China’s Two Sessions: Jobseekers, street vendors seek relief as policymakers bank big on households

Stronger social security and unemployment benefits are among the key support measures they would like to see, some Chinese citizens told CNA, while analysts expect policymakers to ramp up fiscal support with households firmly in mind.

Construction worker He Chuan (left) and street vendor Yang Menglu (right) find their own ways to stay afloat in uncertain times. (Photos: Xiaohongshu/农民工川哥/小鹿新派黄油芝士烤吐司)

This audio is generated by an AI tool.

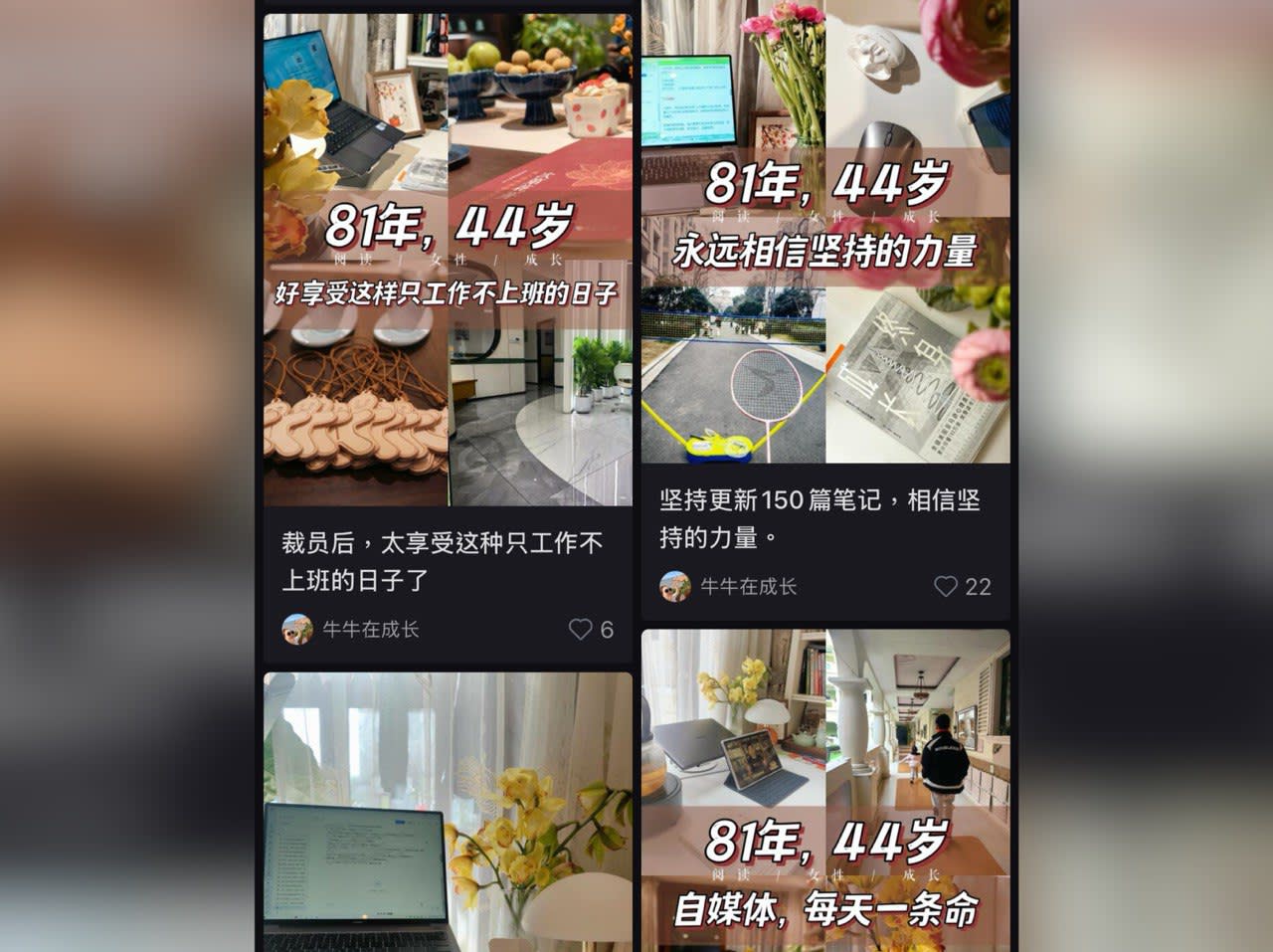

BEIJING: Hangzhou native Niu worries constantly about her family’s financial security.

Laid off from her real estate job last year, the 44-year-old currently draws a nominal and unstable income from sharing snippets of her post-retrenchment lifestyle on Chinese social media.

