Budget 2026: Higher qualifying salaries for Employment Pass, S Pass holders

The local qualifying salary, which sets the minimum salary that local employees must be paid in firms that hire foreigners, will also be raised to S$1,800 this year.

Office workers in the central business district of Singapore. (Photo: CNA/Raj Nadarajan)

This audio is generated by an AI tool.

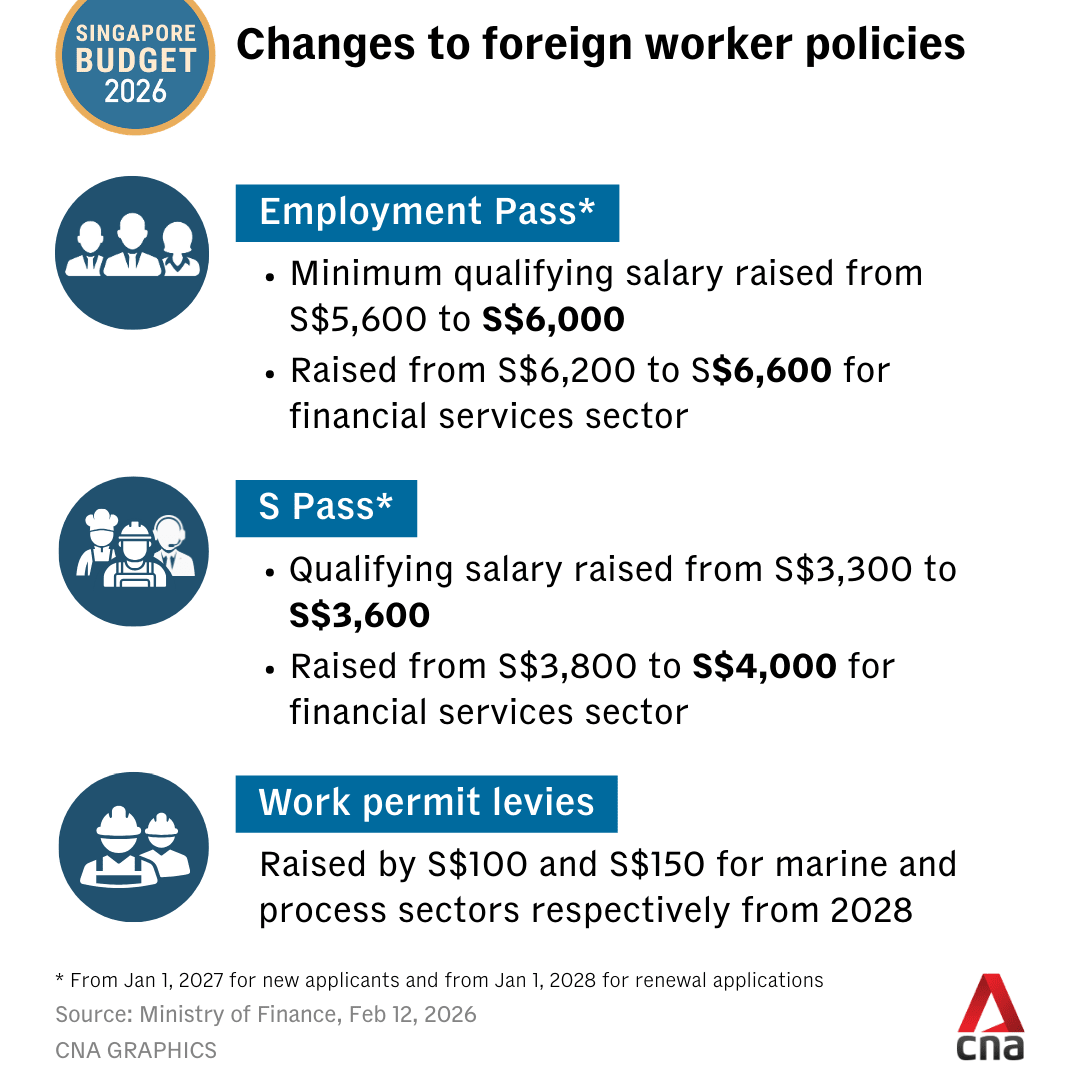

SINGAPORE: Singapore will raise the qualifying salaries for Employment Pass and S Pass holders from January 2027, Prime Minister Lawrence Wong said in his Budget speech on Tuesday (Feb 12).

