

Unsurprisingly, AI is front and centre in China’s industrial strategy this year.

Under the AI Plus initiative, China aims to integrate digital technologies with its manufacturing and market strengths.

“We will support the extensive application of large-scale AI models and vigorously develop new-generation intelligent terminals and smart manufacturing equipment, including intelligent connected new-energy vehicles, AI-enabled phones and computers, and intelligent robots,” Li said in his report.

Wu noted that this year’s Government Work Report provides a clearer reference to China’s “new productive forces” compared to last year, with explicit mention of strategic emerging industries.

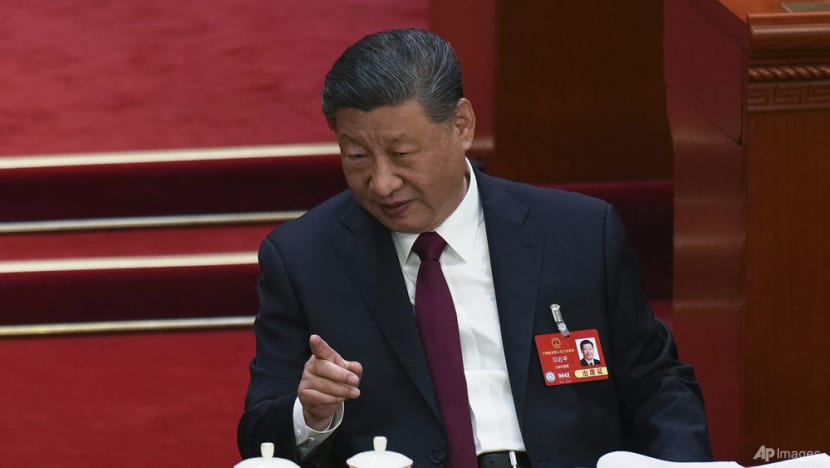

The term “new productive forces” or “xin zhi sheng chan li” in Chinese was first introduced by President Xi Jinping in September 2023 during a research trip to Northeast China.

It refers to a new growth model driven by rapid scientific and technological innovation alongside the upgrading of traditional industries.

This comes as China accelerates efforts to establish itself as a global leader in AI development, following key breakthroughs such as DeepSeek’s AI model. Major companies, including Baidu, Alibaba, Tencent and ByteDance, have also announced their own AI models, alongside the growing prominence of humanoid robots.

According to official government work reports, 21 out of 31 local governments have listed AI+ - an initiative to embed AI into both traditional and emerging industries - as part of their industrial policies to boost economic growth.

Analysts say China is fully committing to AI-driven industrial transformation, extending beyond finance and healthcare to manufacturing, smart logistics and industrial automation.

China has more than 4,500 AI enterprises, with the core industry valued at nearly 600 billion yuan, according to data released in January by the China Internet Network Information Center (CNNIC).

“PRIME TIME FOR PRIVATE ENTERPRISES”

Support for private businesses in China is expected to be a key theme at the Two Sessions, which include the concurrent session of the top political advisory body, the Chinese People’s Political Consultative Conference (CPPCC).

The CPPCC opened on Mar 4, and will close on Mar 10, a day before the NPC ends.

A new Private Economy Promotion Law, which prohibits authorities from imposing fines on private businesses without a legal basis, was raised during the legislative meeting.

The bill is designed to reassure the private sector after years of crackdown.

The high-profile meeting between Xi and private business leaders in February - the first such symposium since 2018 - sent a strong signal, with Xi emphasising the private sector’s critical role in economic growth.

"The private sector enjoys broad prospects and great potential on the new journey in the new era. It is a prime time for private enterprises and entrepreneurs to give full play to their capabilities," Xi was quoted as saying by Xinhua.

China’s central bank and top financial regulators signalled further support for private enterprises on Feb 28, with analysts viewing it as a step towards facilitating financing for private firms amid their growing role in innovation.

“We will proactively strengthen policy frameworks, enhance supervision and implementation, and provide strong financial support for the healthy development of the private economy, helping private enterprises grow stronger, better and bigger,” the People’s Bank of China (PBOC) said in a statement on Mar 2.

China has more than 57 million private companies, accounting for 92 per cent of all enterprises.