What you need to know as Singapore banks raise interest rates on their savings accounts

The three local lenders – DBS, OCBC and UOB – have raised interest rates on their flagship savings accounts twice since August.

A row of ATMs in Singapore. (File photo: OCBC)

SINGAPORE: In a bid to stay competitive amid a rising rate environment, DBS, OCBC and UOB have raised interest rates on their flagship savings accounts twice in the past four months.

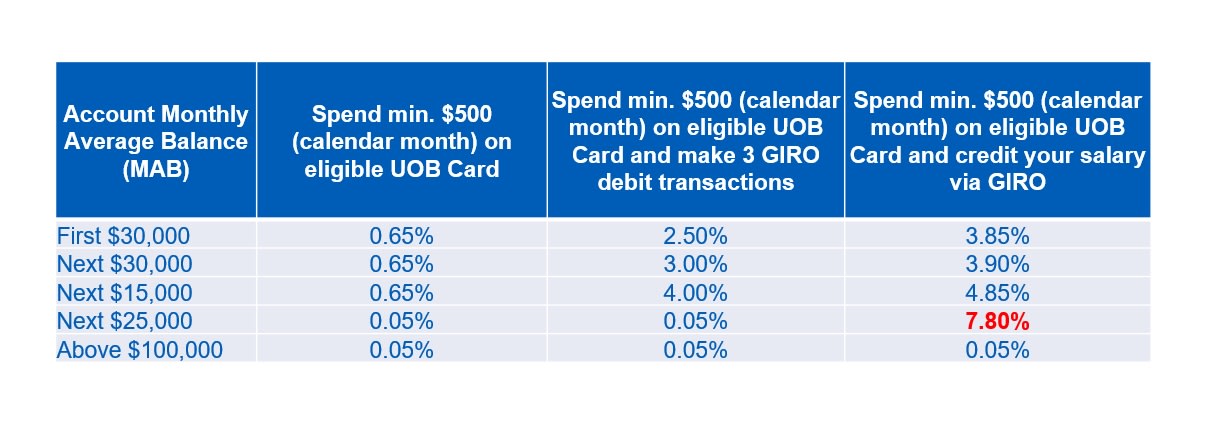

UOB announced last week that it would lift the maximum bonus interest rate on its One account to 7.8 per cent a year, more than double from the previous 3.6 per cent.

This follows similar hikes by the other local banks in early-November.