"The compensation I receive (from doing social media) is enough to give me plenty of free time (to explore other interests)," quipped Niu, who wanted to be known only by her last name. She declined to disclose her average earnings.

Her husband, the main breadwinner, earns about 41,000 yuan (US$5,650) monthly. But money is tight due to fixed monthly expenses hovering at around 40,000 yuan - with most going into repaying their housing loan and providing for their two young children.

"Our expenses are huge right now, though at least I still have my husband (who is working). Some couples are facing double unemployment, making their situation even worse,” she told CNA, adding that government support has felt lacking so far.

For street vendor Yang Menglu, financial uncertainty is a daily reality as well.

Her restaurant startup collapsed in March 2023, leaving her 3.82 million yuan in debt.

"At that time, I was very lost - I didn’t know what I could do, had no income, and no startup funds," she recalled.

The 33-year-old Qingdao native turned to hawking food for a fresh start in February 2024. She started small, selling grilled sausages before pivoting to Korean-style butter toast.

"Street vending can earn about 10,000 yuan a month," she shared, pointing out that much of it goes toward her two children’s tuition fees, family meals, and debt repayments.

But further state assistance could be on the cards for Yang, Niu and other Chinese citizens as China gears up for its tone-setting Two Sessions, or lianghui in Chinese. The annual meetings of China’s legislature and top political advisory body begin on Tuesday (Mar 4).

In the lead-up to the Two Sessions, China’s Communist Party Politburo met on Feb 28, reiterating priorities for 2025 - deeper reforms, innovation, and a renewed focus on stimulating domestic consumption for long‐term growth.

Analysts expect policymakers to unveil new measures centred on a more aggressive, household‐focused fiscal approach, as authorities increasingly look to spending from their own citizens to uplift the economy.

A second Donald Trump presidency in the United States - and the tariff threats he is wielding - is among the external pressures spurring China’s charge to galvanise domestic demand, observers say.

At the same time, they warn that the devil’s in the details. The extent to which anticipated government pledges materialise will be closely watched, along with the pace and evenness of implementation.

“I worry that the leaders (may) over-promise and they may end up under-delivering. Either they directly or their lower-level bureaucrats may end up under-delivering,” Huang Tianlei, a research fellow at the Peterson Institute for International Economics (PIIE), told CNA.

FORGING AN EXPANSIONARY PATH

Analysts CNA spoke to agree that China is set to chart an even more expansionary fiscal path, continuing the direction taken since casting off the COVID-19 pandemic.

Recent actions by Chinese policymakers have already hinted as much.

A Politburo meeting in December 2024 yielded commitments from Beijing to adopt a “moderately loose” monetary stance this year - departing from its longstanding prudent approach that was put in place in 2010, in the wake of the global financial crisis.

China leaders are also said to be planning a record budget deficit of 4 per cent of gross domestic product (GDP) this year, funded in part by off-budget special bonds, Reuters reported in December, citing unnamed sources.

While China has been touting expansionary moves over the last few years, this was not entirely the case - and in fact, was “rather contractionary”, asserted Huang, who pointed out that the country’s fiscal spending as a share of GDP has been declining since 2021.

According to finance ministry data, China logged 38.6 trillion yuan in total augmented spending in 2024 - five per cent less than what was budgeted for the year.

Actual spending by central and local governments under their respective budgets increased by less than one per cent compared to 2023, falling short of targets.

Augmented spending is the total of what the government officially spends, plus all the extra money it injects into the economy through indirect channels. That includes funds raised by government-backed companies, which are not captured in official budget figures.

Huang attributed this contractionary trend to turmoil in the local property sector, which curtailed a key source of local government revenue, along with central and local governments’ conservative approach to debt issuance.

Related:

“I think they have gradually come to realise that their longtime fiscal conservatism is problematic, and they need to really make fiscal policy more useful, make it more expansionary,” Huang said.

Agreeing with this, senior economist Xu Tianchen of the Economist Intelligence Unit (EIU) said this year’s lianghui could bring about more government conversations on spending, potentially leading to more action on this front.

Xu also noted China’s intent to increase funding from special treasury bonds this year. “(While) that is not within the headline budget, they represent extra fiscal firepower," he told CNA.

Reuters reported in December last year, citing sources, that Chinese authorities had agreed to issue 3 trillion yuan worth of special treasury bonds in 2025. That would be the highest on record, marking a sharp increase from the 1 trillion yuan issuance in 2024.

Chinese state planners have not disclosed the planned value, only saying the issuance will go towards spurring business investment and consumer-boosting initiatives.

“GREATER EMPHASIS ON HOUSEHOLDS”

Observers note that these moves are aimed at boosting household-driven growth, which is gaining primacy in China as a troubled external landscape - particularly US tariffs dangled by Trump - threatens to cloud its export prowess.

