Singapore firms power Batam’s tech and manufacturing boom

But with rising regional competition, experts say the Indonesian island must tackle talent gaps and cut red tape to stay ahead.

The Nongsa Digital Park is a 166ha technology and creative hub in northeastern Batam.

This audio is generated by an AI tool.

BATAM: Singapore companies are powering a new economic boom on the Indonesian island of Batam, drawn by lower costs and a growing pool of local talent.

Operators of business parks there with a strong Singapore presence say Batam offers cost savings, particularly for manufacturing and tech-related operations.

Amid renewed talks about economic integration within the Association of Southeast Asian Nations (ASEAN), experts believe the island could draw even more interest from industries looking to tap its strengths.

Singapore remains Batam’s largest investor. It pumped in S$632 million (US$483 million) in the first half of 2025, underscoring its confidence in the island’s potential.

CREATIVE AND DIGITAL HUB

Since 2005, Singapore media firm Infinite Studios has operated in the Nongsa area, long before the site was formalised as Nongsa Digital Park, a 166ha technology and creative hub in northeastern Batam.

Parts of several blockbuster films have been produced at the studio, with Indonesians forming the bulk of the creative workforce.

What began as a three-person team has grown to nearly 400 employees, fuelled by young digital and creative talent relocating to the island.

“For us as a creative company, we really were lucky to be able to tap into the possibility of expanding into more cost-efficient real estate and having that abundance of talent. That's how we're able to grow our business,” said Infinite Studios CEO Mike Wiluan.

The park, launched in 2018, now hosts a mix of Indonesian firms and international players, including Singapore outfits and global tech giants such as Apple and Infineon.

Many use Batam as a base to offshore lower-cost work and train new talent amid the global artificial intelligence boom.

Central to Nongsa’s development is its growing cluster of data centres, with 13 already in operation and more on the way.

These facilities are critical to the AI industry, providing the massive computing power needed to train and run AI systems.

Mr Wiluan, who is also the CEO of Nongsa Digital Park, noted that data centres come with power, water and connectivity infrastructure that companies can tap.

“Now, being in that ecosystem and having that accessibility to power (and) water consistently, gives confidence to businesses to know that they're probably going to experience less power outages, they're going to have more connectivity, and they're in a safe environment.”

INDUSTRY CLUSTERS

In the island’s centre is Batamindo Industrial Park, owned by Singapore-listed investment holding company Gallant Venture.

Opened in 1990, the park has grown by more than a third since 2021 and is a hive of electronics manufacturing activity.

Many Singapore firms there operate on a "twinning model" – with manufacturing in Batam and other functions like research and development in Singapore. The proximity to Singapore also gives firms quick access to the country’s sea ports and airport.

