Banks, e-commerce platforms ramp up safeguards as online scams evolve

Industry players say better checks are needed as scammers increasingly use artificial intelligence to mimic legitimate transactions.

Banks and e-commerce platforms have stepped up safeguards and consumer education, urging shoppers to slow down, verify transactions and use in-app security tools to reduce the risk of falling victim to scams. (Photo: iStock)

This audio is generated by an AI tool.

SINGAPORE: From tighter identity checks and real-time payment alerts to in-app advisories and transaction nudges, banks and e-commerce platforms in Singapore say they have strengthened targeted anti-scam measures, as fraud tactics grow more sophisticated and increasingly resemble legitimate online behaviour.

The year-end period proved especially risky, with higher volumes of online shopping, travel bookings and reselling activity, creating opportunities for scammers to exploit urgency and consumer demand.

HIGH-DEMAND ITEMS A KEY RISK

Online marketplace Carousell said high-demand items such as concert tickets and collectibles carried the most risk for buyers over the year-end period.

Police advisories echoed this, warning of resale ticket scams involving fake screenshots or payment receipts, as well as trading card scams where victims paid deposits for pre-orders that never arrived.

Over S$600,000 (US$467,000) was lost in more than 700 concert ticket scam cases in the first 10 months of 2025, the police previously said.

Losses were also reported in Pokemon trading card scams involving pre-orders that never arrived, with at least S$958,000 lost across more than 470 cases since October, bringing total losses from such high-demand item scams to over S$1.5 million.

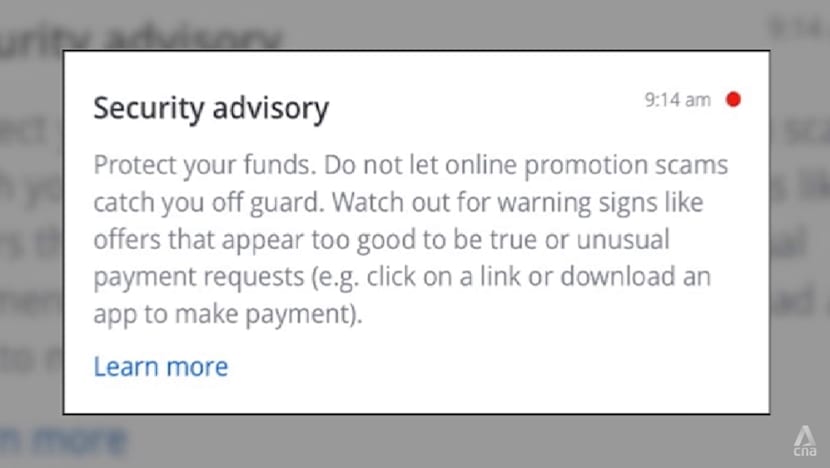

To counter this, Carousell rolled out tighter Singpass verification for higher-risk categories and added in-app safety advisories cautioning users against upfront payments or moving transactions off the platform.

Still, abuse remains difficult to detect.

“The e-commerce scams are a lot more difficult to control because to us, they often look like a normal transaction,” said Mr Gijs Verheijke, director of trust and customer experience at Carousell.

He added that scammers are increasingly using artificial intelligence (AI) to tailor messages, making “it more difficult for us to detect … because they look more like a normal user talking to another normal user”.

He said Carousell relies on a wide range of signals to detect suspicious behaviour, including device and IP location, event patterns and email domains, which feed into its AI models to suspend accounts “even before they do harm”.

The platform continues to emphasise two safer ways to transact – meeting sellers in person to inspect items before payment, or using its buyer protection system, which holds funds in escrow until buyers confirm receipt.

Carousell also flagged a newer scam trend uncovered in mid-2025, where scammers impersonated sellers by emailing victims using usernames that matched their email addresses.

“So anyone who gets an email out of the blue about a Carousell listing should be really careful, because that's almost certainly a scam,” Mr Verheijke said, adding that the company has since changed its default username settings and introduced in-app prompts to reduce such risks.

BANKS SEE SEASONAL SPIKE IN SCAMS

Banks say scam activity typically rises toward the end of the year, particularly for e-commerce and travel-related fraud such as fake hotel bookings and festive purchases.

“Towards the end of the holiday, you see the scams going up by maybe 10 to 20 per cent than the usual amount,” said Mr Beaver Chua, head of anti-fraud at OCBC.

“Then after that, (it) will taper back again. (During the upcoming Chinese New Year period), you will see it going up again. There is, surprisingly, a seasonality effect as well, depending on the festivity.”

However, overall reported scam cases in Singapore have declined, even as total financial losses remain high.

According to the Singapore Police Force’s mid-year scam and cybercrime statistics, the total number of scam cases in the first half of 2025 fell by about 26 per cent to 19,665, compared with the same period in 2024. Total losses also decreased by roughly 12.6 per cent to about S$456.4 million over the same period.

Mr Chua pointed to government official impersonation scams and investment scams as particular areas of concern, as they tend to involve larger sums.

“These are the two types of scams that we are quite worried about, because these are targeted large value losses in comparison to things like e-commerce,” he added.

OCBC has rolled out additional safeguards, including secure in-app calls to help customers distinguish legitimate bank staff from fraudsters, enhanced scam surveillance and frontline training to identify signs of distress.

Its broader anti-scam measures such as money lock, kill-switch functions and cooling-off periods for account changes helped prevent S$10.5 million from being lost to scams in 2025.

It also phased out SMS one-time passwords for mobile wallet provisioning, resulting in a 98 per cent drop in related scam cases in the fourth quarter of 2025 compared with a year earlier.

Mr Chua urged customers to remain vigilant and use available safeguards, particularly during peak periods.

DBS and POSB similarly warned that fake sellers, unrealistic discounts and delivery-related phishing attempts tend to spike during year-end sales.

The bank group said it has stepped up public education and urged customers to slow down, verify transactions and make full use of security tools such as payment controls and digital vaults.

PLATFORMS STRESS EDUCATION AND VERIFICATION

E-commerce platform Amazon said its focus remains on consumer education, urging shoppers to verify purchases only through its app or website, ignore unsolicited messages and be wary of pressure to act quickly.

It warned that scammers continue to rely on false urgency and impersonation, using look-alike logos, messages and links to trick consumers during busy shopping periods.

The company said it continues to work with authorities and industry partners to take down phishing sites and scam phone numbers swiftly.

Meanwhile, Shopee said it reminds users to complete transactions strictly within the app, avoid sharing passwords or one-time passcodes, and rely only on official communication channels. Consumers who encounter suspicious activity are also encouraged to report it in-app.

Singapore’s consumer protection body, the Consumers Association of Singapore (CASE), advised shoppers to research and compare prices, patronise CaseTrust-accredited or reputable platforms with buyer protection features, and avoid making payments outside official channels.