EIU’s Xu highlighted how China's policies used to be very heavily tilted towards investment in the manufacturing sector.

“But we're starting to see a gradual shift towards a greater emphasis on households, on people. That is probably very important for China's sustainable growth,” Xu said.

Chinese officials have made no bones about their domestic consumption push.

Among the latest exhortations came from Premier Li Qiang in a late February State Council study session, where he emphasised that “consumption must be placed in a more prominent position”, with greater efforts and more targeted measures needed.

“Boosting consumption is not only an important way to expand domestic demand and stabilise growth, but also a major measure to transform the development model in the mid to long term," state news outlet CCTV cited Li as saying.

In recent months, local media have carried reports spotlighting various sub-economies and how they are fuelling the consumption engine. Examples include the snow and ice, debut and night economies.

Yang, the street vendor, hopes the street stall economy or “ditan jingji” will emerge as a talking point during the Two Sessions, and lead to better government support.

"It would be ideal if designated times and locations could be established, so as not to affect the city’s appearance and traffic, thereby encouraging low-cost entrepreneurship,” she said.

In 2020, then-premier Li Keqiang threw his weight behind the revival of street stalls, describing them as an important source of employment that could ease the economic pain wrought by the pandemic.

The idea was quickly shot down, with Beijing Daily - the city’s municipal newspaper under China’s Communist Party - notably denouncing the traditional trade as “unhygienic and uncivilised”.

Street stalls have been making a post-COVID comeback in China. But city regulations remain a hurdle, even though some major cities like Shenzhen, Shanghai and Hangzhou have relaxed restrictions.

"In the past, city management was very strict," Yang said. "Although they still enforce rules now, they no longer confiscate our goods; they only ask us to pack up and leave.”

Meanwhile, to encourage household spending, authorities are also banking on an expansive national trade-in scheme that covers everything from automobiles and home appliances to electronics.

The central government has already pre-allocated 81 billion yuan to maintain and possibly expand coverage of the consumer goods trade-in initiative this year, a finance ministry official was quoted as saying by the state-run Global Times in January.

EASING THE FINANCIAL SQUEEZE?

Even as China looks to further support its 1.4 billion people to fire up the consumption cylinders, Niu, the self-employed Hangzhou resident, is uncertain whether help will trickle down meaningfully.

“I'm not even sure whether I should say this, but I feel that (government) support is rather like a drop in the bucket for those living in big cities,” she said.

“I received (a one-off) 2,000 yuan in unemployment benefits, but my social insurance alone costs over 900 yuan. Living in a first-tier city, (the balance of) 1,000 yuan really isn’t enough to cover even a month’s living expenses.

"As for any substantial help, I haven’t seen any around me. Those who were laid off at the same time as I was - even those let go before me - are still at home, unemployed," Niu said.

She added that the current state of the real estate industry makes finding another job in the same field “extremely difficult”.

“So when I was laid off, I never really considered looking for another job.”

Beyond urban workers, the government’s fiscal policies also hold major implications for China’s 400-million-strong blue-collar workforce.

He Chuan, a 55-year-old construction worker from Sichuan, has spent nearly four decades in the industry, witnessing the booms and busts.

The current problems in the property sector have him worried. "The real estate market has been sluggish over the past two years, leading to fewer construction projects, which has made job hunting more challenging," he explained.

Aside from a daily wage of around 400 to 500 yuan, he said construction sites typically provide 2,000 to 4,000 yuan per month for living expenses.

He also earns money by documenting his on-site work on social media. He has nearly 309,000 followers on Xiaohongshu, where he is known as “Brother Chuan”.

But he is acutely aware his fortunes could change, recalling a time when he got injured on the job.

“I did not work for half a year, which caused a lot of anxiety. During that (time), I only shot videos,” he told CNA.

Many of his construction peers don’t have that option of taking a break. According to him, many work as contractors, with neither fixed salaries nor any financial safety net.

Delays in payments - a common issue in the industry - have also made financial security increasingly precarious.

“Many workers are in flexible employment without social security, and this is an area that could be improved,” he said, adding that he and his wife likewise do not have social security.

“The government provides job recruitment and entrepreneurial support for migrant workers, which is quite helpful,” he conceded, though he still worries about his future.

“Retirement will be an issue,” he told CNA.

Huang from PIIE said such experiences underscore the urgency for the Chinese government to see through a more expansionary fiscal policy, to support workers and boost domestic demand.

“(The government) said they will raise pension payments and medical benefits for the rural population, but they haven't said how much they will raise it,” Huang said, adding that a sustainable and significant increment is also needed.

“If you only raise it by 10 yuan a month (for instance) … it's not a meaningful increase,” he remarked.