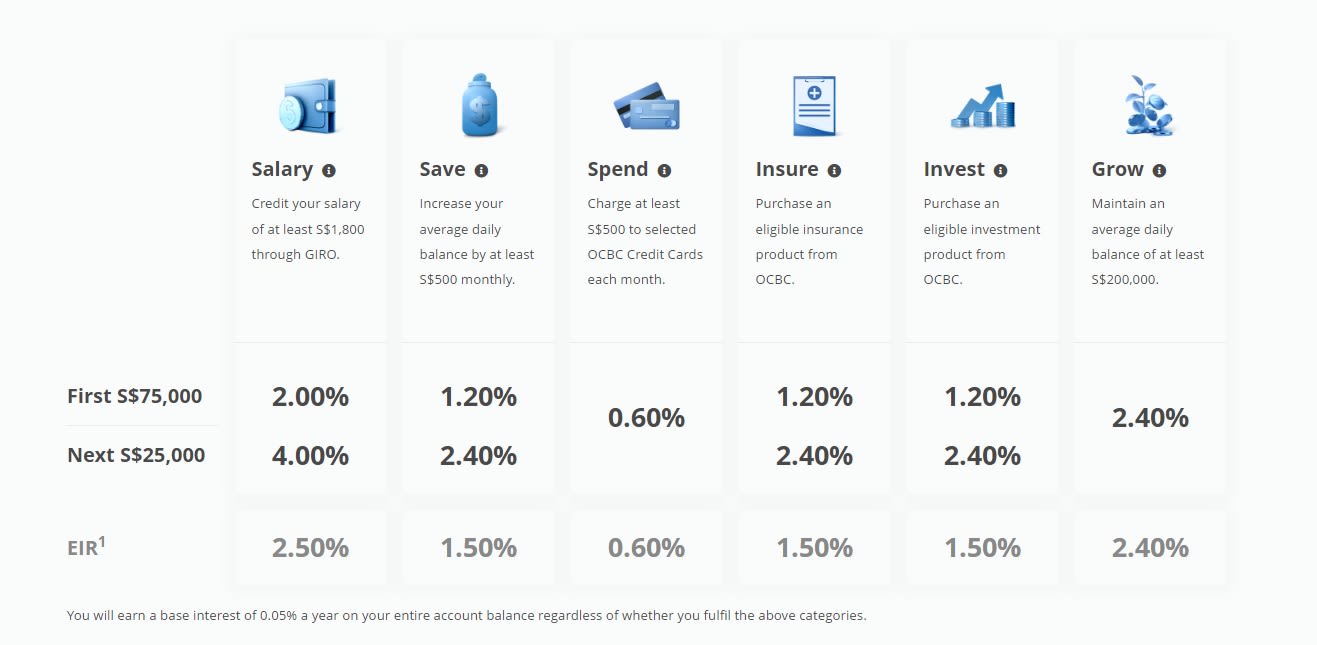

OCBC now pays a maximum of 7.65 per cent a year for its 360 savings account, up from 4.05 per cent, while the highest rate on DBS’ Multiplier account went up from 3.5 per cent to 4.1 per cent per annum.

The rate increases are welcome news for savers following two years of low interest rates amid the COVID-19 pandemic. In fact, two of these savings accounts – OCBC’s 360 account and UOB’s One account – now serve up the highest rates since they were launched.

While mulling the best option for one’s savings, it is important to note that there are conditions to fulfil in order to achieve the highest advertised rates.

Essentially, these flagship savings accounts offer tiered interest rates that go up as customers grow their account balance, spend more on eligible cards and conduct other transactions with the bank such as taking up a mortgage or insurance plan.

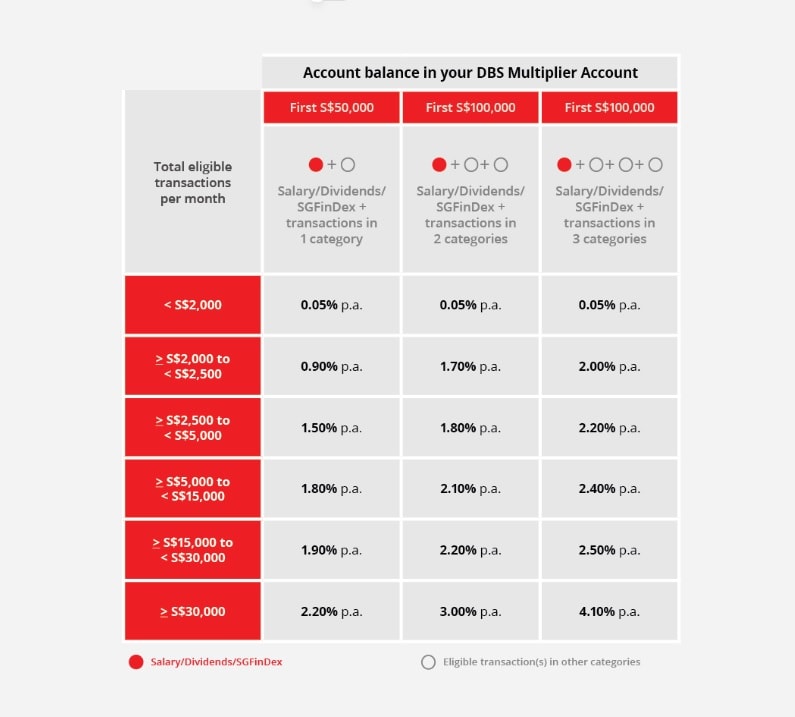

For example, DBS’ maximum interest rate of 4.1 per cent applies to the first S$100,000 in a Multiplier account and when the account holder credits an income stream – such as salary or stock dividend – while chalking up at least SS$30,000 in eligible transactions a month across any three categories. These categories are credit card spending, home loan instalments, insurance and investments.