For Employment Pass holders, the minimum qualifying salary will increase from S$5,600 (US$4,400) to S$6,000. The financial services sector will maintain a higher minimum qualifying salary, which will increase from S$6,200 to S$6,600.

For S Pass holders, the minimum qualifying salary will increase from S$3,300 to S$3,600. In the financial services sector, the minimum qualifying salary will be raised from S$3,800 to S$4,000.

The qualifying salaries for older Employment Pass and S Pass applicants will rise in tandem.

The changes will apply to new Employment Pass and S Pass applications from Jan 1, 2027, and to renewal applications from Jan 1, 2028.

Mr Wong said the changes to foreign workforce policy reflect the government's approach "to stay open to skills and expertise that strengthen our economy, while ensuring that Singaporeans remain firmly at the centre of our workforce and our policies".

SUPPORT FOR LOWER-WAGE WORKERS

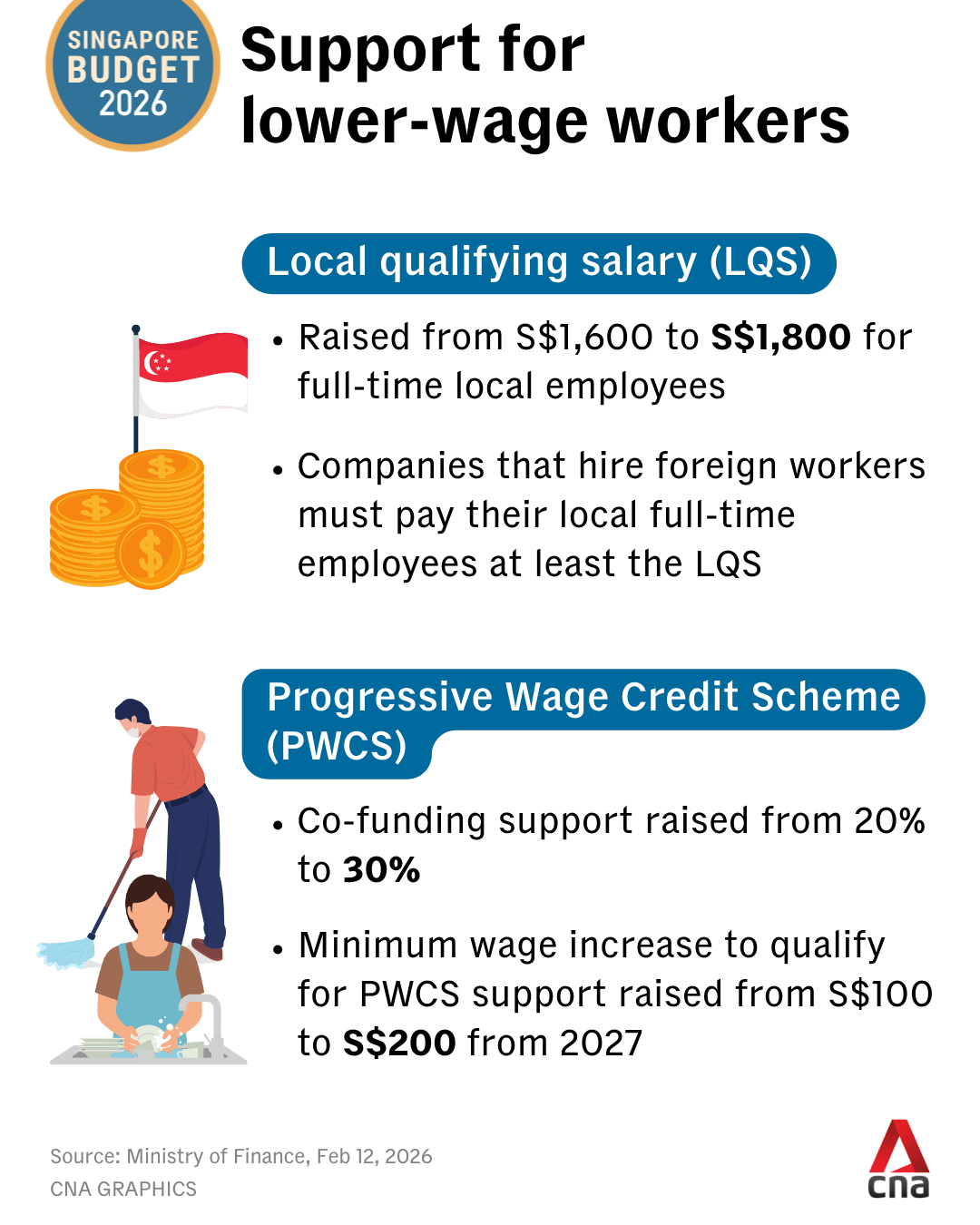

The government will also strengthen support for lower-wage workers.

From Jul 1, the local qualifying salary will be raised from S$1,600 to S$1,800 for full-time local employees.

This means that firms hiring foreign workers must pay full-time employed local workers at least S$1,800 a month, according to the Ministry of Finance's factsheet.

This is because firms that hire foreign workers must pay Progressive Wage Model salaries to local employees covered by the scheme, and must pay all other local employees at least the local qualifying salary.

The government will also enhance co-funding support under the Progressive Wage Credit Scheme, which supports employers as they adjust to mandatory wage increases under the Progressive Wage Model or voluntarily increase the pay of lower-wage workers.

The co-funding support will rise from 20 per cent to 30 per cent for wage increases given in the qualifying year 2026.

The Progressive Wage Credit Scheme will also be extended for two more years.

There will be 30 per cent co-funding support for wage increases given in the qualifying year 2027, and 20 per cent co-funding support for wage increases in the qualifying year 2028.

At the same time, to better target support, firms will need to meet a higher minimum qualifying wage increase to be eligible for the Progressive Wage Credit Scheme.

Currently, an average gross monthly wage increase of S$100 is required. This will be raised to S$200 for qualifying years 2027 and 2028.

Mr Wong said the measures build on the Progressive Wage Model, which goes beyond a “simple flat minimum wage” and links pay increases to skills, productivity and career progression.

“And it is delivering results,” he said.

