Budget 2023: Government-paid paternity leave to double to 4 weeks; mandatory for employers in due course

Changes to the tax relief for working mothers with children born from 2024 were also announced by Deputy Prime Minister Lawrence Wong.

A close-up of a newborn baby's feet. (Photo: iStock)

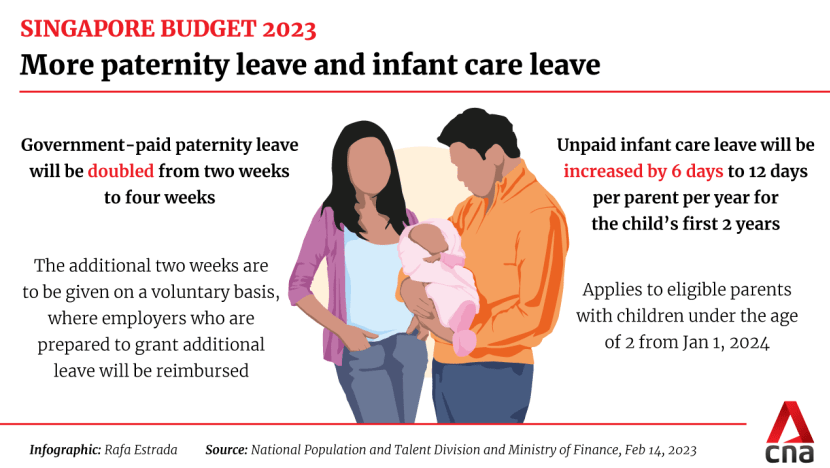

SINGAPORE: Government-paid paternity leave will be doubled from two to four weeks for fathers of Singaporean children born from Jan 1, 2024.

For a start, employers can choose to grant the additional two weeks of leave on a voluntary basis and will be reimbursed by the Government.

“This is also to give more time for employers to adjust, especially taking into account the existing economic conditions and manpower and operational challenges that many employers face,” said Deputy Prime Minister Lawrence Wong as he announced the move in his Budget speech on Tuesday (Feb 14).

When government-paid paternity leave was first introduced 10 years ago, take-up rates were low, said Mr Wong, who is also Finance Minister.

“But over time, the situation has changed. Today, more than half of our fathers take paternity leave,” he added.

“I am heartened by this trend, we should all be. Because many studies, internationally and in Singapore, have shown that children with more involved fathers have better physical, cognitive and emotional developmental outcomes.”

The scheme to offer an additional two weeks of paternity leave will be reviewed, said Mr Wong, adding that the Government intends to make it mandatory in due course.

Related:

Self-employed people who are engaged in a particular business, trade, profession or vocation for at least three continuous months before their child is born will also be eligible for the additional paternity leave, said the National Population and Talent Division (NPTD) in a separate media release.

“With the doubling of paternity leave, I hope the message is clear. We want paternal involvement to be the norm in our society, and we will stand behind all our fathers who want to play a bigger role in raising our children,” said Mr Wong.

Unpaid infant care leave, which can be taken in the child’s first two years, will also be doubled from six days to 12 days per parent per year, announced Mr Wong.

This will apply from Jan 1, 2024, for eligible parents with Singaporean children aged under two.

Employers must grant all eligible parents this additional time off if they have worked for the company for at least three continuous months, said NPTD.

“This will give parents more time to bond with and care for their newborn, or to settle caregiving arrangements,” Mr Wong added.

The Government will increase paid paternity leave in the public service to four weeks from Jan 1, 2024, said the Public Service Division (PSD) on Tuesday in response to media queries.

It also already provides for public officers to take additional unpaid infant care leave of up to four weeks in their child's first two years of life, the PSD spokesperson said.

Related:

TAX RELIEF FOR PARENTS

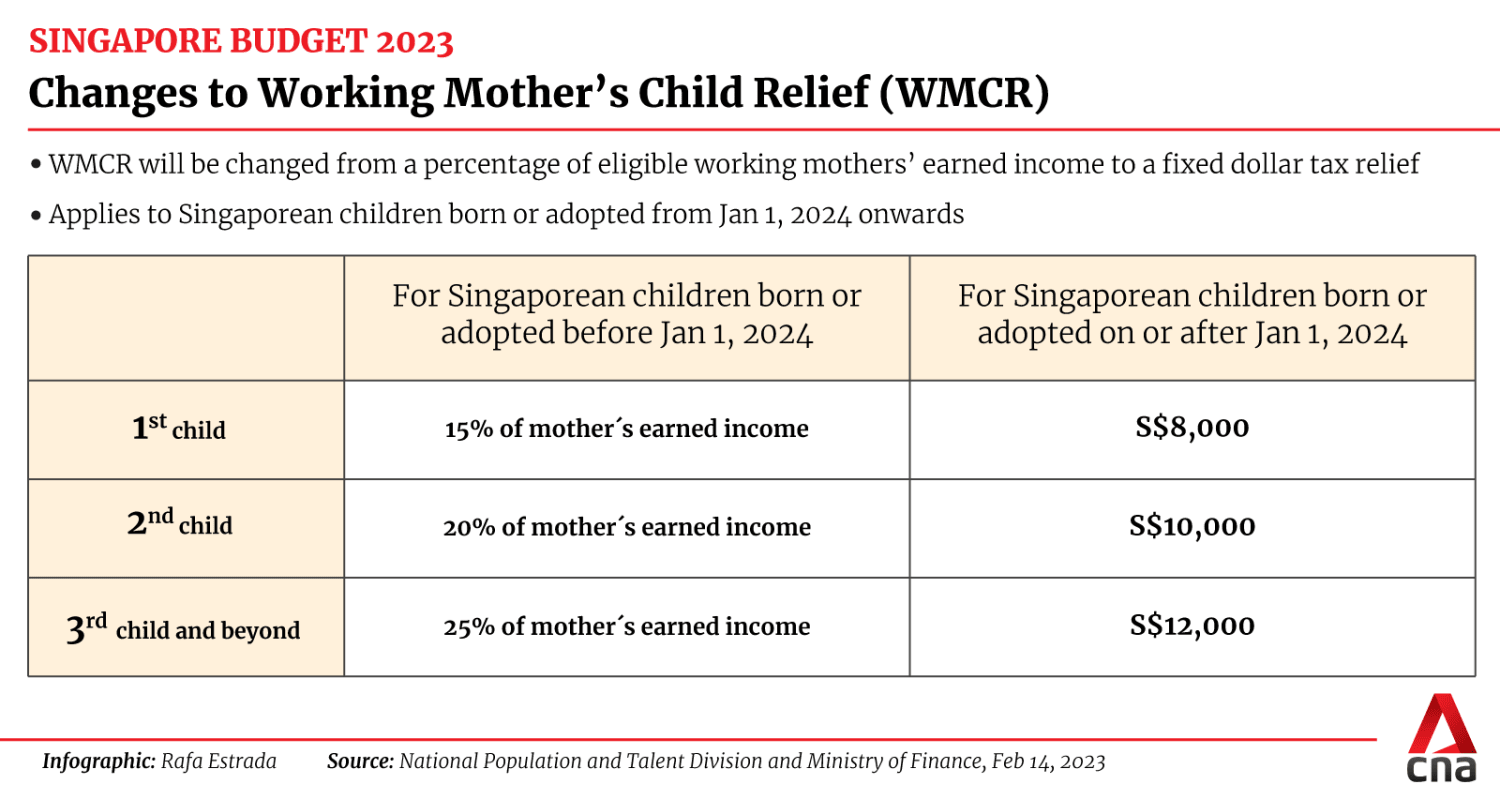

For working mothers with Singaporean children born or adopted from Jan 1, 2024, their Working Mother’s Child Relief will be changed from a percentage of their earned income to a fixed sum, Mr Wong announced.

Eligible working mothers will be able to claim S$8,000 in tax relief for their first child, S$10,000 for their second child and S$12,000 each for their third child and beyond, he added.

Currently, working mothers can claim 15 per cent, 20 per cent and 25 per cent of their earned income for their first, second and third or subsequent children in tax relief.

This will take effect from the Year of Assessment 2025, which would take into account their earnings from 2024.

For working mothers with Singaporean children born or adopted before Jan 1, 2024, there will be no changes to their Working Mother’s Child Relief. They can continue to claim it based on the existing scheme, said NPTD in its media release.

For example, if a working mother has two Singaporean children born in 2021 and 2024, she will be able to claim a tax relief of 15 per cent of her earned income for the first child and S$10,000 for her second child for the 2025 Year of Assessment.

The total amount of relief an eligible working mother can claim for all her children is capped at 100 per cent of her earned income for the Year of Assessment. It is also subject to a total cap of S$50,000 per child.

“Effectively, this will provide more Government support for eligible lower- to middle-income working mothers,” said Mr Wong.

The Foreign Domestic Worker Levy Tax Relief will lapse from the Year of Assessment 2025, said Mr Wong.

“This is because we already have a migrant domestic worker levy concession, which provides more targeted support for families who need help caring for their dependents, including young children below 16 years old,” he explained.

Currently, the concessionary levy is S$60 per month, compared to the standard levies of S$300 and S$450 per month for the first and subsequent domestic helpers respectively. Families caring for dependents, including children below 16 years old, the elderly or people with disabilities who need a migrant domestic worker, can benefit from this concessionary levy.

The Foreign Domestic Worker Levy Tax Relief was introduced in 1989 to support working married women who needed the help of a migrant domestic worker, especially those with childcare needs.

Under the current scheme, eligible individuals can claim double the total migrant domestic worker levy they paid in the preceding year for one domestic worker, said NPTD.