DBS digital banking services disrupted for second time in under 2 months; ATMs also affected

DBS cited a "system issue" unrelated to a recent outage.

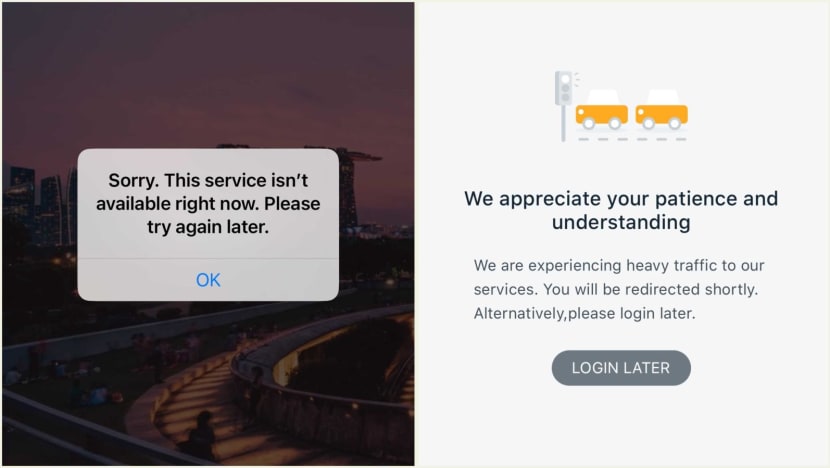

Screenshots of error messages seen on DBS' iBanking mobile app and the PayLah! app.

SINGAPORE: DBS online banking and payment services were disrupted on Friday (May 5) for the second time in less than two months.

Customers reported difficulties logging in to DBS/POSB digital banking, the PayLah! mobile wallet and DBS Vickers mTrading.

Automated teller machines (ATMs) were also affected, while some users said they were unable to use the paywave feature on their DBS cards.

Another customer said she was unable to pay for an order on mobile shopping platform Shopee with her DBS credit card.

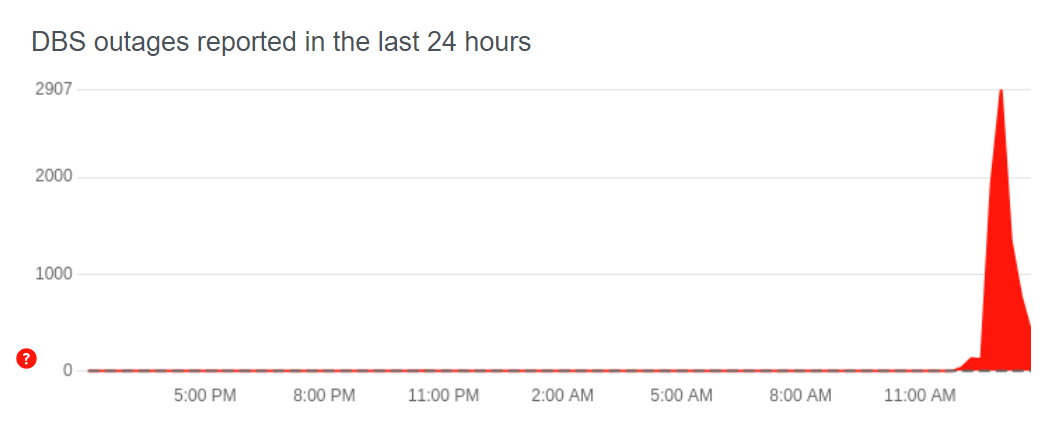

Reports of disruptions to DBS banking services spiked at about noon on Friday on the website Downdetector, which tracks outages.

In a statement on Friday night, Singapore's largest lender apologised for the inconvenience and said the disruption was caused by a "systems issue" unrelated to a day-long outage about a month ago, on Mar 29.

The issue is also not linked to DBS' 5 million hawker meals programme, which gives a S$3 discount at 12,000 food stalls every Friday to the first 100,000 PayLah! customers.

Earlier in the day, DBS said in response to complaints on its Facebook page that it was experiencing intermittent issues.

"We seek your kind patience to try again later due to high login traffic volume," it added.

In a statement at about 2.50pm, the bank said its digital systems returned to normal within 45 minutes at 1.30pm.

"Please be assured our systems are uncompromised, and your monies and deposits remain safe," it added.

DBS said in a later update that "as at 3.10pm, all our ATMs are up and running".

DBS CEO APOLOGISES

Late on Friday, the Monetary Authority of Singapore (MAS) said it had imposed on DBS an additional capital requirement following the successive disruptions, including the earlier one on Mar 29.

DBS will now need to apply a multiplier of 1.8 times to its risk-weighted assets for operational risk, bringing its total additional regulatory capital to approximately S$1.6 billion (US$1.2 billion).

This is up from the 1.5 times multiplier and S$930 million in additional regulatory capital imposed by MAS in February 2022, after a major disruption that lasted two days.

Following the latest incident, DBS CEO Gupta apologised for the disruptions and said that the special board committee review would be completed "as a matter of utmost priority".

"Our customers rightly expect more of us, and we are committed to doing better," he added.

The bank also noted that MAS' supervisory action would reduce its Common Equity Tier 1 capital ratio - which compares capital to assets - from 14.4 per cent to 14.1 per cent.

The special board committee was set up to investigate the day-long outage on Mar 29.

Although the causes of the March and May incidents appear distinct from each other, MAS has now required the review to cover the May incident as well.

The regulator had said following the Mar 29 incident that the disruption was "unacceptable" and that the bank has fallen short of the regulator’s expectations.

"MAS will take the commensurate supervisory actions against DBS after gathering the necessary facts,” it said then.

At the bank's annual general meeting on Mar 31, chief executive Piyush Gupta also apologised for the service disruption, calling the incident "sobering".

"Ensuring uninterrupted digital banking services 24/7 has been our key priority," he said. "Unfortunately, we fell short and I’m truly sorry. Our customers and our shareholders deserve better."

Earlier this week, DBS reported a stronger-than-expected 43 per cent jump in first-quarter profit to a new high from a year earlier on a higher net interest margin, sustained business momentum and resilient asset quality.