WHAT WILL THE TWO SESSIONS YIELD?

The Two Sessions will be closely scrutinised for signals or definitive announcements on China’s fiscal strategy, and whether it can effectively address both macroeconomic stability and the welfare of everyday citizens.

The first indicator to watch is whether the budgets or other fiscal measures announced will align with market expectations, EIU’s Xu emphasised.

China is set to present its GDP growth target for the year at the opening of its legislature, the National People’s Congress, on Wednesday (Mar 5). Last year’s target was “around 5 per cent”.

Xu said the second critical point to watch for is how government funds will be used, pointing to potential measures such as nationwide birth subsidies to support childbearing and child-rearing, and improvements to the social security system to expand and deepen coverage.

He also noted that a third key signal will be the extent to which the government uses its fiscal tools to support innovation.

China has been ramping up a high-tech push, or “new productive forces” - “xin zhi sheng chan li” in Chinese - as the government calls it, to revitalise the economy and improve productivity.

Artificial intelligence (AI) along with its generative aspect has emerged as a key frontier, especially with homegrown tech startup DeepSeek taking the world by storm with its latest models.

Analysts agree that one thing to watch is whether the Two Sessions yield measurable outcomes.

Huang from PIIE pointed to domestic consumption as an example. “What exactly will they do, other than the consumer product trade-in programme, industrial equipment upgrade programme?” he questioned.

“What other concrete measures will they put out to stimulate private consumption and also private investments, sustainably?”

Huang also warned that while there is a wide expectation for greater fiscal stimulus, he is concerned Chinese leaders might overpromise and underdeliver, describing it as a pattern he has observed in other East Asian countries like Japan and South Korea.

“I think this is now the number one thing I will be watching for - whether they will actually deliver the kind of fiscal stimulus that they have signalled,” he said.

Observers will also be watching the Two Sessions for possible signals on external pressures, particularly a Trump-led US that is cracking down on Chinese investments and imports.

“Are they going to signal anything regarding the US? The US is still complaining about overcapacity in China, but not only the US - actually, many countries around the globe are still worried about Chinese overcapacity,” Huang said.

He explained that over time, China has come to understand its longstanding argument that using cheaper exports as a competitive advantage is no longer politically acceptable in many parts of the world.

“Not many countries have an auto industry, but many countries have other manufacturing sectors. They all need to survive, and they simply cannot compete with Chinese exports. So it's a political issue,” Huang noted.

BRIDGING POLICY AND REALITY

Even as China strives to accelerate down the road of economic reforms and hone its focus on households to drive growth, analysts caution that multiple speedbumps beckon.

Bringing down local government debt is one such obstacle.

China unveiled a 10 trillion yuan package in December last year, aimed at reducing local governments’ hidden debt from 14.3 trillion yuan to about 2.3 trillion yuan by 2028.

Hidden debt widely refers to borrowing by local government financing vehicles (LGFVs), which are companies set up by local governments to fund infrastructure and other investment projects.

Bonds sold by LGFVs allow provincial authorities to raise money and increase their spending without logging it on their official balance sheets - effectively allowing them to circumvent borrowing limits.

The ambitious plan to slash local-level debt involves measures like debt swaps, allowing local governments to switch out their high-interest, short-term debt for longer-term, lower-interest special bonds.

In theory, this would reduce their financial burden while offering more space for them to promote economic growth and ensure livelihoods.

However, the vast amount of existing local government debt means the debt swaps will have a limited impact in stimulating the economy, Huang noted.

The national trade-in scheme also faces challenges, even as some results are reaped.

The total sales value of eligible products under the programme topped 1.3 trillion yuan last year, state news agency Xinhua reported. More than 6.8 million vehicles were traded in, while over 56 million home appliances, such as refrigerators and washing machines, were sold under the initiative.

But PIIE’s Huang warned that such “temporary measures” merely front-load consumption rather than addressing the underlying issues affecting private demand.

“More structural measures will be needed, people's income will have to go up, and people have to feel comfortable going out to shop,” said Huang.

“That requires strengthening the social safety net.”

While EIU’s Xu believes the scheme could translate into tangible improvements in people’s daily lives, he cautions that “it may not be enough”.

“It really depends on the size and the scope of what the government will do … (and) the subsidies are only targeting those people that are probably in need of that. They're not probably going to be wide enough to support all walks of life, all kinds of people,” he said.

Moreover, Xu said the trade-in programme seems to favour large producers and e-commerce platforms - the likes of JD.com, Pinduoduo and Alibaba - over smaller businesses.

“So I don't think small merchants are benefiting from that … because they lack the means to cooperate with the governments on such programmes,” he said.

“As an end result, the benefits of those programmes may not be shared evenly between different segments of the economy. And that should be a potential issue that the government should be watching.”