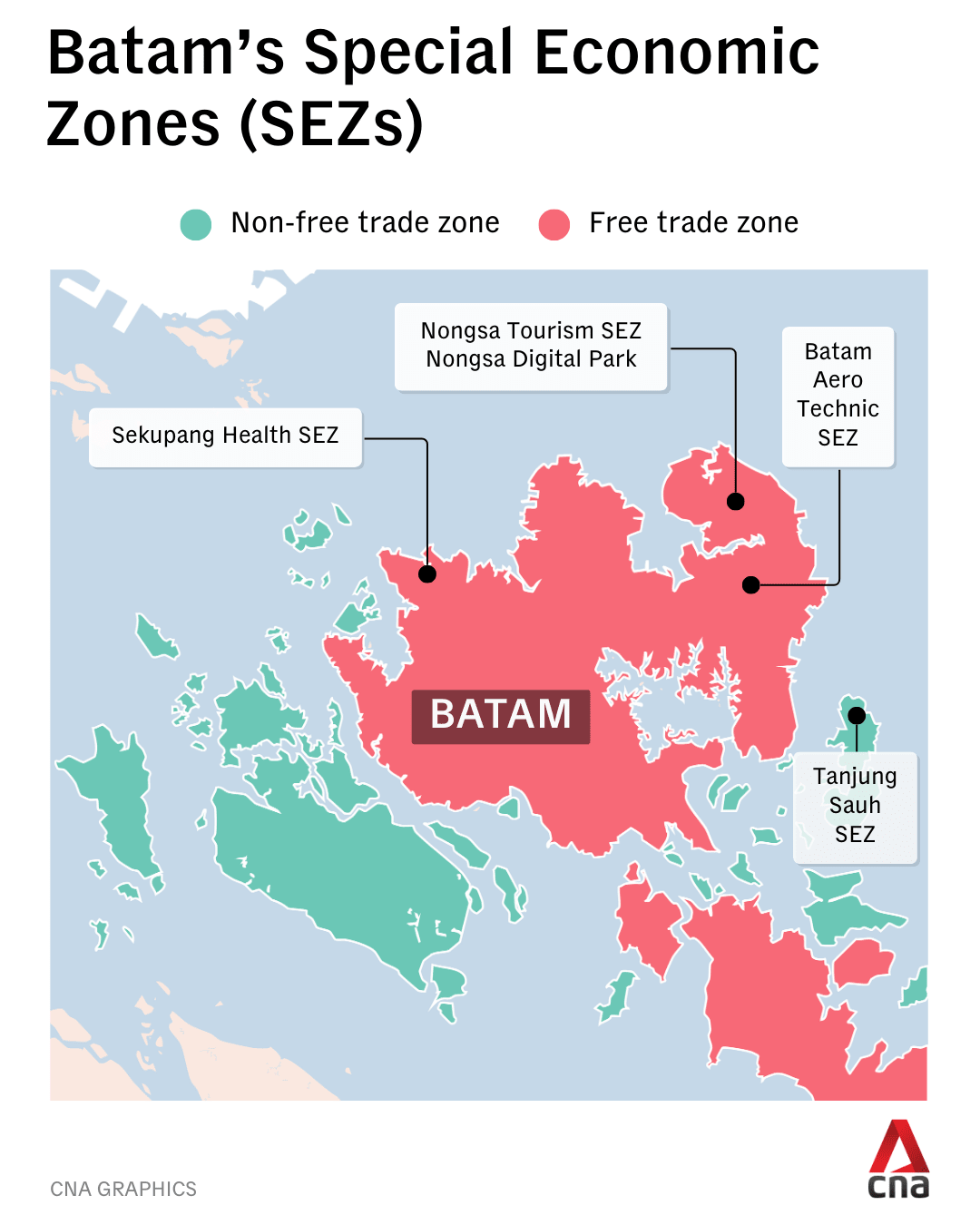

Batamindo sits within the Batam Free Trade Zone which is adjacent to five Special Economic Zones (SEZs), including the Nongsa Digital Park.

The other SEZs focus on sectors such as health services, aviation and electronics. They are:

- Nongsa Tourism SEZ: A destination for tourism, hospitality, and MICE-related developments.

- Batam Aero Technic SEZ: An aviation cluster specialising in aircraft maintenance, repair and overhaul.

- Sekupang Health SEZ: A medical and wellness zone focused on health services and medical tourism.

- Tanjung Sauh SEZ: A logistics and trans-shipment zone positioned to support regional port and cargo activities.

These zones offer tax concessions and customs benefits that reduce export costs and attract foreign investment.

Indonesia's Batam, Bintan and Karimun Islands, Malaysia's Johor state and Singapore also form what is known as the Sijori Growth Triangle – a vision launched in 1989 to integrate trade and investment flows.

In October, Singapore said it intends to revisit the concept and explore new avenues for collaboration.

TALENT GAPS REMAIN

But with shifting global dynamics and the upcoming Johor-Singapore SEZ, experts say Batam may now face stiffer competition for investment.

To stay competitive, they caution it will need to cut red tape and upgrade its workforce.

“It's easy to find people at your basic assembly line level,” said Dr Francis Hutchinson, a senior fellow at the ISEAS-Yusof Ishak Institute’s Regional Economic Studies Programme.

“But if it comes to be more sophisticated, when you're really talking about (work that requires) a diploma level or an undergraduate level, that's where things are more difficult, and you don't really have that sort of base of local universities that are plugged into what firms want.”

Dr Hutchinson added that AI could eventually reduce demand for some outsourced jobs – such as digital bookkeeping and data analytics – though it remains too early to gauge the full impact.

Still, he said he believes Batam will continue to appeal to established manufacturers, e-commerce companies and creative sectors.