Over at OCBC, the bank pays 4.65 per cent a year on balances up to S$100,000 and if customers credit at least S$1,800 of salary into their accounts through GIRO, increase their account balance by at least S$500 a month and spend a minimum of S$500 on certain credit cards.

The interest rate goes up to 7.65 per cent when customers invest and buy insurance through the bank, although these investment products and insurance policies would only qualify for 12 months of bonus interest.

And to qualify for UOB’s maximum bonus interest rate of 7.8 per cent, account holders will need to have an account balance of at least S$75,000, credit a salary of above S$1,600 and spend at least S$500 a month on eligible cards.

It is also key to note that this is a tiered interest rate, meaning that it applies to only a fraction of one’s savings – specifically, deposits between S$75,000 and S$100,000.

Hence the effective interest rate on the One account for deposits of S$100,000 is 5 per cent per annum, according to the bank’s website.

HOW THE RATES STACK UP

Let’s take the example of a person with a take-home pay of S$3,000, chalks up S$500 in credit card spending each month and has S$100,000 stashed away in his bank account.

This would be more than enough to qualify for the maximum bonus interest rates at UOB, translating into S$5,002.50 in interest earned a year.

| Monthly account balance | Interest per annum | Interest earned p.a. |

| First S$30,000 | 3.85% | S$1,155 |

| Next S$30,000 | 3.90% | S$1,170 |

| Next S$15,000 | 4.85% | S$727.50 |

| Next S$25,000 | 7.80% | S$1,950.00 |

| Total: |

S$5,002.50 |

At OCBC, the same person would also earn some bonus interest after meeting salary and card spending criteria. By qualifying for two out of six categories, his annual interest would work out to about S$3,150 per annum.

Assuming the individual manages to grow his account balance each month, he will also qualify for a third category and in turn, the maximum effective interest rate of 4.65 per cent for all his savings. This translates into an annual interest of about S$4,650.

| Monthly balance | Interest per annum for 2 categories |

Interest earned | Interest per annum for 3 categories |

Interest earned |

| First S$75,000 | 2.65% | S$1,987.50 | 3.85% | S$2,887.50 |

| Next S$25,000 | 4.65% | S$1,162.50 | 7.05% | S$1,762.50 |

| Total: | S$3,150 | Total: | S$4,650 |

In the case of DBS, the person would have chalked up S$3,500 in eligible monthly transactions while fulfilling one category (card spending). This would yield an interest rate of 1.5 per cent on the first S$50,000 of savings – translating into S$777.45 of interest a year – based on calculations done on DBS’ website.

In another example where a person has a lower account balance, say S$50,000, UOB still pays the highest interest although the gap with OCBC has narrowed.

Assuming similar salary and card spending, the individual with savings of S$50,000 will earn an annual interest of S$1,935, if he deposits his money with UOB.

With OCBC, the same individual will get a bonus interest rate of 2.65 per cent, or S$1,325 a year, for meeting two categories, and 3.85 per cent or S$1,925 for hitting three categories.

Meanwhile, with eligible monthly transactions of S$3,500, he will earn 1.5 per cent a year or S$751.90 with DBS’ Multiplier account.

There are also other options to earn bonus interest rates.

DBS, for example, also considers transactions via PayLah! as a criteria, although the interest rate is capped at 0.55 per cent per annum for the first S$10,000 savings for those above 30 years old and who spend a minimum of S$500 a month and credit an income stream.

Those who are 29 years old and below do not have minimum income and spending requirements. As long as they transact via PayLah! each month, they get to earn 0.4 per cent per annum on the first S$10,000 in their accounts.

At UOB, customers who meet the minimum card spend of S$500 and perform three Giro transactions in a month can also qualify for bonus interest rates.

For example, interest earned on balances up to S$75,000 has been raised to a range of 2.5 per cent to 4 per cent per annum, up as much as 2.15 percentage points after the latest revision.