Up to S$500 cash for eligible Singaporeans, S$100 CDC vouchers in latest round of support measures

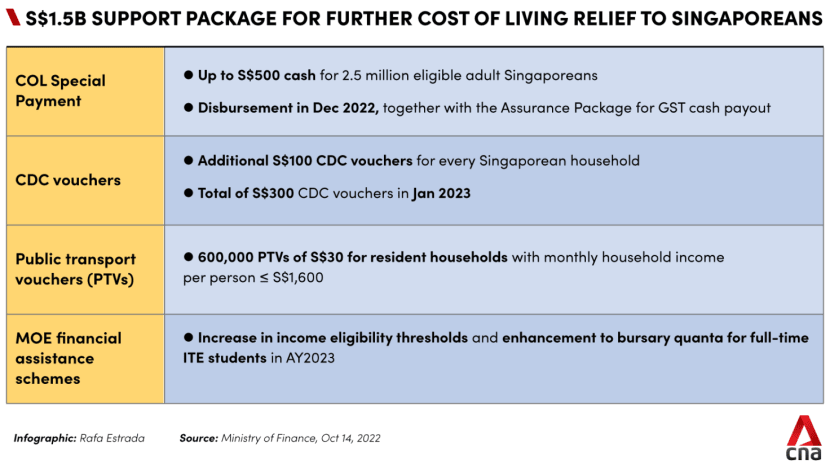

SINGAPORE: Eligible adult Singaporeans will get up to S$500 in cash, while households will get an additional S$100 CDC voucher in the latest slew of government measures to help Singaporeans cope with rising inflation and cost of living.

The measures, which include the public transport vouchers and subsidies announced after the recent fare increase, are part of an additional S$1.5 billion support package for Singaporean households, with more support for lower- to middle-income groups.

Under the package, the Government will also defray school expenses for more students by raising the income eligibility criteria for financial assistance schemes.

The package will be funded by the "better-than-expected fiscal out-turn" in the first half of financial year 2022, the Ministry of Finance (MOF) said in a statement on Friday (Oct 14).

“Omicron was milder than expected, and more sectors of the economy had opened up in tandem, boosting economic recovery,” MOF said.

The ministry said there will be no draw on past reserves for this support package.

COST-OF-LIVING SPECIAL PAYMENT

About 2.5 million eligible adult Singaporeans, or 80 per cent of income earners, will benefit from what the Government calls a “cost-of-living special payment” of up to S$500 in cash.

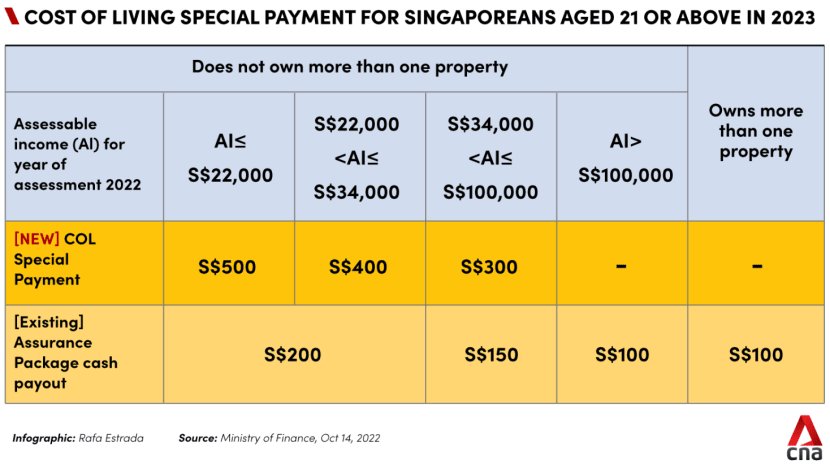

Eligible recipients are Singaporeans aged 21 or above in 2023 who have an assessable income for year of assessment 2022 of S$100,000 and below. They should also not own more than one property.

People with an assessable income of less than or equal to S$22,000 will get S$500. Those who have an assessable income of between S$22,000 and S$34,000 and between S$34,000 and S$100,000 will get S$400 and S$300 respectively.

This payout will be given in December, together with the Assurance Package for GST cash payout announced at Budget 2022. No application is required.

OTHER SUPPORT MEASURES

Every household with at least one Singapore citizen will get an additional S$100 Community Development Council (CDC) voucher in January next year. This is on top of the S$200 CDC voucher announced at Budget 2022.

Of the S$300 vouchers given to each household in total, half can be spent at supermarkets and the remaining at heartland shops and hawkers.

“The Government is also working towards allowing the donation of CDC vouchers,” MOF added.

More details on the vouchers will be released by the CDCs soon.

The Ministry of Education (MOE) will raise the income eligibility criteria for financial assistance schemes from Jan 1 next year for primary, secondary and pre-university students.

The raise will take effect from academic year 2023 for government bursaries for post-secondary and education institutions.

For instance, under the MOE financial assistance scheme for government and government-aided schools and specialised schools, the income eligibility criteria will be raised to a gross household income of less than or equal to S$3,000, or a per capita income of less than or equal to S$750.

The bursary quanta for full-time Institute of Technical Education students will also be enhanced from academic year 2023.

“MOE is reviewing the government bursaries for diploma and undergraduate students, and will share more details when ready,” MOF said.

This latest round of support measures comes after the Government announced in June a support package for households and businesses to help mitigate increased living costs from inflation and rising energy prices.

This aid, also worth S$1.5 billion, was similarly aimed at the lower-income and more vulnerable groups, and not funded by past reserves.

The latest package also builds on cost of living support measures announced in February during Budget 2022, which the Government announced in April would be brought forward amid a global rise in prices.

“This new S$1.5 billion support package, together with earlier rounds of support measures rolled out this year, will fully cover the increase in cost of living for lower-income households on average, and more than half of the increase in cost of living for middle-income households on average this year,” MOF said.

Deputy Prime Minister Lawrence Wong said during a press conference on Friday that the range of support measures this year will also fully cover the increase in cost of living for retiree households.

"I understand that Singaporeans are also concerned about the upcoming GST increase, and as I have explained previously, the Government is fully committed to cushion the impact of the GST increase for all Singaporeans," he said.

The first GST increase from 7 per cent to 8 per cent will take place on Jan 1, 2023, and the second increase from 8 per cent to 9 per cent will take place on Jan 1, 2024.

Mr Wong, who is also Finance Minister, reiterated that the enhanced Assurance Package, announced in Budget 2022, is meant to cover at least five years of additional GST expenses for the majority of Singaporean households, and about 10 years for lower-income households.

"And to keep to this commitment, we will review the sizing and components of the Assurance Package to account for the higher-than-expected inflation, and I will provide more details on this at Budget next year," he said.

"The Government will continue to live within our means and ensure fiscal sustainability."

Earlier on Friday, Singapore’s central bank tightened monetary policy as expected, for the fifth time in a year.

On top of its regular adjustments in April and October, the Monetary Authority of Singapore made two surprise moves in January and July, in bids to strengthen the Singapore dollar and dampen inflation.

Singapore’s core inflation has been steadily rising and August’s figure of 5.1 per cent was just shy of a 14-year high of 5.5 per cent reported in November 2008.

“While supply chain frictions have eased slightly, the ongoing conflict in Ukraine continues to put pressure on commodity prices,” MOF said.

“As a small, open economy, Singapore is particularly susceptible to imported price pressures, through channels such as food and energy.

“Domestically, a tight labour market continues to support strong wage growth. As such, we must be prepared for inflation to stay elevated for some time.”