The prime minister noted recent findings on inequality released by the finance ministry.

He said these showed that over the past decade, Singapore has made good progress with broad-based wage increases and smaller income gaps.

"These improvements did not happen by chance. Left entirely to market forces, they would not have occurred on their own," he said.

Mr Wong added that in many advanced economies, inequality becomes more entrenched as growth slows and Singapore faces the same underlying pressures.

"The government has and will continue to lean against these trends, and strive to ensure that the fruits of growth are shared widely and fairly," he said.

"Every Singaporean, regardless of where they start in life, should have a fair chance to pursue their aspirations and realise their full potential."

He added that the government will also enhance the basic tier of the Workfare Skills Support scheme for workers who attend short courses.

The hourly allowance for workers who upgrade their skills will be increased.

WORK PERMIT LEVIES

The government will also adjust work permit levies.

In the marine shipyard and process sectors, monthly levy rates for basic-skilled work permit holders will increase by S$100 and S$150 respectively.

There will be no change to the monthly levy rates for higher-skilled work permit holders.

In the services and manufacturing sectors, the current three tiers of levy rates for work permit holders will be simplified to two tiers.

The tiers are based on each firm's level of utilisation of its work permit holder quota, known as the dependency ratio utilisation.

The bottom two tiers of dependency ratio utilisation will be merged for the services and manufacturing sectors.

In services, this means there will be two tiers – for dependency ratio utilisation of up to 25 per cent, and from above 25 per cent to 35 per cent.

In the newly expanded bottom tier, the monthly foreign worker levy rate will be S$400 for higher-skilled workers and S$600 for basic-skilled workers.

In manufacturing, the two tiers will be for dependency ratio utilisation of up to 50 per cent, and above 50 per cent to 60 per cent.

In the newly expanded bottom tier, the monthly foreign worker levy rate will be S$300 for higher-skilled workers and S$470 for basic-skilled workers.

These changes will be implemented from 2028 in order to give firms time to adjust. More details on the timeline will be announced by the Ministry of Manpower.

Editor's note: An earlier version of the article stated that the basic tier of the Workfare Skills Support scheme will be enhanced for workers who take up long-form training courses. This is incorrect. It should be short courses. We apologise for the error.